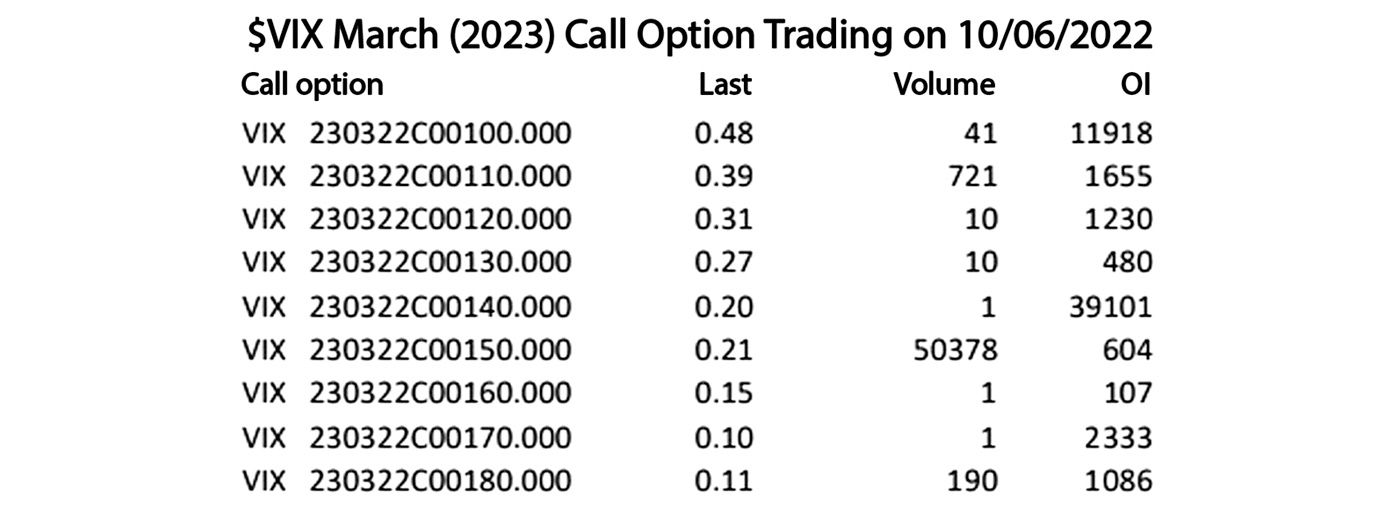

On Oct. 6, someone bought 50,000 $VIX March (22nd of 2023) 150 calls for $0.19. So, that’s 50,000 contracts on the CBOE. Strike is 150 for $VIX—or, technically, for the March (2023) $VIX futures. And the expiration date is roughly six months from now.

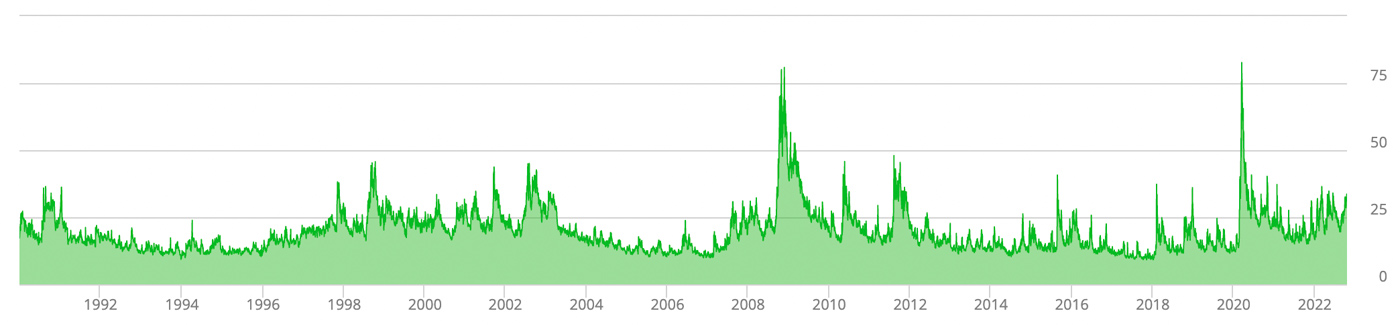

What does this imply, if anything? First of all, it should be understood that $VIX has only traded at that level once—during the crash of 1987. In reality, $VIX didn’t exist at that time, so $VIX has never really traded at 150. But when $VIX was created in 1993, the CBOE backdated the data and estimated that $VIX traded above 150 during that market crash. Of course, pricing data was difficult to discern at that time, since many option markets were extremely wide due to the existence of a crashing market. But let’s just say $VIX did trade there. Now someone expects it will do so again? Wow.

FIGURE 1: HISTORICAL VIEW OF THE VIX INDEX

Source: CBOE

Could this be a hedge? I can’t really imagine what it would be a hedge against. I think it is far more likely to be outright tail speculation—the belief that the market could face extreme risk over the next six months. What could cause that kind of tail move? Well, we know a crash can. The 1987 crash was a 22% drop in the market in one day. That is not even possible now, what with circuit breakers and the like set to stop trading if it gets too violent on the downside.

Of course, if the market dropped “the limit” one day and then opened down “the limit” the next day, that would be the equivalent of a crash, circuit breakers or not. Another possible extreme tail event would be a nuclear war. I can’t think of much of anything else. In the case of nuclear war, though, the markets might not even be open, and this trader might not be able to cash in on his “bet,” even if he survived.

I see that the CBOE has $VIX strikes listed all the way up to 180 for the March calls. On the day, 190 contracts of the 180 strike traded, closing at $0.11.

The following table shows the summary of the Oct. 6 trading in $VIX March options with strikes greater than or equal to 100. (OI is Open Interest as of Oct. 5, 2022—so, not yet including the figure in the Volume column from Oct. 6, 2022.)

TABLE 1: $VIX CALL OPTIONS PRICE STRUCTURE AND VOLUME

Source: McMillan Analysis Corporation

I wonder how they arrived at the price of $0.19 for the trade of 50,000 options on Oct. 6. That sounds way too high, but it is in line with the other contracts. In any case, the buyer really didn’t care. Does Putin have an option account? Scary.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article that was first published at optionstrategist.com on Oct. 10, 2022.

New this week:

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com