Attracting the right successor

Do philosophies matter more than numbers when finding the right successor?

Years—perhaps even decades—before owners of independent advisory firms near retirement, they should be thinking of a succession plan.

While advisors have many options—including merging with other firms—an increasing number are choosing to select and groom a much younger up-and-coming advisor, often for more years than one might expect. The intention is to eventually hand the reins over, but only when both sides are convinced it is a match with a high probability of success. The reasons for such careful scrutiny and trial periods are many. But founders and successors want to make sure current clients are comfortable with the transition and do not have reasons to head for the exit door.

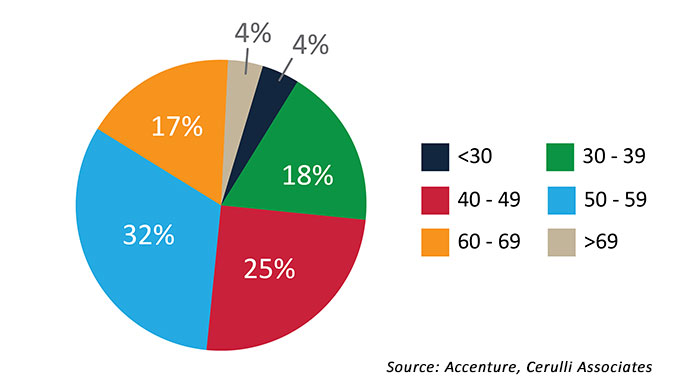

EXHIBIT 1: ADVISOR AGE BY RANGE

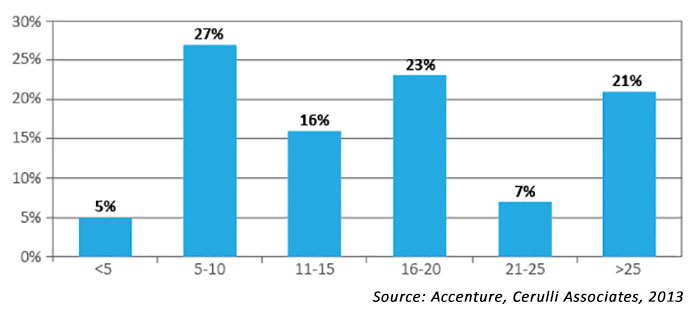

Grooming a younger advisor as a successor may even be reaching a critical phase, as the average age of the advisor community is now over 50 (Exhibit 1). By 2024, about 14,000 advisors will have retired each year—about a third of the current advisor head count—according to Cerulli Associates (Exhibit 2). It is estimated that $2.3 trillion in assets is currently controlled by advisors over the age of 60, making this a high-stakes game for all concerned. The vast majority of single practitioner, independent financial advisory practices simply cease to exist when a founder retires. So grooming a younger advisor might be the best, and most urgent, option for an advisor who wants their firm to live on.

Many transition options to consider

Independent advisors thinking of eventual retirement have several options available to them to keep their firm running well past their prime years. Recent findings from Fidelity’s Inside Track Conference (as reported by Accenture) reinforced this fact and summarized advisors’ retirement options into three general categories: (1) “Sell and Move On,” (2) “Merge and Stay Involved,” (3) “Internal Transition.”

EXHIBIT 2: NUMBER OF YEARS IN WHICH ADVISORS PLAN TO RETIRE OR LEAVE THE INDUSTRY

According to a recent Investment News article,1 “Today’s financial services mergers and acquisitions market offers more options than ever for finding the perfect successor.” This review cites five common strategies advisors might use to facilitate the sale or transition of their most valuable asset:

- Do it yourself “These individuals will spend their own time identifying, screening, and interviewing candidates, then narrow the list and negotiate the deal. In many cases, they might go through this process two or three times before getting it right.”

- Online auction services “Services such as AdvisorBoxExchange.com, RIAmatch.com, SuccessionLink.com, and Schwab-Transitions .com provide sellers with broad exposure for their listing, capitalizing on the sometimes-overheated demand among buyers to realize tremendous value for the exiting advisor. … But some advisors view posting their client relationships for sale as disingenuous and time-consuming as they sort through the multitude of ‘tire kickers’ to find a good fit.”

