The importance of having a game plan—and sticking with it

The importance of having a game plan—and sticking with it

Investors would do well in “taking what the market offers”—through a more completely and actively diversified portfolio that can adapt to challenging market conditions.

The very poor collective performance of the New York Yankees team in the American League Championship Series (ACLS) unfortunately left a sour note related to one of the most remarkable baseball feats in recent history.

That said, I am sure anyone interested in major league baseball followed—either fanatically closely (like New York Yankees supporters) or just as casual fans of the game—the 2022 season of the Yankees’ outfielder Aaron Judge.

In the season’s 161st game (out of 162), Judge hit his record-breaking 62nd home run of the season. This surpassed Roger Maris’ American League (AL) record of 61, set in 1961. It also put Judge in seventh place for all-time single-season home runs, with three National League players from the so-called steroid era in front of him during multiple seasons (which is a whole other story).

As a lifelong baseball fan, I watched the saga of Maris and Mickey Mantle dueling for the record in 1961; the unreal seasons of Barry Bonds, Mark McGwire, and Sammy Sosa in the late 1990s and early 2000s; and Judge’s game-by-game quest this year. In fact, I still have the baseball cards of many of the Yankees’ stars from over 60 years ago in my personal collection!

What is more remarkable to fans and baseball professionals was how completely Judge performed all season—especially when the pressure was on to not only set the new AL home run record but also help carry his team to an AL East title. (Also remarkable was a fan declining the first offer of $2 million for Judge’s record-breaking home run ball, which he caught at the Texas Rangers’ Globe Life Field in Arlington, Texas.)

Two things became clear in the last month of the regular season. Opposing pitchers were not going to let Aaron Judge—one of the Yankees’ few hot hitters (many regulars were out with injuries)—be the one player to beat them. And then, as he was close to tying and then breaking the record, Judge drew numerous walks as he saw very few pitches to hit at all.

Throughout those last days, Yankees’ announcers noted time and again how Judge “stuck to his game plan.” He refused to “chase pitches,” took his walks when offered, and helped win games with hits other than home runs. At the end of a near “Triple Crown” season, he led the majors not only in home runs but also in many other important offensive categories. Following the end of the season, Aaron Judge won the American League’s Hank Aaron Award for most outstanding offensive performer and also the league’s Most Valuable Player (MVP) award.

Sticking with your investment game plan

Jerry Wagner, Flexible Plan Investments’ president, who has authored several articles for this publication, offers this piece of advice to financial advisors and investors:

“Have a plan and stick to it. As I’ve written many times, whether it is trying to invest by following headlines, financial talking heads, so-called market experts, or political predictions, none of these sources are likely to lead investors to long-term profits.

“Instead, investors need to approach the market with a plan. … Investors have to be disciplined. They have to stick with their plan. …

“Having a financial advisor to create your plan and provide counsel at such times can be the difference between success and failure in your investments.”

This message was especially relevant during 2020, and now again in 2022, with investors seeing continuous and elevated volatility and the whipsaw of fast bear market rallies followed by new rounds of market declines.

