Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their Aug. 9, 2021, report on the macro market outlook.

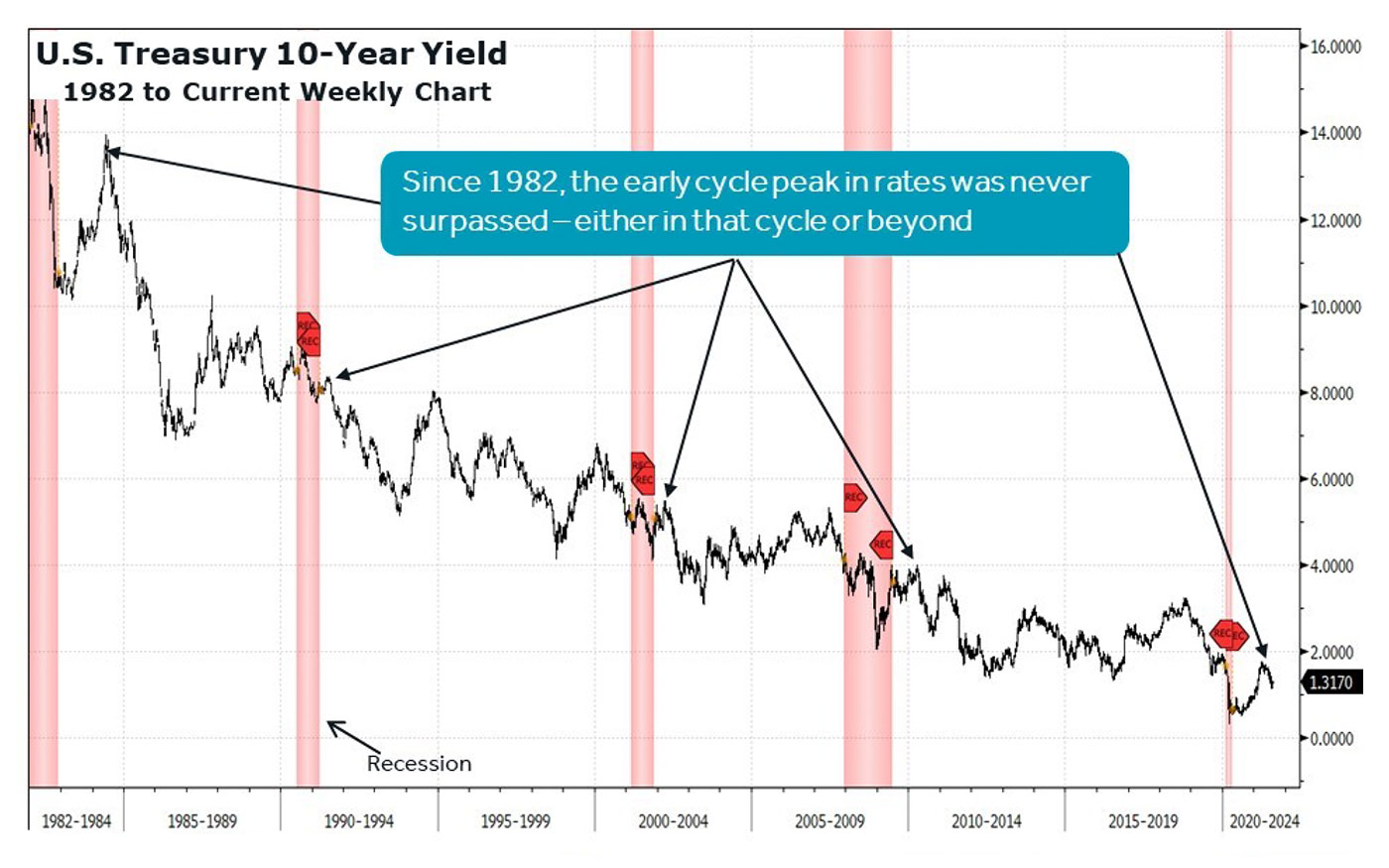

Over the past four economic cycles, the 10-year U.S. Treasury (UST) yield hit the highest point of the cycle just after the economy exited recession, and it never got back above it—ever (Figure 1). If the history of the prior four cycles is a guide, it would suggest 1.74% could be the peak of the current cycle and not be surpassed again.

In a previous article, we highlighted that the cause for each recession and shut down of credit is different, but the monetary and fiscal solution is the same: throw as much stimulus at it as you possibly can. That creates even more debt that becomes unaffordable in a higher rate environment. Simply put, the only way to afford the higher asset prices that come with the expansion of credit each cycle is to have lower interest rates or significantly higher productivity.

Sources: Bloomberg, Canaccord Genuity

Although our tactical position calls for a bounce in the 10-year UST yield as we move toward year-end, like in 2004 and 2010, over the longer duration of the current economic and market cycle, we believe the following:

- The Federal Reserve may keep rates at 0% for the foreseeable future and use the balance sheet to manage around their dual mandate of an average of 2% inflation and full employment.

- The next real fed funds peak rate may be a negative number.

- The 10-year UST yield should experience a year-end bounce above 1.5% but has likely seen the peak of the cycle and perhaps beyond.

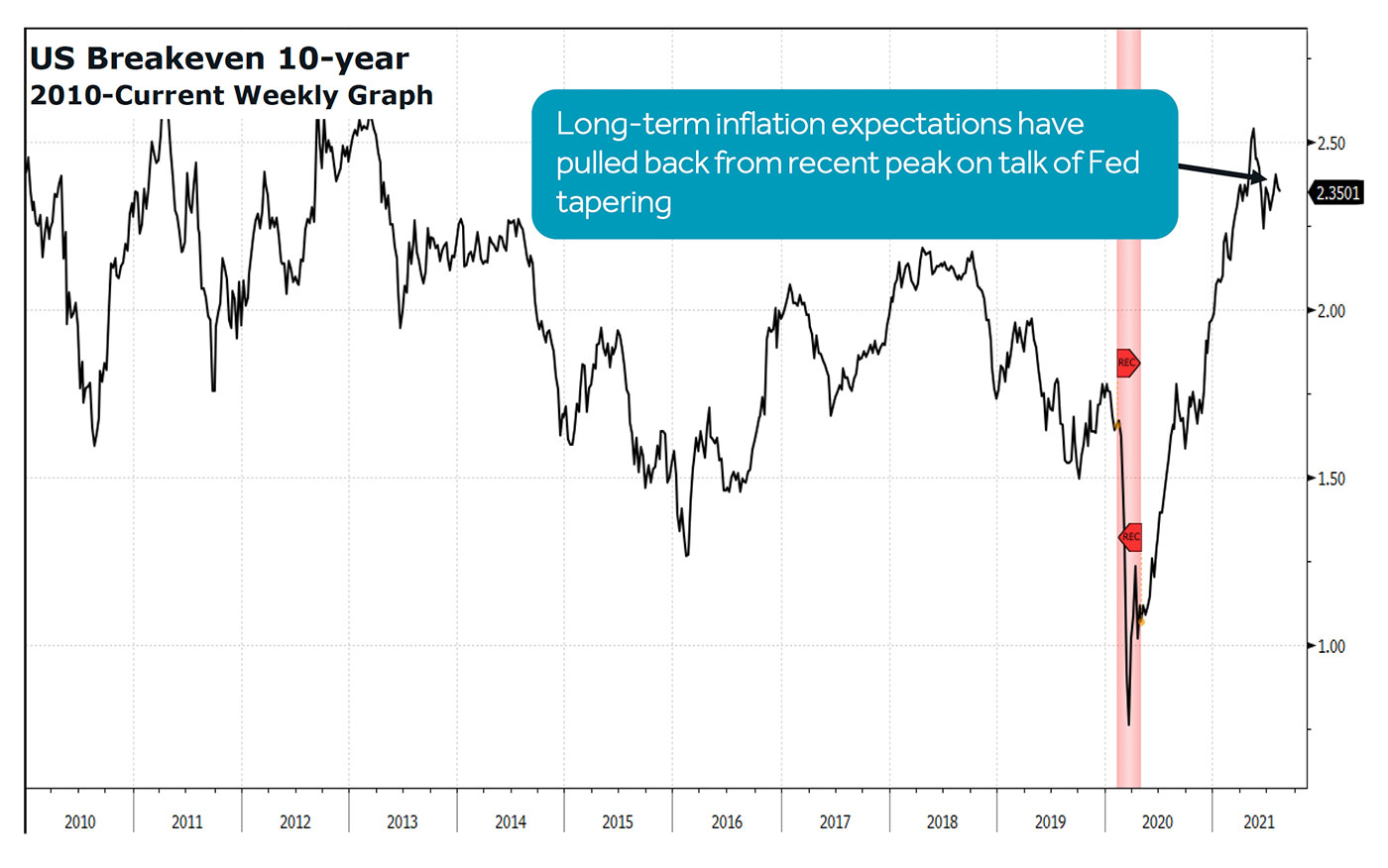

As we move past maximum accommodation of monetary policy, historic fiscal stimulus, and incredible economic and earnings-per-share (EPS) growth rates, we expect (1) inflation to moderate, (2) the Fed to remain historically accommodative while managing interest rates using the balance sheet, (3) the economy to slow from peak growth rate but remain positive, (4) EPS to continue to surprise on a solid growth outlook, and (5) valuations to compress due to sideways action in the market coupled with strong EPS growth.

FIGURE 2: CORE PCE SHOULD REVERSE—ALREADY REFLECTED IN

10-YR INFLATION BREAKEVEN

Sources: Bloomberg, Canaccord Genuity

Since our call in March for a peak in UST yields, the market has favored areas that benefit from declining interest rates. At 1.74%, the 10-year UST yield reflected the coming economic surge, and we believe that at 1.12%, it reflected the impact of the delta variant and moving past “peak everything.”

If we are correct that the recent drop in the 10-year surrounded the low in rates, we may complete the summer of indigestion by a rotation back to the areas that benefit from rising rates, including the Financials, Industrials, Materials, and Energy sectors. This would match the interest rate environment and sector performance from the end of August through year-end in 2004 and 2010.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com