Incorporating financial psychology into the financial-planning process

Incorporating financial psychology into the financial-planning process

Some key principles of financial psychology can help advisors improve their financial-planning approach. This, in turn, should help clients better recognize how their choices impact their financial lives.

The more an advisor understands each client, the better able they are to create a financial plan that will fulfill that client’s goals. This is one of the driving forces behind applying financial-psychology tactics to the planning process.

The psychology of financial planning as defined by the CFP Board is “identifying and responding to attitudes, behaviors, and situations that impact decision-making, the client-planner relationship, and the client’s financial well-being.”

Once advisors have a deeper understanding of financial psychology, they can integrate it into the planning process to help clients recognize how their behavior and financial choices can have lasting impacts on their financial lives.

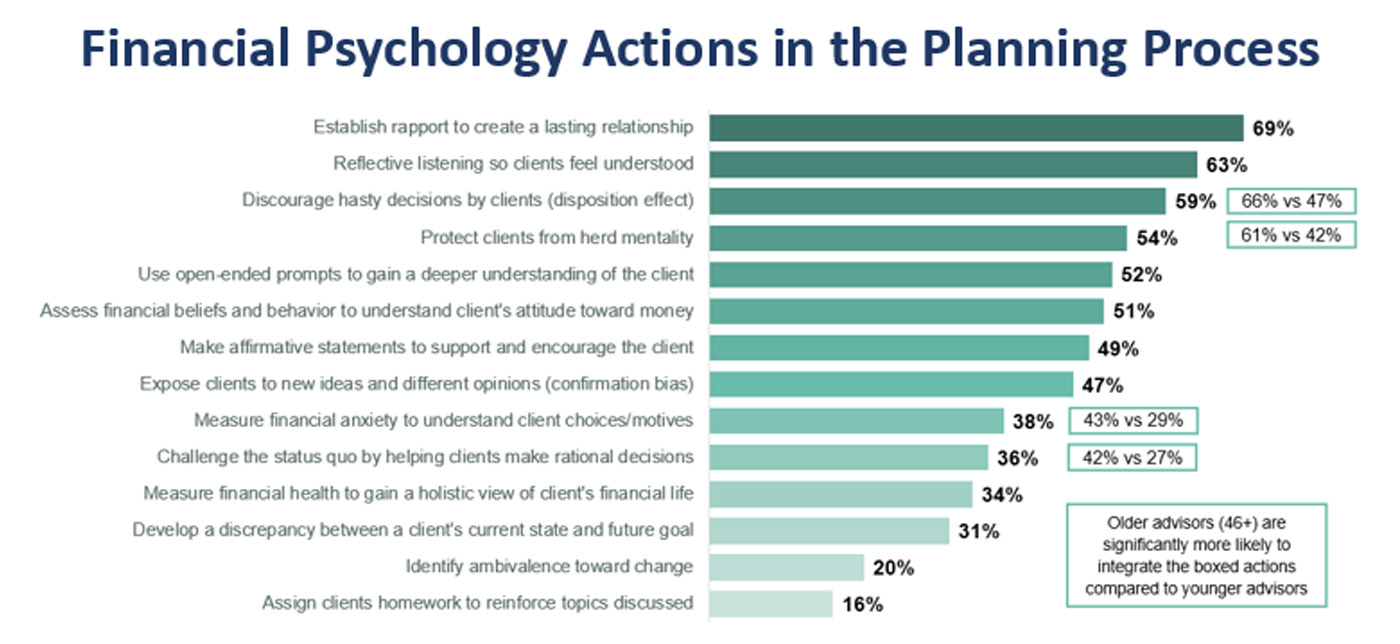

In a recent advisor survey, eMoney learned some of the most common ways advisors are doing this.

Here are some best practices for applying financial-psychology techniques to the seven-step financial-planning process.

Step 1: Understanding the client’s personal and financial circumstances

Building rapport is an important first step in the financial-planning process and one of the most crucial ways to address financial psychology. Ask about your client’s “money story” to learn how it’s shaped the way they think about and spend their money. Use conversation starters to encourage clients to tell you about the following:

- Their first money memory.

- What they spent their first paycheck on.

- How money was discussed where they grew up.

Open-ended questions give clients the opportunity to tell you about a topic without you leading them in a certain direction. Often advisors end up asking closed-ended questions—questions that result in simple yes or no answers. We want clients to elaborate to easily aid in building rapport.

Here are some examples of open-ended questions:

- What brings you in today?

- What can you tell me about your first memory that involved money? How did you feel about that experience?

- What’s important to you about your money today? In the future? Why?

- What keeps you up at night? Can you explain that in more detail?

Honing your listening skills will assist with this step. Do a self-check to see who is talking more. If it’s you, shift the conversation back to your clients with some additional open-ended questions. When in doubt, the words “tell me more …” are a great way to begin an open-ended question to keep the conversation flowing.

Step 2: Identifying and selecting goals

While goals are important, values are what we believe are important in life. Conducting a values activity with clients can help create goal alignment and provide precise focus.

One values activity allows clients to go through a virtual deck of 51 values and decide to keep or discard that value based on what’s significant to them. This is helpful when working with spouses and partners to establish financial congruence within the household.

Selecting goals can feel very abstract for clients as they think of the future and their future selves. Research shows us that often we think of our future selves as strangers. If you’re able to help your client connect their older self to their present self, it may result in the accumulation of larger financial assets over time. Bringing together their values with their current passions can help create goals that are personalized and meaningful, helping clients follow through with their financial plan.

