Why gold should be a strategic—not reactive—investment

Why gold should be a strategic—not reactive—investment

While many view gold as an opportunistic “trade,” investors concerned about enhanced diversification, capital preservation, and optimized returns should consider gold as a key portfolio element.

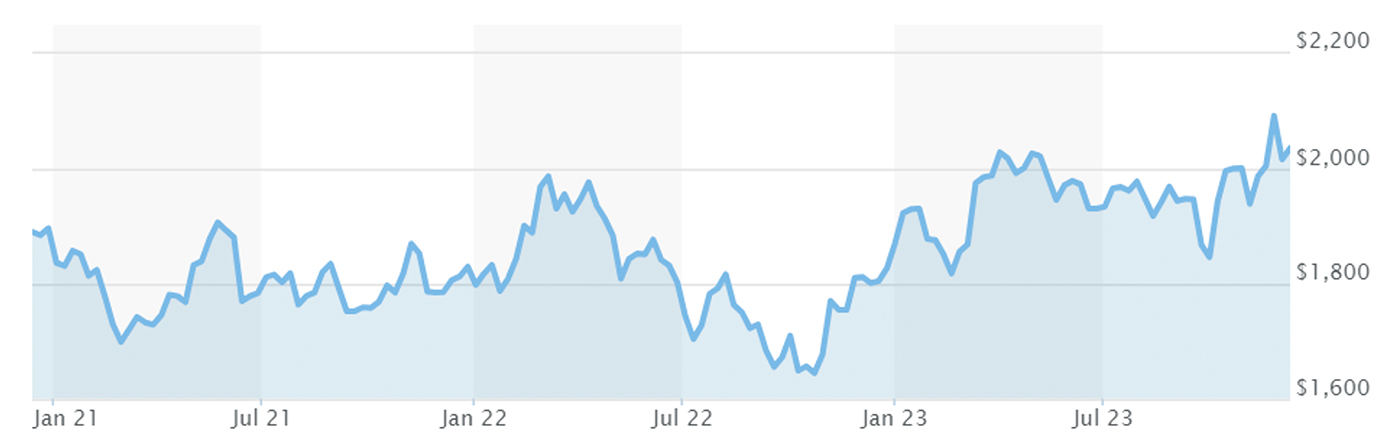

The performance of gold has been one of the more interesting asset-class stories of the past 14 months.

The price of gold was up about 13% for calendar year 2023. Since significant lows in October 2022, gold’s continuous futures contract has gained about 26% through the start of the new year.

FIGURE 1: GOLD CONTINUOUS CONTRACT OVER THE PAST THREE YEARS

Source: Yahoo Finance, data through Jan. 3, 2024

Gold reached an all-time high recently, with CNBC reporting the following on Dec. 3, 2023:

“Gold prices notched another record to kick off the week—with spot prices touching $2,100 an ounce as the global rush for bullion appears set to continue.

“Spot gold briefly traded above $2,100 an ounce on Sunday evening in New York, setting a new all-time high, before falling about 2% on Monday to roughly $2,028 per ounce. Gold futures hit an intraday record of $2,152.30 but settled down 2.27% at $2,042 per ounce.

“Gold prices are on course to hit fresh highs next year and could remain above $2,000 levels, analysts said, citing geopolitical uncertainty, a likely weaker U.S. dollar and possible interest rate cuts.”

