How long can the AI-driven bull market last?

How long can the AI-driven bull market last?

Analyzing the growth cycles of new technologies

New technologies are a major driver of U.S. economic prosperity. Studying the growth cycles of past innovations can provide insight into the long-term potential of today’s emerging technologies. Historically, new technologies grow in cycles within an ongoing long-term bull market phase.

Artificial intelligence in 2025

In 2025, artificial intelligence (AI) is the most powerful and widely adopted new technology, with applications spanning all 130 U.S. industries. Examining past technology-driven bull markets reveals that new technologies typically experience 8–10 growth cycles before reaching market saturation. At that point, extreme speculation often leads to a collapse in the bull market. A key market-related question for 2025 is: Where is AI in this overall cycle?

Primary industries developing AI

To determine AI’s current growth cycle, it is essential to examine the primary industries developing AI-related hardware, software, and firmware:

- Hardware: This area is led by the semiconductor industry but also includes computers, hardware for data storage, and other supporting products.

- Firmware: This category includes software infrastructure and cybersecurity technologies.

- Software: This focuses on AI’s development, functionality, and accessibility, primarily within the software application industry.

While these are the core industries driving AI advancements, many others are involved in AI development, including those producing phone apps for consumers and business use. For example, companies in the diversified industrials industry are also engaged in AI-related hardware and firmware creation.

Evaluating AI’s bull market

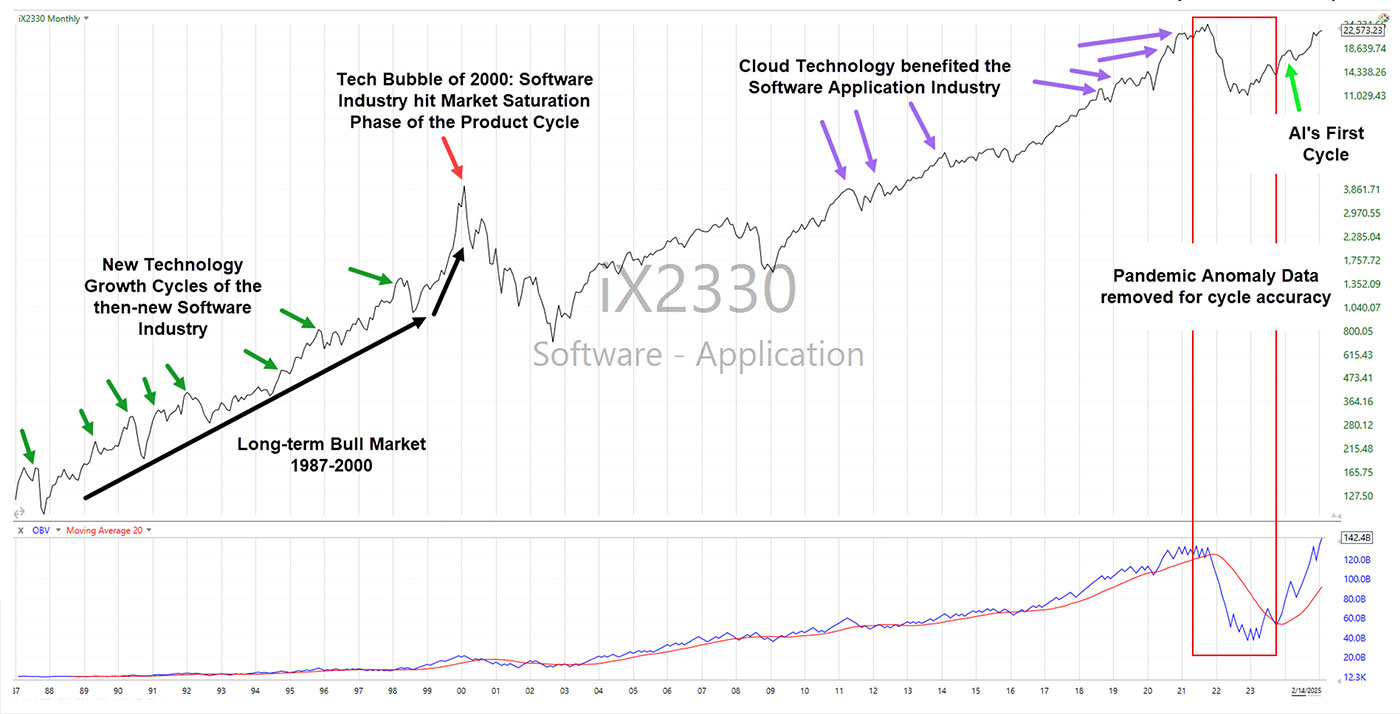

Industry index charts are valuable tools for cycle theorists analyzing the potential trajectory, duration, and stages of an AI technology-driven bull market. The software application industry, which includes 272 publicly traded U.S. companies with a vast array of services, plays a crucial role in this analysis. Since software was integral to the last two tech-driven bull markets—and AI cannot exist without software programming—this industry is an excellent choice for analyzing growth cycles within each bull market phase.

Historical context and current trends

- Past trends: The software application industry was formally recognized in the U.S. in 1987, just after the savings and loan bear market crash. It saw a slower-paced bull cycle starting in 2011 when cloud technology started to dominate.

- Cloud computing: The shift from local applications to cloud-based solutions fueled another decade of software industry expansion. However, software advancements during this period were much slower compared to AI.

- AI cycle: The AI technology cycle started in 2020 but was interrupted by the pandemic, resuming in 2023. Accurate cycle analysis requires removing this anomaly to properly determine the number of cycles within the new AI technology.

TECHNOLOGY GROWTH CYCLES FOR THE SOFTWARE APPLICATION INDUSTRY (1987–2025)

Source: TechniTrader

Future projections

AI technology has had its first growth cycle. Based on historical industry index data, the AI-driven bull market is projected to continue for many more cycles. The current cycle marks the beginning of a long-term technology bull market fueled by AI, with at least seven and potentially up to 10 more cycles. The emergence of quantum computing will likely extend the AI cycle.

Historical data going back to the early 1900s indicates that new technology cycles have gradually lengthened over time. Each successive technology has experienced more growth cycles, impacting future bull markets based on new technologies.

For example, during the 1985–2000 bull market cycle, six major new technologies emerged. By contrast, more than 20 new technologies are expected to develop in the coming decade. Each new technology will likely incorporate AI, contributing to a higher number of growth cycles than in previous bull markets.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Martha Stokes, CMT, is the co-founder and CEO of TechniTrader and a former buy-side technical analyst. Since 1998, she has developed over 40 TechniTrader stock and option courses. She specializes in relational analysis for stocks and options, as well as market condition analysis. An industry speaker and writer, Ms. Stokes is a member of the CMT Association and earned the Chartered Market Technician designation with her thesis, "Cycle Evolution Theory." technitrader.com

Martha Stokes, CMT, is the co-founder and CEO of TechniTrader and a former buy-side technical analyst. Since 1998, she has developed over 40 TechniTrader stock and option courses. She specializes in relational analysis for stocks and options, as well as market condition analysis. An industry speaker and writer, Ms. Stokes is a member of the CMT Association and earned the Chartered Market Technician designation with her thesis, "Cycle Evolution Theory." technitrader.com

RECENT POSTS