The start to the Q1 earnings season began last week with earnings reports from a couple of key money center banks. We thought it would be good to highlight current SPX operating earnings estimates (source: I/B/E/S data from Refinitiv):

- Q1 2019 EPS (earnings per share) growth is estimated to be down 2.5%, but we believe the end result might be a small positive. Since 2009, every quarter has been revised higher from the first day of EPS reporting season to the end by a median of 3.5%.

- 84% of companies beating estimates. Of the S&P 500 companies that delivered Q1 earnings by April 11, 2019, 84% reported above-analyst estimates.

- The Q1 2019 revenue growth estimate is 4.9%. The Energy and Technology sectors are the only two sectors expected to show slightly negative revenue growth.

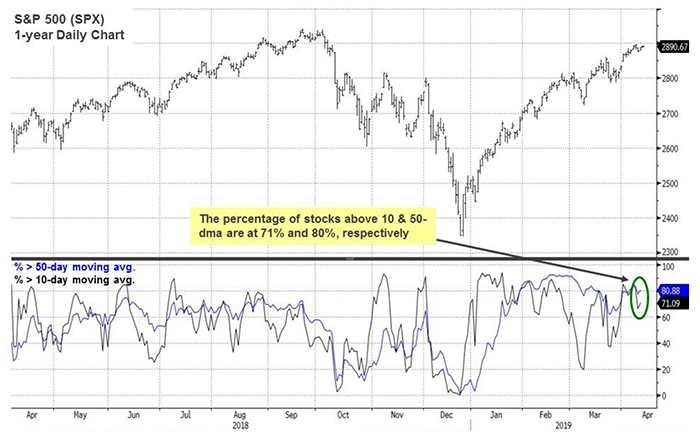

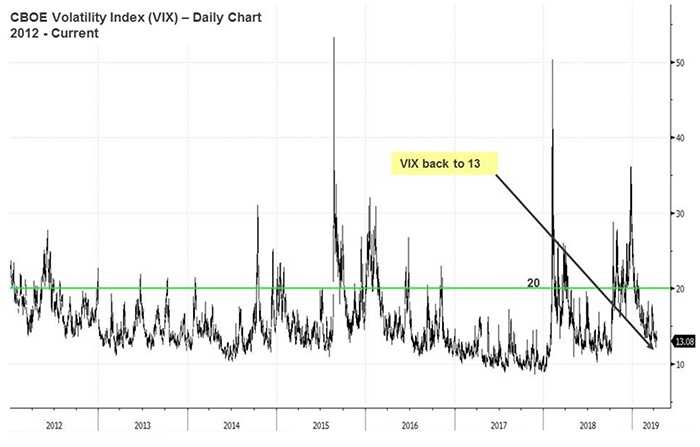

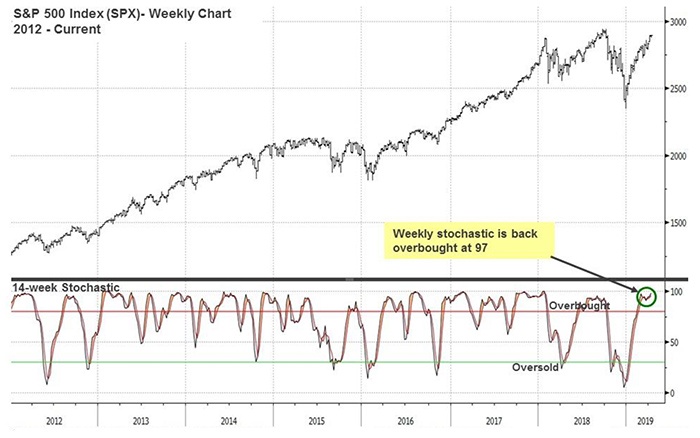

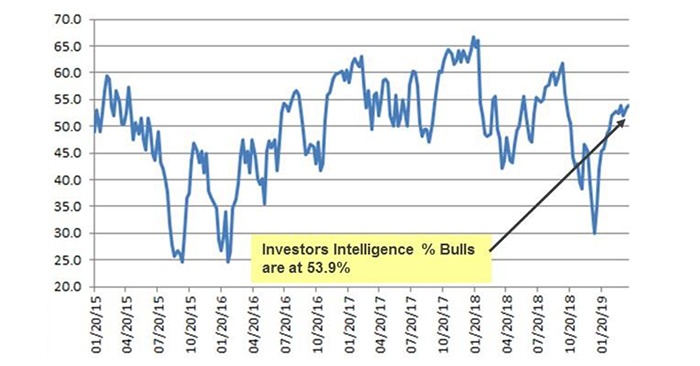

Our intermediate-term tactical indicators all reached an extreme oversold/pessimistic level in late December/early January and have since climbed back near overbought levels, as the SPX has advanced 23% off the Christmas Eve low (as of April 11, 2019). The extreme levels these indicators hit suggest that a cyclical low was set in December, but the current overbought level could lead to a brief pause in the upside.

- The percentage of S&P 500 (SPX) Index components above their 10- and 50-day moving averages has surged. On Dec. 24, 2018, they were at 0.2% and 1.2%, respectively. The recent rally has the percentages at 71% and 80%, respectively (Figure 1), suggesting a solid breadth recovery.

Sources: Bloomberg, Canaccord Genuity. Data as of 4/11/19.

- The VIX Index reversed from its late December spike. There was a significant jump in the CBOE Volatility Index (VIX), which surged to over 36 on Dec. 24, 2018. The VIX has since been trending lower and is back down to 13 (Figure 2). Ultimately, we expect it could drop back toward single digits.

Sources: Bloomberg, Canaccord Genuity. Data as of 4/11/19.

- The 14-week stochastic indicator is in extreme overbought range. Our trusty intermediate-term oversold indicator for the S&P 500 (SPX) hit 4 the week of Dec. 21, 2018. It is currently in overbought territory at 97 (Figure 3).

Sources: Bloomberg, Canaccord Genuity. Data as of 4/11/19.

- Bullish newsletter writer sentiment is reversing extreme pessimism. During the week of Jan. 4, 2019, Investors Intelligence reported only 29.9% of newsletter writers were bullish. Sentiment has since turned more bullish and is currently at 53.9% (Figure 4).

Sources: Bloomberg, Canaccord Genuity. Data as of 4/11/19.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com