The employment report issued last Friday by the U.S. Bureau of Labor Statistics exceeded the most optimistic expectations, with topline jobs growth of 353,000 in January and upward revisions of 126,000 jobs for November and December.

The consensus projection was for a gain of 185,000. With the unemployment rate remaining at 3.7%, First Trust noted that the jobs added represented “the largest gain in a year.”

First Trust also observed:

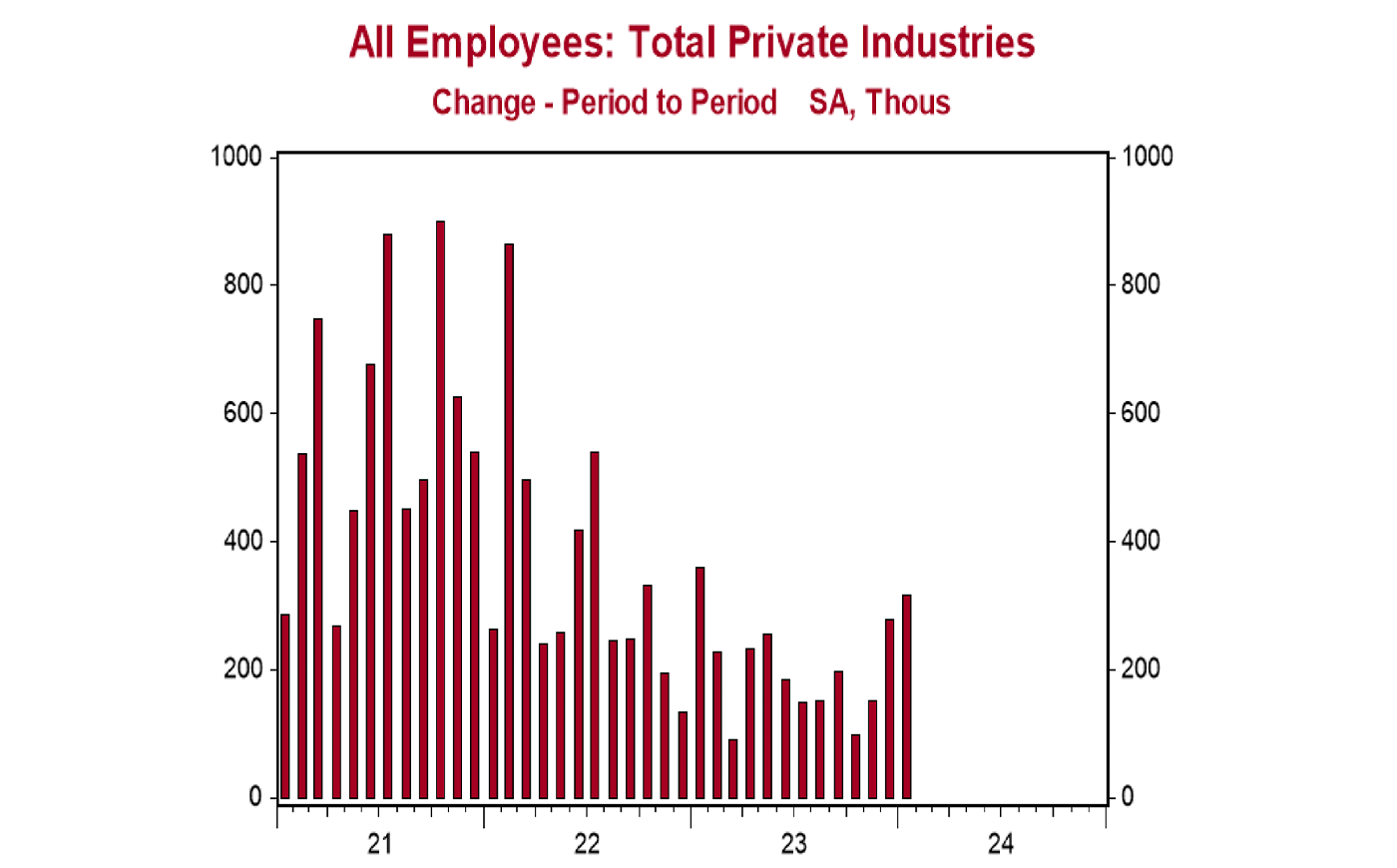

- “Private sector payrolls rose 317,000 in January [Figure 1] and were revised up by 130,000 in prior months. The largest increases in January were education & health services (+112,000), professional & business services (74,000, including temps), and retail (+45,000). Government rose 36,000 while manufacturing increased 23,000. …

- “Average hourly earnings—cash earnings, excluding irregular bonuses/commissions and fringe benefits—rose 0.6% in January and are up 4.5% versus a year ago. Aggregate hours declined 0.3% in January but are up 0.3% from a year ago.”

FIGURE 1: PRIVATE SECTOR PAYROLLS INCREASED 317,000 IN JANUARY

Sources: Bureau of Labor Statistics, Haver Analytics

The White House issued a statement from President Biden regarding the jobs report, which said in part,

“America’s economy is the strongest in the world. Today, we saw more proof, with another month of strong wage gains and employment gains of over 350,000 in January, continuing the strong growth from last year. Our economy has created 14.8 million jobs since I took office, unemployment has been under 4% for two full years now, and inflation has been at the pre-pandemic level of 2% over the last half year. It’s great news for working families that wages, wealth, and jobs are higher now than before the pandemic. …”

Even conservative talk show host Larry Kudlow, director of the National Economic Council during the Trump administration, had some positive comments:

“So, we had a blowout jobs report. More than twice the consensus expectation. I know many of my conservative friends are trying to drill holes in it, but you know what folks, it is what it is—a very strong report.

