The Q3 2023 earnings season surpassed expectations, contrary to initial forecasts by many analysts who predicted negative or flat year-over-year earnings growth. As recently as Oct. 13, FactSet projected modest earnings growth of about 0.4%.

Instead, the Q3 earnings season, which is near its conclusion, has been surprisingly strong. FactSet says, “Both the number of positive earnings surprises and the magnitude of these earnings surprises are above their 10-year averages.”

FactSet also notes the following key metrics:

- “Earnings Scorecard: For Q3 2023 (with 98% of S&P 500 companies reporting actual results), 82% of S&P 500 companies have reported a positive EPS surprise and 62% of S&P 500 companies have reported a positive revenue surprise.

- “Earnings Growth: For Q3 2023, the blended (year-over-year) earnings growth rate for the S&P 500 is 4.8%. The third quarter will mark the first quarter of year-over-year earnings growth reported by the index since Q3 2022.

- “Earnings Revisions: On September 30, the estimated (year-over-year) earnings decline for the S&P 500 for Q3 2023 was -0.3%. Nine sectors are reporting (or have reported) higher earnings today compared to September 30 due to positive EPS surprises and upward revisions to EPS estimates.

- “Earnings Guidance: For Q4 2023, 69 S&P 500 companies have issued negative EPS guidance and 38 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 18.7. This P/E ratio is below the 5-year average (18.8) but above the 10-year average (17.6).”

Sector performance for Q3 2023

Looking at specific sectors, FactSet reports,

“Eight of the eleven sectors are reporting (or have reported) year-over-year earnings growth, led by the Communication Services, Consumer Discretionary, and Financials sectors. On the other hand, three sectors are reporting (or have reported) a year-over-year decline in earnings: Energy, Materials, and Health Care.”

The Communications Services sector reported the highest earnings growth of all sectors in the S&P 500 at 42%. A significant portion of this growth was attributed to mega-cap companies such as Meta Platforms.

Another highlight was the outperformance of the Consumer Discretionary sector, which nearly doubled its estimated earnings growth rate from earlier projections, finishing with 41.9% year-over-year growth. Amazon’s results were a key contributor to the sector’s performance

FIGURE 1: S&P 500 PROJECTED EARNINGS GROWTH BY SECTOR (Q3 2023)

Source: FactSet

Expectations for Q4 2023 earnings and beyond

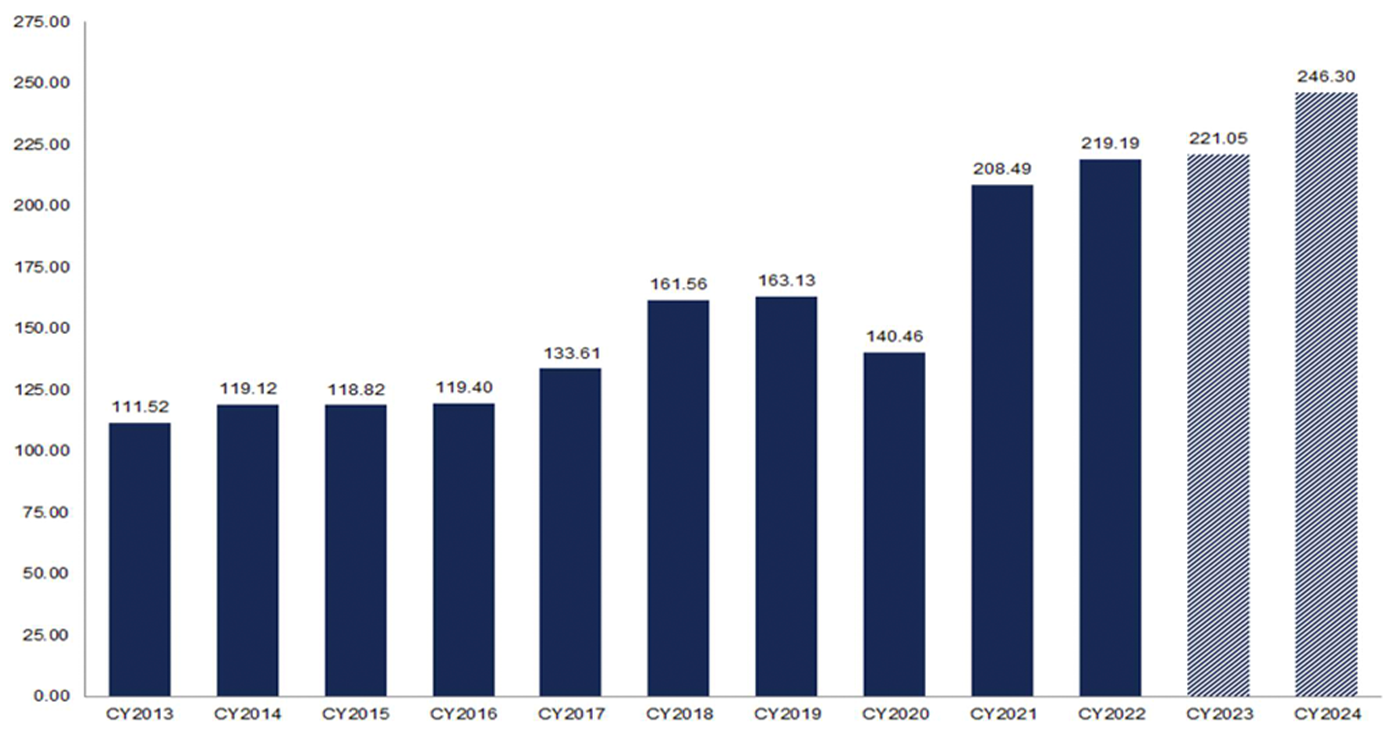

FactSet also offers forecasts for upcoming quarters and the entirety of 2024, generally predicting positive trends for next year. Despite the better-than-expected results for Q3 2023, the anticipated earnings growth for CY 2023 is expected to be barely positive at +0.8%. Estimates for Q4 2023 earnings growth have already seen downside revisions and may see more if the U.S. economic situation deteriorates.

FactSet notes,

“Given concerns in the market about a possible economic slowdown or recession, have analysts lowered EPS estimates more than normal for S&P 500 companies for the fourth quarter?

The answer is yes. During the months of October and November, analysts lowered EPS estimates for the fourth quarter by a larger margin than average.”

FactSet’s forward estimates are as follows:

“For Q4 2023, analysts are projecting earnings growth of 3.0% and revenue growth of 3.1%.

“For CY 2023, analysts are projecting earnings growth of 0.8% and revenue growth of 2.3%.

“For Q1 2024, analysts are projecting earnings growth of 6.8% and revenue growth of 4.2%.

“For Q2 2024, analysts are projecting earnings growth of 10.9% and revenue growth of 5.0%.

“For CY 2024, analysts are projecting earnings growth of 11.7% and revenue growth of 5.4%.”

FIGURE 2: S&P 500 CALENDAR YEAR BOTTOM-UP EPS

ACTUALS AND ESTIMATES

Source: FactSet

FIGURE 3: S&P 500 QUARTERLY BOTTOM-UP EPS

ACTUALS AND ESTIMATES

Source: FactSet

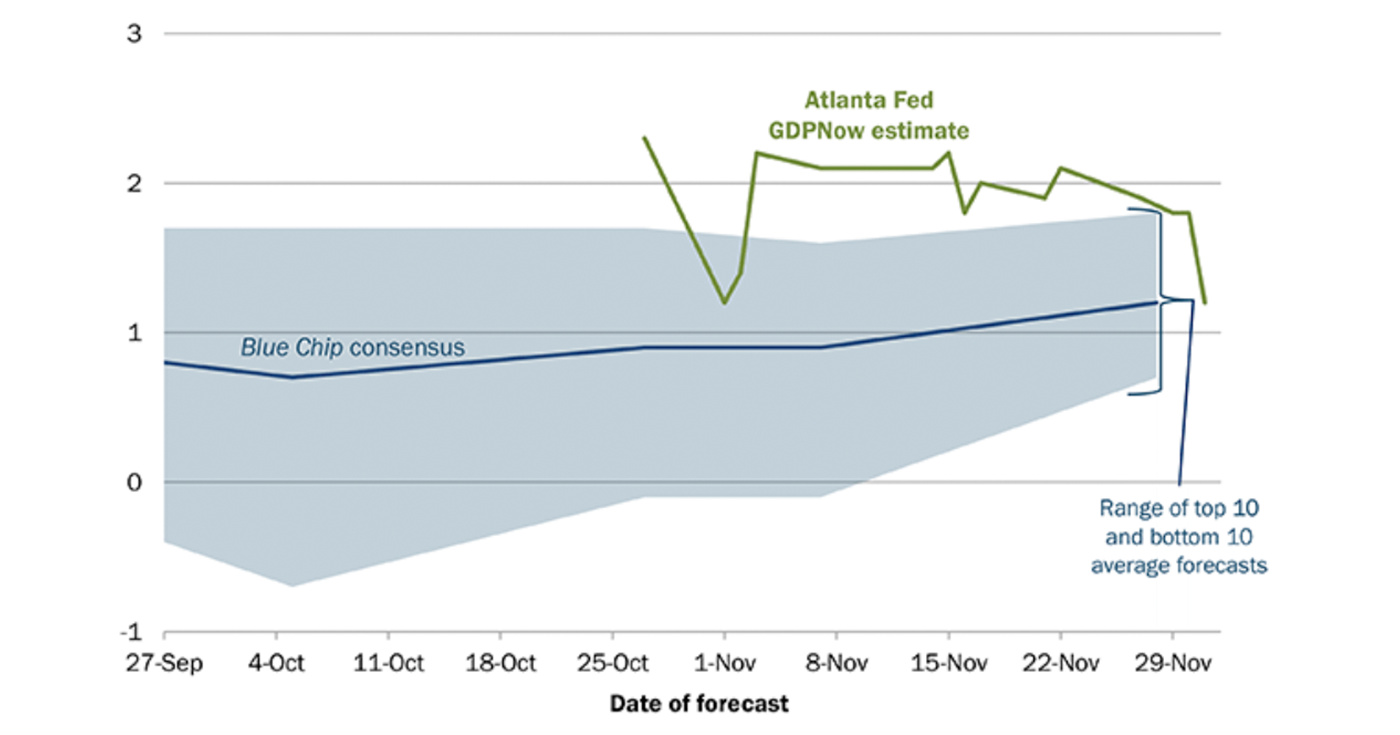

GDP estimates support a cautious outlook for Q4 earnings

U.S. GDP increased at an impressive annual rate of 5.2% in the third quarter of 2023, according to the second estimate released by the Bureau of Economic Analysis.

Will this growth rate extend into Q4 2024? According to the latest Atlanta Fed projections, U.S. GDP growth is estimated to be 1.2% for Q4. If this slowdown in economic growth occurs and continues into 2024, the optimistic earnings estimates cited previously may be at risk.

FIGURE 4: EVOLUTION OF ATLANTA FED GDPNOW ESTIMATE FOR Q4 2023

Quarterly percent change (SAAR)

Note: The top (bottom)10 average forecast is an average of the highest (lowest) 10 forecasts in the Blue Chip survey.

Sources: Atlanta Federal Reserve, Blue Chip Economic Indicators, and Blue Chip Financial Forecasts

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

RECENT POSTS