But few investors realize that simple diversification among asset classes is not enough. During times of stress, correlation among assets increases substantially. To better increase the chances of avoiding large portfolio shocks, investors also need to ensure that they have diversification among strategies.

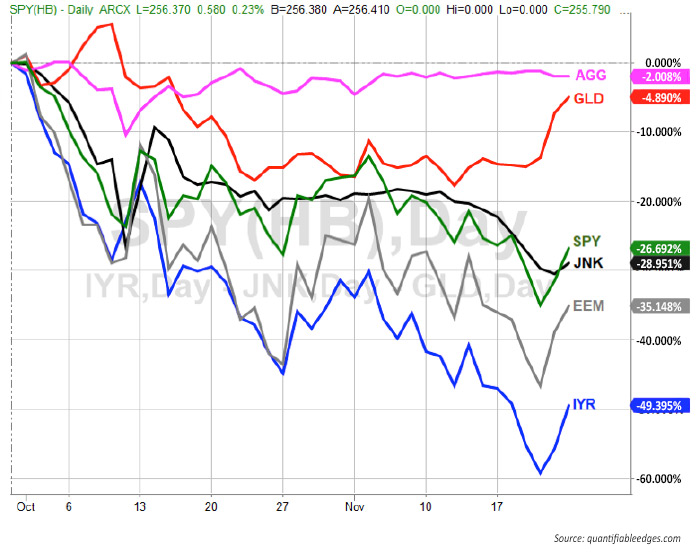

Figure 1 demonstrates this important concept. It shows six “diverse” asset classes: AGG (investment-grade bonds), GLD (gold), SPY (S&P 500), JNK (junk bonds), EEM (emerging equity markets), and IYR (real estate). It is a “% change” chart that examines the stock market crash in 2008. The start date is Sept. 30, 2008, and the end date is Nov. 24, 2008.

FIGURE 1: PERFORMANCE OF DIVERSE ASSET CLASSES (LATE 2008)

This example from 2008 demonstrates how strain can carry through into basically all asset classes. A real crisis does not just impact one asset group. It does not just lead to rotation, or redistribution, of wealth. A real crisis leads to destruction of wealth. Stocks, bonds, gold, and real estate all saw substantial declines during the 2008 bear market as wealth was destroyed and investors in all types of instruments saw declines in the value of their portfolios.

During October 2008, investment-grade bonds (AGG) held up the best with a decline maxing out just over 10%. Real estate (IYR) did the worst, and its max drawdown was near 60%. Nothing provided a safe haven. This is something I often refer to as “crisis correlation risk,” and it should be considered when constructing a portfolio.

Another way to see the increased correlation among these different asset classes is to look at the dates they made major bottoms:

- AGG—10/10/08

- GLD—11/12/08

- SPY—3/6/09

- JNK—3/9/09

- EEM—11/20/08

- IYR—3/6/09

We see here that all of these instruments hit major lows within a five-month period. That means everything suffered substantially prior to those bottoms. A long-only approach across many different asset classes may help cushion drawdowns during minor corrective periods, but this kind of approach does a poor job of protecting against major meltdowns that can cause severe damage to a portfolio. Instead of simply diversifying among asset classes, investors can look to reduce crisis correlation risk by diversifying among strategies.

A recent paper from Societe Generale published at AIMA (Alternative Investment Management Association), “Managed Futures—Riding the Wave,” found that managed futures strategies performed well in terms of controlling drawdown, and their max drawdown occurred at a different time than being long-only the asset classes shown in Figure 1.

Rather than late 2008 or early 2009, managed futures saw their worst drawdown bottom out in 2013. This suggests low correlation with the asset classes discussed above. Managed futures strategies could be one way to go. Traders could also consider market-neutral strategies, trend-following, intraday, or short-term multi-day trading techniques as other alternatives.

When constructing a portfolio, investors should remember that different strategies will shine during different environments. To better improve their chances of avoiding a substantial drawdown, traders should consider not just alternative asset classes but also alternative strategies. Noncorrelated strategies can provide some real advantages. I would encourage all traders and investors to examine their portfolios and consider whether the types of strategies, and not just the assets classes they employ, are diversified enough.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com