Wealth-management trends: What defines ‘high-growth financial advisors’?

Wealth-management trends: What defines ‘high-growth financial advisors’?

Research findings from the PriceMetrix study “The State of Retail Wealth Management 2017” identify key trends and success factors for “high-growth financial advisors.”

In many respects, 2017 was as challenging a year for financial advisors as was 2016, due to several factors:

- The many twists and turns in the proposed enactment of new fiduciary guidelines.

- The anticipation tied to the Trump administration’s steps on financial regulations and tax reform.

- The prospects of changing interest-rate policy from the Federal Reserve in an aging equity bull market.

- The significant impact of changing demographics for both the advisor community and its client base.

- The ongoing threat of inroads by automated “robo-advisors” and profit-margin squeezes on financial advisors from all sides.

Proactive Advisor Magazine thanks PriceMetrix, a leading research, data, and consulting firm focusing on the financial advisor segment, for their permission to highlight some of the key findings of their May 2018 comprehensive study “The State of Retail Wealth Management 2017.”

The PriceMetrix study, which includes data from North American wealth-management firms with $6 trillion in assets under management (representing over 12 million retail investors), presented five major findings:

- 2017 saw record highs in both assets and revenues per advisor, driven largely by equity market performance. (The MSCI World Index was up 22.4% in 2017.)

- There was an overall deepening of client relationships, with more financial products provided by advisors per household.

- There was an increase in the proportion of fee-based revenues and assets for financial advisors, with further growth in discretionary accounts.

- The stagnation in the number of new client relationships continued, with no improvement in penetration of “next generation” assets.

- Prices declined for both fee and transactional product lines.

Advisor assets and revenues reached record highs in 2017

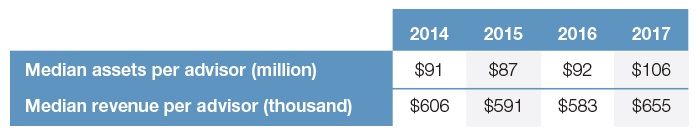

According to PriceMetrix, assets managed per advisor grew by 15% to a record $106 million in 2017. They say, “This significant and predominantly market-driven asset growth resulted in a corresponding increase in revenues, helping advisors turn around a multi-year decline. Median revenue per advisor was $655,000 in 2017, up 12% year over year.”

TABLE 1: AVERAGE AUM AND REVENUES HIT RECORDS IN 2017

Source: PriceMetrix, “The State of Retail Wealth Management 2017,” May 2018.

Fee-based revenue and AUM continue to grow as a percentage of advisors’ business

PriceMetrix says,

“Financial advisors have been steadily increasing the percentage of revenues from asset-based fees. The percentage of fee-based revenue jumped from 54% to 63% between 2016 and 2017, and assets that were in fee-based accounts rose from 37% to 46%.

“Currently, 46% of households have at least some fee-based business, up from 29% in 2014. That said, we are far from seeing the end of the transactional business model. Today, 54% of advisory relationships still have no fee-based accounts at all, and even amongst the 46% of households that have fee accounts, more than 60% of those have transactional accounts as well.

“One of the fastest-growing account types is discretionary, where advisors can make investment decisions on behalf of clients. By year end 2017, 15% of assets were in discretionary accounts, up from 10% in 2014.”

TABLE 2: TRENDS IN FEE-BASED REVENUE AND AUM

Source: PriceMetrix, “The State of Retail Wealth Management 2017,” May 2018.

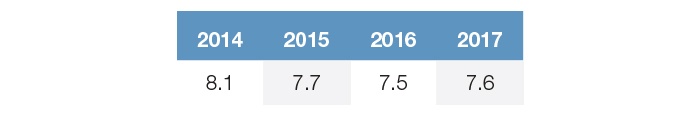

New client growth is flat for the third straight year

Despite the asset and revenue growth cited previously, financial advisors “continue to struggle with new client relationships.” Essentially, 2017 was a flat year for the addition of new households as clients for the advisors who were part of the PriceMetrix study. The average advisor developed 7.6 new household relationships in 2017, up slightly from 7.5 in 2016.

TABLE 3: NEW HOUSEHOLD RELATIONSHIPS PER ADVISOR

Source: PriceMetrix, “The State of Retail Wealth Management 2017,” May 2018.

The study adds,

“Hiding behind the aggregate statistics, though, is a wide range in performance from advisor to advisor. The top quartile, or the 25% of advisors who added the most new households in 2017, added 17 on average, compared to just one household added for the bottom quartile. Previous PriceMetrix research shows that both top and bottom performers ‘look relatively similar in terms of tenure, geography, price level, and book demographics. With such a wide gap between high- and low-performing advisors, and a strong link to overall practice growth, it’s no wonder that more and more firms are incorporating new client acquisition as a metric in their compensation plans.’”

FIGURE 1: HOUSEHOLDS ADDED IN 2017

Source: Organic Growth Insights, PriceMetrix, 2017

Deeper client relationships support growth

While overall penetration of new households was flat on average in 2017, there was a continuation of the trend for deepening client relationships per household:

- 61% of advisor households now have multiple accounts with their advisor, up from 57% in 2014.

- The average household has 2.9 accounts, up from 2.6 in 2014.

- 70% of retail wealth-management relationships include a retirement account, up from 64% in 2014.

TABLE 4: RELATIONSHIP DEPTH WITH HOUSEHOLDS

Source: PriceMetrix, “The State of Retail Wealth Management 2017,” May 2018.

PriceMetrix notes,

“These improvements in relationship depth have helped advisors maintain and grow their current-year revenue levels. … In addition, previous PriceMetrix research shows that deeper relationships help improve client retention levels, which should bolster advisor growth rates in years to come.”

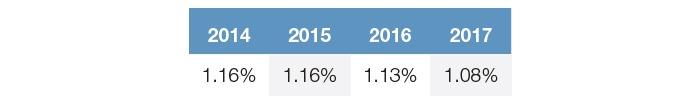

Wealth-management ‘pricing’ continues to decline

PriceMetrix reports,

“Pricing on fee-based accounts continued to slide in 2017. For households with $1 million to $1.5 million invested, fee account pricing dropped from 1.13% in 2016 to 1.08% in 2017. The drop was a result of advisors lowering fees for both existing and new client accounts. Fees for new accounts are lower than for existing accounts, and continue to fall, from 1.07% in 2016 to 1.04% in 2017. The drop in fees affected households of all sizes, with steeper declines for smaller households.”

TABLE 5: AVG. FEES FOR HOUSEHOLDS WITH MANAGED ASSETS OF $1M–$1.5M

Source: PriceMetrix, “The State of Retail Wealth Management 2017,” May 2018.

The study also notes, however, that lowering fees was not a particularly effective strategy for enhancing a firm or advisor’s growth:

“Overall in 2017, advisors realized revenue growth, while prices continued to decline. To understand the relationship between the two, we looked specifically at advisors who lowered prices in 2017. Surprisingly, only 30% of advisors lowered price levels year over year, while 70% percent maintained or even increased prices. The advisors who lowered their price experienced lower growth than those who maintained or increased their price, and attracted fewer new fee assets. Lowering price to add assets and drive growth is generally not an effective strategy.”

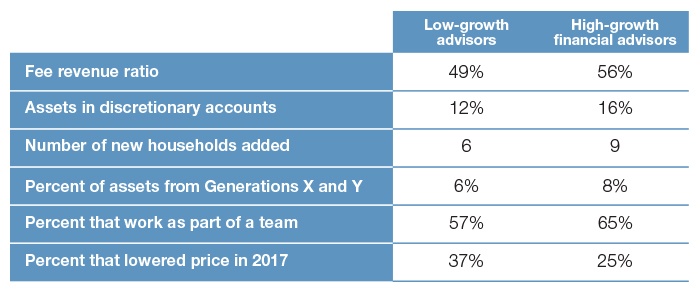

What characteristics define the most successful and fastest-growing advisors?

The PriceMetrix study examined several key factors that separated “high-growth financial advisors” from “low-growth advisors.” They found that “the top quartile of advisors (the 25% who grew the most, year over year), increased their revenues by 37%, while the bottom quartile actually saw revenues decline by an average of 8%.”

Looking at advisors who grew the most in 2017, certain characteristics stand out, says PriceMetrix:

- A higher percentage of revenue is fee-based, and they are more likely to manage assets on a discretionary basis.

- They added 50% more household relationships in 2017 and have had more success in attracting younger investors.

- They are more likely to work as part of a team than as a sole practitioner.

- Notably, they were less likely to lower fees in 2017.

TABLE 6: GROWTH-DEFINING FACTORS FOR ADVISORS

Note: Bottom 25% based on year-over-year revenue growth. Revenue growth between 2016 and 2017 was -8%, on average. Top 25% based on year-over-year revenue growth. Revenue growth between 2016 and 2017 was 37%, on average.

Source: PriceMetrix, “The State of Retail Wealth Management 2017,” May 2018.

From this study and several others that PriceMetrix has conducted on the retail wealth-management industry, the firm takes their conclusions a step further in putting forth recommendations for enhancing advisors’ practice growth:

“The growth of advisors, and ultimately the growth of their firms, is a result of individual skills and decision-making—both of which can be invested in and improved. Executives looking to unlock breakaway organic growth require an end-to-end organic growth playbook. This playbook should include client acquisition and servicing programs like next generation sales enablement, CRM and digital marketing, as well as programs that build skills and improve decision-making, such as analytics-based practice management programs, behavior-based compensation plans, and capability-building initiatives for field managers.”

Further specific success factors shared by leading advisors who consistently exhibit organic growth, in PriceMetrix’s opinion, include the following:

- A strong emphasis on retirement planning, taking proactive steps to capture or protect wealth that is set in motion during this key inflection point.

- Consistently addressing client needs, particularly as clients move from wealth accumulation to distribution in their retirement years.

- A focus on the next generation, starting to build relationships as early as possible. Listed beneficiaries and trustees of current clients can be an excellent starting point.

- Basing pricing decisions on “facts, not gut feel.”

- Expanding practices to include teams of advisors serving a wider range of client needs.

The study concludes, in part,

“Advisors operate in a constantly changing environment; how they respond to change can greatly affect their outcomes, and ultimately, the financial performance of the firms they work for. The good news for wealth management firms is that a large portion of advisors are thriving.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

Recent Posts: