The Fed announcement on Oct. 30 helped boost the S&P 500 to a new all-time high. So does this mean the positive reaction to Fed policy is likely to propel the market higher in the coming days and weeks?

One factor I have found to be important when examining Fed Day rallies like the one we saw last week is whether the move up is accompanied by a long-term high.

To see just how important the new long-term high is, I have created two studies. They show performance following positive Fed Days, broken down by those that closed at a new high versus those that did not.

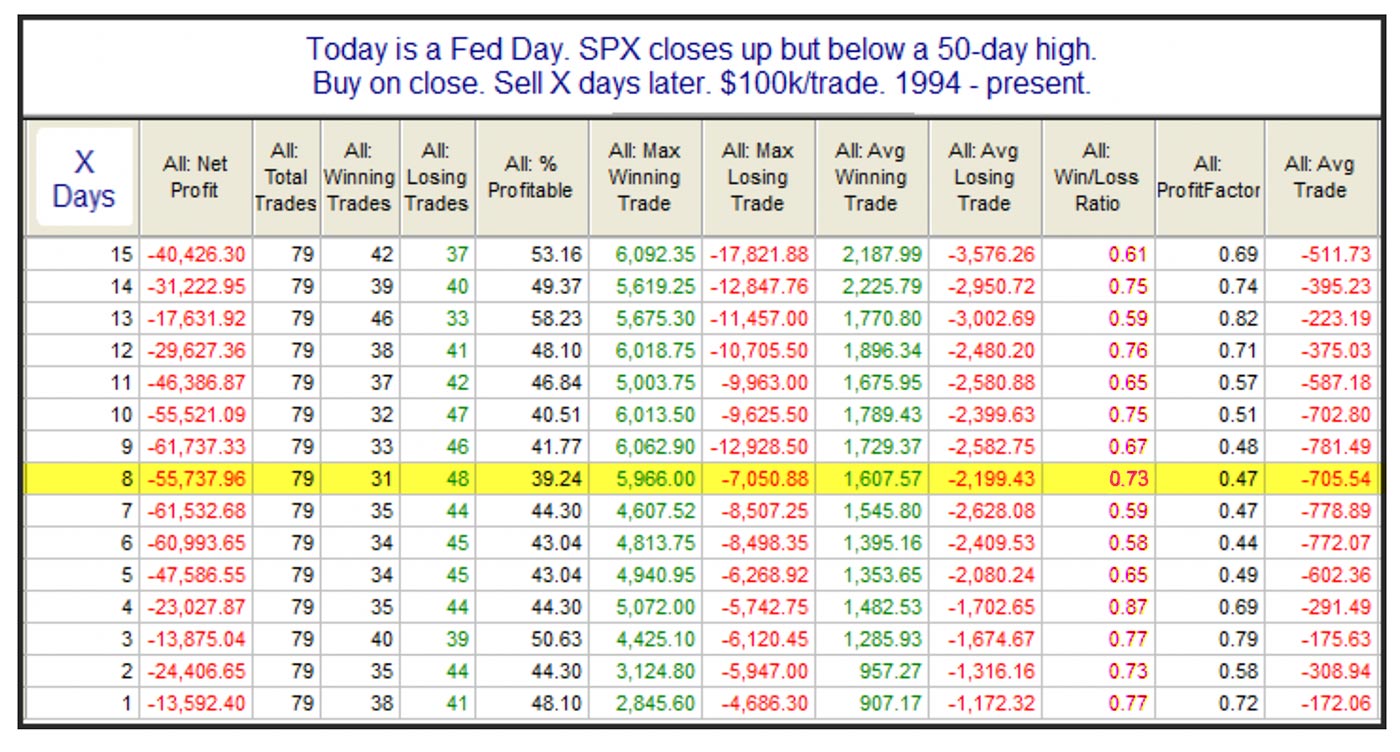

First, let’s look at the Fed Day rallies without new 50-day closing highs (Table 1).

Note: Assumes no slippage or commissions for trades. Profit Factor = Gross Gains/Gross Losses.

