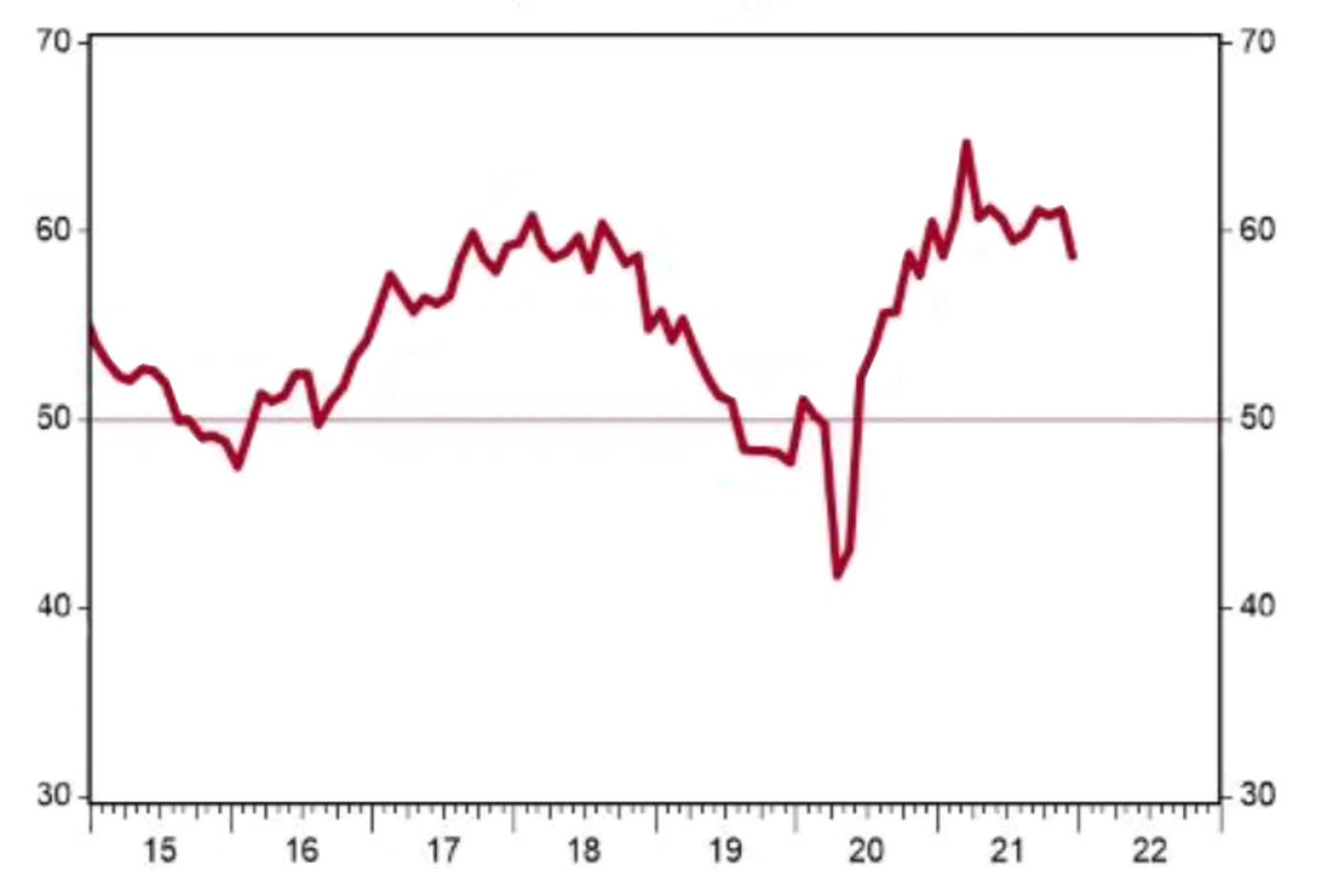

The manufacturing sector continued to expand in December, though at a slower pace, with 15 of 18 industries reporting growth.

