Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their March 12, 2019, report on the macro market outlook.

The muscle memory of the 20% S&P 500 (SPX) market crash in Q4 2018 has investors wondering if there is going to be another major drawdown following the sharp rally back and data showing slower momentum in the economy.

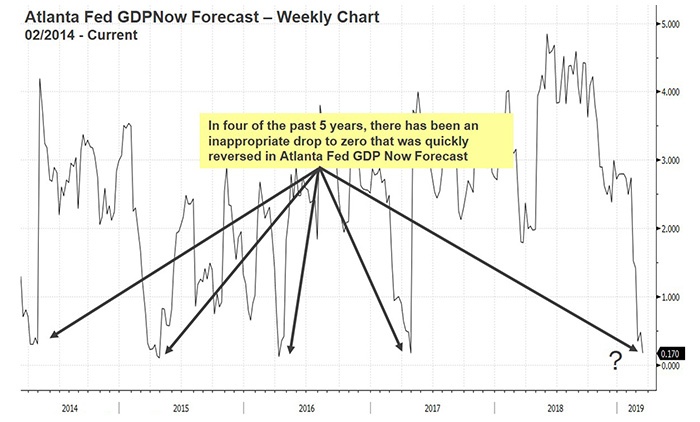

Indeed, the widely followed Atlanta Fed GDPNow forecast model currently shows Q1 2019 annualized growth at just 0.17%, increasing fear a recession might be on the near-term horizon.

We are not overly concerned because (1) our core fundamental thesis remains positive, (2) our recession indicators continue to point to slower but positive growth, and (3) there is clearly a seasonality to the Atlanta Fed data (Figure 1).

FIGURE 1: ATLANTA FED GDPNOW HAS SHOWN ZERO GROWTH IN 4 OF THE PAST 5 YEARS

Source: Bloomberg, Canaccord Genuity

Although there is clearly data showing significantly slower momentum in global and domestic economic growth, our three recession indicators remain subdued:

- Yield-curve inversion. The yield curve between the 2-year and 10-year U.S. Treasurys has yet to invert, and every recession since the early 1950s has been preceded by an inversion of the curve. How can we call for a recession if the indicator that has worked perfectly for anticipating a recession has not yet signaled?

- ISM survey. ISM manufacturing and services data have bounced back from Q4 2018 related weakness. In fact, the ISM Services New Orders and Business Activity Indexes are at new cycle highs.

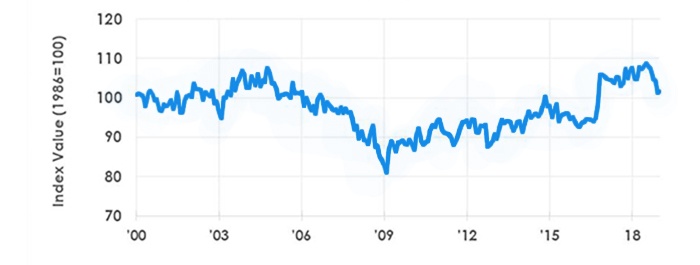

- Small-biz optimism. The NFIB Small Business Optimism survey has pulled back from the August cycle high, yet history shows its cycle peak leads recession by nearly four years (Figure 2).

Based on 10 survey indicators, seasonally adjusted.

Source: NFIB.

The current economic, market, and political environment reminds us of the 1994 Fed tightening cycle and macro backdrop that led to near recessionary growth in the first half of 1995. U.S. GDP growth was less than 1% in the first two quarters of 1995, which caused the Fed to cut interest rates in July and December after doubling rates the prior year. In addition, there was a special investigation surrounding the president, a potential trade war with the world’s second largest economy, and the market was on a low-volatility run following the 1994 internal bear market.

With near-zero growth, political drama, and double-digit first-half 1995 gains, you would think there would have been a significant drawdown, but the opposite took place as the SPX ended the year up over 30% without ever having a 5% correction. Our point is, the Fed policy shift was much more important to the market than the economic slowing, political drama, or potential trade war.

- Inflation and inflation expectations drive Fed policy. Fed policy is driven by core inflation, which should remain in the range of the past 20 years. This gives the Fed leeway to be more patient as economic data weakens from the peak. While inflation is roughly at the Fed target level, the five-year inflation breakevens suggest the Fed pivot to neutral makes sense.

- Fed policy drives the yield curve. The steepness of the yield curve and availability of credit is driven by Fed policy, which should be considered neutral looking at the real fed funds rate. It is essential for the Fed to follow the inflation indicators and remain patient given the recent tightening of financial conditions and slowing in soft data.

- The yield curve drives the economy. Although the economy should remain on a positive trajectory, there is a clear deceleration into 2019 as the impact of tariffs and higher interest rates dampen robust economic activity. That said, until there is a yield-curve inversion that shuts down credit, we continue to expect a positive, yet back-end-loaded, trajectory.

- The economy drives EPS. The direction of earnings is driven by economic activity, which remains in an uptrend—albeit at a much slower pace given the global trade issues, impact of higher interest rates, and lesser impact of the 2017 tax-cut legislation.

- EPS drives the market. The equity market is most closely correlated to the direction of earnings. We expect sharply slower EPS growth of 5% in CY 2019 following the gain of about 25% for CY 2018.

The market is straight up nearly 20% since the Christmas Eve 2018 low and is now taking a slight break. Our positive fundamental core thesis driven by credit coupled with the history of “breadth thrust” and “rally requirement” indicators continues to suggest focusing on the intermediate-term potential new high in 2019 versus any temporary risk.

The Q4 2018 crash suggested the Fed made a mistake, and the ramp back indicates that the Fed’s pivot to a “patient” data-dependent stance fixed it. This is the third global “recession” scare this cycle, and while all three major corrections associated with these fear-based drops have been larger than anticipated, similar to 2011 and 2016, the pessimism again became too extreme. Absent an inversion of the yield curve that shuts down credit, the market pessimism following a nonrecession crash continues to set the stage for new highs in 2019.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com