Source: Quantifiable Edges, TradeStation

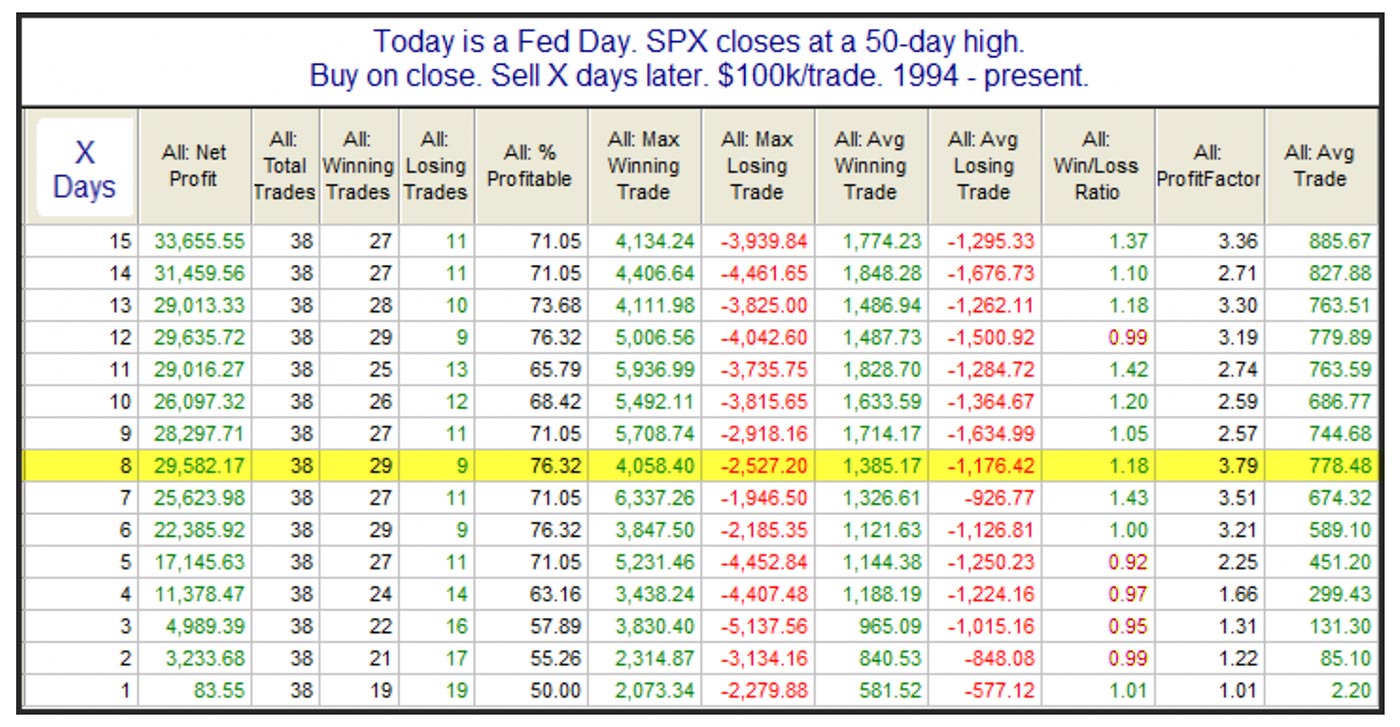

With the average trade showing a loss for all holding periods measured, the numbers here suggest the market has struggled in the following days and weeks to maintain the Fed Day positivity in this scenario. Now let’s look at the times when a new high was made (Table 2).

Note: Assumes no slippage or commissions for trades. Profit Factor = Gross Gains/Gross Losses.

Source: Quantifiable Edges, TradeStation

The results here are substantially different. Net returns went from all red to all green for the average trade for all holding periods measured.

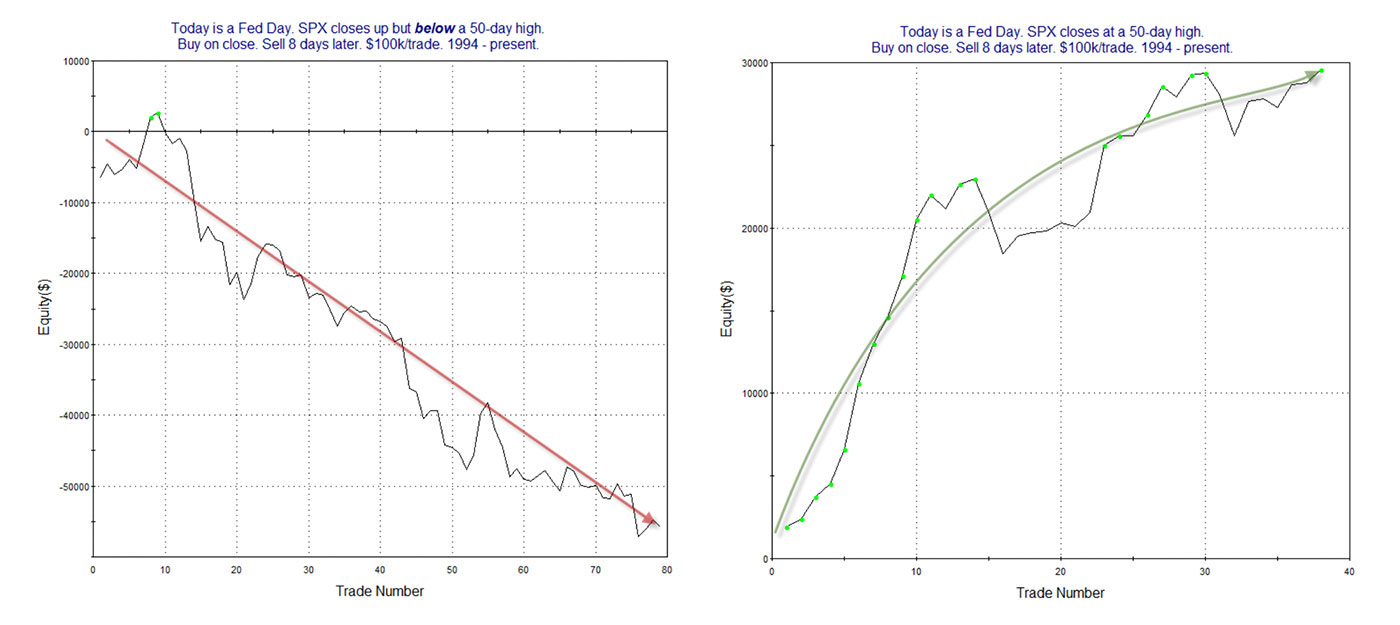

Historically, there appears to have been a solid tendency for the market rally to persist. I also produced eight-day profit curves to visualize the difference and see how the edges have played out over time (Figure 1).

Source: Quantifiable Edges

The curves appear to confirm the tendencies suggested by the statistical tables. Fed Day rallies without a strong intermediate-term trend behind them have a tendency to stumble in the following days and weeks. But those that are backed by a new long-term high have shown an ability to add to the Fed Day gains. The new high that accompanied the Oct. 30, 2019, Fed Day rally appears to be a positive.

More research on Fed-based edges can be found on the Quantifiable Edges blog.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com