How to enhance client services and practice growth through integrated banking solutions

How to enhance client services and practice growth through integrated banking solutions

Successful financial advisors are expanding their range of value-added services by offering clients integrated financial services that encompass both personal and business banking.

To succeed in today’s financial-services landscape, advisors need to be proactive and flexible, especially when faced with challenges from new competitors and service models. In considering best practices for your business, it is helpful to reflect on strategies used by the most successful industry leaders.

Another way to put it: Many clients want to work with a holistic advisor who can provide a wide range of financial products and services. They prefer a closer relationship with their advisor that reflects a deep understanding of their overall financial situation. To provide this, financial advisors must deliver a broad base of services, including integrated banking products such as checking accounts, savings accounts, and certificates of deposit, and comprehensive lending solutions like mortgages, jumbo loans, and products that offer access to liquidity.

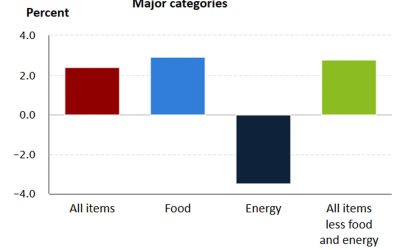

More than half (51%) of financial advisors are increasing their focus on providing holistic financial-planning services, including integrated banking. This trend underscores evolving client expectations and the value of integrated financial services that encompass both personal and business banking.

Strong demand for integrated banking

There appears to be strong demand among clients for banking services from their financial advisor. Four out of 10 financial advisors say that their clients have asked them about banking services, but only two out of 10 financial advisors can offer these services. At large firms with over $500 million in assets under management, six out of 10 advisors say clients have asked them about banking services.

The 2021 Elite RIA Study, sponsored by Axos Advisor Services, identifies banking and lending as areas of opportunity for RIAs. It notes that since many affluent clients are principles of a business, their personal and business lives often merge. This gives their financial advisor an opportunity to maximize the financial aspects of both parts of their lives.

In their competition with trust banks and the wealth management units of large commercial and investment banks, financial advisors are likely to see demand for banking services grow. According to the study, banking and lending services are often a “useful and relatively easy-to-add component to their current service offering.”

The merging of integrated banking with wealth management isn’t new. Wire houses have been offering integrated banking to clients for decades. The emergence of tech-enabled lending platforms and banking-as-a-service (BaaS) solutions has provided independent financial advisors access to the same integrated banking capabilities and service offerings that were previously available only to the wire houses and big brokerage firms.

In fact, independent advisors may have an advantage over wire houses when it comes to meeting their clients’ banking needs. Wire houses can only sell their own banking products, which might not be the best fit for a client. This is especially true for specialized loans like aircraft or boat loans

Benefits of offering integrated banking

Your firm could enjoy a number of benefits by integrating personal banking services into your business, including the following:

- Become a “one-stop shop” for all client financial needs. This is the biggest benefit of integrated banking for many financial advisors. Most people, especially affluent individuals and families, lead busy lives. Being able to access banking services from their financial advisor can be a big convenience and time saver for them.

- Increase client satisfaction. By making things easier for your clients, you will likely boost their satisfaction and loyalty to your firm. They may view you as the indispensable leader of their financial and investment team. You might also be able to offer clients better rates and terms than they can find elsewhere.

- Gain a competitive advantage. Offering integrated banking can help differentiate your firm from other financial advisors who don’t offer these services. This can boost client retention and attract new clients who want to work with a more well-rounded financial advisor.

- Boost revenue. Cross-selling fee-based banking products and services can increase your firm’s AUM and share of wallet and keep assets closer to home. And when clients borrow money instead of withdrawing it from their portfolio, this retains AUM in your firm.

- Keep clients in the fold. Many banks today offer the same or similar investment management services that financial advisors provide. By offering banking products and services to your clients, you can avoid sending them to a potential competitor. Your client relationships become “stickier.”

- Offer better client advice. This gets back to the idea of being a holistic advisor. When banking products are integrated into your overall service offerings, you can offer more comprehensive advice that’s based on your clients’ overall financial situation and their unique goals and needs. Offering integrated banking can also help start new conversations with clients, such as how to finance the purchase of a vacation home or yacht.

Approaching your clients about integrated banking

You have probably segmented your clients according to certain criteria such as AUM or profitability. This is a good place to begin as you strategize how to approach clients about integrated banking services. For example, you could start by having conversations with your “A” clients about the benefits of consolidating their banking services with your firm.

Your CRM may include information about where clients do their banking, which you can also use to start conversations with clients about integrated banking services. Accommodating the business banking service needs of clients who are entrepreneurs can be especially lucrative for your firm, so make these clients a priority.

As you begin conversations with clients about integrated banking, explain the one-stop-shopping benefits of moving their banking business to your firm. For example, it may result in more seamless funds transfers between their investment and bank accounts, eliminating any potential delays. This could be crucial if clients are finalizing the purchase of a major asset such as a second home or recreational vehicle.

Also, explain to clients how integrated banking can help you deliver more customized financial solutions. With banking services under your roof, you have more control to create solutions that are designed to meet their overall needs. This is especially important in today’s tight, rising-rate lending environment.

How to integrate banking services into your advisory practice

You can integrate banking products such as checking accounts and securities-based lines of credit into your existing service offerings through platforms like the Axos Client Portal. These services allow you to offer clients additional value by streamlining financial management, providing seamless access to both investment and banking products.

By incorporating integrated banking, you can strengthen client relationships through:

- Enhanced value and services. Offer premium banking and lending benefits, providing your clients with time savings and convenience.

- Holistic guidance. Integrated banking services help you spark new conversations and give more comprehensive advice.

- Consultative support. Platforms like the Axos Client Portal can help you gain deeper insight into clients’ overall financial positions, which allows for more customized advice and solutions.

These integrated services provide a practical way for you to meet evolving client needs in an increasingly competitive financial landscape.

Integrated banking: A win-win solution

Offering integrated banking products and services could be a win-win for your clients and your firm. Talk to your custodian about how they can help you offer integrated banking products and services to your clients. If your custodian doesn’t offer these services, you might want to consider diversifying your custodian to work with one that does.

This article is an edited version of the white paper “Integrated Banking Solutions: How to Enhance Client Services and Grow Your Business” by Axos Advisor Services. Republished with permission. The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Investment Products: Not FDIC Insured—No Bank Guarantee—May Lose Value.

Axos Advisor Services is a trademark of Axos Clearing LLC. Axos Clearing LLC provides back-office services for registered investment advisers. Neither Axos Advisor Services nor Axos Clearing LLC provides investment advice or makes investment recommendations in any capacity.

Securities products are offered by Axos Clearing LLC, member FINRA & SIPC. Axos Clearing LLC does not provide legal, accounting, or tax advice. Always consult your own legal, accounting, and tax advisors.

© 2024 Axos Clearing LLC. Member FINRA & SIPC. All Rights Reserved.

Axos Advisor Services is an RIA custodian that delivers individualized attention, intuitive technology, and knowledgeable consulting support. As a hybrid custodian and financial-services company, Axos Advisor Services provides powerful, integrated custodial and banking solutions that enable RIAs to offer a wider range of services to their clients. Advisors have access to the intuitive Liberty Platform, designed and built specifically for RIAs. Axos Advisor Services is offered by Axos Clearing LLC, a licensed broker-dealer.

RECENT POSTS