We are seeing some wild numbers for NASDAQ share volume lately, much bigger than anything in recent years. This points to a speculative blow off underway.

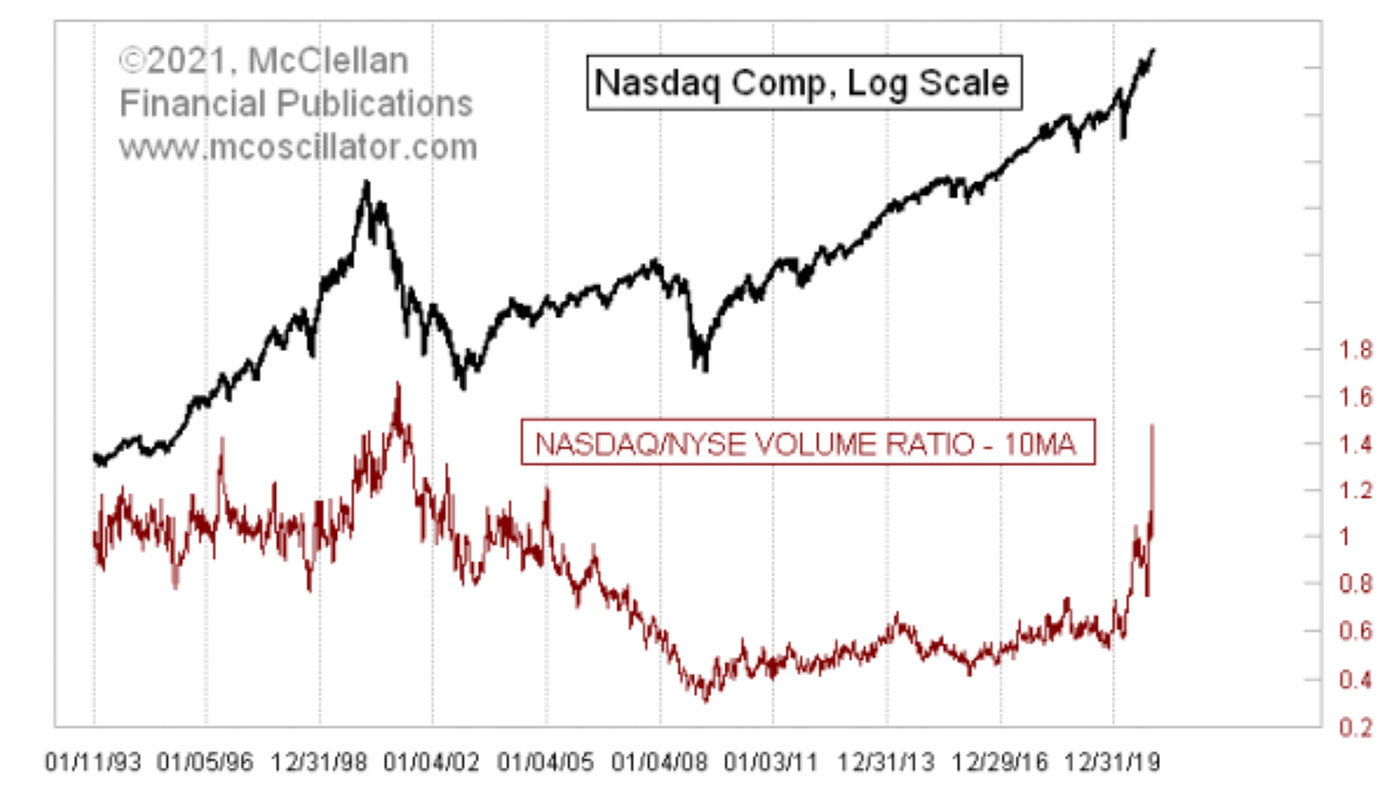

For many years, analysts have looked at the ratio of NASDAQ to NYSE volume as an indicator of tops and bottoms for stock prices. Figure 1 shows a 10-day simple moving average (MA) of that daily ratio. The current reading is the highest it’s been since 2001, when the stock market was in the process of violently unwinding the 2000 Internet bubble peak. If you look closely at the chart, you can see that other lesser peaks in this 10-day MA have been associated with meaningful price tops. This reading is in a whole separate category.

Source: McClellan Financial Publications

Part of what is happening is an upsurge in the trading of stocks that have a low share price. Here is a recent tally of the most active stocks on the NASDAQ, as published by MarketWatch.

TABLE 1: NASDAQ MOST ACTIVE

Source: www.marketwatch.com, data as of Jan. 7, 2021

Notice how many of these are priced in the single digits—many are even below $1. So to trade any meaningful dollar amount in these stocks means trading more share volume, due to those low prices.

A lot of investors, especially new investors, hold the funny belief that a low numerical share price means that a stock is “cheap.” That used to be true, back in the 1800s and early 1900s, when companies issued stock at a “par” value of $100. That custom was also part of why the NYSE would delist a stock if its share price fell below $5, because that meant it had fallen so far from its par value that it was not considered a reasonable investment.

But nowadays, companies can pick their own IPO prices at fanciful numerical values. So the message of a low-priced stock being a “cheap” stock is no longer a valid one. But that does not stop the Robinhood crowd from playing around in that segment of the market.

And this is a big part of why the NASDAQ/NYSE volume ratio works as an indicator of froth, or fear. The extent to which traders and investors decide it is a good idea to speculate on the low-priced stocks, and to jack up their trading volume, can be an indication of frothy bullish sentiment.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on Jan. 7, 2021.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com