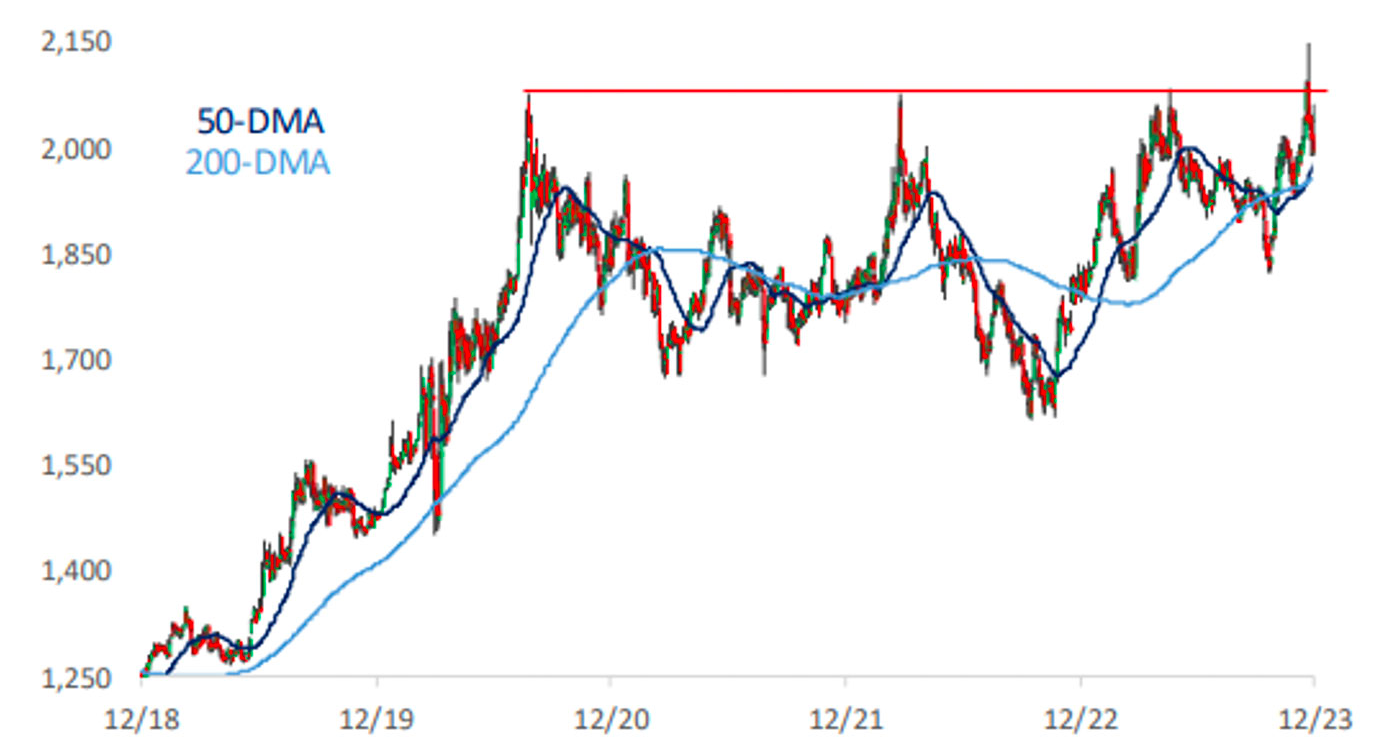

However, Bespoke Investment Group has a cautionary note for gold’s prospects, based on technical factors:

“Like the three other times it hit new highs in the last four years, as fast as it broke out, [gold] reversed lower just as fast. Gold also experienced a ‘golden cross’, but as we noted in a recent Chart of the Day, golden crosses in gold have been anything but bullish for the commodity going forward. If the recent weakness continues and the sector breaks below its 50 and 200-DMAs, a repeat of its performance after the last three all-time highs will look increasingly likely.”

FIGURE 2: GOLD–LAST FIVE YEARS

Source: Bespoke Investment Group

Despite Bespoke’s uncertainty about gold’s price direction, Costco members seem to be enthusiastic bulls. CNBC reported in December, “Costco is once again selling gold bars to members. The one-ounce bars typically sell out within a few hours, according to Costco CFO Richard Galanti.”

Outlook for gold moving forward

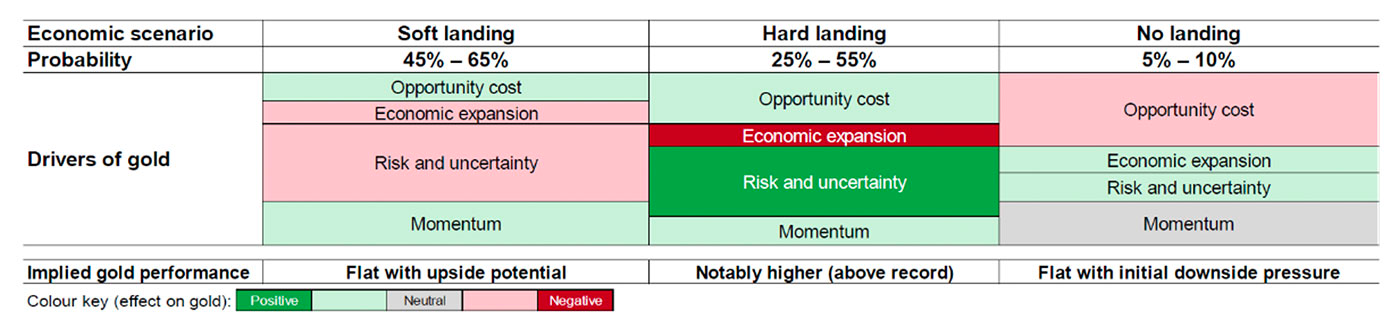

Regarding the outlook for gold in 2024, the World Gold Council offers an interesting and even-handed perspective related to gold’s performance in the face of various recession prospects:

“As we look forward to 2024 investors will likely see one of three scenarios [see the following table]. Market consensus anticipates a ‘soft landing’ in the US, which should also positively affect the global economy. Historically, soft landing environments have not been particularly attractive for gold, resulting in flat to slightly negative returns.

“That said, every cycle is different. This time around, heightened geopolitical tensions in a key election year for many major economies, combined with continued central bank buying could provide additional support for gold.

“Further, the likelihood of the Fed steering the US economy to a safe landing with interest rates above five percent is by no means certain. And a global recession is still on the cards. This should encourage many investors to hold effective hedges, such as gold, in their portfolios.”

TABLE 1: ECONOMIC SCENARIOS, PROBABILITY OF OCCURRENCE, AND KEY GOLD DRIVERS

Note: Based on market consensus and other indicators. The size of gold drivers represents relative importance within each scenario. The impact on gold performance is based on average annual prices as implied by the Gold Valuation Framework.

Source: World Gold Council

Gold’s long-term strategic role in portfolios

Having examined several forecasts for gold in 2024, the tendency for many analysts is to lean bullish. However, the presence of so many influential economic, geopolitical, interest-rate, and election-year factors underscores the uncertainty surrounding many asset classes this year, not just gold.

Two phrases in several of the outlooks I have reviewed are more important for financial advisors and their clients than a short- or intermediate-term outlook or trying to “chase” gold higher. These are “portfolio diversification” and “strategic allocation.”

What evidence supports a more long-term rationale for investors owning gold?

The World Gold Council’s paper, “The Relevance of Gold as a Strategic Asset 2020,” provided a wealth of data-driven findings. John Reade, head of research and chief market strategist noted the following:

- Since 1971, when gold was released from its peg against the U.S. dollar, its average annual return has averaged 7.8%—higher than cash, bonds, and emerging-market equities.

- Gold has demonstrated unique characteristics of correlation to U.S. equities since 1987:

- When the S&P 500 is relatively flat over a weekly period, gold has a very slightly negative correlation—essentially no correlation either way.

- When the S&P 500 has been especially strong over a weekly period, gold has had a moderately positive correlation—far more than traditional commodities.

- When the S&P 500 sharply declines over a weekly period, gold shifts over to a moderately negative correlation, unlike traditional commodities. (This is a historical average. As we have seen during volatile market “events,” the negative correlation of gold to equities can be far stronger.)

Jerry Wagner, founder and president of Flexible Plan Investments (FPI), has remarked,

“For investors looking for further portfolio diversification, gold is a unique diversifier—especially in trying times. Our comprehensive white paper shows that over the past 40-plus years gold has proven to be the best or second-best asset class to hold during eight different investing scenarios that concern investors. And holding gold in even a balanced portfolio has increased risk-adjusted returns over that period.”

