Taking financial advice ‘beyond the plan’: Harnessing technology and psychology

Taking financial advice ‘beyond the plan’: Harnessing technology and psychology

Advisors who fully embrace technology and use financial psychology in their practices can achieve better client outcomes—improving client satisfaction, retention, and referrals.

Financial professionals know that the most successful plans are the result of high client engagement. How is that engagement secured in this post-pandemic, tech-driven landscape? By harnessing technology and psychology, advisors can go beyond tactical planning to meet client needs and expectations.

Through a recent study, we advanced our understanding of this topic with behavioral metrics that show advisors who are committed to service and professional growth can harness the power of going beyond.

This study examined the combined effects of financial psychology and technology (i.e., the client portal) on client outcomes

Prior to this research, we knew:

- Client portals and behavioral science software are wealth management’s top transformational technologies.*

- Most advisors are familiar with the concept of financial psychology (71%).**

- Most advisors believe providing clients with a personalized financial-planning experience is important (86%).**

From this background, we formed our hypothesis: Today’s clients are not just seeking financial advice; they desire an enriched and personalized experience.

Advisors who fully embrace technology and/or use financial psychology in their practice have better client outcomes than those who don’t.

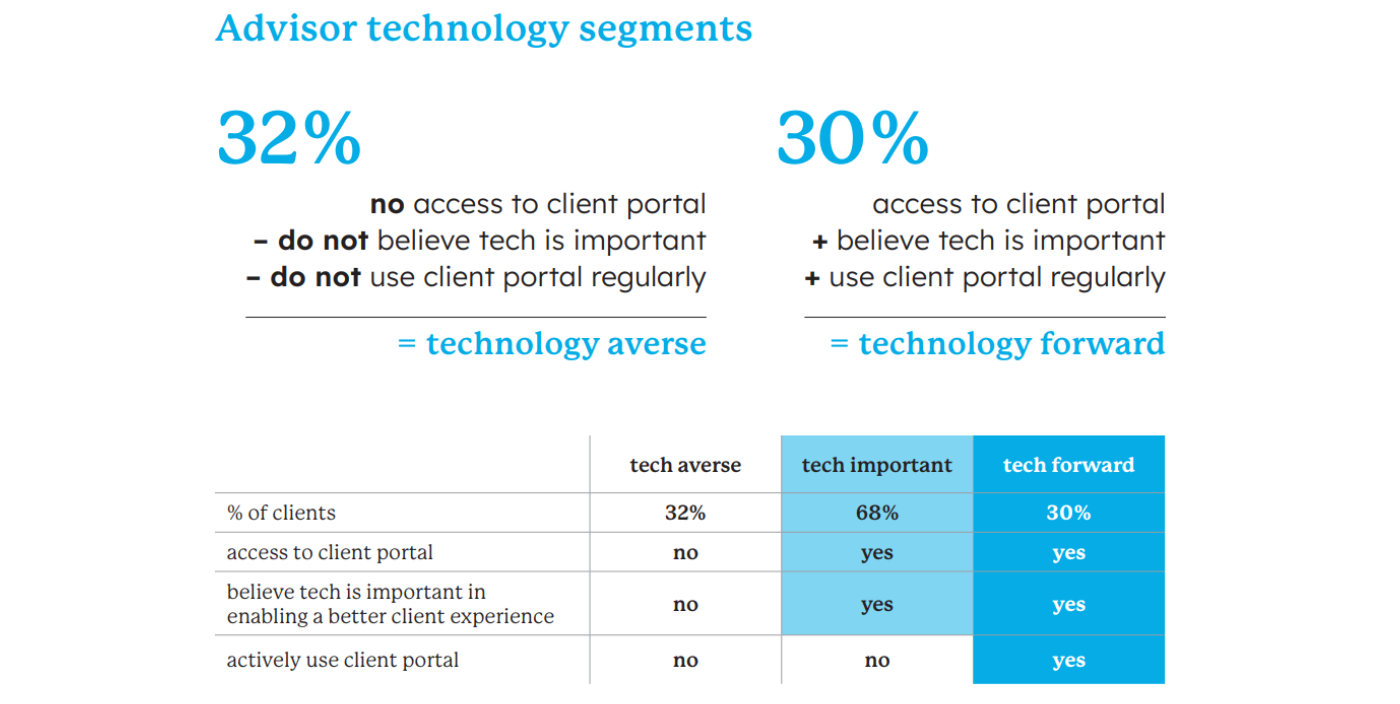

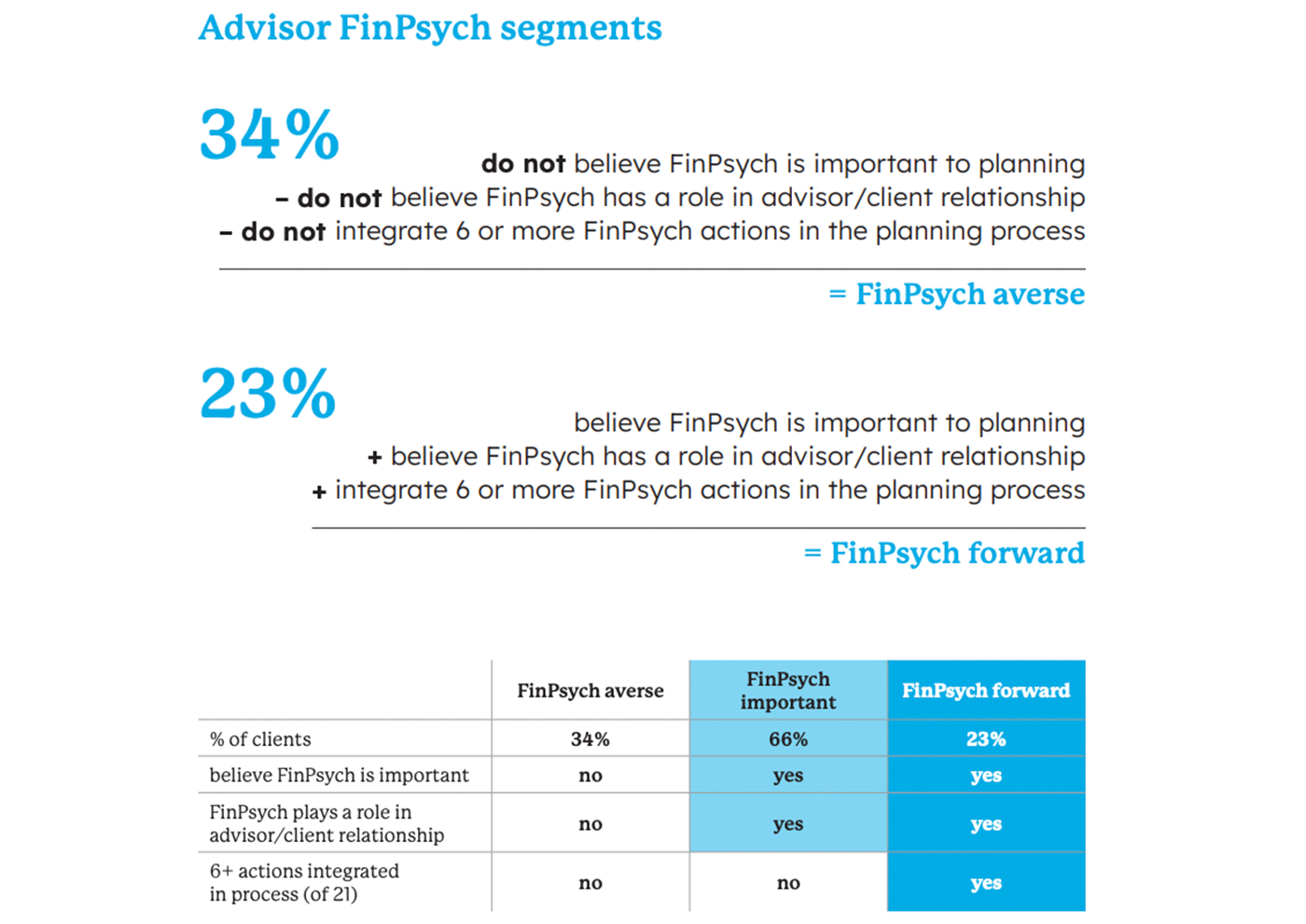

Research method and advisor segments

For this study, we surveyed 500 advisors and 1,000 clients on the topics of technology and financial psychology (aka FinPsych, the practice of using psychology to understand and improve financial decision-making and behaviors) to shed light on how they improve outcomes for financial-planning clients. Based on responses, we determined our technology and financial psychology levels and segmented advisors accordingly.

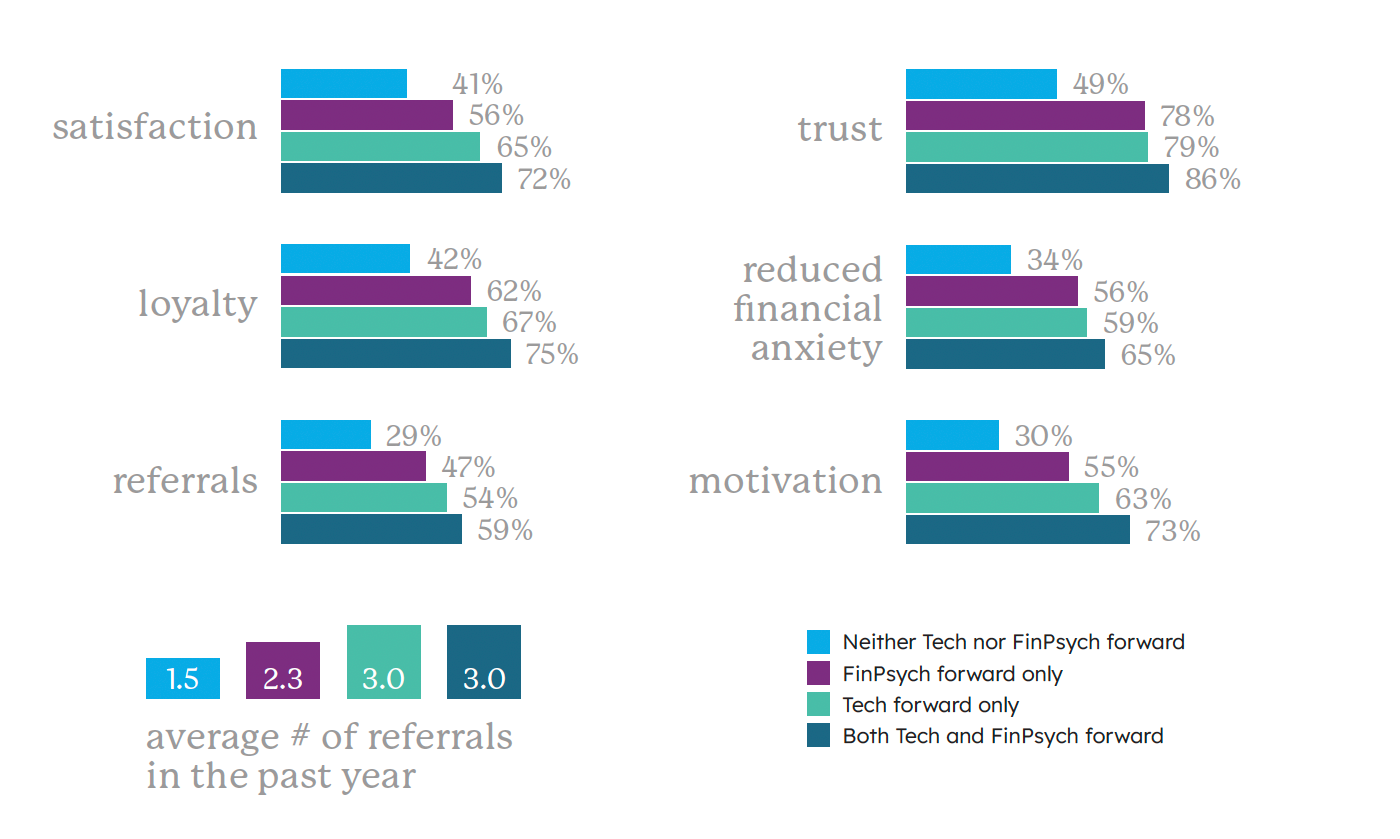

Client outcomes are best when advisors employ both a portal and FinPsych

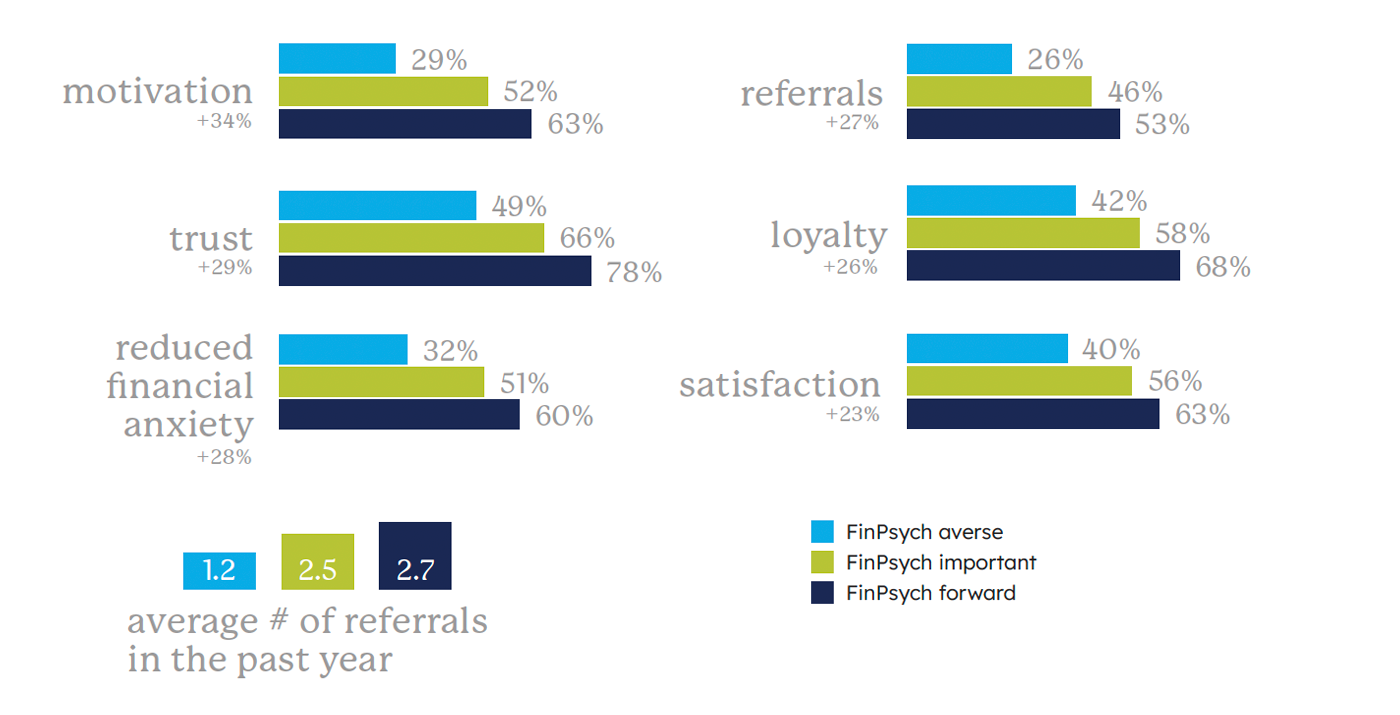

Clients who work with tech-forward advisors have significantly better key outcomes than those who work with advisors who are tech averse. Similarly, key outcomes for clients working with FinPsych-forward advisors are significantly better than those of clients working with advisors who are FinPsych averse.

The two practices are synergistic: When both a client portal and FinPsych are part of their financial-advising experience, client levels in key outcomes of satisfaction, loyalty, referrals, trust, reduced financial anxiety, and motivation are best across the board.

The study identifies a large gap/growth opportunity in the industry: Only 17% of advisors have fully embraced both practices.

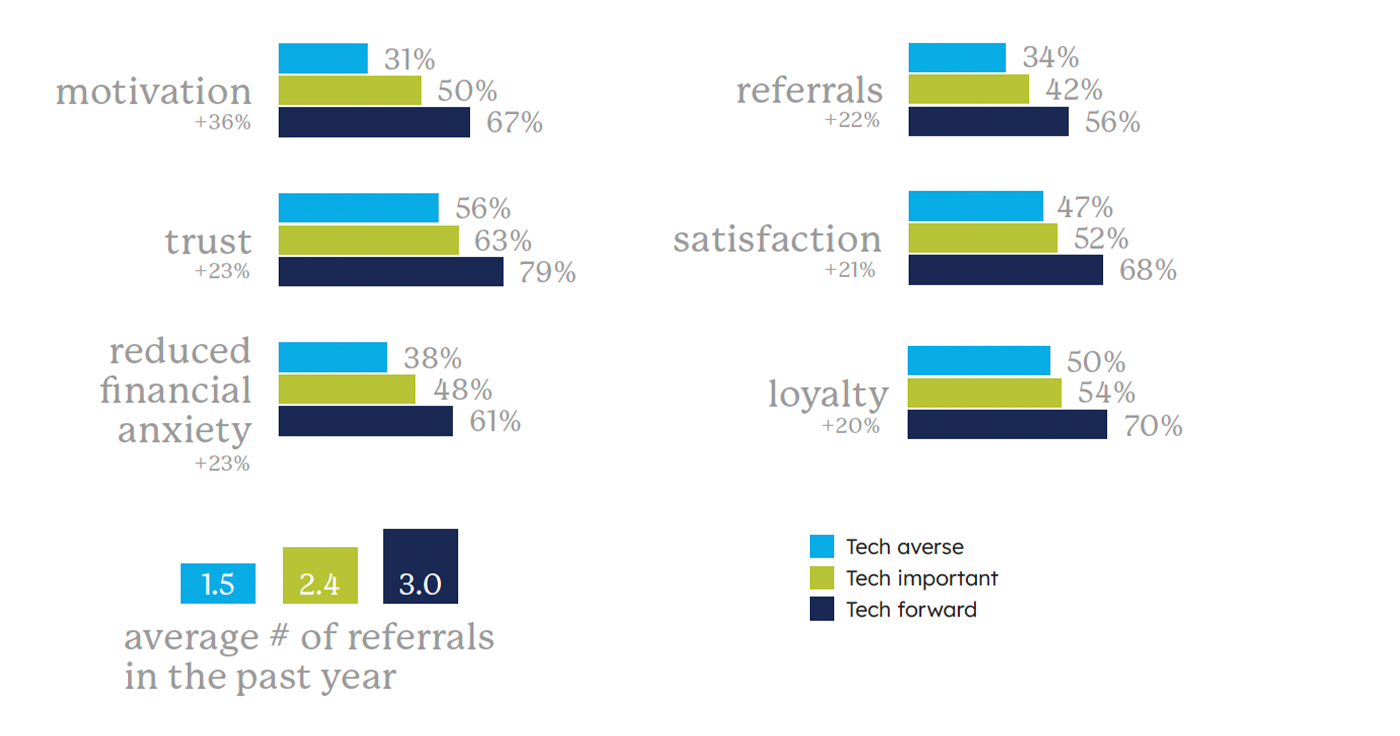

Client motivation more than doubles when their advisors are tech forward

Study results make clear the inherent value of tech-forward advisors—their clients score significantly higher in all areas of key outcomes: motivation, trust, reduced financial anxiety, referrals, satisfaction, and loyalty. Indeed, the demand for tech-forward advisors has exploded over the past four years. This surge is driven by the transformative capabilities of client portals, a tool that is revolutionizing client-advisor interactions. To meet this demand, advisors need to invest in their digital capabilities, ensuring they deliver a best-in-class planning experience to their clients.

There are significant differences between “believing” tech is important and actively practicing it.

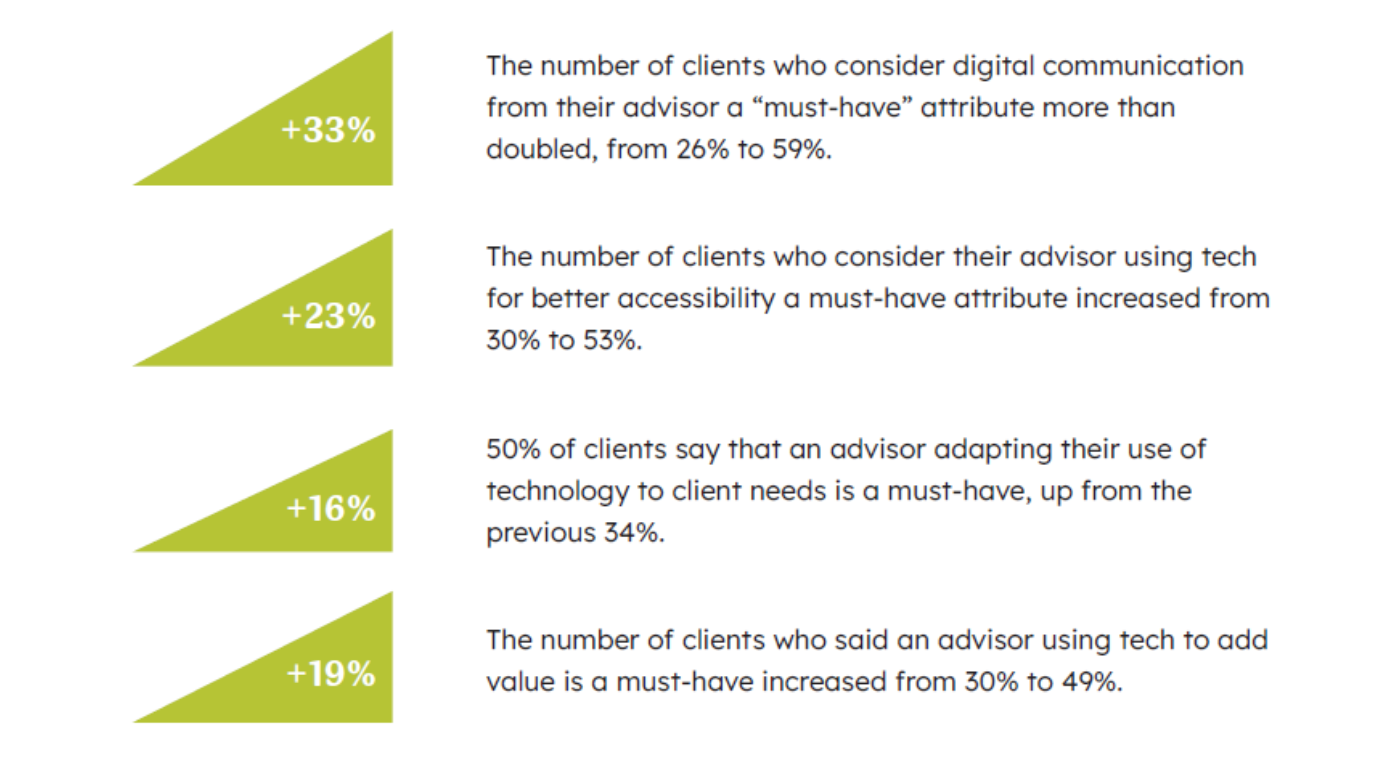

Clients need and value technology in the financial-planning experience

Between 2019 and 2023, client expectations around tech-related attributes they expect from advisors rose substantially.

Tech-forward planned spending is tied to client expectations

Tech-forward advisors understand the growing expectations of their clients and are responding accordingly: 87% of tech-forward advisors expect spending increases in the near future. The top three reasons for their planned spending are higher client satisfaction, improved client retention, and increased client engagement.

