The yield curve’s 15-month lag

The yield curve’s 15-month lag

Economists got very animated in late 2022 when the Federal Reserve’s hiking of short-term interest rates resulted in an inversion of the yield curve. Inversion happens when short-term rates go above long-term rates, which is not typically the condition rates are supposed to be showing. Most of the time, long-term rates pay higher yields than short-term ones, and that makes sense. If you are going to lock up your capital for a longer time, you would expect to get paid more for that.

Yield-curve inversions have a perfect track record of bringing economic recessions. Yet many economists think this time is different, and that the Fed has somehow managed to engineer either a “soft landing” for the economy or a “no landing” scenario in which GDP never shrinks and the good times just keep rolling.

This complacency stems from a misunderstanding of how yield-curve inversions work. The effect of an inversion is not felt right away but rather after a lag time of about 15 months.

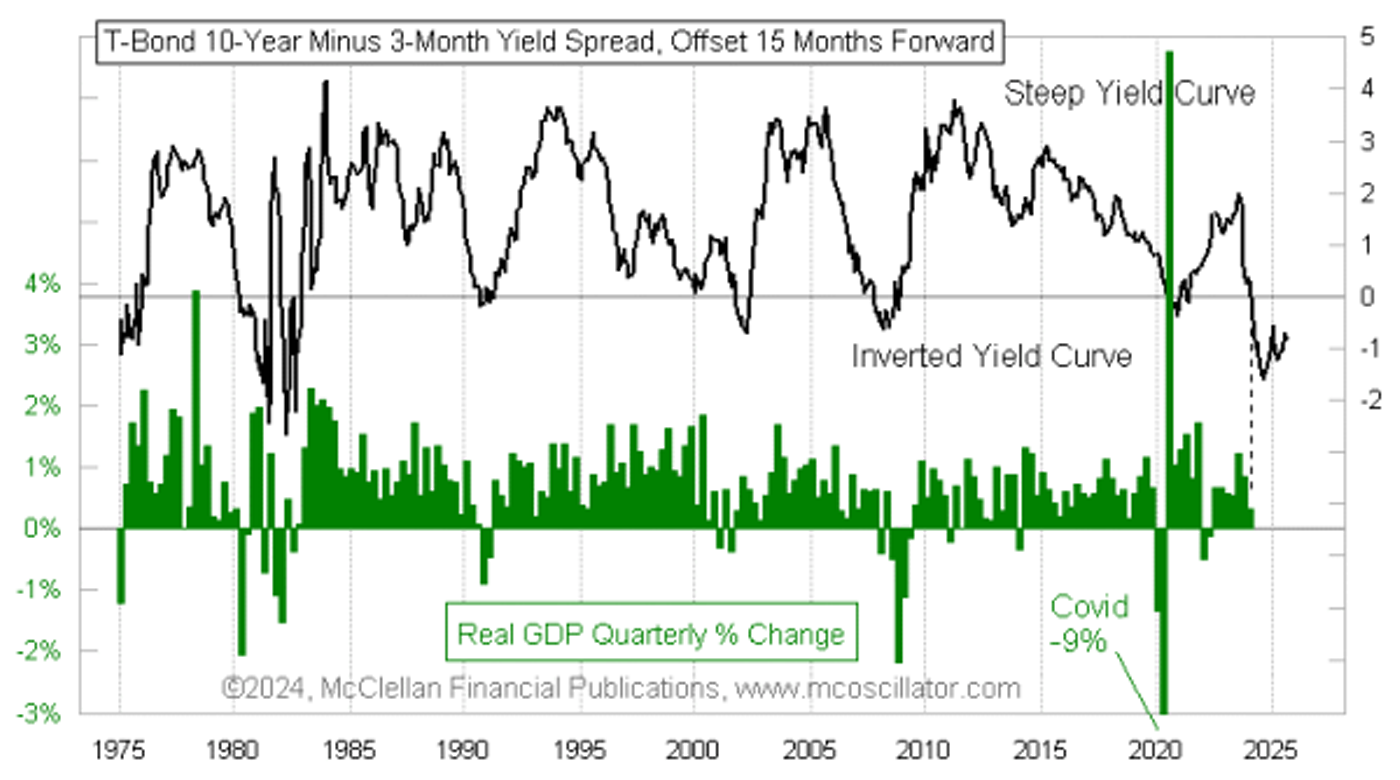

Figure 1 shows the spread between the 10-year and three-month Treasury yields, shifted forward by 15 months to illustrate how GDP responds with that lag time. This yield spread first inverted on a monthly basis in November 2022. Counting forward 15 months takes us to February 2024, which was in the first quarter (Q1). While Q1 did not see a negative real GDP growth rate, it fell to a very low positive number. The full effect of the current inversion of the 10-year and three-month rates has yet to be felt.