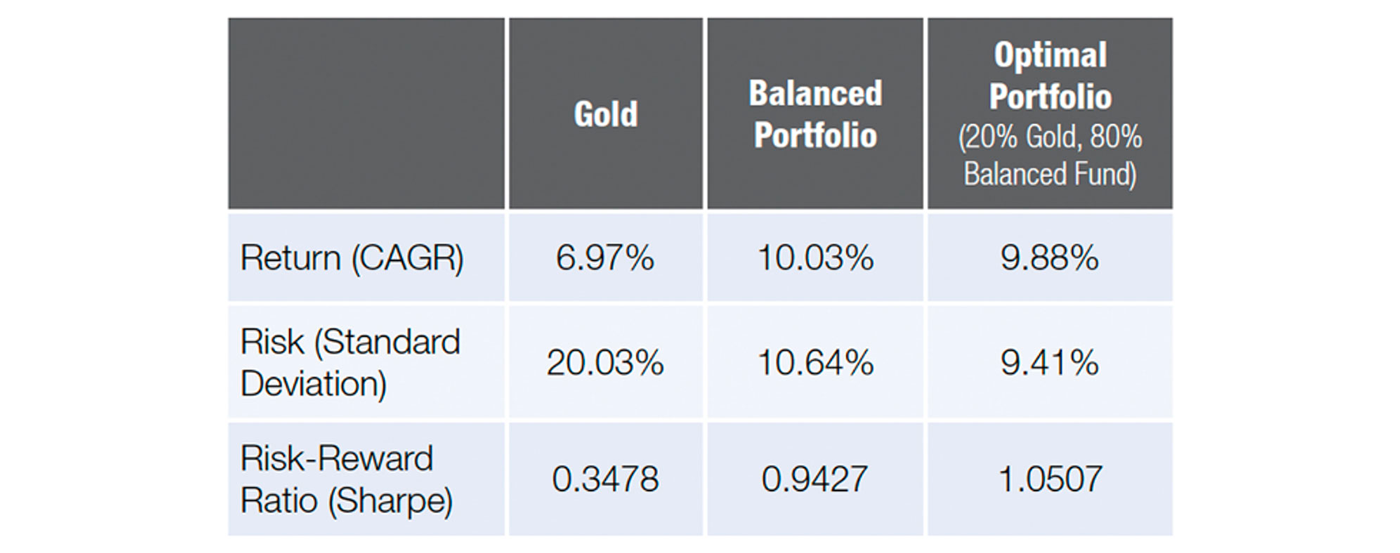

TABLE 2: GOLD VS. A BALANCED PORTFOLIO VS. AN ‘OPTIMAL PORTFOLIO’ (1973–12/31/2021)

Flexible Plan Investments, “The Role of Gold in Investment Portfolios,” July 2022

The FPI white paper referred to is a comprehensive analysis of gold’s performance, looking at data over a lengthy period (1973–2021).

“The Role of Gold in Investment Portfolios” presents the history and ongoing discussion about the investment merits of gold, offering many compelling reasons why investors should consider adding the precious metal to their portfolios.

The paper does the following:

- Examines the performance of gold relative to other asset classes under different market environments that typically concern investors.

- Looks closely at how gold performs under different classic economic regimes.

- Analyzes gold’s diversification characteristics versus other asset classes.

- Reviews the risk-reward characteristics of portfolios with different allocations to gold.

The study concludes, in part,

“… Adding gold to a typical balanced portfolio has been beneficial across a wide range of allocations in terms of boosting risk-adjusted returns. … It appears most investors are likely underinvested in a full range of investment alternatives, and specifically in gold as a long-term asset class. …

“Investors concerned about capital preservation in times of macroeconomic risk and optimized returns in favorable times should strongly consider gold as a key portfolio element. Over the long term, gold offers the broad benefits of (a) ongoing marketplace demand in the face of limited supply; (b) historic protection from extreme market events, high periods of inflation, and devalued currencies; (c) a time-tested component of portfolio diversification; and (d) liquidity and versatility in terms of the many forms of ownership possible for an investor.”

While the news, macroeconomic data, monetary policy, and sentiment all influence gold’s short-term price swings, historical data regarding gold’s potential role in a well-diversified portfolio should be the focus. No matter how an investor chooses to take advantage of the investment benefits of gold, the key point is that an investment in gold should be strategic, not reactive.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS