The impact of rising interest rates for stocks paying a healthy dividend was examined last week by MarketWatch. They quoted findings by one analyst, saying, “If the bottom is in for yields, stocks (low-volatility, high-dividend yield bearers) that stand in as proxies for bonds are in for a rough ride.”

They further noted:

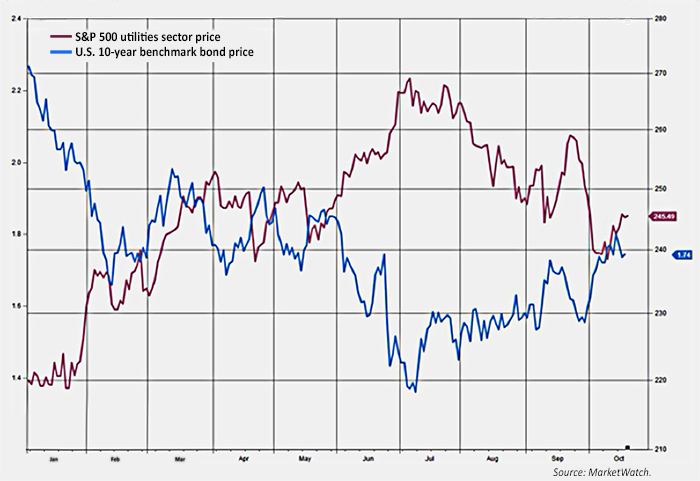

“Over the third quarter, the S&P 500 utilities sector fell 6.7% compared with a 3.3% gain for the broader S&P 500 index SPX, according to FactSet. Meanwhile, the yield on 10-year Treasurys rose about 40 basis points to 1.75%. The inverse correlation of rate-sensitive stocks with 10-year yields is striking.”

FIGURE 1: S&P 500 UTILITIES SECTOR VS. 10-YEAR TREASURY YIELD

Strategists at Matrix Asset Advisors, an asset management firm established in 1986, recently took a deeper look at why active management of a dividend portfolio makes sense, especially in an environment where interest rates are likely to rise. The following is an abridged version of findings from their paper on the topic.

The case for active management in dividend income portfolios

Dividend income portfolios, such as those represented by the passively managed S&P High Yield Dividend Aristocrats Index, have thrived in the current low interest-rate setting. But this outsized performance has led to two concerns. One, are they likely to underperform when rates start rising? And two, have valuations among high-dividend stocks become inflated, potentially creating more risk in these investments? If so, is this true for all components of the high-dividend space?

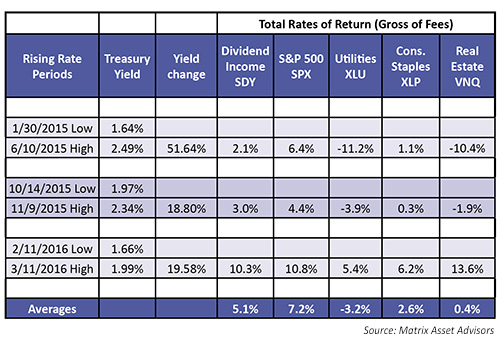

Using the SPDR S&P Dividend ETF SDY (as a proxy for the Aristocrats Index), along with some sector-specific ETFs usually composed of stocks with relatively high dividends, we first look at the issue of rising interest rates over the recent past (through the end of the first half of 2016). Interest rates rose on three separate occasions since January 2015. The SDY portfolio underperformed the S&P 500 (SPX) in all three periods.

TABLE 1: COMPARISON OF TREASURY YIELDS VS. SPX AND SPECIFIC SECTORS

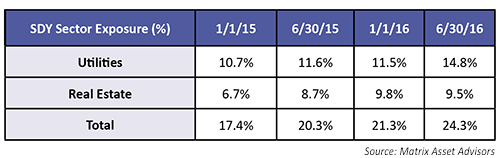

It is fair to conclude from these data that any dividend-focused portfolio or index with significant exposure to Utilities and REITS is likely to underperform in a rising rate environment. More troubling, however, is the fact that SDY has an increasing interest-rate risk exposure, as shown in Table 2. Nearly 25% of the passively managed SDY was exposed to interest-rate-sensitive sectors at the end of the first half of 2016.

TABLE 2: SDY EXPOSURE TO UTILITIES AND REAL ESTATE SECTORS

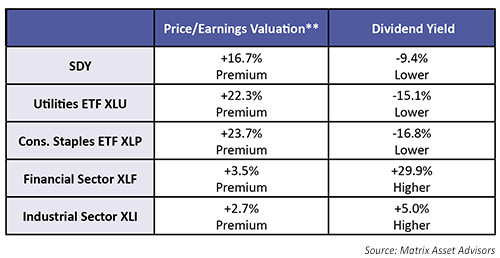

With regard to valuations at the end of the first half, we considered SDY overall, along with four ETFs as proxies for some of its larger sectors.

TABLE 3: METRICS COMPARED TO AVERAGE OF PRIOR SIX YEARS (AS OF 6/30/16)*

*The average of the 6/30 values in 2011 through 2016. **Based on trailing 12-month price to earnings.

These data indicate that SDY was trading at a meaningful premium on June 30, 2016, and delivering a lower yield, largely driven by the Utilities and Consumer Staples sectors.

The Financial and Industrial sectors, however, had more attractive valuations and have seen dividends increase over the past six years. Clearly, not all of the stocks within the dividend space have seen their valuations stretched.

We do not believe that passively managed dividend-focused portfolios (like SDY) are effectively addressing the twin risks of interest-rate sensitivity and overvaluation. Actively managed dividend portfolios can effectively address these risks, while still delivering above-average and growing income streams.