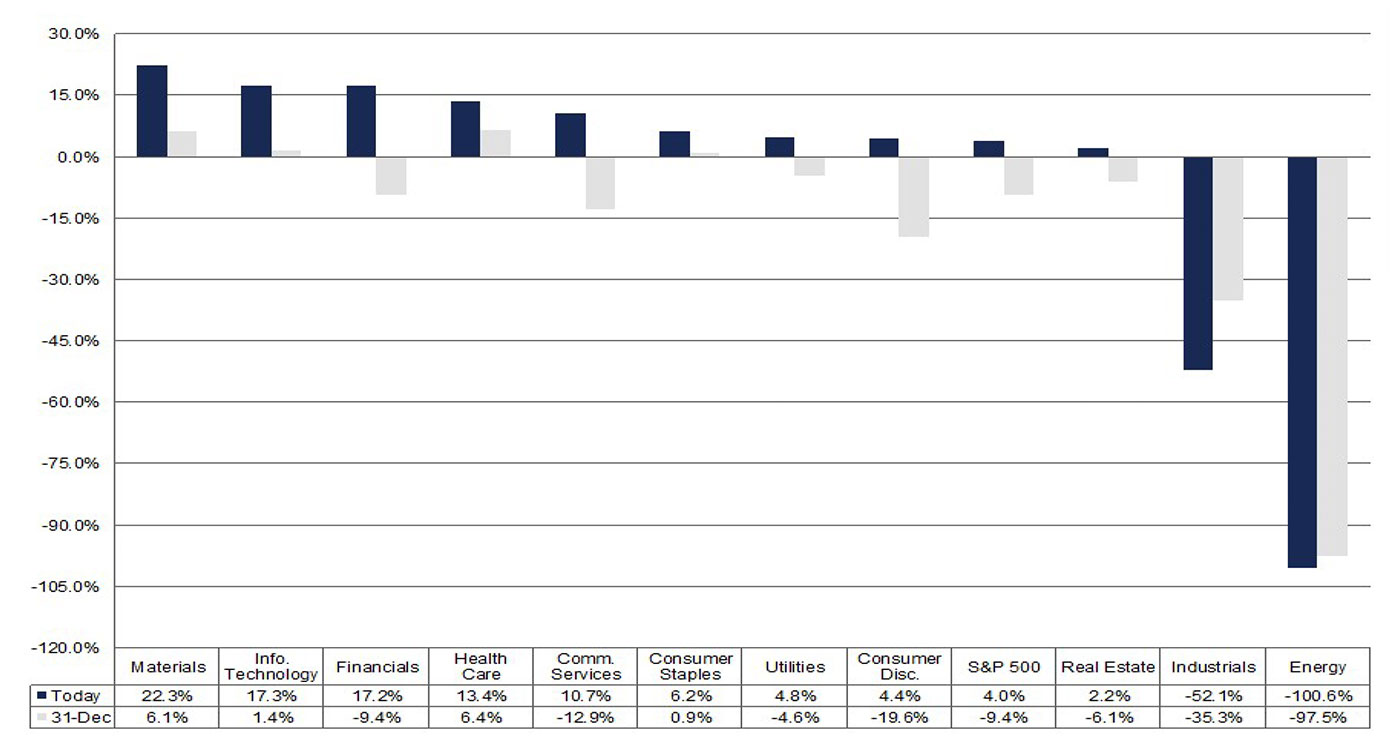

With the Q4 2020 earnings season all but over, the financial sector delivered strong results.

According to FactSet, the financial sector had the third largest quarterly earnings growth rate in Q4, up 17.2%. This was a major improvement from initial earnings estimates back on Dec. 31, 2020, when analysts were forecasting an earnings decline of 9.4%.

Source: FactSet, as of 3/19/2021.

