So far in 2023, September has lived up to its reputation as the weakest month of the year for the stock market.

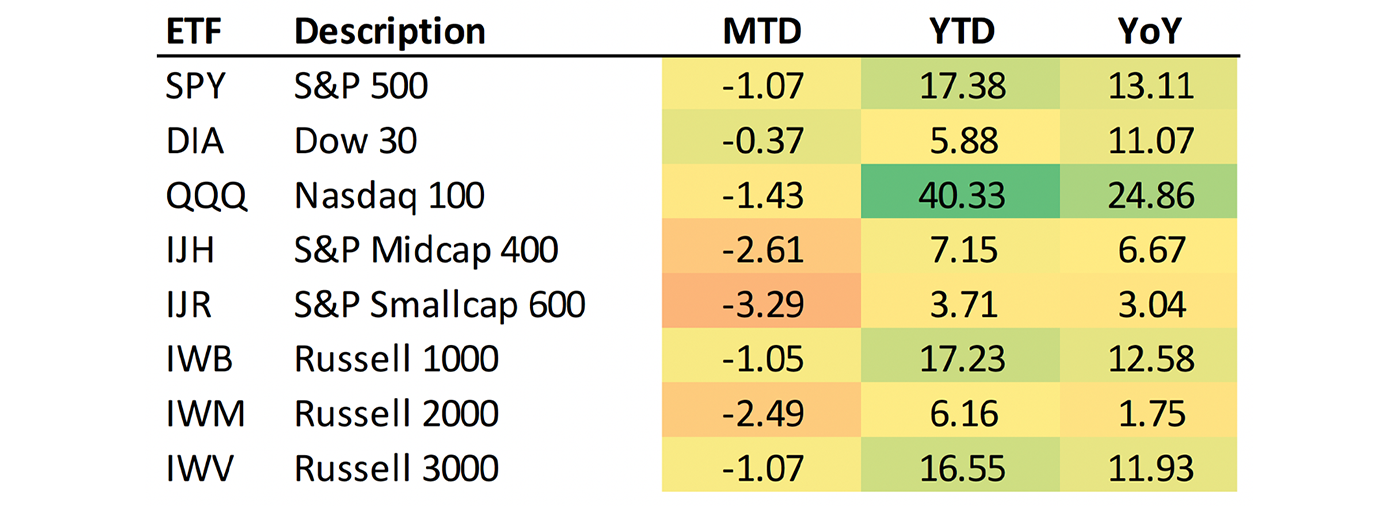

While major indexes are still showing impressive gains for the year through the end of last week, especially the S&P 500 (+17.4%) and the NASDAQ 100 (+40%), this month has seen declines across the board. The weakness is especially pronounced in small-cap equities.

FIGURE 1: YEAR-TO-DATE/MONTH-TO-DATE PERFORMANCE OF MAJOR U.S. MARKET INDEXES

Source: Bespoke Investment Group

Last week’s market returns for the major indexes—both in the U.S. and abroad—were down significantly and a major contributor to September’s overall decline so far.

Schwab’s research group noted,

“Bullish investors didn’t have much to cheer about last week. Only energy and utilities kept their heads above water, making September the third straight month to start off in the red. Tech shares fell more than 2%, worse than the 1.3% decline in the S&P 500 Index (SPX), amid concerns about China’s economy and Beijing’s targeting of the iPhone.

“Surprisingly, volatility didn’t heat up as markets cooled down last week. The muted Cboe Volatility Index (VIX) could be a sign that despite many concerns, traders don’t expect any of them to cause a market meltdown, notes Randy Frederick, managing director, trading and derivatives at the Schwab Center for Financial Research. The implied daily move in the SPX (based on the VIX), is a narrow 36 points in either direction.

“Keep an eye on small-cap stocks, which had a rough week. Softness in this part of the market can reflect worries about the U.S. economy, because small-caps tend to have more of their sales at home.”

FIGURE 2: EQUITY RETURNS FOR THE WEEK ENDING 9/8/2023

Source: FS Investment Research

It is probably not surprising that September is off to a rough start—with the month historically showing the largest average monthly loss in data going back to 1928.

FIGURE 3: S&P 500 INDEX—AVERAGE PERCENT CHANGE EACH MONTH 1928–2023

Source: Yardeni Research

What trends should investors be looking forward to in coming months?