Adding deeper diversification to investor portfolios

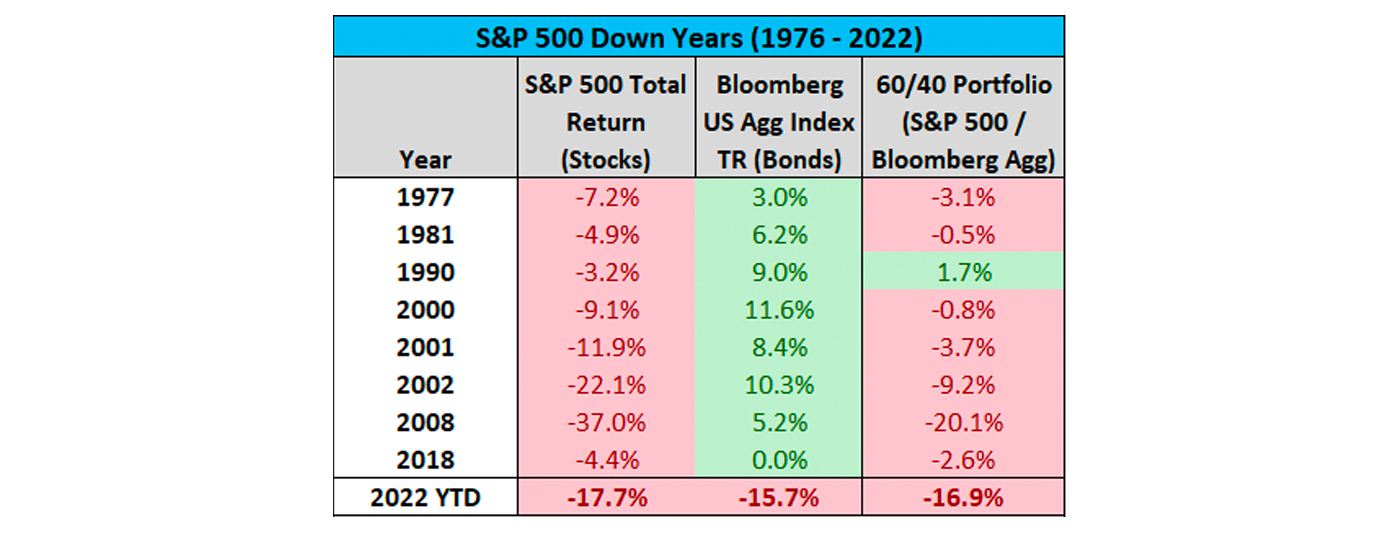

The classic 60/40 portfolio, the time-honored representative of simple portfolio diversification, was off to its worst year-to-date performance through a September in recent history (down 20.1%). Markets improved significantly in October, but a 60/40 portfolio through the end of the month was still on pace for its worst performance since 2008. Both stocks and bonds were down over 10% through the end of October, something Compound Capital Advisors said was “something we’ve never seen.”

Source: Charlie Bilello, Compound Capital Advisors. Data through 10/31/22.

Financial advisors we have interviewed for Proactive Advisor Magazine frequently talk about the fallacy of thinking that a combination of passive indexed equity funds and passive bond funds will provide the kind of diversification that will mitigate steep portfolio risk in volatile markets.

Rather, many endorse using a combination of actively managed strategies across various asset classes that are meant to work together (with different performance characteristics) as a cohesive portfolio over full market cycles.

As one advisor puts it,

“A cornerstone of my active management approach is offering a very wide potential combination of diversified strategies. In line with this overall risk-managed active approach, l will generally use several different noncorrelated strategies, in several different asset classes. While not every strategy ‘will fire on all cylinders’ at the same time, that is exactly the point.”

Mr. Wagner has written about this same aspect of diversification. He has said, “If every strategy in a portfolio is going up or down at the same time, there is a high probability that the portfolio is not properly diversified.”

Another advisor team told our publication, referring to the volatility seen in 2020,

“We believe in the many benefits of managed money accounts. We have access to third-party managers who have sophisticated risk-managed strategies that seek to minimize drawdowns in poor market environments and to capture upside market moves in favorable environments.

“We saw both types of periods in 2020 and were very pleased with how these strategies performed. It is not only the benefits of risk management or a defensive posture with active strategies. Many of these strategies can seek to optimize performance through sector rotation or the use of leverage. We see investment managers as close partners. We provide broad, big-picture oversight and set client allocations, and the managers execute on all elements of their strategies.”

The ultimate point? As our first advisor notes, when strategies are “objectively quantified” and work in combination in a well-diversified portfolio, “emotion and ego can be put aside for the most part, and clients can more freely allow their strategies to perform as designed, without constant second-guessing.”

Just as Aaron Judge took a disciplined approach that led to his noteworthy regular season performance—reacting effectively to what pitchers offered—investors would do well in “taking what the market offers” through a more completely and actively diversified portfolio that can adapt to challenging market conditions. That should allow them to better follow their investment game plan over the “long season” that is their investment time frame.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.