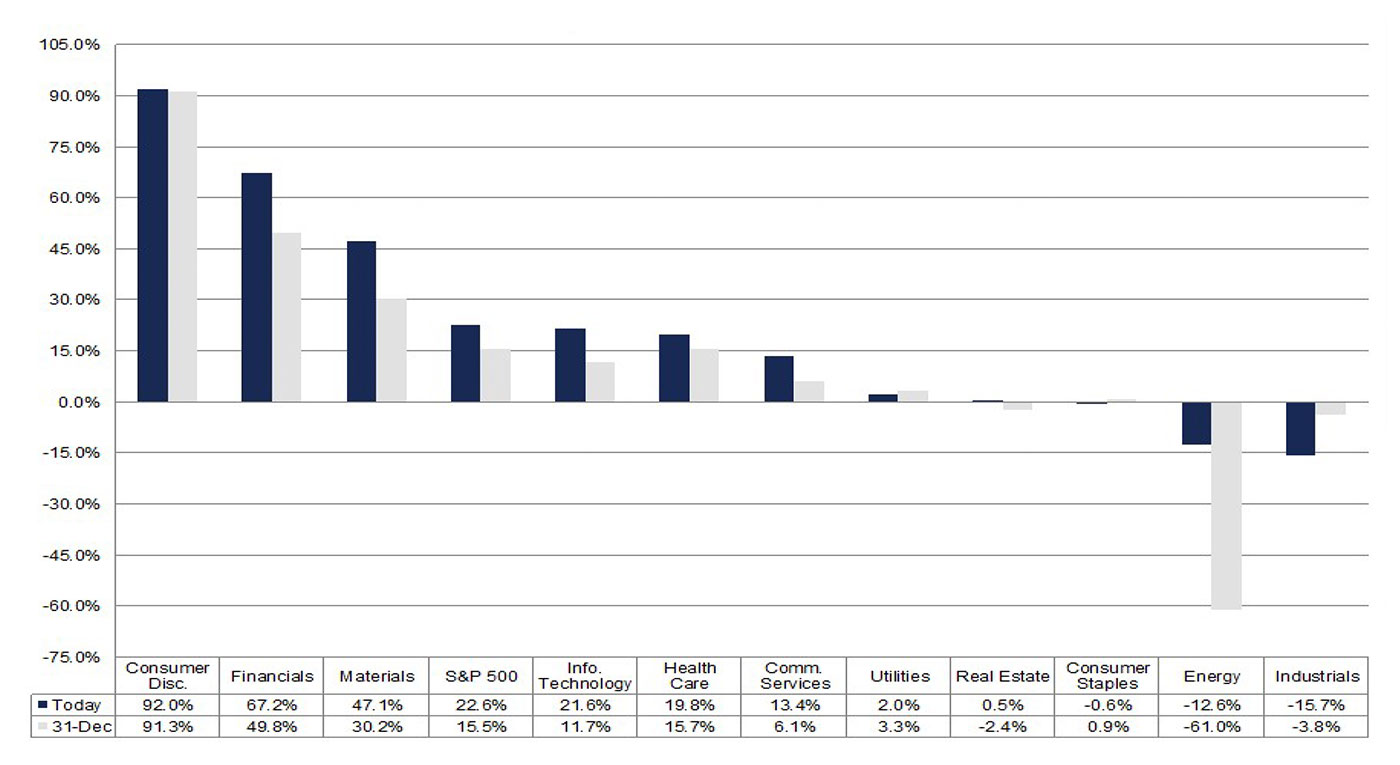

For the Q1 2021 earnings season, FactSet reports that the overall outlook is very positive from analysts, with the estimated earnings growth rate for the S&P 500 at 22.6%. This would mark “the highest year-over-year earnings growth rate reported by the index since Q3 2018 (26.1%).”

Embedded within this forecast is a robust estimate for the financial sector, with the sector’s 67.2% estimated earnings growth second only to the consumer discretionary segment.

FIGURE 2: ESTIMATED S&P EARNINGS GROWTH BY SECTOR: Q1 2021

Source: FactSet, as of 3/19/2021.

FactSet notes the following regarding the financial sector earnings outlook for Q1 2021,

“The Financials sector has recorded the second-largest increase in its expected earnings growth rate of all eleven sectors since the start of the quarter (to 67.2% from 49.8%). This sector has also witnessed the second-largest increase in price (+16.9%) of all eleven sectors since December 31.

“Rising interest rates are likely contributing to the increase in earnings estimates for companies in this sector, as the yield on the 10-year Treasury note has increased to 1.72% today from 0.92% on December 31. Overall, 48 of the 65 companies (74%) in the Financials sector have seen an increase in their mean EPS estimate during this time. …

“At the industry level, all five industries in this sector are predicted to report year-over-year growth in earnings: Consumer Finance (N/A due to year-ago loss), Banks (131%), Capital Markets (32%), Insurance (7%), and Diversified Financial Services (2%). The Banks industry is also projected to be the largest contributor to growth for the sector.”

