Trend-following strategies: Dealing with ‘whipsaws’

Trend-following strategies: Dealing with ‘whipsaws’

Followers of a rules-based, trend-following investment approach know that whipsaws can be the “cost of doing business”—especially if you want to avoid the devastation that can come during severe bear markets.

We think it is a good time to revisit a topic that is always top of mind for tactical money managers and investors in rules-based strategies like trend following, and that is whipsaws.

Whipsaw trades are the one issue that will constantly concern investors using trend-following strategies. Whipsaw trades can cause losses or cause you to miss out on gains, and aside from those monetary impacts, they are difficult to tolerate emotionally. If you are going to do anything different than being a buy-and-hold investor, you are always going to compare to “what could have been” if you were using a buy-and-hold strategy.

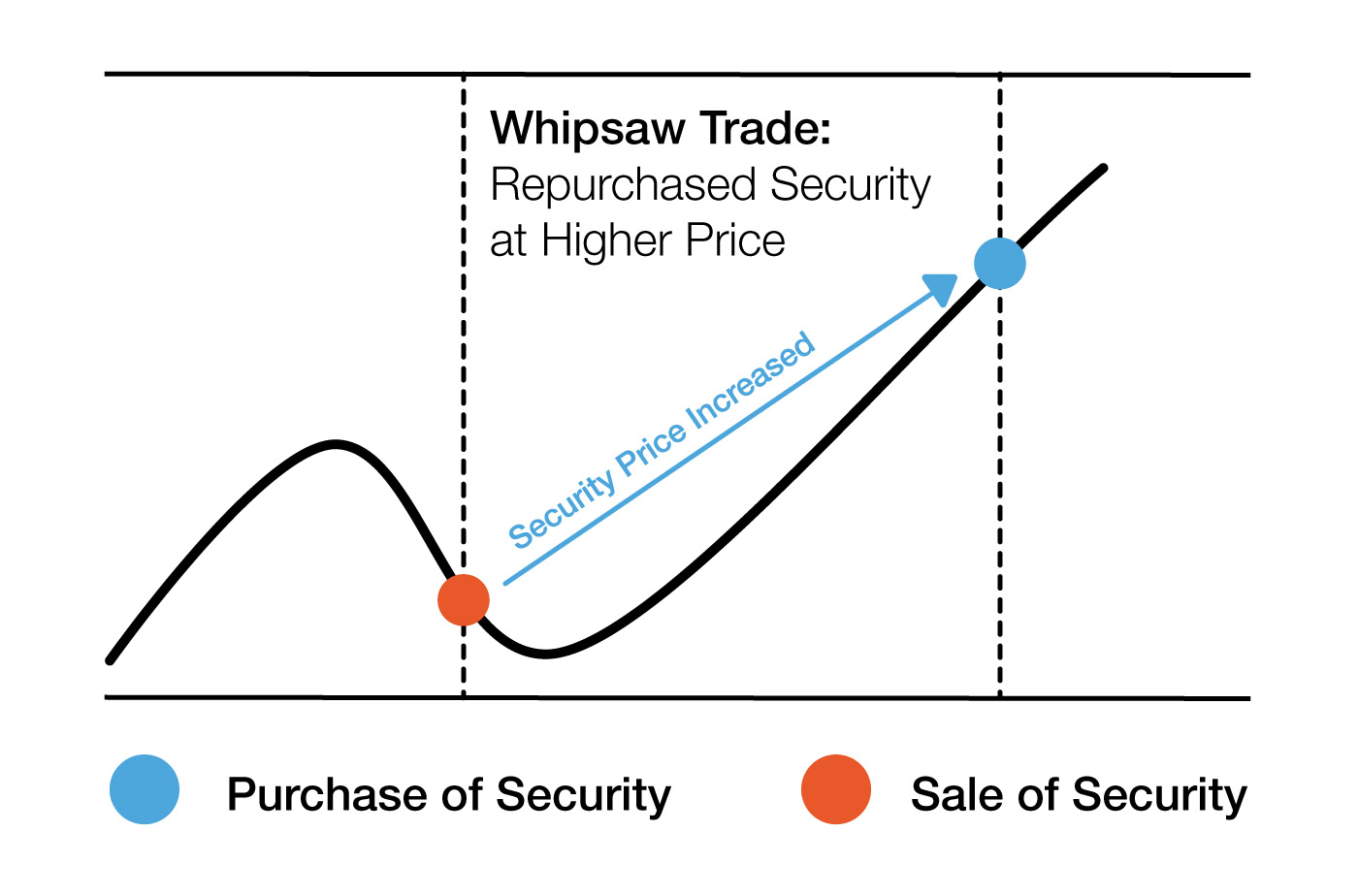

A whipsaw is basically a trade or change in your investment position that the market does not cooperate with. There are two ways to get whipsawed when trend following. One is to move from being invested to being defensive (i.e., selling) and then the market moves higher and forces you to buy back in at a higher price.

FIGURE 1: ‘WHIPSAW’ RESULTING IN BUYING BACK AT A HIGHER PRICE

Source: Grant and Greg Morris, Dancing with the Trend blog at StockCharts.com

This type of whipsaw does not necessarily cause losses in your account but does cause you to miss out on gains. This trade makes investors think that if they stayed invested and not sold when they did, their account value would have increased; “Everyone else is getting rich and I’m not!”

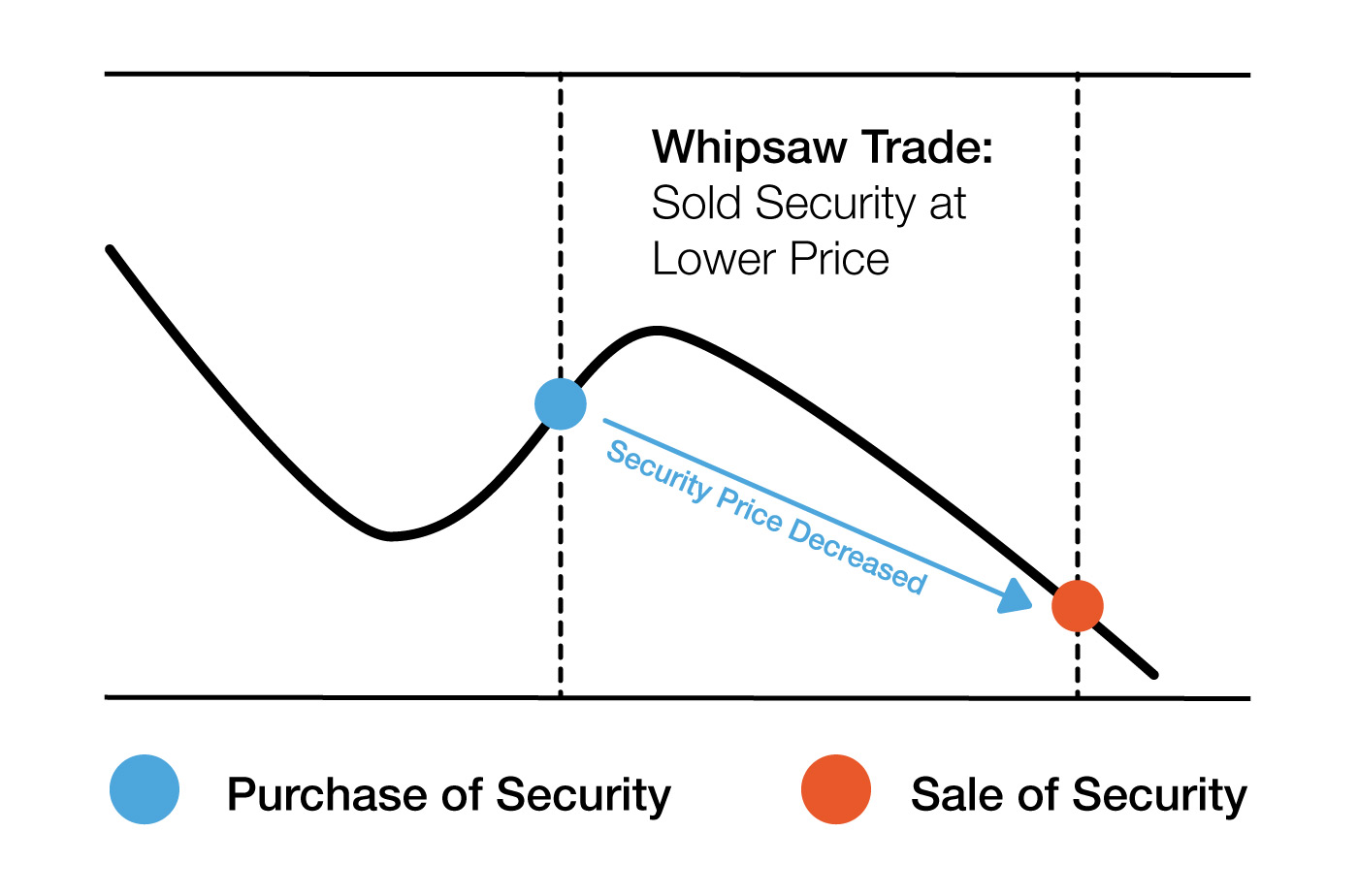

The second type of whipsaw is when you are defensive and move to being invested (i.e., buying) and the market moves down after you enter, forcing you to sell at a lower price.

FIGURE 2: ‘WHIPSAW’ RESULTING IN SELLING AT A LOWER PRICE

Source: Grant and Greg Morris, Dancing with the Trend blog at StockCharts.com

This type of whipsaw does cause losses in the account and makes you think that if you weren’t so anxious to buy, you could have bought in later at a lower price; “I’m buying high and selling low; this strategy is not working!”

Whipsaws are an inevitable consequence of eschewing the buy-and-hold approach that will eventually cause you to become a victim of a bear market. Whipsaws are the “cost of doing business” if you want to avoid the devastation that comes during bear markets.

We know this fact to be true, watching the market plummet from the sidelines is not a bad thing, emotionally or financially. We never know if a few down days are going to turn into a correction, or if a correction is going to turn into a bear market. No one can reliably predict such things (even though countless people try), but at least we are always prepared for the worst outcome.

That is why we accept whipsaw trades in our trend-following approach—for the benefit of the downside protection our selling rules provide. It allows us to try to participate in the good times and avoid the bad times. Are the calls always correct? Are the trades always positive? Definitely not, but we know that there is only one thing worse than being wrong, and that is staying wrong.

We don’t think there is any way to get over whipsaw trades. We hate them, our clients hate them, and people quit using investing strategies because of them. Yet, they are never going away; they are absolutely part of the process and cannot be avoided. We think it just takes experience to get used to whipsaws, if one ever does. Taking a longer-term view of a strategy’s investment results and not focusing on the current trade that may not be working is one way to make whipsaws more tolerable.

There are, however, ways to reduce the number of whipsaw trades that occur in any rules-based strategy, and that is to de-sensitize the model to the market’s actions; one such example would be using wider stops. We caution against this approach to whipsaws as it may reduce the frequency of them, but it can also reduce overall performance, especially during bear markets. Having wider stops means you’ll stay invested during more uptrends, as smaller pullbacks do not trigger selling, but you’ll inevitably not get out of the way as quickly during corrections and bear markets, forcing you to ride the market down further before selling.

Know that whatever stop level you choose, there will be times when the market does not cooperate. Adjusting a model based upon sound principles so that the whipsaws in the recent past are reduced or eliminated likely leads to whipsaws at other times and worse returns where it matters most—in the future.

Ironically, most buy-and-hold investors are really just very de-sensitized tactical investors, because they do eventually sell near market lows when the pain of further losses is far more than they can tolerate! Very few have the ability to always implement the “hold” portion of buy and hold, and we don’t think it is a good plan for most investors with serious money at stake. We think it is better to accept the whipsaws and avoid the devastation of bear markets.

Editor’s note: This article, written by Greg Morris (with assistance from Grant Morris), was first published at StockCharts.com on April 11, 2022. Many thanks to the authors for permission to republish the article. Please see their frequent commentaries on the blog Dancing with the Trend.

The opinions expressed in this article are those of the authors and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Greg Morris has been a technical market analyst for over 50 years. His experience includes analysis software development, website analysis and education, and money management. He has a long history of understanding market dynamics and portfolio management and has written four books: “Candlestick Charting Explained” (and its companion workbook), “The Complete Guide to Market Breadth Indicators,” and “Investing with the Trend.” He previously served as the chief technical analyst and chairman of the investment committee for Stadion Money Management and currently serves as a senior advisor to McElhenny Sheffield Capital Management (MSCM).

Greg Morris has been a technical market analyst for over 50 years. His experience includes analysis software development, website analysis and education, and money management. He has a long history of understanding market dynamics and portfolio management and has written four books: “Candlestick Charting Explained” (and its companion workbook), “The Complete Guide to Market Breadth Indicators,” and “Investing with the Trend.” He previously served as the chief technical analyst and chairman of the investment committee for Stadion Money Management and currently serves as a senior advisor to McElhenny Sheffield Capital Management (MSCM).

Grant Morris, CFA, CFP, specializes in tactical investment strategies and technical analysis for McElhenny Sheffield Capital Management (www.mscm.net). He joined MSCM after developing a rules-based trend-following strategy to manage his personal investable assets. Mr. Morris has vast experience serving clients in the financial-services industry, previously as a consultant, and now in managing multiple tactical ETF strategies for MSCM clients and other RIA firms.