What’s next for financial advisors in 2021?

What’s next for financial advisors in 2021?

While U.S. equity markets—and many parts of the economy—have staged an impressive comeback from 2020’s depressed levels, financial advisors and their clients must still deal with an uncertain financial and economic landscape.

What’s on the horizon for financial advisors and their clients in 2021?

One thing is certain: This year will likely usher in a plethora of changes across a wide range of fronts—politics, economics, public health policy, government regulations, and societal initiatives.

Of course, the COVID-19 pandemic—and its impact on public health and the economy—remains a primary concern for financial advisors, their clients, and all Americans.

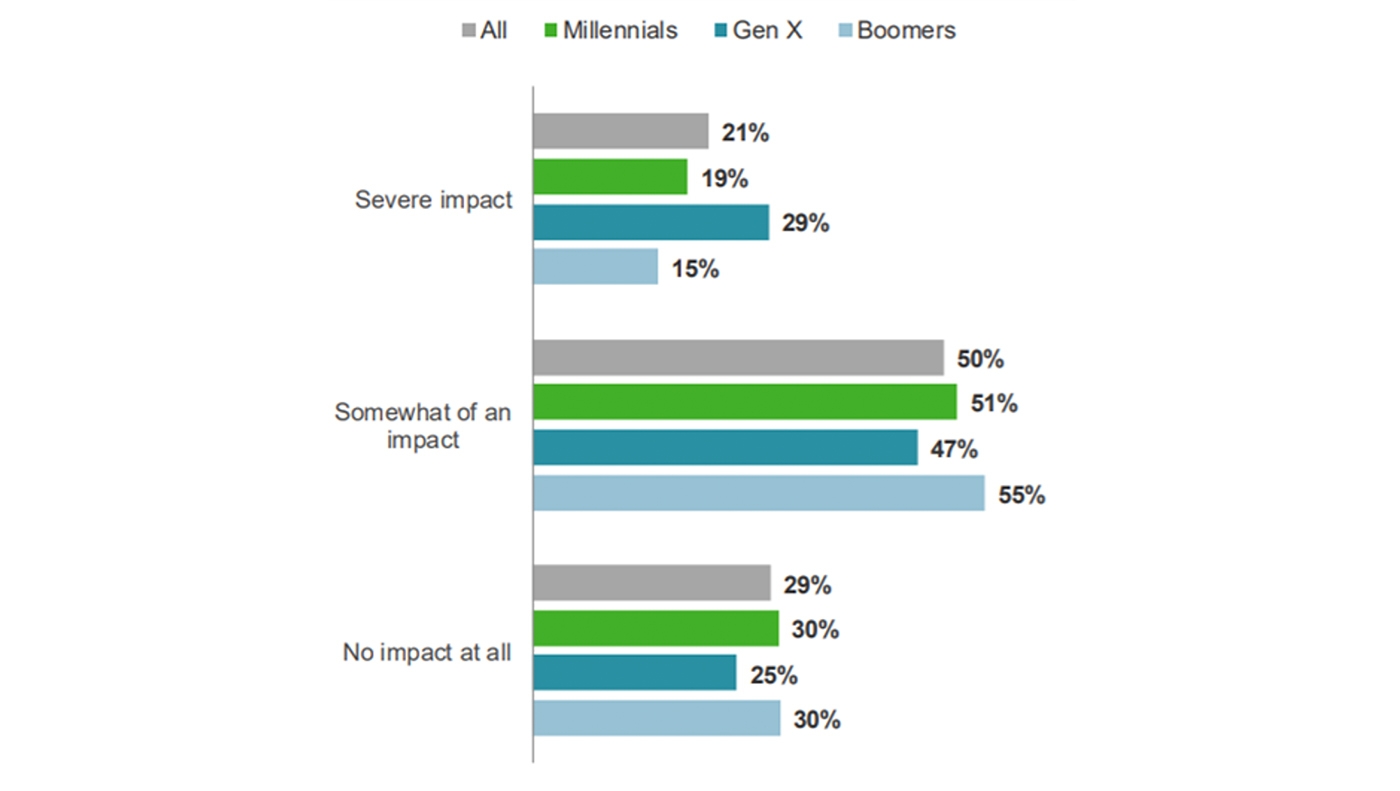

A 2020 TD Ameritrade study on retirement planning showed that seven in 10 Americans (71%) anticipated the pandemic would impact their retirement plans.