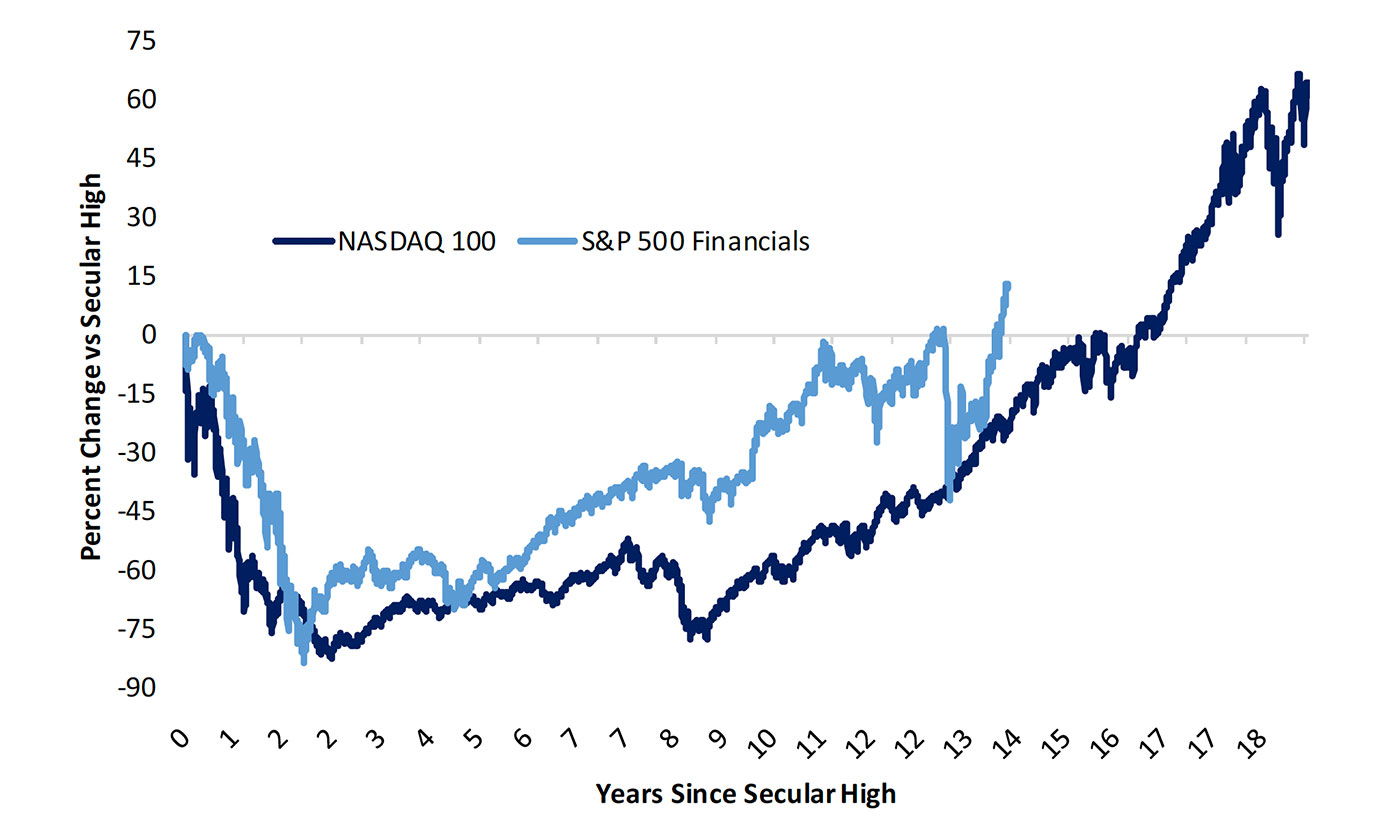

Bespoke Investment Group recently cited some bullish trend factors for the financial sector and the banking industry, while noting that it has taken approximately 12-13 years for some major financial indexes and ETFs to finally recover from the financial crisis of 2007-09.

“The rally in bank stocks that has taken the S&P Bank ETF (KBE) 27% higher since January 29th has taken the financial sector to new definitive new highs. It took over 12 years for the S&P 500 Financial sector to make new closing highs relative to the pre-global financial crisis peak in bank stocks from 2007.

“Financial stocks technically made a new closing high relative to the pre-GFC peak just prior to the COVID shock that hit stocks back in Q1 of 2020, but the move was barely a new high; this most recent high-water mark is a definitive breakout.

“With the Financials breaking out above their pre-Financial Crisis highs, we thought it would be interesting to see how the path for Financials looks relative to the path that the Nasdaq 100 took following the Dot Com crash. As shown below [Figure 3], both the Nasdaq 100 and the Financials sector fell roughly the same amount over the same two-year time frame during their post-bubble crashes. It took 17 years for the Nasdaq 100 to finally take out its March 2000 high, while it took 13 years for the Financials to definitively break out.

“Both struggled to breakout above prior highs the first time this resistance level was tested, while the Financials had two failed tests before finally breaking out this time around. What’s noteworthy in our view is that once the Nasdaq 100 did manage to break out to new highs, it kept on surging (~60%) for multiple years.

“While the Financial sector has had a big run and is overbought in the near term, we’re still in the early stages of a much bigger leg higher if it follows a similar path as the Nasdaq 100. After all, since its 2007 high, the Financial sector is just barely in the green at this point.”

Source: Bespoke Investment Group