Sustaining client loyalty during challenging times

Sustaining client loyalty during challenging times

Perhaps at no time in recent history have individuals and families had a greater need for the trusted guidance of a financial advisor. Spectrem Group provides insights on the factors investor clients consider most important in building and sustaining loyalty and trust with their financial advisors.

Our recent article “Is the market’s lofty valuation justified in the middle of a pandemic?” speaks about the ups and downs of this unprecedented year, current market valuations, and some of the behavioral finance issues that have surfaced in 2020.

The author, Richard Lehman, points out the difficulties faced by investors in today’s challenging environment:

Put another way, perhaps at no time in recent history have individuals and families had a greater need for the trusted guidance of a financial advisor.

Tom Rampulla, managing director of Financial Advisor Services at Vanguard, noted in a recent webinar,

According to ThinkAdvisor’s summary of the webinar, which included Vanguard CEO Tim Buckley, Rampulla envisions advisors using a “dual mode of engagement” in the future, which will allow them to cover more clients, including those who aren’t local, and use in-person meetings for the client’s most important and sensitive topics.

But, says ThinkAdvisor, Rampulla warns that this is not a time for investors or advisors to try to identify different market winners. “This is a time for diversification and discipline. There is too much uncertainty out there,” says Rampulla.

To that end, Rampulla noted that advisors need to “be present” for their clients, helping them rebalance their portfolios as they guide clients to achieve their goals, acting like behavioral coaches to prevent panic selling. “Clients never forget that,” he says. “It builds trust.”

On the theme of trust, Spectrem Group released a new study in 2020 titled, “The Advisor Relationship: How to Develop Loyalty.”

The report focuses on the loyalty of investors to their financial advisor and how advisors can develop and cultivate that loyalty. The report states, “Loyal customers are long-term customers. This provides a financial advisor with stability in his/her income stream, along with referrals for new business and additional assets as the relationship matures.”

Respondents in the study, who range from moderately affluent to very affluent, rate their loyalty to their financial advisor, RIA, financial planner, or investment manager as roughly 80 on a scale of 1–100. That is a good deal higher than ratings they provide to categories such as their airline or brand of automobile, and about on par with their self-stated loyalty to their dentist or physician.

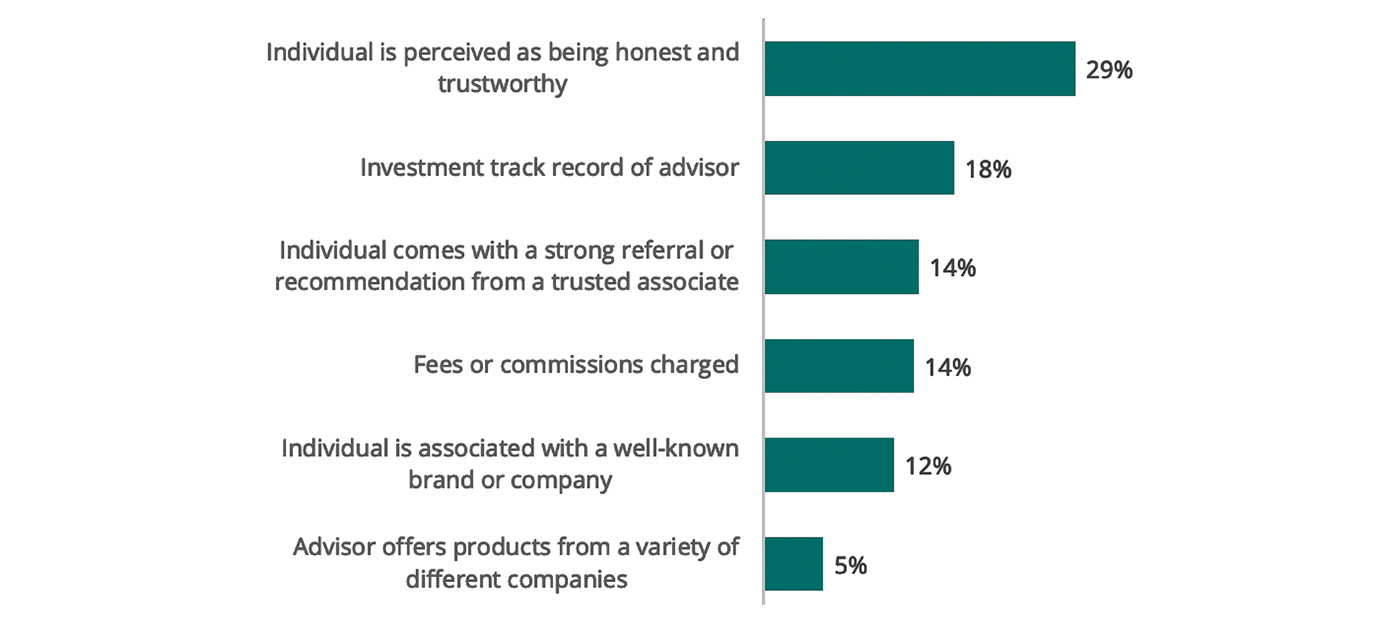

Within that context, Spectrem says,

“Trust is the most important factor when choosing an advisor and remains important throughout the relationship. Trust is manifested by proactive and ongoing communication. … Asked to describe the first trait they look for in a new advisor, 29 percent of investors chose honesty and trustworthiness.”