“Not every economic stat should be viewed through a political lens. …

“Also, a good thing: worker wages continue to improve. Average hourly earnings for production workers—a.k.a. middle-class, blue-collar folks—are now up to 4.8% over the past 12 months and their rate of productivity—that is, output per hour, a very important economic efficiency and growth indicator—rose 2.7% last year. That is a good number.

“So, the workforce is earning its pay hike. Plus, over the past three months, inflation-adjusted real wages increased by 4.5% so typical working families got a nice real wage boost, for a change. Unfortunately, over the duration of Joe Biden’s presidency, real average hourly earnings are still down 2.4%.”

Are there downsides to the jobs report?

Despite the overall strength of the jobs report, MarketWatch noted problematic issues that “could weaken Biden’s re-election prospects”:

“But below the surface these latest jobs figures may yet prove unhelpful to the president’s re-election campaign. That’s because they pose not one but two possible risks that could prove a headache in the months leading up to November: the risk of more inflation, but also the risk of a recession. …

“These figures are good for workers and for job hunters. But they raise the concerns that Federal Reserve chair Jay Powell’s economic medicine is not yet working the way it’s supposed to, and that the economy is not cooling off.

“‘Wages came in hot at 0.6%, which is the highest release since March 2022,’ writes Jeff Schulze, head of economic and market strategy at ClearBridge Investments, in a note to clients. ‘This reading, coupled with the overall jobs number, effectively takes a March rate cut off the table and should raise fresh concerns about the potential for a reacceleration of inflation.’”

First Trust’s analysis raises a related point:

“What will surely get the Federal Reserve’s attention is a 0.6% rise in average hourly earnings, which are now up 4.5% versus a year ago, not much different than the 4.6% increase in the year ending January 2023. If the Fed wants 2.0% inflation, given long-term productivity trends, they probably want to see wages growing closer to 3.5% per year, not 4.5%. But here’s the bad news. In spite of the solid payroll numbers, total hours worked in the private sector declined 0.3% in January and are up a meager 0.3% versus a year ago. The drop in hours in January is the equivalent of losing 465,000 jobs. Average weekly hours haven’t been this low since March 2020, with the onset of COVID. What this means is that businesses have added lots of jobs in the past year and are paying their workers more per hour, but they are finding less for them to do. In turn, this is consistent with our view that companies have gotten out over their skis in terms of hiring, a recipe for layoffs later in 2024.”

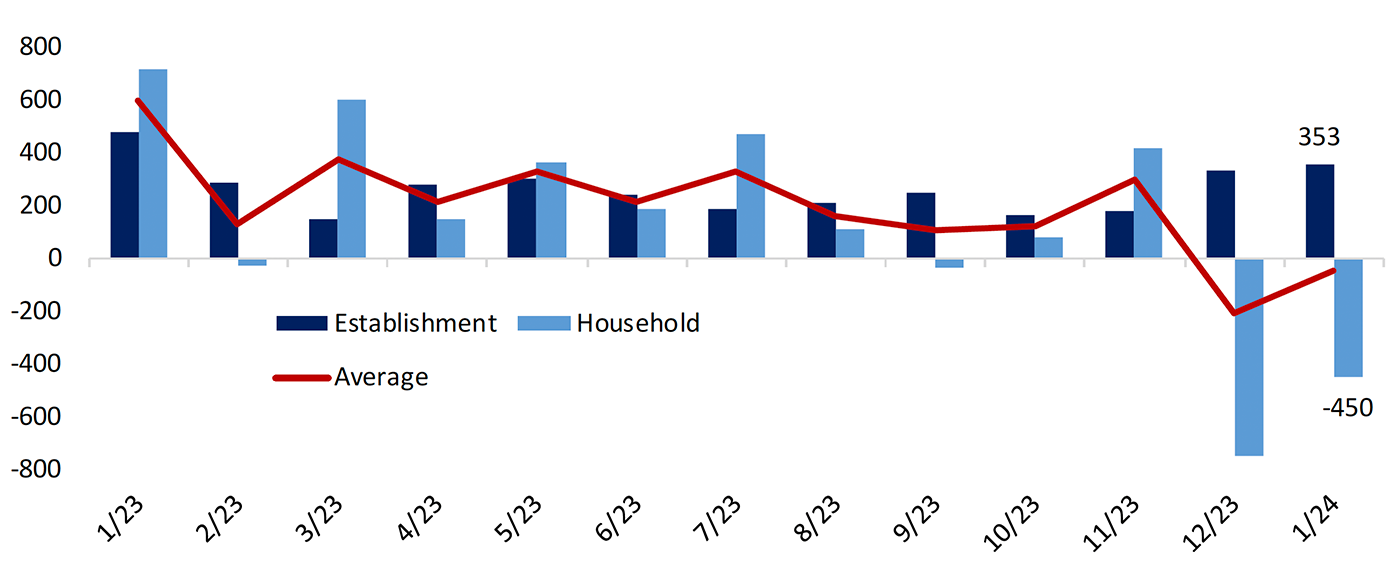

Bespoke Investment Group also notes (as does MarketWatch) the divergence between two sets of numbers published by the Fed with each report: the business (establishment) survey and the household survey.

Bespoke writes,

“While payrolls measured by the business survey were very strong, the household survey was very weak for a second consecutive month. While wages beat, hours missed, and on balance the average weekly pay of private sector workers in aggregate has slowed right back to where it was before COVID. We also note that labor slack is rising steadily, though not yet fast enough to be recessionary.”

FIGURE 2: PAYROLLS SURGED IN JANUARY, BUT HOUSEHOLD SURVEY IS WEAKER

Month over month, in thousands

Sources: Bespoke Investment Group, Bureau of Labor Statistics

RECENT POSTS