The ‘Big Fat Lie’ and five truths of succession planning

The ‘Big Fat Lie’ and five truths of succession planning

Financial advisors should not let “I’ll always be there for you” become a big, fat lie. While succession planning is a critical element of a financial advisory business, it is often overlooked or poorly planned. Learn what it takes to successfully implement a succession plan that will benefit a firm’s founder, clients, employees, and other key stakeholders.

“Our industry is facing a succession planning crisis,” says Ray Sclafani, founder and CEO of ClientWise, in recent comments to Barron’s. He adds, “It’s about integrity and alignment. It’s about the nobility of our profession and not simply having the right legal documents signed.”

Barron’s notes in the same article,

Sclafani adds that building an orderly succession plan between founders and next-generation leaders could take as long as seven to 10 years for high-end, multi-member advisory teams.

Sclafani and his firm have consulted with advisory firms of all types and sizes during the development of short- and long-range phases of their succession planning process. They offer an extensive toolkit to financial advisors, which forms the basis for their coaching efforts, webinars, and workshops.

ClientWise introduces the topic of succession planning in the toolkit in this manner:

“While succession planning is a critical element of a financial advisory business, it is often overlooked, due to the magnitude of thinking it requires to successfully implement. Considering your succession in its full capacity can take years of disciplined thinking with regard to your own retirement, your clients, your firm, and the industry overall.

“Succession planning involves the identification and advancement of possible successors for an organization, through a systematic evaluation process, which usually requires the ability to understand an individual’s capacity for a role in which he or she has never held. This is true both for the new leaders, as well as for the owner/operator who will be expected to step into a different role upon retirement or semi-retirement, thus completely changing his or her relationship with the business.

“This is a monumental transition, especially when taking into consideration that the future of financial services will be very different than the industry in which we are currently operating. Add to that the changes occurring outside financial services that also affect the consumer and investor marketplace, and we are working in an environment that seems almost entirely unpredictable.

“At ClientWise, we’ve found that the best way to approach succession planning is through an outcomes-based approach. That is, by considering the results you wish to achieve through succession, and working your way backward from those goals, to determine how to get there. This is true for advisors who want to retire completely, as well as those who want to have some involvement in their business even after retirement.”

Sclafani’s popular succession planning webinar sets the stage with this advice for financial advisors: “Don’t let ‘I’ll always be there for you’ be a big, fat lie.”

He says, “As advisors, we owe it to our clients to deliver on the promises we’ve made to them. We must not think about succession selfishly, but through the lens of putting our clients first.”

Sclafani says that one in four advisors (25%) are expected to leave the industry in the next 10 years and efforts to recruit younger advisors into the industry have been lackluster. Not surprisingly, 92% of advisors recognize the risk in not having a succession plan, but only 36% of firms have a process for developing internal successors in place.

ClientWise’s toolkit expands on this point,

“Many advisors ignore the importance of succession planning because at the peak of their careers—which for the best and brightest can last decades—they feel invincible. This is an understandable and powerful feeling. In fact, 43% of advisors plan to work ‘forever’ and therefore don’t consider succession planning a ‘top of the list’ necessity. While this represents the dedication and perseverance that is so common in financial services, it’s also indicative of financial advisors’ failure to fully consider the promises they are making to their clients.

“Further, studies reveal that even those advisors who are planning for succession aren’t being strategic or proactive enough. … Partial planning is about as effective as no planning at all; so while the thought is good, the real power is in the execution. According to our latest research, financial advisory practices that have an effective plan in place earn more than double the profit as those that don’t. And even they aren’t fully considering the process of succession from the full perspective that we do at ClientWise.”