Source: Spectrem Group

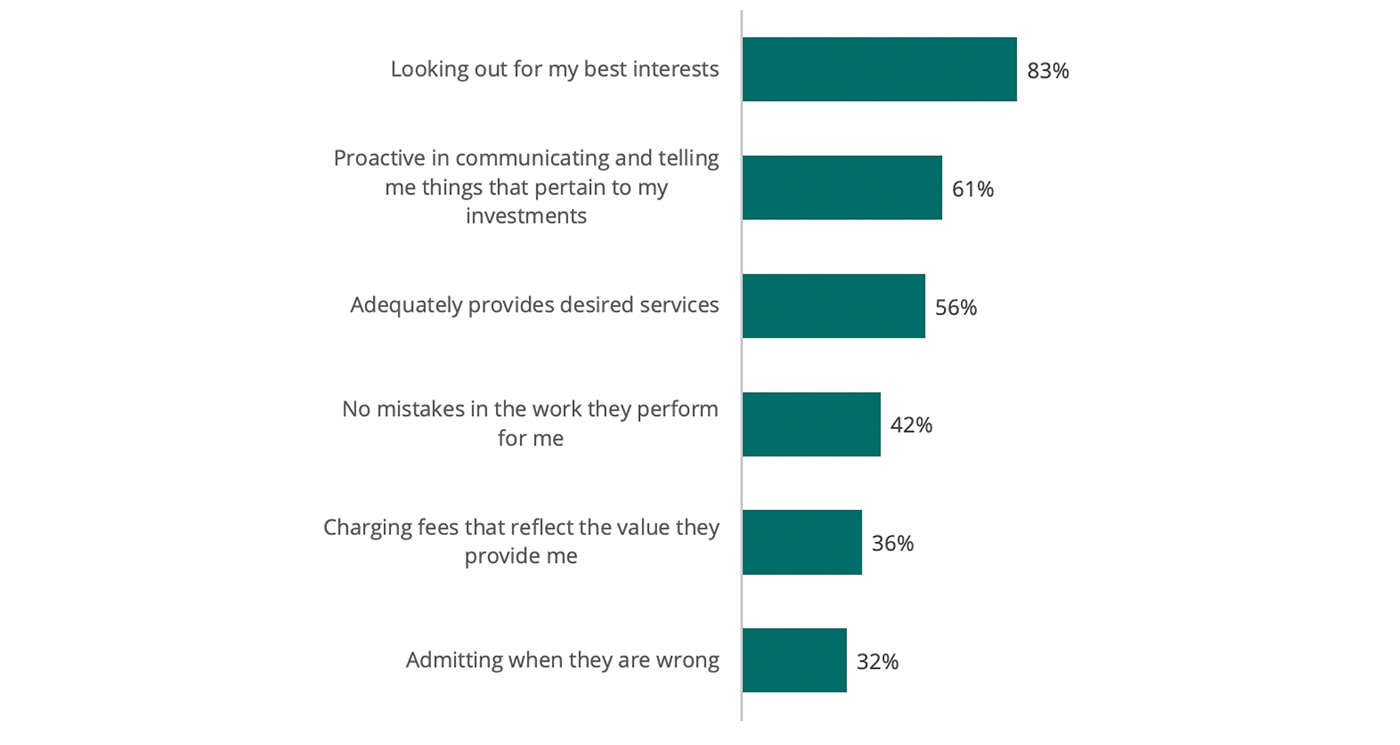

When respondents were asked how they define trust in the context of an advisor relationship, Spectrem says,

“Trust and loyalty are not the same trait but they go hand-in-hand. Most investors define trust as having an advisor who looks out for their best interests. Sixty-one percent of investors believe proactive communication is critical to developing trust.”

FIGURE 2: “DEFINE TRUST AS IT PERTAINS TO YOUR PRIMARY FINANCIAL ADVISOR”

Source: Spectrem Group

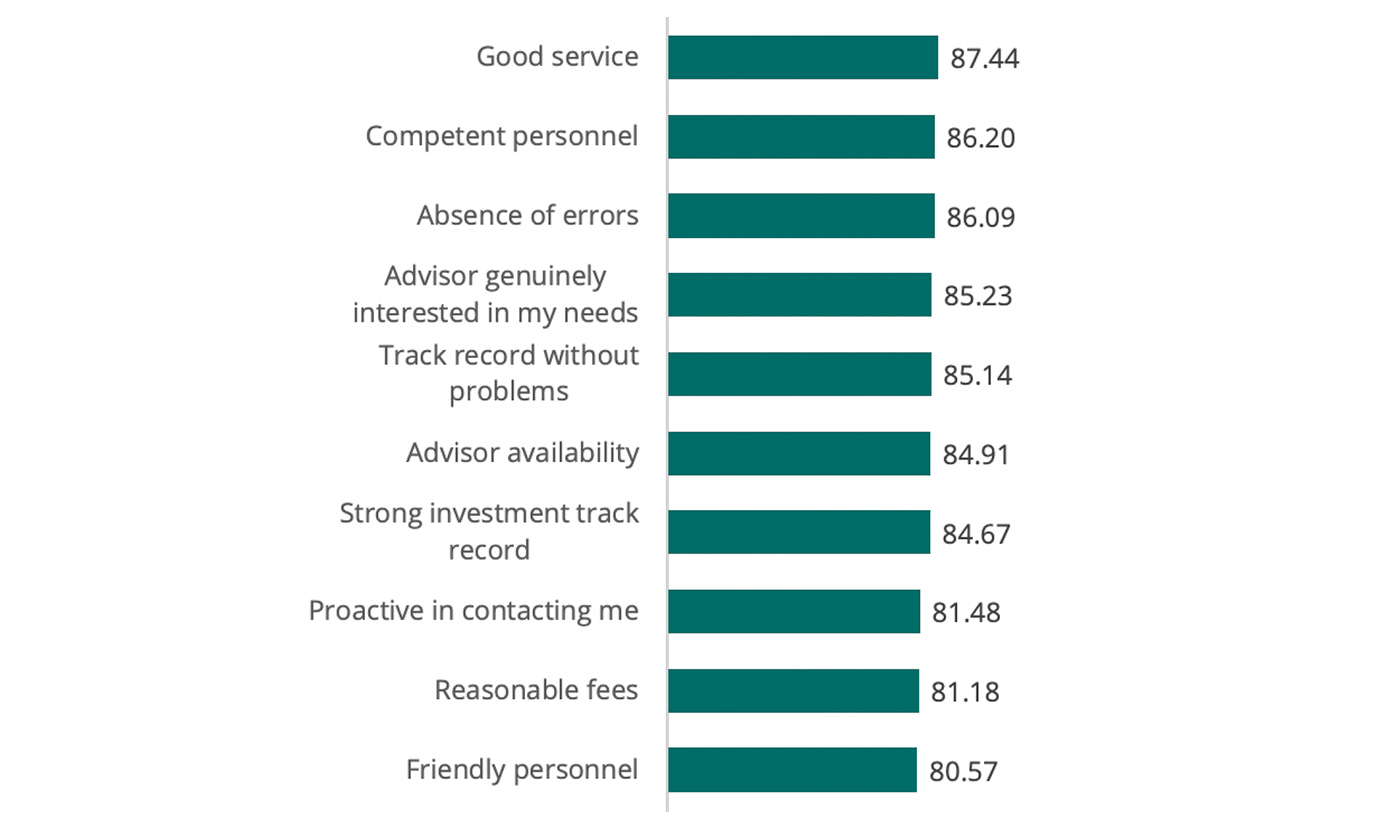

In probing further, Spectrem asked respondents how specific attributes ranked in helping to promote a feeling of loyalty. As can be seen in Figure 3, many attributes are clustered near the top in terms of defining loyalty for the most highly rated 10 attributes.

Says Spectrem,

“Investors want their investments to perform well, but they look to other advisor traits for creating loyalty, such as good service, overall competency and an absence of errors. Additionally, advisors must be generally interested in the needs of the investor. Client appreciation events are not [highly rated] drivers of loyalty … but are appreciated by more than half of investors.”

FIGURE 3: “RATE THESE ATTRIBUTES IN DEVELOPING LOYALTY FOR YOUR FINANCIAL ADVISOR”