Note: Seasonally adjusted; 50+ indicates economic expansion

Sources: Institute for Supply Management (ISM), Haver Analytics

While both the new orders and production indexes remain solidly in expansion territory, it’s clear the factory sector would be growing even more rapidly if it weren’t for a slew of unusual factors holding back output. Respondent comments in December continued to be dominated by widespread worries about input availability, labor shortages and retention, and transportation pressures. These issues have all come together to keep manufacturing activity from rising quickly enough to meet the explosion of demand as the U.S. economy reopens.

However, there has been recent progress on several fronts. For example, the supplier deliveries index looks to have peaked in May and posted its largest monthly decline in over a year in December, signaling that supply-chain issues are easing. That said, delays are far from over, with 14 of 18 industries reporting waiting longer for inputs.

This, in turn, has resulted in long lead times for the clients of U.S. factories, who continued to see their inventories shrink in December. Keep in mind, businesses will eventually restock their shelves, which will be a big source of future demand for manufactured goods as well as a tailwind for GDP growth. There has also been recent progress on hiring, with the employment index rising for the fourth month in a row. However, staffing troubles remain a persistent issue when it comes to ramping up production.

Manufacturing is one of the worst-hit sectors in the ongoing labor shortage, with job openings twice what they were before the pandemic. Notably, the recent recovery in the employment index has coincided with the end of generous federal pandemic unemployment benefits, which expired in September. With fewer disincentive effects in the labor market, we expect the shortage of workers to continue to abate in coming months.

Finally, there also seems to be progress on the inflation front. Price growth for inputs slowed in December, with the prices paid index falling to a still-high 68.2. Factory-related price growth appears to have peaked back in June and has been slowing consistently ever since. December saw the largest monthly decline for the index so far during the aftermath of the pandemic, though some of this was likely the result of large declines in energy costs as omicron first emerged. This is consistent with our view that inflation remains a problem but won’t rise as rapidly in 2022 as it did last year.

We also recently got data on construction spending, which rose 0.4% in November. Looking at the details, large increases in home building and manufacturing projects more than offset declines in road construction and health care. In other recent news, home prices keep rising, but not as quickly as earlier in the COVID era. The national Case-Shiller index rose 1.0% in October, a large gain by normal standards, but the slowest increase for any month since mid-2020. Still, the index is up 19.1% from a year ago, led by price gains in Phoenix and Tampa, with the slowest gains in Chicago; Minneapolis; and Washington, DC.

The Federal Housing Finance Agency (FHFA) index, which measures prices for homes financed by conforming mortgages, increased 1.1% in October and is up 17.5% from a year ago. Look for continued national price gains in 2022, but not nearly at the level of those in 2020–2021.