Source: Harris Poll for TD Ameritrade, June 2020

The most common actions envisioned by respondents at the time of the study were “increasing retirement savings contributions,” “delaying retirement,” or “withdrawing from an emergency fund/savings account.” Interestingly, 72% of respondents agreed with the statement, “I will prioritize saving for retirement once the Covid-19 pandemic is over.”

For many, the rapid recovery in the equity markets—and certain segments of the economy—likely diminished concerns about the pandemic’s long-term effects on retirement plans. Others, of course, were not so fortunate, facing elevated unemployment levels versus the pre-pandemic period and uncertain outlooks for many businesses and industries.

However, even individuals and families with strong relationships with their financial advisors—and well-constructed financial and investment plans—need to take note of factors potentially impacting their financial lives this year and into the future.

In its “2021 Financial Planning Outlook,” Schwab noted this past December,

Schwab noted three significant trends that will “have implications for planning and wealth management”:

- Low short-term interest rates that likely will not move higher for some time, “though longer-term Treasury yields may rise.”

- Tax uncertainty under the new administration, “but probably not sweeping tax policy changes”—as it will take some time to gain support for any sweeping legislation.

- A heightened sense of urgency, prompted by the pandemic, around various financial-planning needs. These include fundamental retirement-income planning, estate planning, and family protection via risk management and insurance strategies.

Courtney Dominguez, CFP

Senior wealth advisor at Payne Capital Management, New York, NY

“This could be the new Roaring ’20s. We’ve been locked down so long that we want to get out and do things—just like people did after the last pandemic subsided 100 years ago.

“Throughout the pandemic, everyone has actually saved a lot of money from their paychecks, as well as from the stimulus checks. Americans have saved an extra $1.6 trillion in 2020, thanks to the combination of lower consumption and extraordinary amounts of government aid, according to an analysis by Oxford Economics.

“Most have used the money to pay down consumer debt. As a result, average household debt is down while average household net worth is up. People don’t know how long the pandemic will last, so they’re also holding on to cash. The total net assets of money market funds—a measure of cash on the sidelines—remains elevated at $4.3 trillion in January 2021 and above the prior 2009 financial crisis peak of $3.9 trillion, according to the Investment Company Institute.

“But as soon as the economy reopens, hopefully by the summer or the fall, many people are really going to start spending—even much more than they did before.

“What’s going to happen to portfolios now that the administration and the control of Congress have changed? That’s the question all of my clients are asking me now. Increased government spending can lead to inflation, and we could see interest rates rise. So we’re making sure that our clients’ portfolios have inflation hedges, such as commodities, real estate, energy, and alternative investments.

“The biggest concern I’m getting from clients is whether there could be tax increases, proactively making sure we find ways to realize tax savings within portfolios is beneficial. Making sure you are being as tax efficient as possible is always a great idea.

“Take a look at the types of accounts you are contributing to—for example, perhaps you are adding to an IRA but a Roth is more appropriate or vice versa. Perhaps you are in a lower tax bracket now than you expect you will be in the future and Roth conversions could be a good thing to consider. Make sure your investment vehicles are tax appropriate as well—for example, municipal bonds for tax-free bonds or booking any losses from funds that may be showing a loss to offset any current or future capital gains.

“During the pandemic, we’ve been doing all meetings virtually, and I would guess a certain percentage of clients will continue to want to do that after the pandemic. However, I don’t think that will ever fully replace in-person meetings.”

Pamela Mayfield-Kizzee, MRFC

President of the Southeast Texas region at Money Concepts Capital, Houston, TX

“We were already doing some virtual meetings and paperless transactions, but that’s ramped up quite a bit during the pandemic. From a business standpoint, it’s actually made our entire practice more efficient. Before, client meetings at our office may have extended for over an hour, but with virtual meetings, we have been able to reach more clients during the same time frame. It’s made us more available to clients, so that was a good thing.

“To be honest, the relationships with clients have become a little more personal. Some clients have had someone close become infected with COVID, and in a few cases there were deaths. They were more comfortable sharing this with us, and because of our support, we’ve become closer.

“This year we’ll probably be doing more of that—reaching out to our clients, not only doing annual reviews but also taking the time to connect more with them.

“Last year the market was very volatile, but that doesn’t mean that our clients were having losses. We were managing portfolios and pivoting some of the investments based on how we saw the market was reacting to the pandemic. I think this year is going to be the same—being proactive, looking at the trends that are in the market. Hopefully, we’ll see some of the more hospitality-related stocks improve as the vaccines are issued.

“With a full spectrum of nonproprietary financial products and services to choose from, we can deliver a customized financial and investment strategy that helps fit our clients’ unique situations. We generally look at about five third-party managers and assess the consistency of their performance record, what asset classes they tend to specialize in, and how their strategies can align with a client’s goals. Some of the managers use a sophisticated, algorithm-based approach to managing strategies, and that can be effective in identifying trends and major changes in overall market direction or specific asset classes or sectors.”

Moses LaCour, MRFC

Regional director for Southeast Texas at Money Concepts Capital and founder of LaCour Financial Services Inc., Houston, TX

“Being able to communicate with clients in Zoom meetings was more efficient for me. It also motivated me to do business electronically sooner than I would have, such as sending forms and having forms signed electronically.

“I think a lot of businesses throughout the country are now more efficient, and many will continue to have fewer people work in the office. Many might then decide to reduce their overhead costs and downsize their office space significantly. That might increase their profit margins, which could then potentially increase their stock price, which then bodes well for investors, including our clients. I also think the economy will do really well once people are comfortable going out again and spending more.

“Because of the new makeup in DC, there’s a possibility that Congressional members will try to work better together. For example, they may address making Social Security and perhaps Medicare more sustainable, and people below a certain age before retirement might have to wait longer to get benefits—but the changes might help older people.

“I work in a highly consultative role with clients, helping people who have a sincere desire to grow and protect their financial assets over the long term. Many times, we will use a bucket-type approach to planning, assuming different levels of risk for different time horizons or specific investment objectives. We want clients to achieve the most efficient returns they can within the parameters of their risk profile. We work hard to find strategies or specific investments that can deliver a suitable return for clients without assuming too much risk. That is our single-minded goal.”

Claudia Mott, CFP, CDFA

Principal of Epona Financial Solutions LLC, Basking Ridge, NJ

“The estate tax laws that have been put in place are supposed to sunset at the end of 2025, and the question becomes whether any of those things—such as the estate tax exemption—will be repealed back to prior levels. My sense is that this administration has got a lot more pressing issues on their hands, and so they may not address this immediately. Current estate laws are quite beneficial to certain parts of the population, and I’m not sure the administration and Congress will push to make changes to it right away.

“President Biden has expressed a desire to roll back changes that were put in place by the Tax Cuts and Jobs Act and allow the estate tax exemption to revert to $5 million from the current $11.7 million. But this is only one piece of a much larger set of tax proposals and will likely be challenged.

“A factor in the decision to allow levels to reset backwards may depend on what the tax revenue picture looks like. Has the economy bounced back from the pandemic? Have interest rates returned to normal levels? Does the federal government need that revenue enough to change estate income levels? Right now there’s not a clear picture to understand the impact the pandemic has had on the economy to discern these things.

“As far as other regulations, there’s not been a great deal of success getting through some of the restrictive regulatory changes to the fiduciary standard that impact the financial advisory business, as there’s not been a lot of support for sweeping changes. I don’t see the Biden administration necessarily coming in with a mandate to overhaul the way financial advisors do business. What may perhaps fall under the microscope are the newer trading platforms for individuals, especially in light of the recent fiasco with GameStop.

“Regarding the economy, there is going to be a long, slow road to recovery, as there are so many different aspects to our economy that have suffered as a result of the pandemic. I think there is going to be a different view of how things function going forwards, and how that all is going to impact the economic picture is a really big question.

“In particular, since more people are now shopping online, many retailers are going to have to become much more focused on their online enterprises than brick-and-mortar locations. There have been a lot of closures of big-name stores as shoppers have shifted their focus. While many people still prefer the in-person shopping experience, the question remains whether the bulk of big retailers will be able to continue to garner enough business to keep present stores open or if scaling down locations will be required.

“Also, the increasing trend of people working from home, expedited by the pandemic, will be a game changer for the commercial real estate industry. With many companies allowing employees to permanently work from home, and many others continuing to delay bringing workers back to the office, the loss of revenue is staggering.

“There are many other areas that have been hard hit by the pandemic, including the hotel, travel, and entertainment and hospitality industries, including movie theaters, airlines, and cruise lines. It’s going to take some time for people to have a comfort level to partake in these activities, and the vaccines hold out the promise that vacations will be in our future once again. What is unanswerable is how long it will take for those industries to truly come back and what the new level of normal is going to be.

“How does this impact clients’ portfolios? As a believer in buy-and-hold investing, when it comes to creating portfolios, the current economic environment creates challenges, but should not steer investors off course. A portfolio should reflect the client’s appropriate risk profile and be designed to meet their long-term goals. By and large, you don’t want to second-guess trends, timing when to get out of the market. Now is the time to really be diversified in different types of securities, both domestic and international, fixed income and equity. The problem that arises when trying to move portfolios around too much is that you’re likely going to do more harm than good, and then you have to play catch-up. This would have been the case in March of 2020 when the market took a nosedive as a result of the pandemic, yet the S&P 500 ended the year up 18%.

“Regarding post-pandemic practices: For me, the most important thing will be getting back to one-on-one in-person meetings, though I’ll continue to do a lot more things electronically, like document signing, which has proved to be incredibly helpful.

“I think we all need to be prepared for continued volatility in the market. There’s a long road ahead of us, and there are going to be more stumbles—probably not as drastic and dramatic as we saw this past March, but it’s inevitable. The sputtering economy is going to need to be kick-started, and that’s going to cause the market to have some bad days. It’s a fact of life. But that doesn’t mean we have to bail out and alter our strategies dramatically.

“What’s next for advisors as we get knee-deep into this year?

“Advisors are expressing optimism that the economy will rebound post-pandemic, albeit with an unsure timetable. The federal government under new leadership will likely bring marked changes, though the extent to which any significantly impact clients and their portfolios remains to be seen.

“One thing that is certain: The pandemic has permanently altered the way most advisors practice their business, becoming another industry sector to embrace the digital age—while the tried-and-true method of building client relationships in face-to-face meetings will likely never disappear altogether.”

Bob Chitrathorn

Vice president of wealth planning at Providence Wealth Planning, Corona, CA

“When there is a change of power, you typically think there’s going to be lots of changes—because of human nature but also because of the things that may have been promised. So I think there are going to be changes because people expect them. I certainly hope we see some positive changes, or reexamine previous negative changes.

“For example, I can’t tell you how many clients have come through the door with portfolios that sometimes I can’t fix because they had been sold overweight insurance products. Insurance specialists have different rules to abide by, but we’re all helping people with money. Regulations across different regulatory agencies just need to be consistent.

“But if regulations become too stringent, that might cause advisors to help only higher-net-worth people because of the increased risk of working with the average American. But it’s better for society if we can help as many people as we can.

“Regarding changes in practice due to COVID, before the pandemic, I worked remotely with some clients, but most came to my office for meetings. However, they would sometimes be late because they were stuck in traffic, or we would have to find a good time to avoid traffic. With virtual meetings, it’s so much more efficient. It’s easier to schedule virtual meetings, remind people about them, and make adjustments. We screen share all of the information, though now and then we have technological issues.

“Speaking to the economic outlook and client portfolios, the economy may continue to improve as things open back up and people start spending more. But there are still challenges with low interest rates if clients are using bonds for income and downside protection. Companies are going to have to continue to be innovative with new products.

“There may be an uptick of clients using real estate investment trusts (REITs) in their portfolios, but that may not be the best thing because they are not as liquid, especially nontraded REITs, and they are not guaranteed income.

“I see issues when interest rates are so low, because certain products and vehicles may be sold when they may not actually be the best solution for the client. We should always do what is best for the client. But I sometimes see representatives selling people these things because people are scared. It’s very important to educate clients about the pros and cons of these products. It’s important to take a look at clients’ time frames as well.

“There may be inflationary pressures on the horizon. There are just so many unknowns, and many clients are now more conservative than they were in the past and want to continue having some downside protection.

“I believe that active investment management is very important, especially in times of uncertainty and volatility. It allows for portfolios and investments to be moved more actively between different asset classes, as well as cash. Using third-party asset managers can assist as well in helping to meet the investment objectives of our clients.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Please refer to the links provided to each advisor’s firm for additional disclosure statements.

_______________________

All securities through Money Concepts Capital Corp. Member FINRA/SIPC. Pamela Mayfield-Kizzee and Moses LaCour are independent contractors of Money Concepts. LaCour Financial Services Inc. is an independent firm and not affiliated with Money Concepts.

_______________________

Bob Chitrathorn is a registered representative with, and securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Strategic Wealth Advisors Group LLC, a registered investment advisor. Strategic Wealth Advisors Group LLC and Providence Wealth Planning are separate entities from LPL Financial.

Investing in REITs involves special risk such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.