Source: Spectrem Group

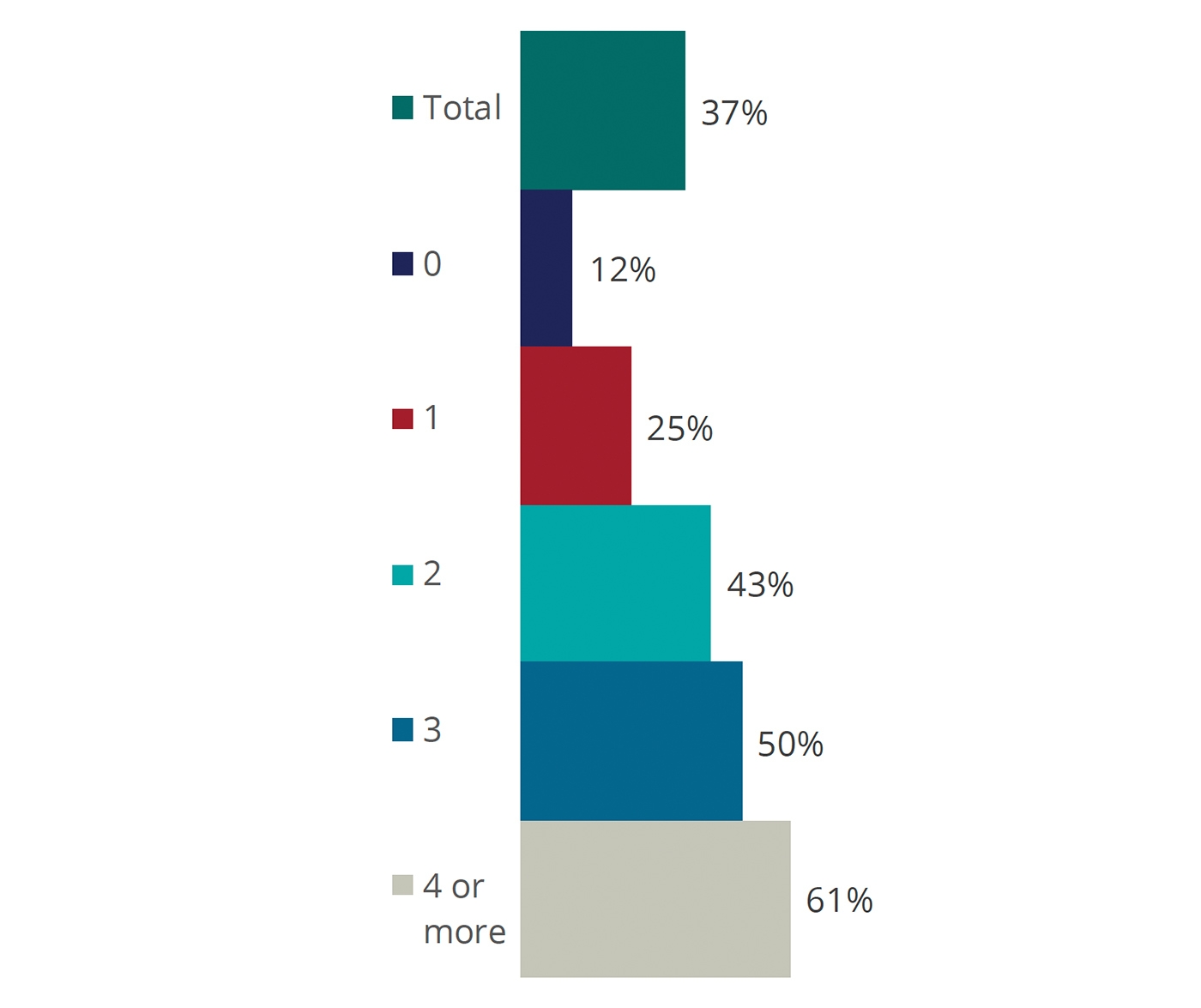

In a separate study performed in May 2020, and tied to the COVID-19 pandemic, Spectrem looked at investor sentiment and how investors felt advisors were performing in this difficult environment.

Among many findings, the study found that investors who have communicated multiple times with their financial advisor since the onset of the pandemic were much more likely than others to indicate they are more impressed with their financial advisor than before the pandemic.

FIGURE 4: ADVISOR-CLIENT RELATIONSHIPS IMPROVE WITH FREQUENCY OF COMMUNICATION

Source: Spectrem Group

Spectrem provided the following specific conclusions in “The Advisor Relationship: How to Develop Loyalty”:

“Developing loyalty is critical for financial advisors to build a successful long-term practice. Loyalty will result in more assets under management. Loyal clients are more likely to make referrals leading to a greater number of total clients. Loyal clients are also more likely to leave a financial firm to follow an advisor wherever he or she may go.”

What do advisors need to remember in order to cultivate loyalty among their clients, according to Spectrem?

- “Old-fashioned customer service will develop the greatest loyalty with clients. Friendly, competent employees that quickly respond to client inquiries [are important to developing] loyalty among investors.

- Advisors must generate ongoing interest in the investor’s concerns. One of the best ways to create customer loyalty is to continue to express interest in the investor’s life as well as the issues that concern the investor. Advisors also need to be available for clients. …

- Client appreciation events are not the most important factor in developing loyalty, but are appreciated by more than half of investors. Younger investors are more interested in client events than older investors.

- Developing trust is critical to attracting new customers and retaining existing customers. The best way to develop trust is to continue to let clients understand their importance through responsive service and a genuine concern regarding their lives and goals. If relationships should become more virtual in the future, developing loyalty through traditional methods will still be important. Investors will continue to seek good service and will want to discuss their lives and long-term goals with an advisor who cares, even if it is conducted remotely.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.