According to Reuters, Goldman Sachs sees more modest returns for the S&P 500 in 2022, reflecting “decelerating economic growth, a tightening Fed, and rising real yields.”

Also built into the mid-November forecast from Goldman was a forecast for net income per share for S&P 500 companies “to grow 8% to $226 in 2022.” At the time, Goldman’s outlook for 2022 S&P 500 equity returns was in the 9% range.

In contrast, around the same time, Reuters reported that “Morgan Stanley analysts see the S&P 500 moving lower in 2022, with equity markets more volatile as earnings growth slows, bond yields climb and companies try to manage supply chain disruptions and higher input costs.”

Both of these analyst notes were issued before the late-November news on the emergence of the omicron variant of COVID—and the news from the final Federal Reserve meeting of 2021—so the outlooks appear subject to possible revisions.

More recently, FactSet published its comprehensive preview for 2022 S&P 500 earnings and provided this overall summary statement:

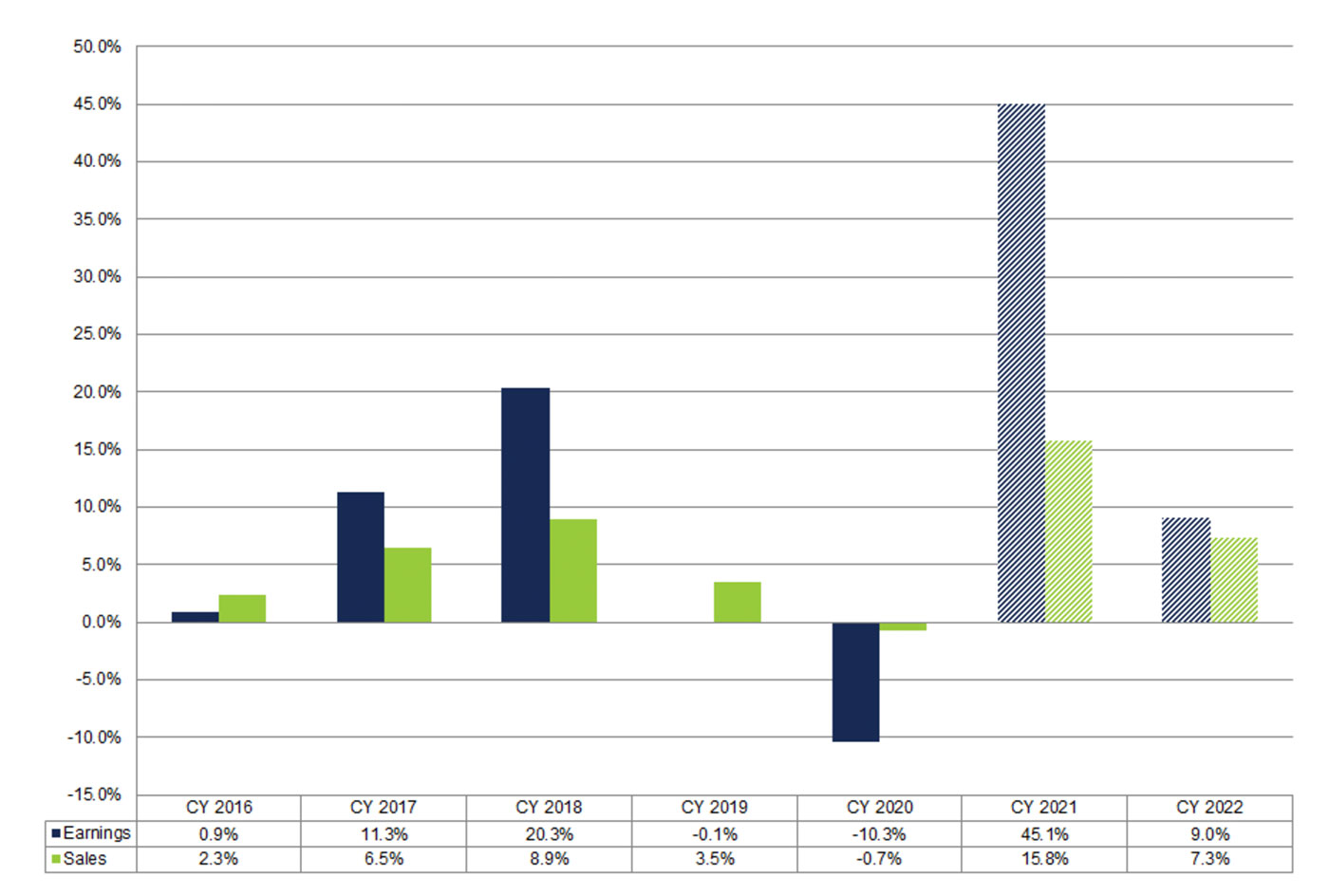

“Even with a difficult comparison to (expected) record-high earnings growth of 45.1% in CY 2021, analysts still expect the S&P 500 to report high, single-digit earnings growth in CY 2022. The estimated (year-over-year) earnings growth rate for CY 2022 is 9.0%, which is above the trailing 10-year average (annual) earnings growth rate of 5.0% (2011 – 2020).

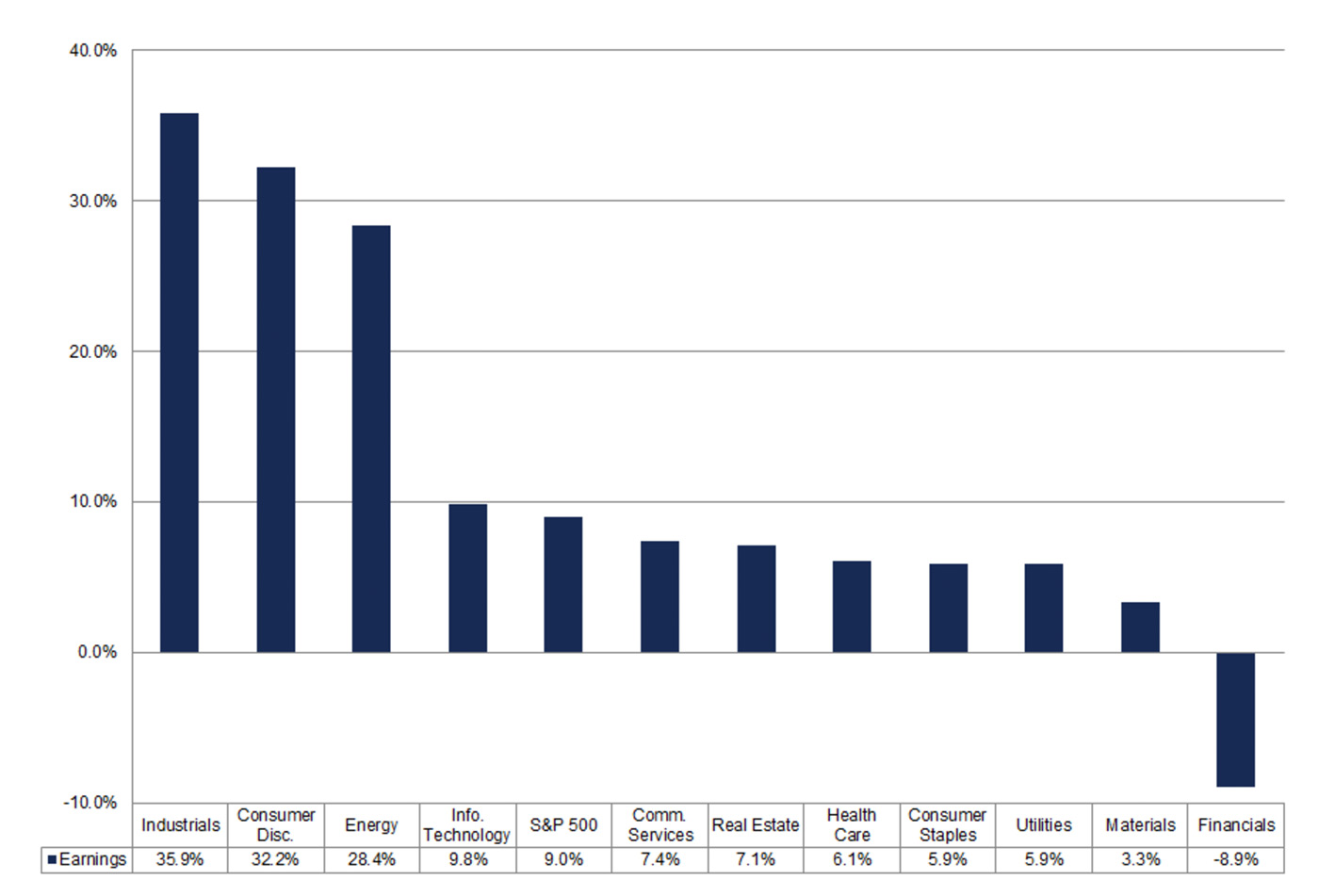

“Ten of the 11 sectors are projected to report year-over-year growth in earnings, led by the Industrials, Consumer Discretionary, and Energy Care sectors. The Financials sector is the only sector projected to report a year-over-year decline in earnings.”

Source: FactSet

Source: FactSet

“The estimated net profit margin (based on aggregate estimates for revenues and earnings) for the S&P 500 for 2022 is 12.8%. Despite concerns about labor shortages, higher inflation, and supply chain disruptions, if 12.8% is the actual net profit margin for the index in CY 2022, it will mark the highest (annual) net profit margin for the index since FactSet began tracking this metric in CY 2008. The current record is 11.5%, which occurred in CY 2018. Analysts are currently expecting a net profit margin of 12.6% for CY 2021.”

Financial Advisor Magazine recently published a cautionary perspective authored by Jim O’Neill, a former chair of Goldman Sachs Asset Management and a former UK treasury minister. He writes,

“With the calendar year drawing to a close, the parlor game of pretending to know what will happen in the next 12 months has begun. Yet when it comes to 2022 (and beyond), I am not sure whether it is worth even pretending. I cannot recall a previous time when there were so many big question marks looming over so many key economic issues. …

“Although I did suggest at this time last year that inflation would become a bigger issue than weak GDP growth, now, as I look ahead to 2022, I am far less sure.

“Much of today’s inflationary pressures could still relate to the speed of the recovery in many economies, and, of course, to large, still-persisting supply disruptions. But the supply shortages themselves may be symptoms of bigger problems, such as economic over-stimulation, ineffective monetary policies, or weak productivity growth. The implications for financial markets would be quite different depending on which of these factors are at work, and to what extent.”

Estimates from three major banks on 2022 U.S. GDP growth are in a very tight range, according to Yahoo Finance, which reported the following on Dec. 8, 2021:

- Goldman Sachs, in a post-omicron note as of Dec. 4, cut its 2022 GDP estimate from 4.2% to 3.8%.

- Bank of America called for 2022 GDP growth of 4.0%, in an estimate issued on Nov. 21.

- Wells Fargo, in a forecast issued on Nov. 12 and reiterated in December, also looked for 2022 GDP growth in the 4% area.

On Nov. 10, The Conference Board provided this perspective on 2022 growth:

“We forecast that the US economy will grow by 3.5 percent (year-over-year) in 2022 and 2.9 percent (year-over-year) in 2023. This forecast is a downgrade from our October outlook despite the recent approval of a large bipartisan infrastructure package by Congress. While this package will certainly benefit growth in 2022 and 2023, our forecasts had already assumed it would pass for several months.

“The downgrade this month is due to two concerns. 1) Despite progress in the vaccination campaign we expect to see a resurgence in new cases in COVID-19 in Q1 2022 due to colder weather and more time spent indoors. … 2) We now expect the US Federal Reserve will raise policy rates earlier and more frequently than we previously anticipated. … While these two factors will moderate growth in 2022 and 2023, it is important to note that our projections still show robust economic expansion over the next two years. …

“Next year, the bulk of economic growth will be associated with continued expansion in consumer spending. However, we also expect support from business investment and, critically, a rebound in private inventories. Government spending should also grow more rapidly as money associated with the infrastructure package begins to be spent.”

It should be noted, as Bank of America pointed out in its forecast, that 2022 GDP growth in the 4% range would be above the pre-COVID trend seen in 2019.

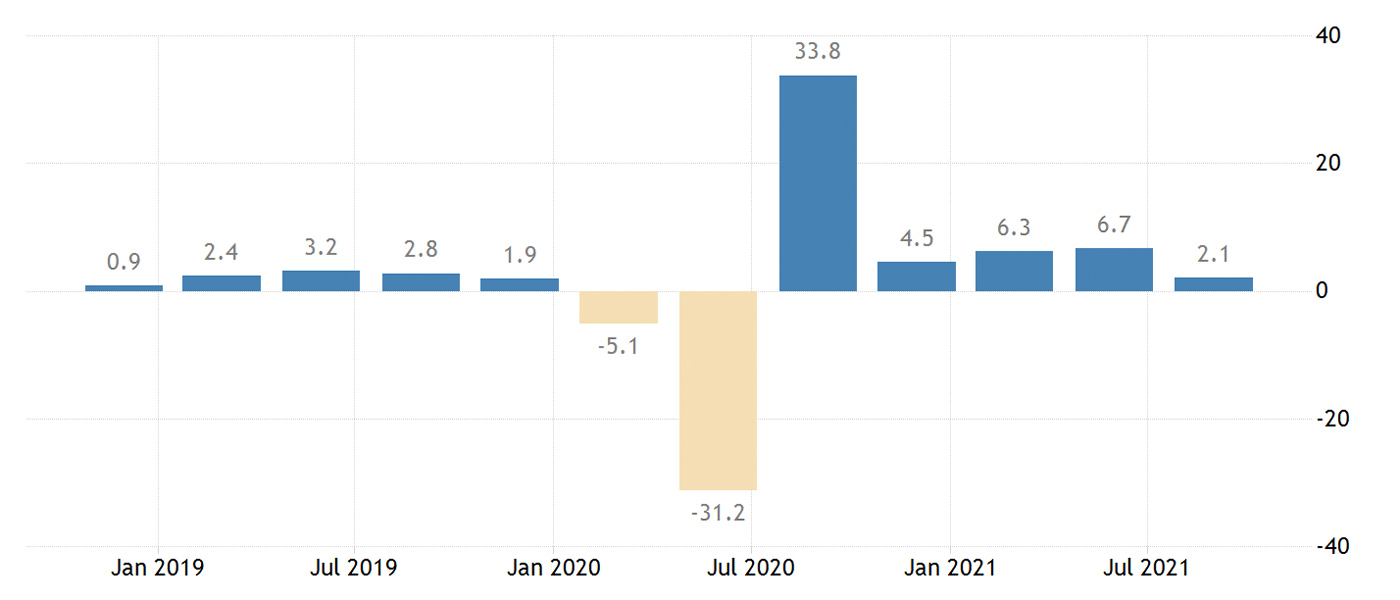

Sources: Trading Economics, U.S. Bureau of Economic Analysis