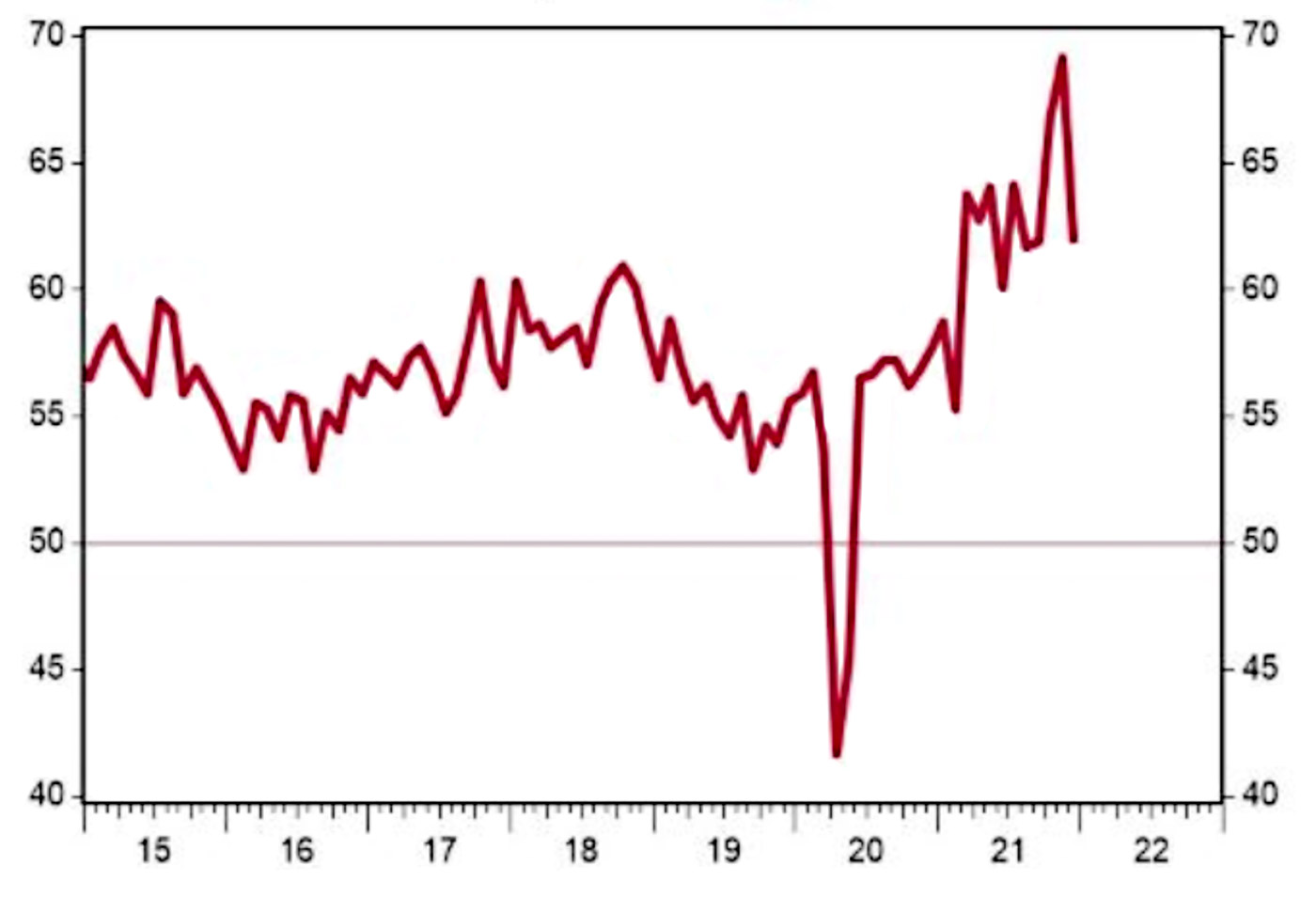

The service sector continued to expand rapidly in December, though not as fast as the record-setting pace in November, as news about the omicron variant hit more pandemic-sensitive industries.

Gains remained broad-based, with 16 of 18 industries reporting growth. However, most major components moved lower, with both the new orders and business activity indexes falling from record highs.

Note: Seasonally adjusted; 50+ indicates economic expansion

Sources: ISM, Haver Analytics

Survey comments continue to be dominated by discussions related to supply-chain shortages, signaling the possibility of even faster growth in the service sector if these problems can be fixed.

On that note, the Jan. 6 report showed recent progress for supply chains on several fronts. Though still historically elevated, the backlog of orders index fell for the second consecutive month. Meanwhile, the supplier deliveries index posted its largest monthly decline since 1997, signaling shorter wait times for inputs.

Only time will tell if these improvements continue into the start of 2022, but recent similar movements from the ISM Manufacturing report out recently also signal that the tide may be shifting. The pace of hiring also slowed in December, with the employment index falling slightly from 56.5 to 54.9.

Despite the short-term impacts of omicron, we expect hiring in the service sector to be a tailwind for activity in the months ahead and help alleviate some of the supply-chain pressures that have been ingrained since the beginning of the pandemic.

The one major component of today’s report that moved higher was the index of price growth, which rose to 82.5 from 82.3 in November. While the rate of price growth in the manufacturing sector has been slowing recently, we are seeing the opposite in services. This is likely the result of Americans beginning to shift their consumption preferences back to services from goods.

Keep in mind that before the pandemic, services made up roughly 69% of consumption spending. That number fell to 64% during the depths of the pandemic as people stopped going to concerts, movies, restaurants, and so on. However, there are likely to be inflationary pressures and supply-chain snags as spending continues to shift back to the pre-pandemic status quo.

New this week:

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com