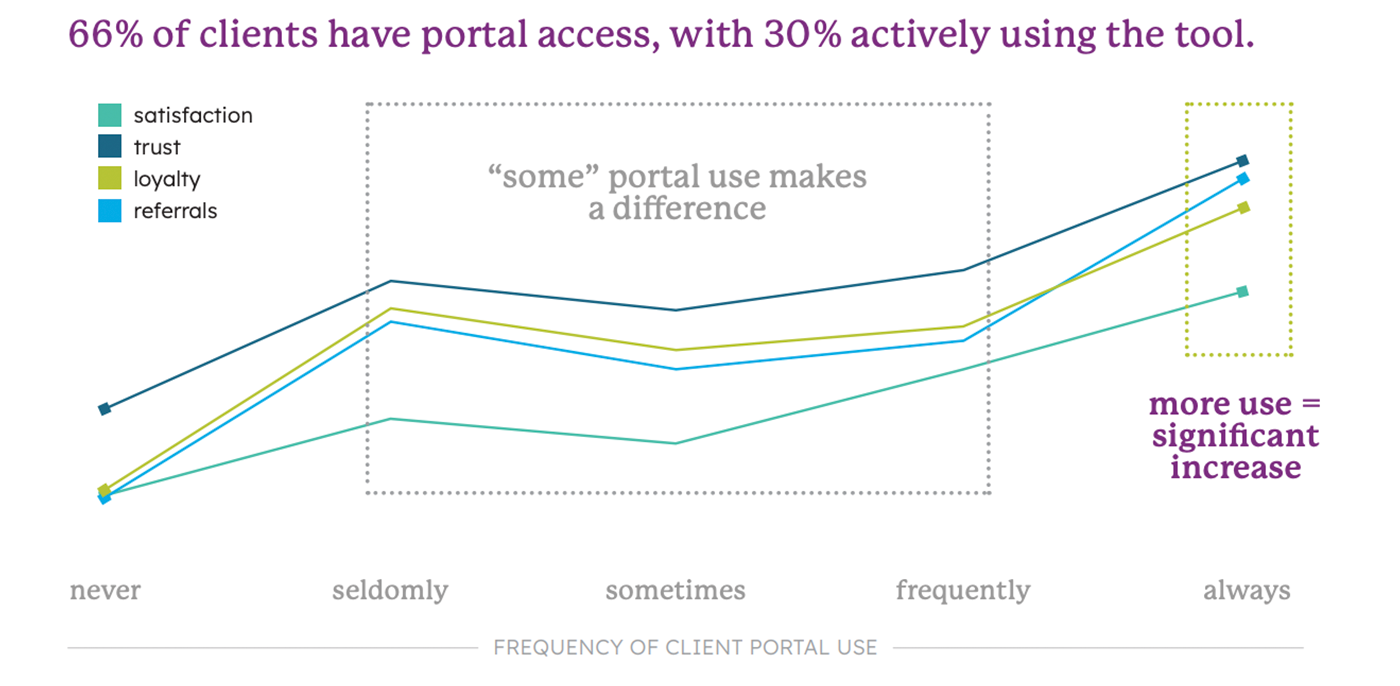

Among clients, more portal use aligns with increased advisor satisfaction

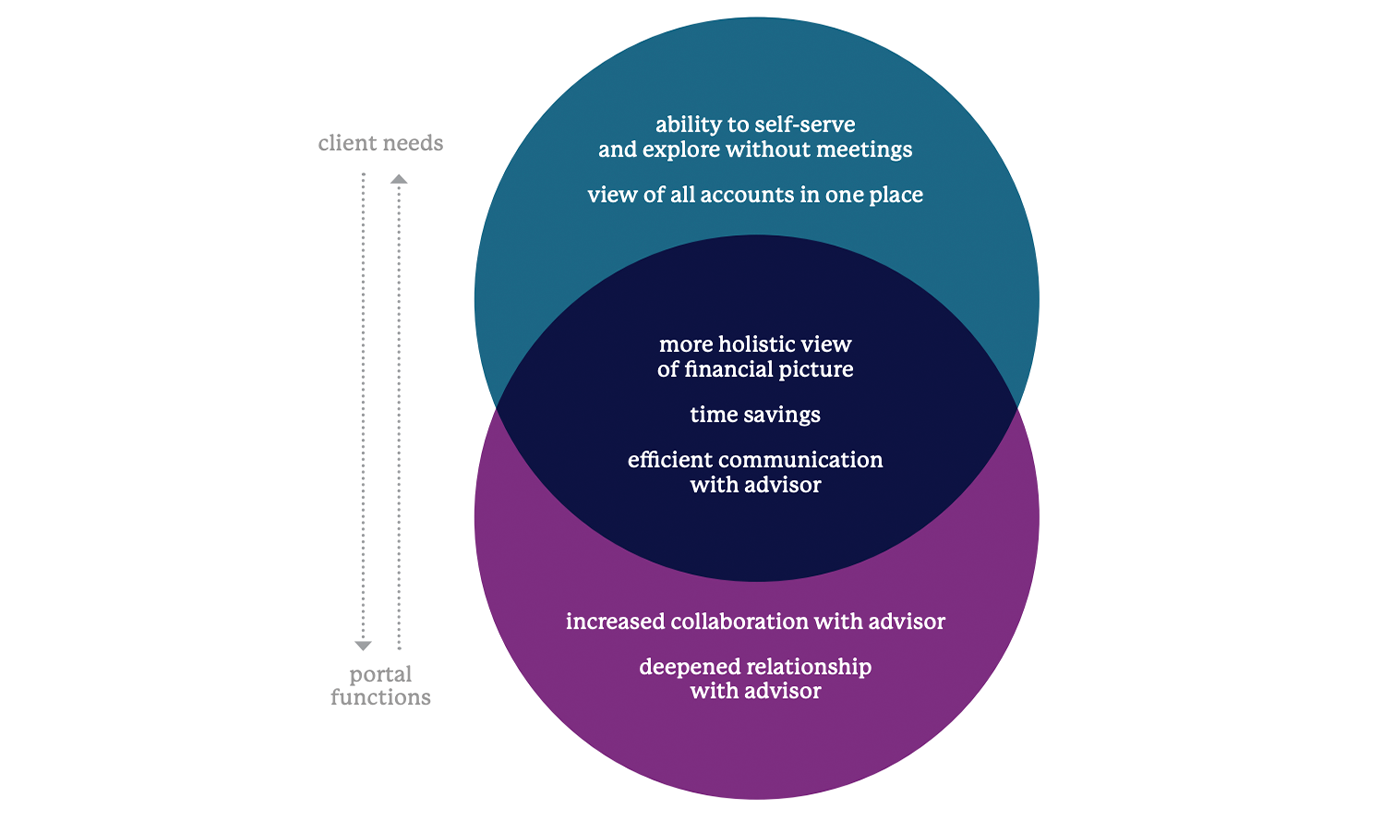

When it comes to portals, client outcomes are tied closely to level of use, with overall advisor satisfaction increasing as portal use increases. Portals offer clients a platform to view all their accounts in one place, save time through automation, gain a holistic financial picture, and communicate more efficiently. The result? Time saved, enhanced collaboration, and enriched advisor-client relationships.

What clients want, portals deliver

The study showed that portal functions align with what clients most want from the tool.

Clients benefit the most when their advisors fully embrace financial psychology

FinPsych is not an all-or-nothing concept. Client outcome increases can be achieved simply by an advisor believing in the importance of FinPsych in financial planning and starting to incorporate it in their practice. When an advisor takes the next step and commits to holistically weaving financial psychology throughout their client relationships, the client has even better outcomes across the board.

Financial psychology in planning is not a mere theory; it is an approach that tangibly increases client satisfaction while diminishing financial anxiety.

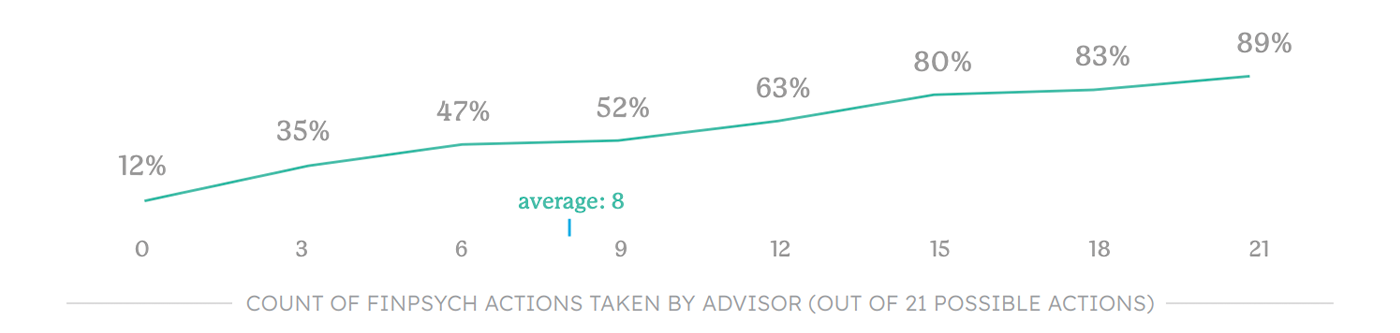

Client satisfaction increases with each additional action taken by an advisor

All FinPsych is not created equal

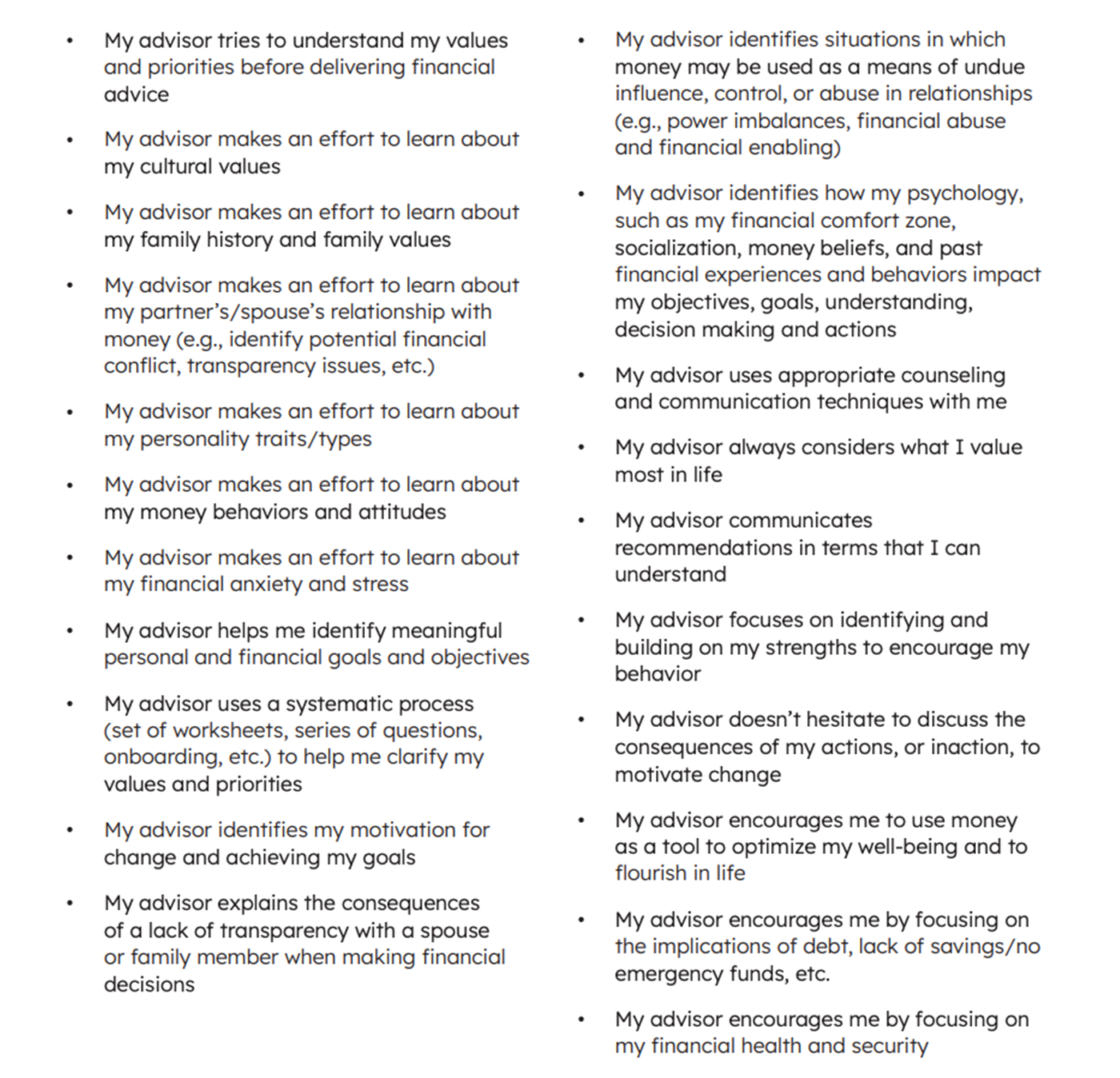

The following five advisor FinPsych actions have the greatest positive impact on overall client satisfaction and are most effective at decreasing client anxiety. (A complete list of the study’s FinPsych agreement statements appears at the end of the article.)

- Helps me identify meaningful personal and financial goals and objectives.

- Always considers what I value most in life.

- Communicates recommendations in terms that I can understand.

- Makes an effort to learn about my money behaviors and attitudes.

- Tries to understand my values, including my cultural values, and priorities before delivering financial advice.

While we know many advisors do one—or many—of these, the research tells us there is opportunity for improvement

- Advisors take these actions less than 50% of the time.

- Taking actions to understand client values is a common and important theme that clients want advisors to do more often.

- Client satisfaction increases by adding just one of these actions, and by adding three, satisfaction is lifted by 23%.

- With each subsequent action added, there is a steady and significant increase in client satisfaction.

Consider it a call to action—and an opportunity

What we know now: Advisors who put portals and FinPsych to work have the happiest, most satisfied clients. We also know that client expectations for both will only continue to grow and, as of now, only 17% of advisors are both tech forward and FinPsych forward. The industry needs a proactive response, and the field is wide open.

Regardless of your status as forward or averse, there are plenty of ways to develop, and the client portal is key.

Two of the most obvious areas where you can adopt technology to streamline the planning process are data gathering (a surprising amount of the profession’s data entry remains manual) and consolidation. For instance, while clients rank having everything in one place as the portal’s most important feature, fewer than half of tech-forward advisors upload presentations—or focus on using the portal to meet the continually growing client demand for personalization.

Opportunities to facilitate financial psychology actions through technology include data storage (make sharing easy for clients), comprehensive assessment tools (planning involves a wide range of details about the client), education (clients want to learn), and gamification (make finances fun and engaging).

The future of financial advising is here. Are you ready?

It’s time for financial advisors to seize the moment—ride the wave of digital transformation, immerse yourself in the world of financial psychology, and set the stage for your own success and the transformation of the financial advisor realm.

FinPsych agreement statements used in the study

Proactive Advisor Magazine would like to thank eMoney Advisor for permission to republish an edited version of the white paper “Beyond the Plan. The Evolution of Advice: Harnessing Technology & Psychology.” A corresponding blog post with more information on the research can be found here.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

©2023 eMoney Advisor LLC.

*2022 Arizent study across banking, wealth management, insurance, and mortgage verticals.

**eMoney study “Evolution of Advice” (2022).

eMoney Advisor LLC (“eMoney”) provides technology services that help people talk about money. Rooted in holistic financial planning, eMoney products and services seek to strengthen client relationships, streamline business operations, enhance business development, and drive overall growth. More than 106,000 financial professionals across firms of all sizes use the eMoney platform to serve more than 5.8 million households throughout the U.S. For more information, please visit emoneyadvisor.com.

RECENT POSTS