- M&A consultants “M&A consultants are specialists that provide transition services and are hands on throughout the process. … The key benefit these firms provide is their ability to leverage their knowledge of the market and advocate for a client to obtain the best value and terms. But most consultants have a limited bandwidth. They therefore serve a more exclusive clientele and may be more expensive than other solutions.”

- Recruiters “With a seemingly endless network of connections, recruiters can provide advisors looking to sell their practices with a large pool of succession candidates. And because recruiters are paid by the buyer or the buyer’s broker-dealer or custodian, they are a low-cost solution. However, while recruiters know everyone and can make introductions, facilitating the sale of a business will typically require hiring a consultant or CPA and attorney.”

- Broker-dealers and custodians “These organizations have a vested stake in their advisors (and those advisors’ assets) remaining on their platform. Because of this, most firms have developed internal solutions and resources, or partnered with external experts, to ensure that their advisors are proactively engaging in the succession process.”

Despite this apparent wealth of resources for an older advisor considering his or her options, very few advisors address the issue on a timely basis. According to Accenture’s research, only 29% of advisors currently considering retirement have a succession plan of any fashion in place.

Wealth Management recently interviewed practice consultant David Grau, who says many advisors near retirement aren’t selling their practices at all. “The number-one exit strategy in use in the independent space today isn’t internal or external,” Grau says. “It’s attrition. The owner is married to the cash flow stream; they work it as long as they can. And by the time they’re done with it, there’s nothing left to sell.”

A two-way street

For those advisors who do decide to go the route of screening, selecting, negotiating with, training, and integrating a younger advisor (with the intention of working side-by-side for some years), what are some of the important considerations?

Sid Tobiason, partner at business consultant/CPA firm Moss Adams LLP, says, “Whether that successor is a family member, your management group, or a third party, succession is a process that will affect your business, family, wealth, and future. … Succession can be a complex undertaking filled with questions.”

He identifies three key questions, each having many underlying points for consideration:

- When should you transition away from your ownership role?

- If you sell your business, how can you get solid value for it?

- Who’s the best person to lead your company into the future?

Timing and profit-and-loss considerations are foremost for many advisors first embarking on the succession process, but the third (much less tangible) question might be the most difficult to wrestle to the ground for a self-starting advisor used to being in charge. These advisors care deeply about their client base, have worked many years to establish a reputation for excellence and trust, have standing in the community, and have built a practice model they feel serves their clients well. It is certainly not an easy “package” to just turn over to an “outsider” (Exhibit 3).

EXHIBIT 3: OWNERSHIP TRANSITION

Similarly, a younger advisor considering entering into some form of partnership, transition, or sales arrangement will have concerns that go beyond the pure dollars and cents represented by a balance sheet and cash flow:

- What are the demographics and size of the current client base? How sticky are the relationships?

- What is the primary compensation arrangement with clients?

- What third-party relationships are in place?

- Is there a good philosophical fit between founder and successor on broad planning and investment strategies?

- What standards of service, reviews, and communications have been established?

- How has technology been incorporated into the practice?

- Does the practice have a discernible and advantageous value proposition?

Does the right fit also reflect industry trends?

There is little doubt that the fee-based advisory model has taken hold in the industry. According to many sources, advisors’ fee-based revenues in the industry as a whole have surpassed 50% of total revenues for the first time in history—and are expected to become a larger and larger piece of the pie.

For younger advisors considering investing time, effort, and perhaps significant capital into a new relationship with an established practice, the fee-based model naturally can work to both sides’ advantage. Other significant growing trends include outsourced investment management, the use of more quantitatively-based investment strategies, practice innovations through technology, and the growing use of social media and digital

record-keeping and communications.

When a new working relationship is in its formative stages, both parties need to consider the importance of these factors—as strong selling points for a practice founder and as attractive benefits to his or her successor.

1. David Grau, “Help Is on the Way,” Investment News, March 15, 2015.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.