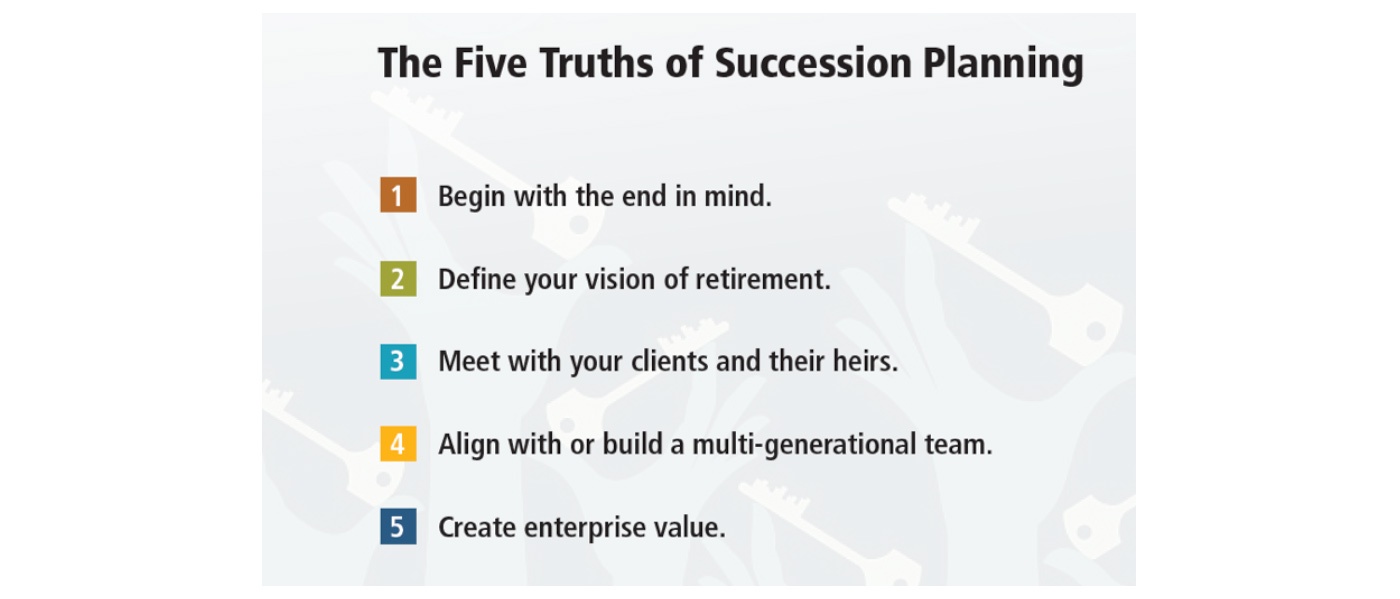

ClientWise’s ‘Five Truths of Succession Planning’

Source: ClientWise

Principals of an advisory firm should first work through the following types of question areas, says Sclafani, “creating a clear picture of where they want to end up in every aspect of their business in both the short term and long term.”

- What do you want as a final outcome for your business or your retirement? How is this stated in the positive with a forward perspective?

- What will having this outcome do for you or your business? What is the purpose of your outcome? The intent?

- How will you know when the outcome is successful? What will change and how will you recognize that change?

- Who, what, when, where, and why: In what context do you want your outcome? When do you want results? Who will fill in the gaps if you aren’t continuing to work?

- What effects will the outcome have on your organization, people, clients, services, third parties, etc.? Are there any blocks, challenges, or organizational restrictions that could create difficulty in reaching your outcome?

- What resources do you have or need in order to get your outcome? Is getting your outcome within your control?

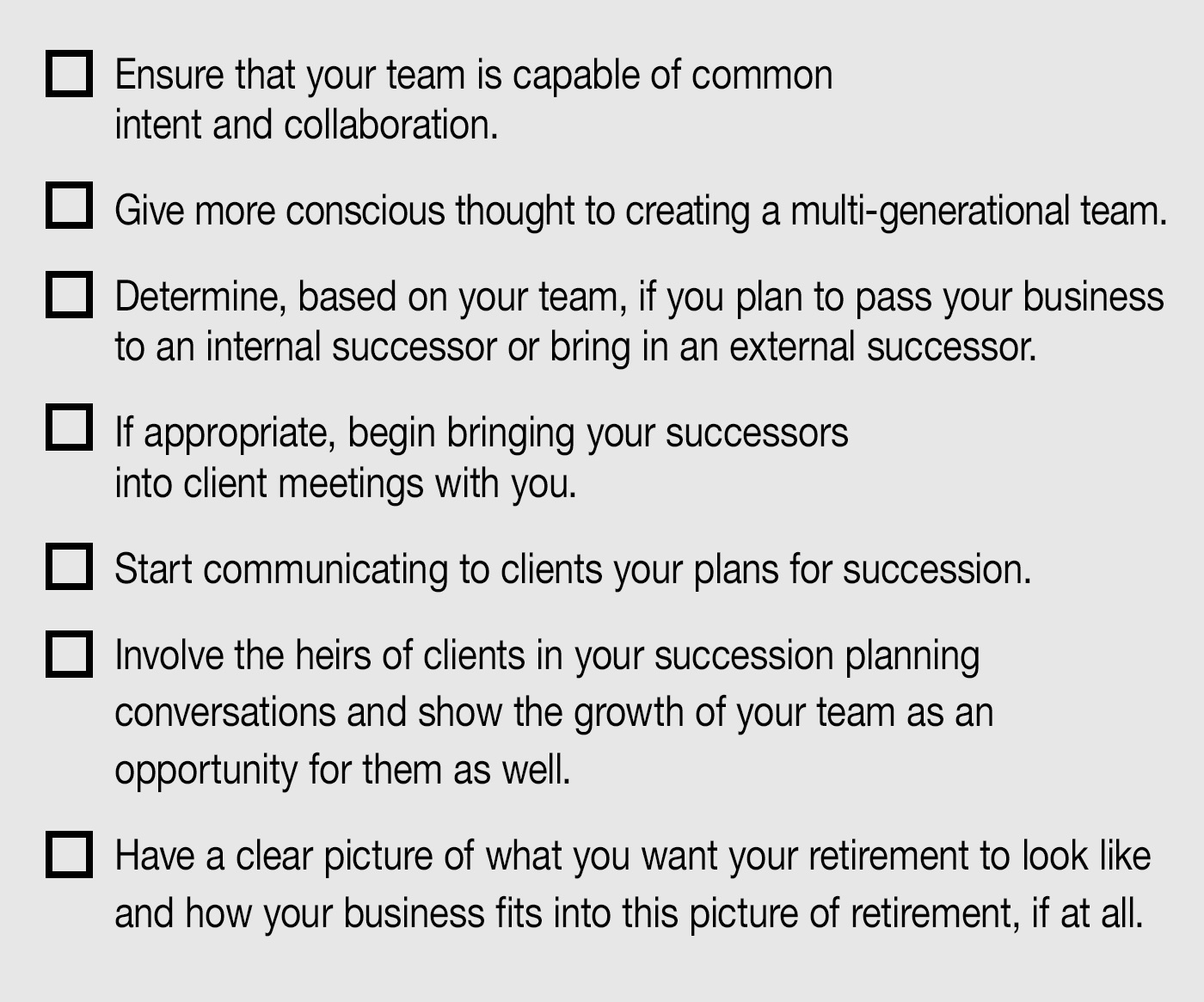

Sclafani notes that succession plans may fail if they are not professionally and fully communicated in advance with current clients and their heirs. Their input and buy-in are critical to maintaining strong relationships far into the future and preemptively helping to take client departures off the table. He offers the following specific guidance:

- Meet with current clients to share your plans for succession.

- Partner with them to determine their final plans for their transfer of wealth.

- Determine how your business can continue to fully address their financial needs over the long term, while still achieving your succession planning goals.

- Use this as an opportunity to include the heirs of their wealth in your conversation—not in a presumptuous way, but through discussions that make it clear you are aware that they could potentially be impacted by your succession as well.

