How everyday analogies can help clients understand risk management

How everyday analogies can help clients understand risk management

Financial advisors use a wide range of analogies with clients in communicating the need for constant portfolio vigilance, risk management, and planning for worst-case scenarios.

One experienced financial advisor we have interviewed for our publication is an outspoken advocate for a proactive, risk-managed approach to managing his clients’ investment portfolios.

Adam Koos, CFP, CMT, CFTe, and the founder and president of Libertas Wealth Management in Columbus, Ohio, recently wrote the following in an update note to clients:

“The 2nd-longest bull market in United States history came to an end last month after a whopping 11 years without a single drop of -20% or more. Incredible …

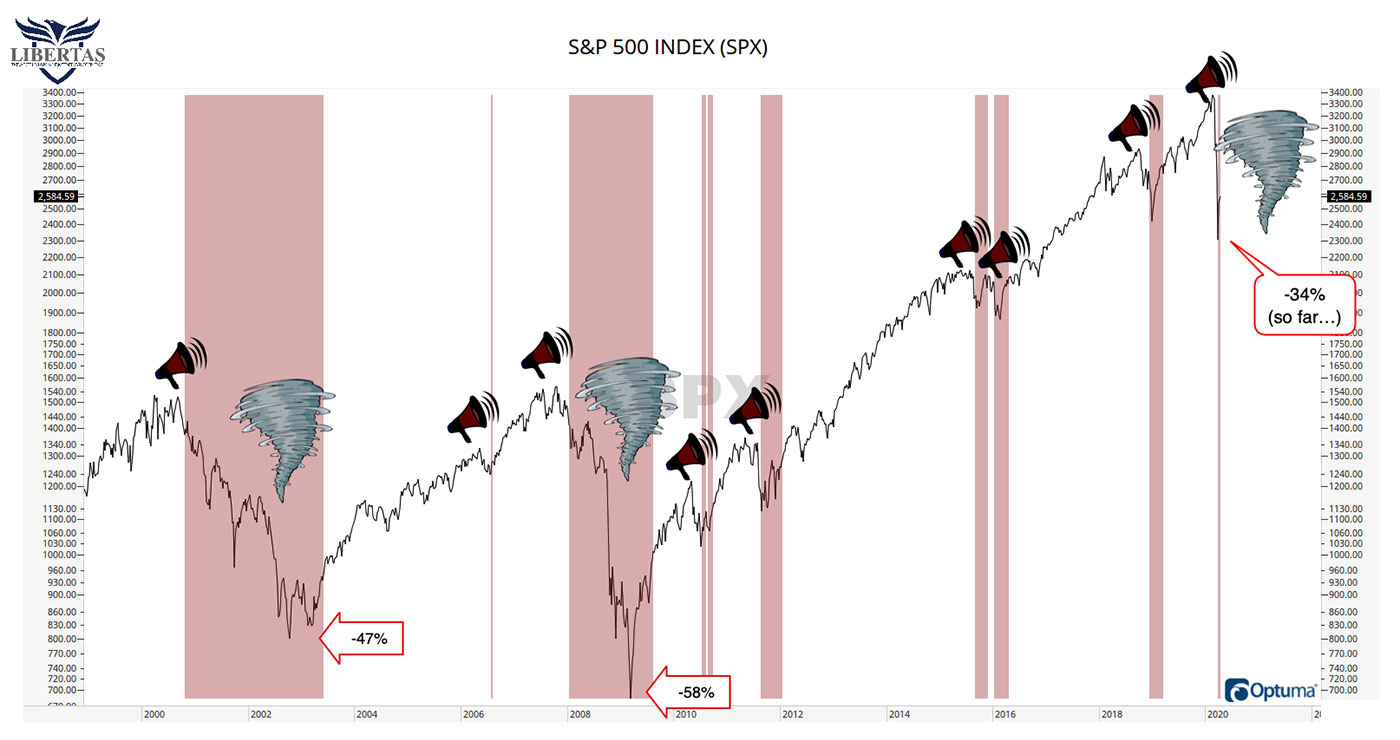

“Those of you who have been clients long enough know that I often use the analogy of ‘tornado sirens’ to explain my sell signals (when it’s time to get out of the stock market). If you’ve been a client for longer than a year, then you also know how annoyingly frustrating this 11-year bull market has been!

“Why has it been frustrating? Because there has never been a stretch of time in history that has gone by, where the market has gone up for so long, with so many tornado sirens, without a single tornado touching down! Needless to say, the sirens did go off a few weeks ago and it was time to take our hard-earned retirement savings and head to the basement.

“During THE longest uptrend in market history—from Black Monday in October of 1987 until the Dot-com bubble burst in 2000—there were only five ‘tornado sirens’ that went off without a subsequent tornado. One in 1990, two quick ones in 1994, another quick one in 1998, and then the siren that preceded the tornado that wiped out -47% of the S&P 500’s value between 2000-2. But still, that’s it … only 4-out-of-14 years (or one every 2.8 years, on average)!

“If we take a look at the past 20 years, you can see a much different picture:

- There was only one, extremely short ‘tornado siren’ (in 2006) between the bottom of the 2000-02 crash and the peak of the market in 2007.

- However, between the bottom of the 2007-09 market crash resulting from the mortgage crisis and today, there were seven ‘tornado sirens’ in only 11 years!

- That’s an average of one every 18 months or so.

“What this means is that it’s been one of the toughest stretches of time in market history to manage investments using a tactical, proactive, trend-following strategy. But that has now come to an end, with a potentially destructive tornado hitting portfolios that were not positioned to weather the storm.”

Source: Libertas Wealth Management. Market data via Optuma software.

Mr. Koos diligently factors in each client’s or family’s financial plan objectives, risk profile, and time horizon (among many other factors) in the investment-planning process. But despite widely ranging financial goals, virtually all of his clients’ portfolios emphasize a “manage risk first” philosophy.

One of the most compelling visual analogies communicating this point was presented in the article “What is risk really all about?” by Jerry Wagner, founder and president of Flexible Plan Investments.

Mr. Wagner wrote,

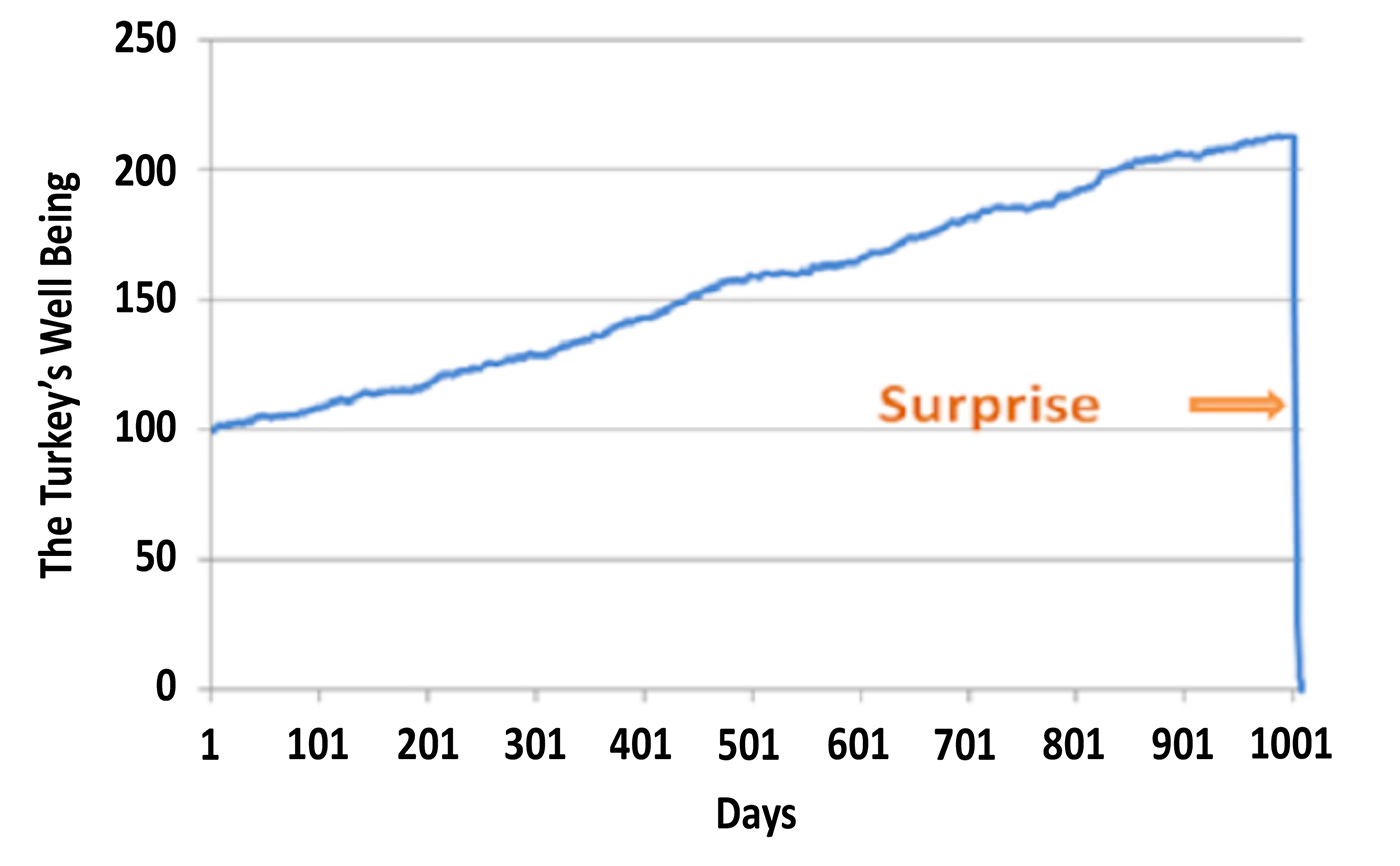

“I spent a good amount of time recently in a very small workshop with Nassim Taleb, author of many of my favorite books on risk (“Fooled by Randomness,” “The Black Swan,” and “Antifragile”). It was an awesome workshop that helped me refocus on the reasons for risk management. In the latter two books, Nassim describes ‘The Turkey Problem’:

“‘For a thousand days, the butcher feeds the turkey. With each passing day, as he steadily grows in size, the turkey becomes more convinced of the butcher’s benevolence and the probability of an ever-brighter future. Then the day before Thanksgiving (or, as is the case in a few weeks, Christmas) arrives, and the turkey gets a surprise.’

Source: Wikimedia Commons

“The poor turkey falls prey to an issue that we all have to deal with in our daily lives. Humans have necessarily evolved into creatures that survive by taking a few events and generalizing them into a prediction of the future that they think they can reliably act upon.

“We touch a stove and are burned, so we don’t touch a hot stove again. A forecaster examines a stream of earnings reports that looks like the turkey’s first 1,000 days and predicts that the next quarter will be even better.

“While such ‘inductive’ reasoning serves us in many tasks, it does a very bad job of preparing us for surprises to come. Like the turkey on the day before the holiday feast, the surprise comes abruptly, and the result can be shocking. One can learn overnight that the hand that feeds you can literally be the one that also wrings your neck.

“Our investment goal should be to avoid being the turkey.”

***

The “tornado siren” and the story of the turkey present memorable images that help to visualize specific market situations. Many of the financial advisors we have interviewed have shared their own particular take on using analogies in communicating financial concepts to clients, especially the importance of risk management.

Let’s take a look at a few.

Larry Welder • San Antonio, TX

Larry Welder • San Antonio, TX

Read full article

Larry Welder, founder of Granite Financial Solutions LLC, a multi-office firm, talks about the similarities between financial planning and major construction projects:

“My training as an engineer taught me how to effectively problem-solve and think analytically. The quantitative orientation of engineering also has added value as I evaluate financial options for our clients.

“Managing a building project and designing a sound financial plan are similar in many ways. Both involve considering numerous variables and start with a strong foundation. You must select appropriate materials for a construction project so that it meets the needs of the owner. You then have to monitor and maintain the structure, much like you have to monitor and maintain a financial plan.

“Risk management is important in both construction and financial planning. Depending on where a construction project is located, it will have to be able to withstand hurricanes, earthquakes, tornadoes, or extreme heat or cold. Those are just the worst-case scenarios. Risk management covers virtually all areas of a building’s design and how it is used on a daily basis. Similarly, in financial planning, we need to evaluate how clients’ financial plans will withstand worst-case scenarios within the financial markets, as well as the realities of changes in a client’s personal, professional, or family situation.”

Nancy Hairsine, CFP, RFC • Pittsburg, CA

Nancy Hairsine, CFP, RFC • Pittsburg, CA

Read full article

Anticipating conditions that could threaten livestock and crops, farmers must plan for the worst and protect for the future. Nancy Hairsine, an advisor in Pittsburg, California, says that she likes to share her father’s experience as a farmer to explain why she, like him, uses a variety of financial and technological tools in her efforts to mitigate risk and preserve what’s important:

“From my upbringing on a farm, I often use analogies in talking to clients. I think it starts with managing risk. Farmers are exposed to all kinds of conditions outside of their control, most importantly the weather. But there are lots of very sophisticated tools they can use today to manage risk, including financial instruments such as futures hedges and vast improvements in farming technology.

“This, to my mind, is directly analogous to managing within today’s financial environment. You cannot control what is going to happen in the economy or within specific markets, but you need to use the most advanced and modern tools to manage risk.”

Jay Blanchard • Williamsville, NY

Jay Blanchard • Williamsville, NY

Read full article

Jay Blanchard was a captain and satellite communications specialist in the Air Force before becoming a successful entrepreneur and later entering the financial-services industry. He says he often compares his Air Force training to some of the challenges in the financial markets:

“Here is what I tell clients: ‘I’m an old Air Force officer. I did get to fly, though I wasn’t a pilot. The Air Force teaches the importance of emergency training first. We were taught how to exit the aircraft very quickly in case of emergency or even to eject. Investments are much like that in that we always need to be prepared with contingency plans in case of tumultuous times in the economy or the markets.’

“You don’t start thinking about what to do when the wings are on fire in a jet … you should know that already. Same thing with investments in terms of having active strategies that are already prepared to react to changes in market conditions. … No matter what the overall market may be doing, we will have in place a well-diversified strategy combination, with each element doing what it is supposed to be doing. It is impossible to predict the future, or future returns, but I am firmly convinced that a well-diversified combination of strategies will perform the best, with managed risk, over market cycles.”

Gary Strawn • Plano, TX

Gary Strawn • Plano, TX

Read full article

Gary Strawn, a Texas-based investment advisor representative and football fan, knows that coaching his clients through a full market cycle requires endurance, a long time horizon, and active risk management:

“The natural inclination of most people—the human behavioral factor—is to want to chase returns or enter or exit the market at the wrong time. And that is exactly why the well-documented investment record of most people is so poor.

“Clients really have to understand the full-cycle nature of investing in general, especially as it relates to actively managed investment approaches. Risk management means exactly that, and it can sometimes lead to underperformance in bull markets. Some active strategies might also not match market returns in difficult sideways markets. But those same strategies might do extremely well when considering both bull and bear markets in their totality.

“Even within active management, it is tempting to try to chase returns and allocate more to strategies that have done well over the past year or so. That is where our discipline comes in. Our approach is to construct a diversified blend of active strategies with different potential performance characteristics that can work well together over various market cycles.

“I tell clients it is very much like a football game—and you know we are real football fans here in Texas. You have to go through four quarters to find out who wins the game. Anybody—even the best teams—can be behind at halftime, or after the first or third quarter, but that’s not the point. The point is that the full investment cycle is a bull and a bear market and everything in between. Only after you get through those two cycles can you determine how effective you were in your investment process.”

Gary Ziegler • Madison, WI

Gary Ziegler • Madison, WI

Read full article

A Wisconsin native, Gary Ziegler has weathered scorching summers and frigid winters. Like the thermostats he relies on for climate control, active management for his advisory clients is at work around the clock—adjusting his clients’ portfolios in all market conditions:

“On the tactical side, [our broker-dealer] has developed some excellent client materials and presentations that help explain active management. So have many of our third-party managers. I will thoroughly go through these materials with clients, explaining about market cycles, risk and return, the math of drawdowns, and the need to play both offense and defense with your portfolios. We look together at some numbers showing how portfolios protected against downside risk, and minimizing those drawdowns, can perform over time versus just sticking with the performance of a market index.

“I also use some simple analogies. My favorite involves a thermostat. I will ask my clients what their ideal temperature is in their house all year round. Let’s say they answer 70 degrees. In Wisconsin, weather can go above 90 degrees in the summer and below zero in the winter. However, if you have a thermostat, a furnace, and an air conditioner, you can keep your home at a comfortable temperature all of the time.

“That is the goal of tactical money management—to make your investing experience less volatile. Sometimes you need to run the furnace and other times you need the air conditioner. It is nice to have a thermostat to help keep things comfortable and under control. I try to relate this back to the markets and the fact that you cannot do the same thing in all market conditions—it just does not make practical sense.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.