The benefits of a trend-following investment approach

The benefits of a trend-following investment approach

In the search for the latest, greatest trading system or strategy, don’t neglect the one system that has been proven to work over the long run.

What if there was one investment approach that guaranteed you would always be invested during sustained upward moves of your selected investment or asset class and would miss the majority of a major downtrend?

Naturally, there would be some negatives to the approach.

Not every trade would be successful. In fact, you would experience periodic whipsaws and losses when the market changes direction only to reverse itself a little later. In strong, rising markets, performance would likely lag that of the major indexes. The wisdom of the investment approach might take years of somewhat lagging performance before a market downturn triggers a significant performance payoff.

Perhaps most disconcerting, staying the course would require ignoring much of the financial news and the omnipresent forecasts of market professionals. It would require admitting you have no idea what is going to happen next and shutting down your emotional responses to economic and political events. It would remove the “gaming” element of investing, turning it into a discipline versus an art.

That one investment approach is trend following. It’s been around for well over 100 years, takes advantage of the phenomena of performance persistence and is, in many ways, Isaac Newton’s first law of motion applied to financial markets. To paraphrase, “An object in motion tends to remain in motion until acted upon by an outside force.”

What do investment professionals think about trend following?

Why isn’t trend following a more accepted investment approach, widely taught in CFP accreditation programs and college finance classes?

Michael Covel, bestselling author, financial educator and trader, and founder of TurtleTrader.com and TrendFollowing.com has written:

“Universities teach fundamental analysis and the efficient market theory–both dead ends to actually making money. The great trend traders do the exact opposite. Believe it or not, there are literally only a handful of finance professors at U.S.A. schools who even know about the existence of trend-following trading. …

“Trend following aims to capture the middle, or meat, of a market trend, up or down, for profit. You will never get in at the absolute bottom or get out at the absolute top. …

“If you want to make money in any market, you need to mirror what the market is doing. Other things being equal, the longer you stay right with the market, the more money you will make. The longer you stay wrong with the market, the more money you will lose. … Trend following has above-average performance over the last seven decades. The potential to compound wealth is huge.”

Why don’t more financial advisors recommend trend-following strategies for their clients?

Perhaps it’s because trend following just isn’t, for the lack of a better term, sexy. In fact, it can be downright boring. There’s no opportunity to pit one’s intellect against the wiles of the market, to perceive what others have missed, to find great investments before the crowd, or just to take advantage of mispricing due to the mistakes of others. Imagine the nightly business news without the astute (and typically incorrect or vastly oversimplified) explanations of market moves during the day.

David Moenning, a past chairman of the National Association of Active Investment Managers (NAAIM), stresses the importance of trend following in his investment strategies.

“While there are challenges to a trend-following approach, not the least of which is ‘sticking with it’ when the market is experiencing a mean-reverting phase, one of the primary keys to the methodology is that unlike so many other indicators, price cannot deviate from itself,” he explains.

“It is for this reason that I place a fair amount of ‘price trend’ indicators into my market models. Trend following systems are the ultimate ‘stop loss’ triggers if other indicators are ‘fooled’ or ‘confused.’ To be sure, one should never use any indicator in a vacuum and, in my humble opinion, diversifying by indicator methodology is mission critical. But, given that ‘markets are never wrong,’ trend following—or better still, multiple trend following systems used in conjunction with other indicators—is an important part of any market model.”

The many advantages of trend following

The potential negatives of trend following are often the result of “cognitive dissonance”—the behavioral and emotional conflict created when the need for patience and inaction run up against the strong desire to “do something.” It is important, therefore, to periodically reinforce the many advantages of a trend-following approach for advisors and their clients.

The potential negatives of trend following are often the result of “cognitive dissonance”—the behavioral and emotional conflict created when the need for patience and inaction run up against the strong desire to “do something.” It is important, therefore, to periodically reinforce the many advantages of a trend-following approach for advisors and their clients.

- It is easy to be wrong when trying to forecast future market moves. Logic and emotion can run head-on into each other in what are frequently illogical financial markets. By following the market’s trend in a systematic and disciplined fashion, the investor is guaranteed never to miss out on a major market up move, nor stay heavily invested during a punishing down move.

- A common argument says, “A trend-following strategy may not outperform a buy-and-hold position over the long run.” But that argument is dependent upon the buy-and-hold investor actually holding through a major downturn—over and over again. Few do. Trend following avoids the “buy high, sell low” behavioral tendency of individual investors by moving investors back into a rising market and out of a falling market.

- Traditional risk management uses portfolio diversification. But diversification assures that a major part of the portfolio will underperform in up markets, with no guarantee of protection in a down market, when asset classes have historically become correlated and declined together. Trend following can allow the investor to concentrate the portfolio in rising sectors of the market—avoiding underperforming investments—with the knowledge that assets will be moved to safety when the sectors decline.

- Markets cycle. To be successful, an investment approach must accommodate the changing nature of market sentiment and the economic environment. Trend following forces the investor to be flexible and adapt to changing markets early rather than waiting until the pain of losing money, or the feeling that one is missing out on gains, causes self-defeating behavior.

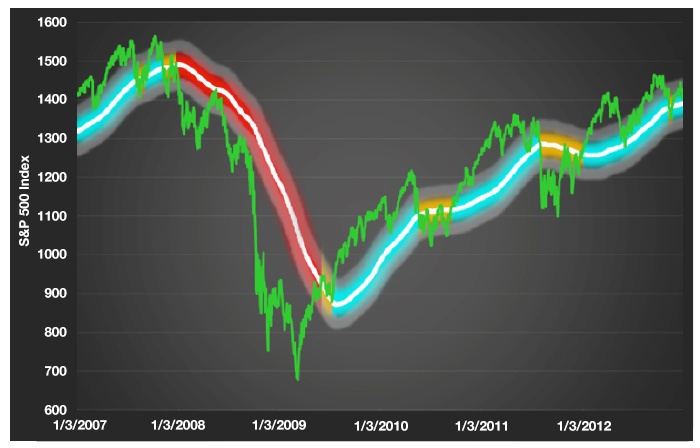

Figure 1 provides a simplified overview of one of the most basic, yet effective, trend-following strategies. The methodology involves using a simple 200-day moving average, with the strategy “long,” or invested in an S&P 500 fund or ETF, when the 200-day moving average is below the price level for the S&P 500 Index (SPX). The strategy goes to cash and is out of the S&P 500 when the 200-day moving average is above the S&P 500 price.

The 200-day moving average positioned the investor on the right side of the market during major up- and downtrends in the period examined, but did encounter whipsaw trades (shown in gold) when market direction was less definitive.

FIGURE 1: TREND-FOLLOWING APPROACH USING 200-DAY MOVING AVERAGE (2007–2013)

Source: FCA, market data.

- Humans are curious creatures, always demanding to know the reason why. Most investors have difficulty reacting to a market move without understanding why the move is happening or has happened. The result is an endless stream of financial news programs, blogs, and analysts expected to have a ready answer to the latest gain or loss. There’s just one problem. They are often wrong. The fortunate trend follower doesn’t have to know why, just what has happened.

- It is hard to overstate the danger of emotional decision-making. Gut feelings are very poor market indicators. Fear of loss and greed distort reactions. Without a quantitatively-based, non-emotional decision-making process, few individuals can take an objective approach to financial markets and react to what is happening versus what they believe is happening.

While trend following can be complemented by different strategies and investment signals designed to target potential investments and monitor market risk and opportunity, it can be perhaps the most important tool in an active investor’s or active manager’s toolkit.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Recent Posts: