While Thanksgiving week historically tends to be positive for the U.S. stock market (up about 75% of the time, according to CNBC), last week saw outsized gains for major market indexes and several record highs.

The Dow Jones Industrial Average closed above 30,000 for the first time on Tuesday (Nov. 24) and was up 2.2% for the week. The S&P 500 Index rose 2.3% and the NASDAQ Composite gained 3%. The Russell 2000, which gained 3.9% on the week, continued its stellar gains for November.

Overall, according to several market commentators, “November was a month to remember,” despite a pullback on Monday, Nov. 30.

MarketWatch noted,

- “The Dow rose 11.8%, its biggest monthly rise since January 1987 and its biggest November gain since 1928.

- The S&P 500 gained 10.8%, for its biggest monthly advance since April and its largest November rise since 1928.

- The Nasdaq Composite saw an 11.8% gain, its biggest monthly rise since April and best November advance since 2001.

- The small-cap Russell 2000 jumped 18.3%, its largest monthly rise on record.”

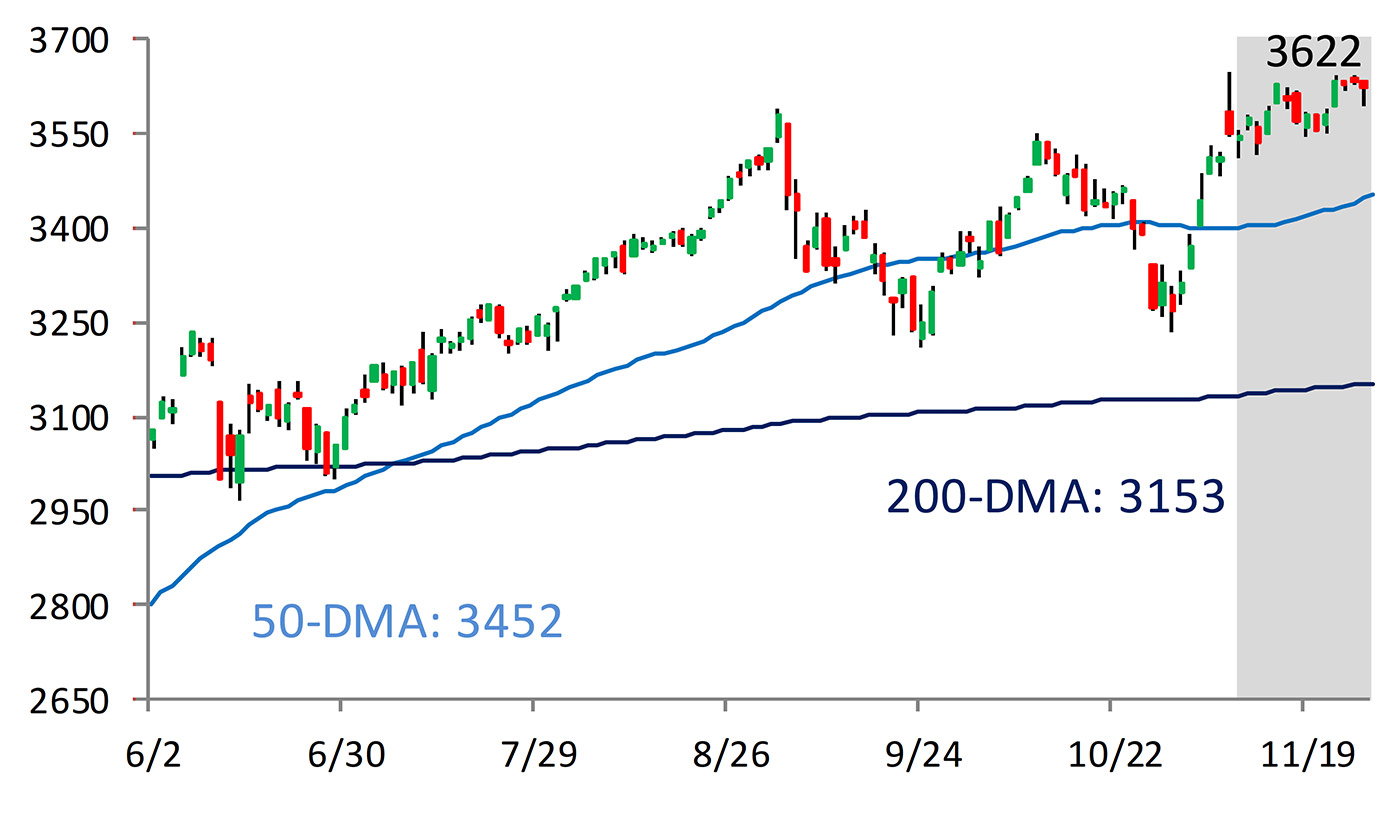

Source: Bespoke Investment Group, data as of 11/30/2020

Barron’s Up and Down Wall Street column cited Barclay equity derivatives strategists, who pointed to a “perfect trifecta of outcomes” for the recent rally: “a ‘decisive victory’ scenario in the U.S. elections; news of effective Covid-19 vaccines; and positive surprises on third-quarter earnings—an average gain of 18% for S&P 500 companies, with more than 80% beating expectations.”

These positive developments helped markets resoundingly overcome concerns about rapidly rising COVID cases and many states’ increased pandemic-related restrictions, a mixed picture for economic indicators, the continued lack of progress on a new government stimulus program, and the frequent news reports of long lines as many Americans sought supplies from local food banks (a 60% increase in demand versus last year, according to USA Today reporting.)

On the impact of the pandemic in the coming months, Barron’s reports,

“Deutsche Bank economists write in a research note that ‘states with faster Covid spread have labor markets that are underperforming, i.e. more people flowing into and fewer people flowing out of unemployment, than states with more moderate growth in Covid cases.’

“The worsening trend in claims is why the bank has a below-consensus 2.3% estimate of fourth-quarter gross-domestic-product growth. That is massively lower than the Atlanta Fed’s 11% GDPNow estimate, which its website emphasizes in red letters doesn’t reflect the potential impact of Covid-19 and social mobility measures.”

At least two other factors could be thrown into the mix for the market’s positive results in November: (1) what seems to be a generally positive assessment of President-elect Biden’s cabinet selections so far (especially the selection of former Fed Chair Janet Yellen as Treasury Secretary) and (2) increased optimism over the 2020 holiday shopping season.

Business Insider remarked on the choice of Yellen,

“If her nomination is confirmed by the Senate, she would be the first woman to have led the Federal Reserve, the White House Council of Economic Advisers, and the Treasury Department. Her appointment is a welcome choice for investors. It shows that Biden is aiming for a centrist to a moderately liberal economic program, according to Deutsche Bank economists. ‘In Yellen, he has tapped a pragmatist, a skilled economist, and an experienced financial and regulatory policymaker,’ they said.”

Regarding the holiday shopping season, the National Retail Federation (NRF) forecast that “holiday sales during November and December will increase between 3.6 percent and 5.2 percent over 2019 to a total between $755.3 billion and $766.7 billion.”

The NRF added in its press release,

“‘We know this holiday season will be unlike any other, and retailers have planned ahead by investing billions of dollars to ensure the health and safety of their employees and customers,’ NRF President and CEO Matthew Shay said. ‘Consumers have shown they are excited about the holidays and are willing to spend on gifts that lift the spirits of family and friends after such a challenging year. We expect a strong finish to the holiday season. …’

“The NRF expects that online and other non-store sales, which are included in the total, will increase between 20 percent and 30 percent to between $202.5 billion and $218.4 billion, up from $168.7 billion last year.”

Over this past weekend, CNBC noted three key points about the early holiday shopping season:

- “Consumers spent $9 billion on the web the day after Thanksgiving, up 21.6% year over year, according to data from Adobe Analytics.

- The pandemic pushed more shoppers to stay home and shop online from their sofas, avoiding crowded stores and waiting in lines at malls.

- Cyber Monday 2020 is expected to become the biggest digital sales day in history in the United States.”