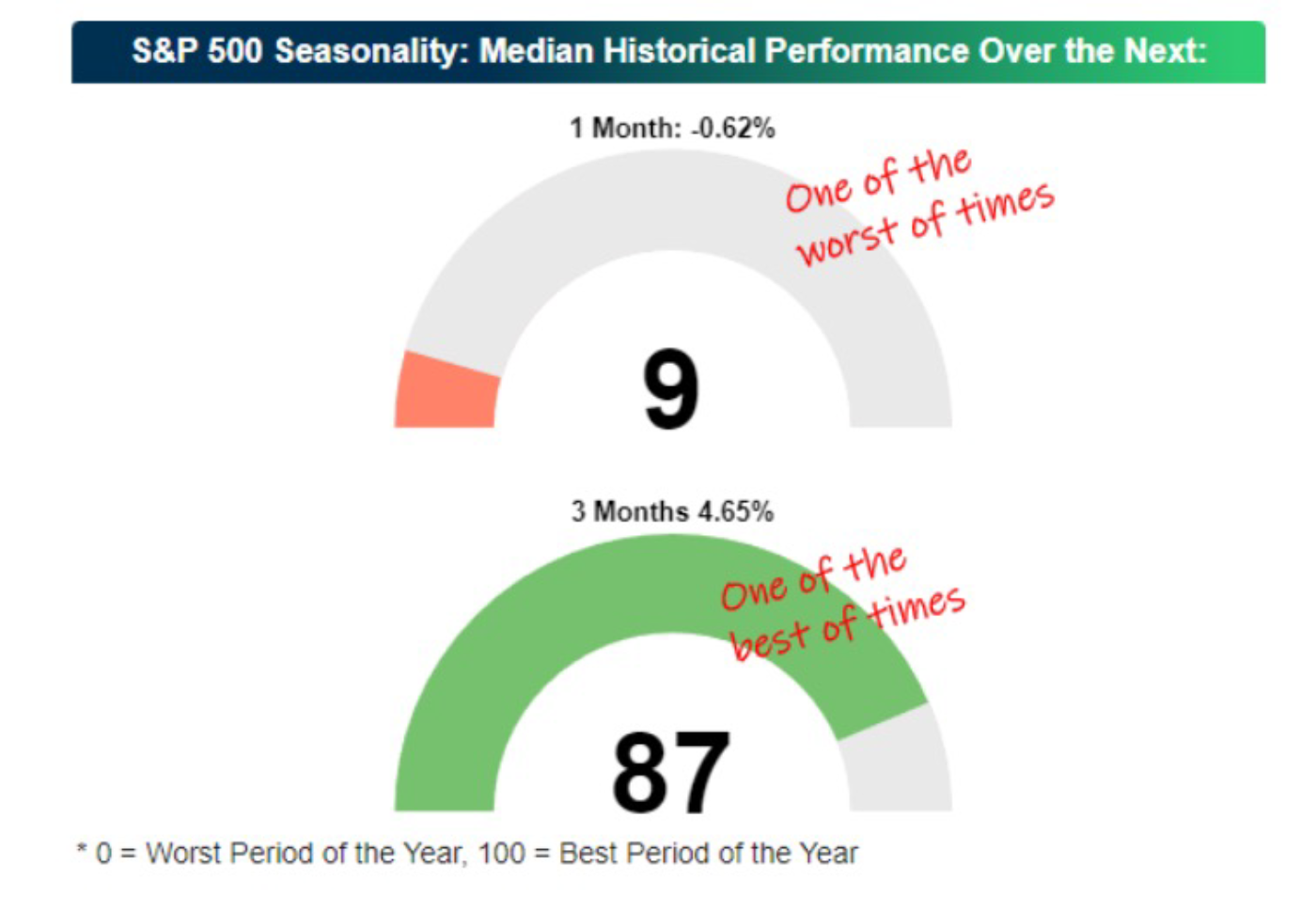

Bespoke Investment Group says that while Septembers can be bleak for the markets, it is usually more than made up for in the closing months of the year:

“In the month following the close on 9/8, the S&P 500’s median performance over the last ten years has been a decline of 0.62%, which ranks in just the ninth percentile relative to all other rolling one-month periods. Not that we need to tell you, but that’s pretty bad.

“While seasonal trends for the upcoming month have been poor, performance in the three months following the close on 9/8 has been among the best relative to any rolling three-month period throughout the year. As shown below (Figure 4), the median gain of 4.65% ranks in the 87th percentile relative to all other three-month periods throughout the year.

“The stock market may be coming up on the best of times when it comes to the calendar, but to get there, it must get through the worst of times first.”

FIGURE 4: S&P 500 RETURNS—1 MONTH VS. 3 MONTHS POST-SEPT. 8

Source: Bespoke Investment Group

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

RECENT POSTS