- If you’re not completely set on your succession planning structure, allow their insights to help to shape your approach to succession.

Sclafani notes, “Only 5% of the current 315,000 registered reps and financial advisors are under the age of 30,” creating tremendous opportunity for today’s leaders of advisory firms to mentor the next generation of financial advisors.

He says, “Too many advisors mistakenly understand succession planning as something that’s connected solely to the sale of the business, and therefore don’t begin thinking about it until late in their careers. Ideally, however, succession planning needs to be considered very early on, while the business is still being built. And while not all advisors choose to grow their businesses by building a team, this is a popular route among advisors today, from both a succession planning standpoint and a multi-generational appeal standpoint.”

In considering a succession plan that will eventually transition a firm’s ownership internally, Sclafani says, “If a financial advisor is truly successful as a leader, he or she will build a team that participates as owners in his or her business, not just as operators.” This means placing an emphasis on leadership development and articulating a shared purpose, vision, and values. The firm principal needs to evolve from “Lone Ranger to Leader.”

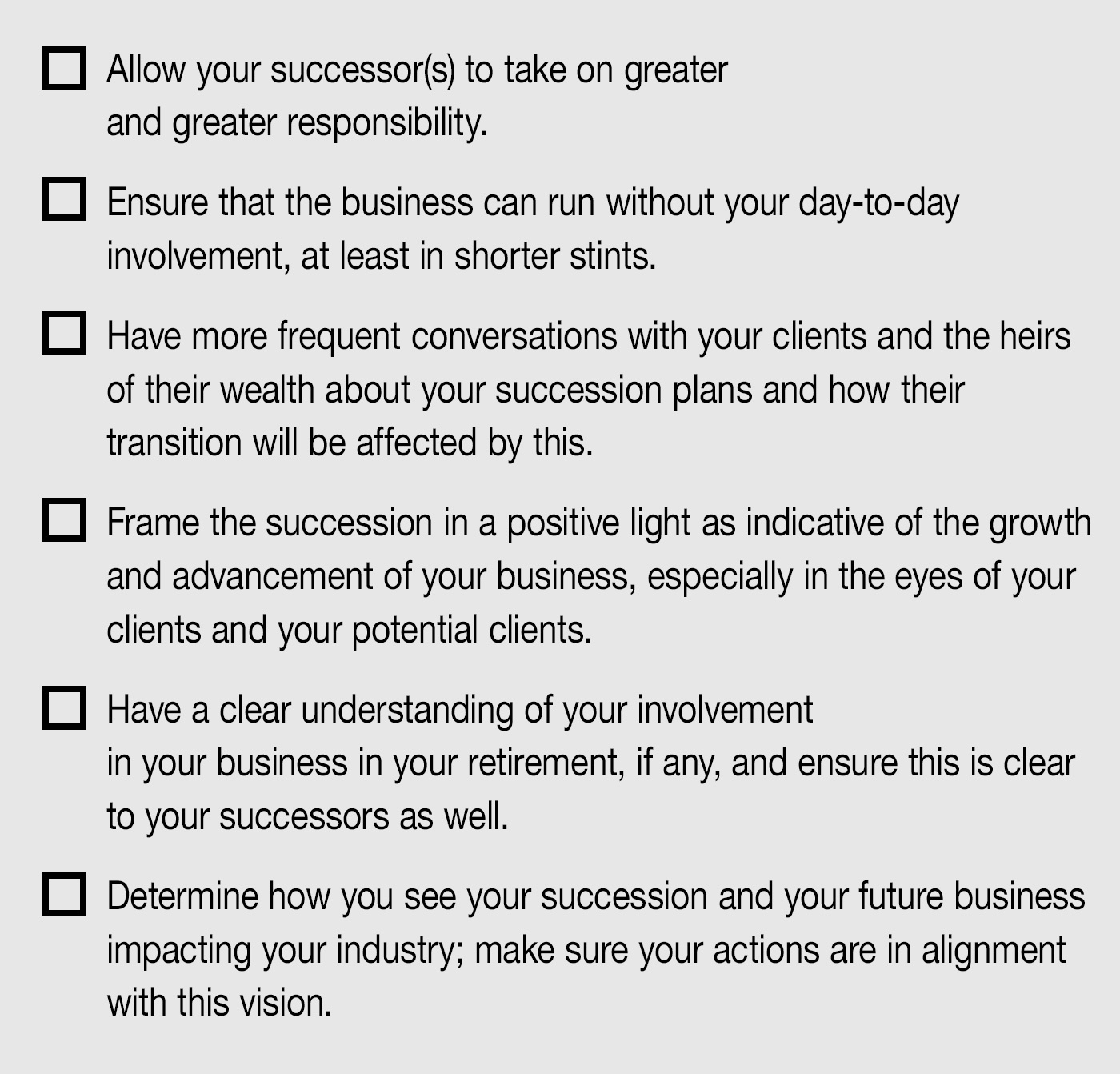

Sclafani believes the succession planning process for an advisory firm principal can have a huge supplemental benefit—helping them find new ways to create enterprise value.

He says, “When you fully focus on creating value for others, team members, and clients, you create enterprise value for the owners of your firm.”

“Measure what matters when creating enterprise value,” says Sclafani. ClientWise has identified seven key areas where firms should place a strong focus:

- Hone your firm’s value proposition.

- Understand what factors are critical to sustainable, profitable growth.

- Build recurring streams of revenue.

- Institutionalize your firm’s brand.

- Develop multi-generational leaders.

- Share client advising across your firm.

- Institutionalize your firm’s best practices for business development.

In summary, Sclafani says, “Looking ahead and imagining where a financial advisory practice will eventually end up allows you to create strategic objectives to achieve that vision, with the larger outcome—that of the industry—in perspective. This is a much more effective process than running a practice that is completely reactive or planning for a future that is determined around how you respond to an unpredictable environment. To achieve this, you must understand the larger goal of what you are working toward for the industry, for yourself, and for your business.”

Sclafani adds, “Building a business that is durable, profitable, and sustainable is an ideal platform from which to launch a succession plan. In order to achieve this, there are key actions that should take place at various points in the growth of your practice.”

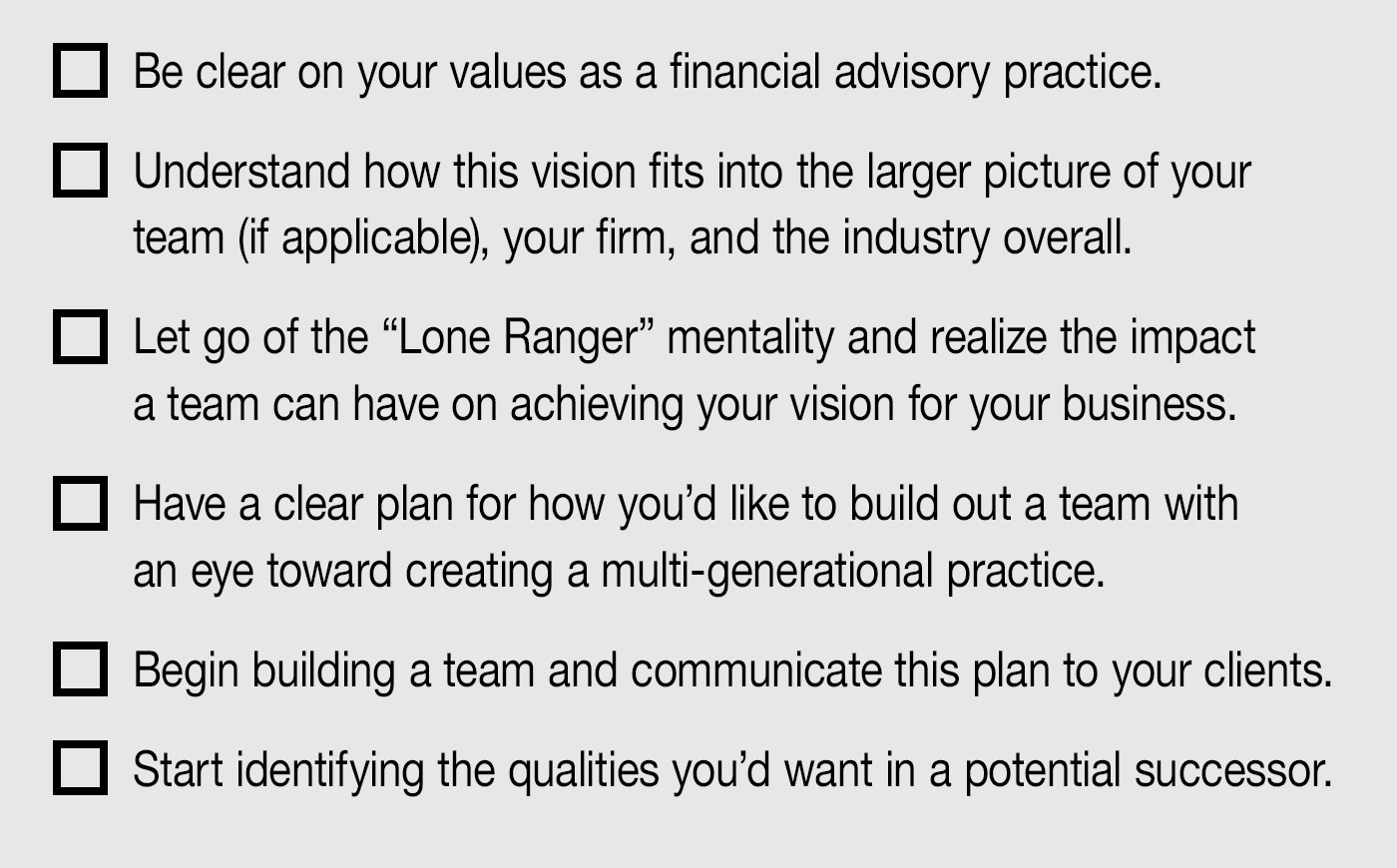

ClientWise’s process can help advisors determine how far out they see themselves from retirement and provides specific next steps for aligning priorities in each phase, following the checklists below:

These checklists are suggested guidelines for the steps advisors should take to ensure a proper succession plan and the successful transition of their business.

Sclafani says, “Remember, succession planning is a long-term play. These steps take careful consideration and planning over an extensive period of time; they will be difficult to condense into a shorter time period without the guidance of a trusted mentor or coach. Those advisors who are just starting out will have the opportunity to implement these actions throughout the course of their growth. Those who are closer to retirement can take the perspective provided by these guidelines to inform their final years moving into retirement.”

Editor’s note: Ray Sclafani is the founder of ClientWise, a premier coaching company exclusively serving the financial-services industry. A professional certified coach and the holder of a master’s certification in neurolinguistics, Mr. Sclafani leads a firm that has trained thousands of financial advisors in advanced practice management principles and methodologies to achieve more consistent success. He says these principles are based on years of studying and analyzing the best practices of financial firms of all sizes—both here and abroad. In his 2016 book, “You’ve Been Framed,” Sclafani tackles the opportunities financial advisors have “to create change by the way in which they conduct their practices.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Proactive Advisor Magazine wishes to thank Ray Sclafani and ClientWise for permission to use webinar and website material and excerpts from the book, “You’ve Been Framed.” Cover image by Corbis Images/Getty Images. Mr. Sclafani’s book, published by John Wiley & Sons, Inc. in 2016, can be obtained at www.wiley.com or at Amazon.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.