FIGURE 1: REAL GDP QUARTERLY CHANGE COMPARED TO TREASURY-YIELD SPREAD (10-YEAR MINUS 3-MONTH)

Source: McClellan Financial Publications

Furthermore, that economic effect should continue to be felt for 15 months after the spread between the 10-year and three-month Treasury yields finally “disinverts.” In other words, the Federal Open Market Committee (FOMC) members might believe that they are fighting current inflation by tightening economic conditions with high interest rates, but the effect is delayed. The continuing inversion of the yield curve means poor GDP conditions for 15 months after the yield curve disinverts, and there are no signs of disinversion yet.

![]() Related Article: Follow the money supply

Related Article: Follow the money supply

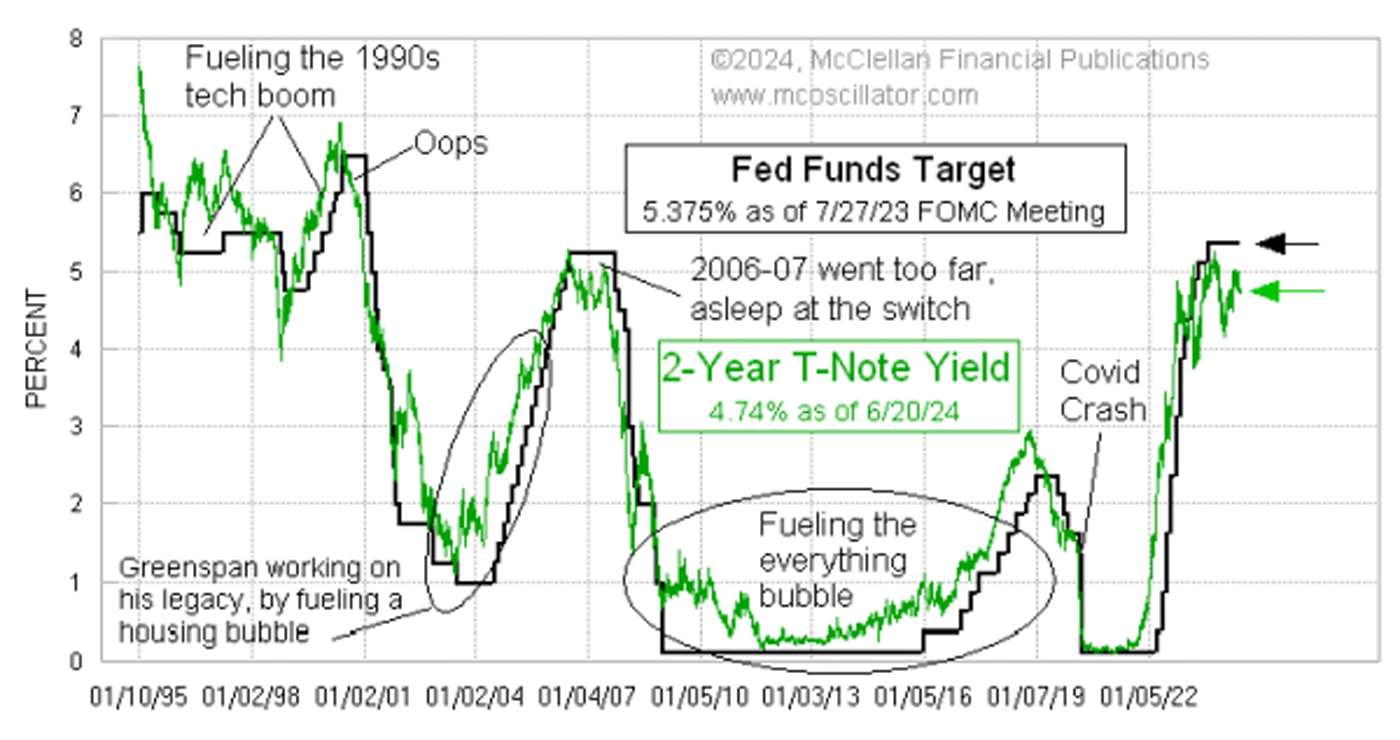

If I could impose one change on our economic system, I would have the Fed outsource setting short-term interest rates to the bond market. Let the two-year Treasury yield determine the fed funds target rate.

FIGURE 2: FED FUNDS TARGET RATE COMPARED TO 2-YEAR TREASURY YIELD

Source: McClellan Financial Publications

Figure 2 shows that the two-year yield knows what the Fed is going to do before it does it. Problems arise when FOMC members (with their expensive economics degrees) think that they know better than the bond market. When they keep rates too low, below what the two-year yield says, they help to fuel bubbles in both the stock market and the economy. And when they keep the fed funds target rate too high, like they are doing now, they overdo the braking force, leading to big problems.

But as far as I know, none of the FOMC members will read this or other articles in my “Chart in Focus” series, and they probably would not accept that suggestion from me anyway. People generally do not like to be told that someone (or something) else could do a better job than they do. So we will just have to live with a Fed that is almost always behind the power curve, applying the gas or brakes at the wrong times.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on June 20, 2024.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

RECENT POSTS