The Associated Press notes that robust online shopping on Black Friday was accompanied by a significant drop in physical U.S. store visits, down 52% according to Sensormatic Solutions, a retail tracker.

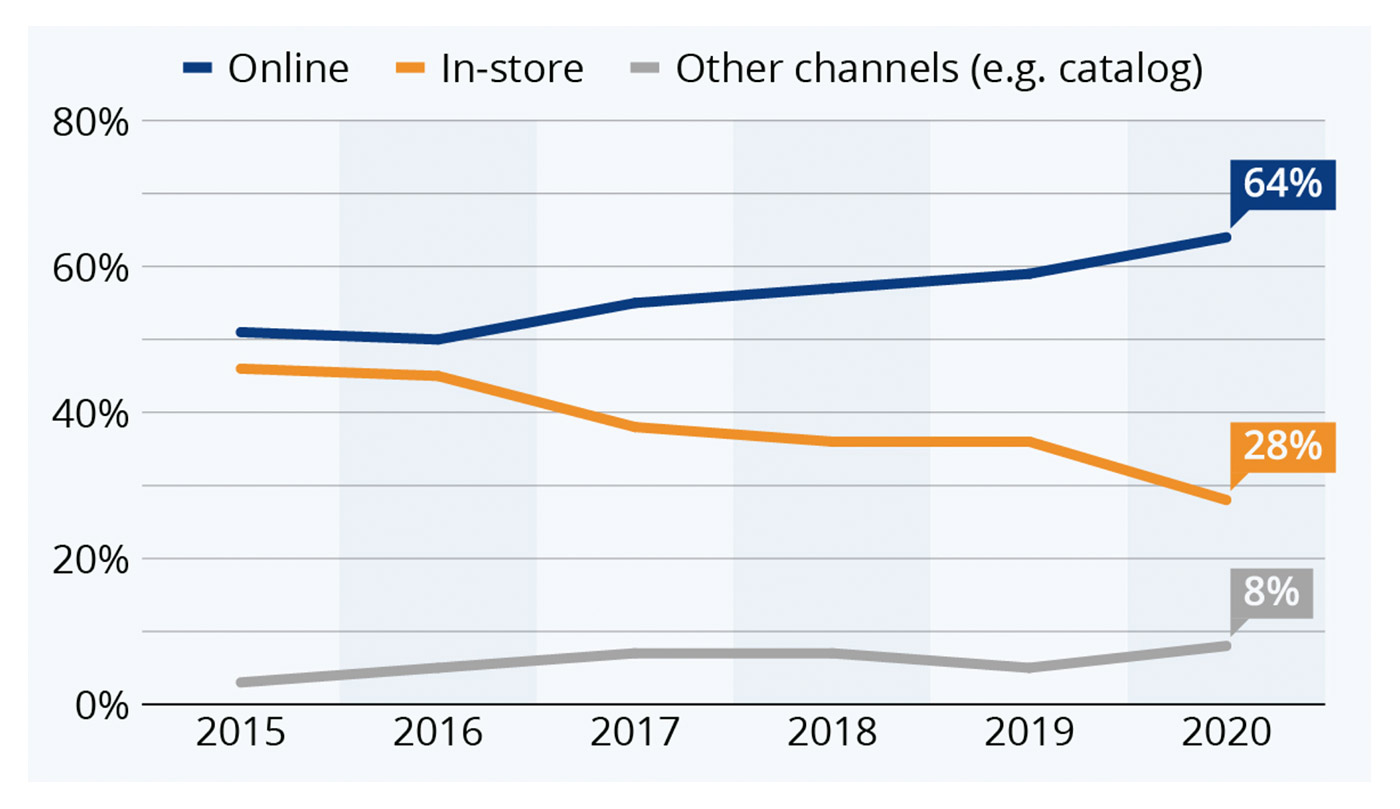

Statista cites Deloitte’s annual Holiday Retail Survey that measures consumers’ shopping intentions, saying,

Sources: Statista, Deloitte

Sources: Statista, industry data; 2020 is projected