Step 3: Analyzing the client’s current course of action and potential alternative course(s) of action

Are your clients ready for the change they are about to encounter? Having an understanding of the stages of change and knowing where clients land on the Transtheoretical Model of Change (TTM) can help with recommendations and provide options when creating your clients’ plans. The TTM was initially used in the health-care industry to help change unhealthy behaviors—like motivating people to stop smoking.

The stages of change can help financial advisors know where their clients stand when those plan-wrecking habits—such as holding excessive credit card debt, overspending, or making risky investments—creep in.

The stages of change are as follows:

- Precontemplation: Clients deny they have a problem or are unaware of the consequences.

- Contemplation: Clients are considering the pros of changing their behavior but underestimate the cons and experience contradictory feelings.

- Preparation: Clients have decided to act and started steps toward their new goal.

- Action: Clients are engaged.

- Maintenance: Clients have been “doing the work” for at least six months.

Advisors should primarily look to the TTM for guidance. For new clients, it can be used as a building block for awareness of where your clients are with a financial issue. For more tenured clients with whom you have built rapport, it provides an opportunity to have an open and honest dialogue about unhealthy behavior that is impacting the financial plan. Remember that you can’t make decisions for your clients, but you can assist and guide them with education, compassion, and analysis of their best course of action.

Step 4: Developing the financial-planning recommendations

Financial planners working on plan recommendations should be on the lookout for clients who demonstrate these notorious behavioral finance biases:

- Confirmation bias: Looking for information that confirms the opinion they’ve already established.

- Cognitive dissonance: Having conflicting views about the same decision.

- Herd mentality: Being influenced by a majority of others, causing them to think and behave in ways that conform with a group.

Knowledge and awareness are key when it comes to behavioral-finance biases and can help curb their effects.

At this stage of developing a financial plan, your conversations with clients should include discussions of financial-education concepts. However, this could prove challenging if you aren’t mindful of your client’s preferred learning style.

Only about 30% of the population are auditory learners, those that learn by hearing information. Other learning styles include visual or verbal learners. If you’re trying to educate visual learners about risk tolerance, the power of compounding, or behavioral finance concepts through discussion alone, they might not be able to fully process the information. Consider adding visual aids and written text to the meeting for clients who are visual or verbal learners. Asking your client about their preferred learning style during your initial meetings will help you provide the information in a way that enables them to grasp difficult concepts.

Step 5: Presenting the financial-planning recommendations

When presenting your recommendations to the client, pay particular attention to your listening skills. Use reflection to verify and clarify what the client has said to avoid becoming an advisor who only focuses on fixing problems. What this looks like in practice is your client speaks, you reflect, and your client confirms.

After you’ve finished presenting the financial plan, make use of “minimal encouragers” as you listen to their reaction to your presentation. Minimal encouragers are used to let clients know you are interested in what they have to say. We do this in everyday conversation without much thought. These encouragers include words and phrases such as “yes,” “I’m with you,” “OK,” and “I see what you mean,” but also include physical cues such as smiling and nodding your head. They can help move the conversation along and confirm you want to continue to engage.

Lastly, be mindful of the frequency of your communications with your clients. Communication and trust go hand in hand. One of the key indicators of holistic planning is reassessing a client’s financial plans once annually, and while that may be sufficient for some, it might not work for everyone. Find out how often clients want to be in contact with you, and then honor it. Creating an air of transparency in the client-planner relationship can go a long way in cementing that trust.

Step 6: Implementing the financial-planning recommendations

During this step, help clients build financial self-efficacy—the belief in their ability to use financial knowledge to manage money—with frequent positive feedback. Clients need to know what they are doing well in their financial lives, so point out successes that have occurred since the last time you saw them. At times, making the “right” choice with money is difficult, and providing that encouragement can build confidence and motivation.

To help build confidence faster, create a checklist that tackles smaller items first—to give early wins—then moves on to progressively larger items. Exceptions should be made for urgent items on the list, such as adjusting insurance policies upon the birth of a child.

Using financial-planning technologies that have a client portal or website can also go a long way in building confidence and motivation. Clients who can view their assets under the firm’s management as well as aggregate their accounts feel empowered in their financial situation. These tools also create a safe and convenient way for clients to send documents to their advisor to streamline the planning process.

Step 7: Monitoring progress and updating

As your book of business continues to grow, it’s critical to continue monitoring progress and providing updates. By conducting at least one client meeting per year, you will continue to build rapport and strengthen your relationship. As your clients’ lives evolve, practicing and continuing to learn the elements of financial psychology you’ve used throughout the planning process will ensure their financial plan evolves along with them.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Sasha Grabenstetter, AFC, BFA, is a financial planning education consultant at eMoney Advisor. She is an integral part of the internal and external financial planning education programs, as well as financial planning content development. Sasha won the 2020 Outstanding Symposium Practitioners’ Forum Award from the Association for Financial Counseling and Planning Education. She previously co-authored “Apple Seed: A Student Guide to Pro Bono Financial Planning” and “All My Money: Change for the Better.” With close to 10 years in financial education, Sasha received her AFC designation in 2015 and graduated with her master’s degree from Texas Tech University in 2012.

Sasha Grabenstetter, AFC, BFA, is a financial planning education consultant at eMoney Advisor. She is an integral part of the internal and external financial planning education programs, as well as financial planning content development. Sasha won the 2020 Outstanding Symposium Practitioners’ Forum Award from the Association for Financial Counseling and Planning Education. She previously co-authored “Apple Seed: A Student Guide to Pro Bono Financial Planning” and “All My Money: Change for the Better.” With close to 10 years in financial education, Sasha received her AFC designation in 2015 and graduated with her master’s degree from Texas Tech University in 2012.