‘Picking up the team’: How diversified investment strategies work together

‘Picking up the team’: How diversified investment strategies work together

Actively managed strategies in a well-diversified portfolio will likely have different performance characteristics, with the sum of the parts achieving competitive risk-adjusted returns through different market cycles.

Editor’s Note: A revised and updated version of this article can be found here.

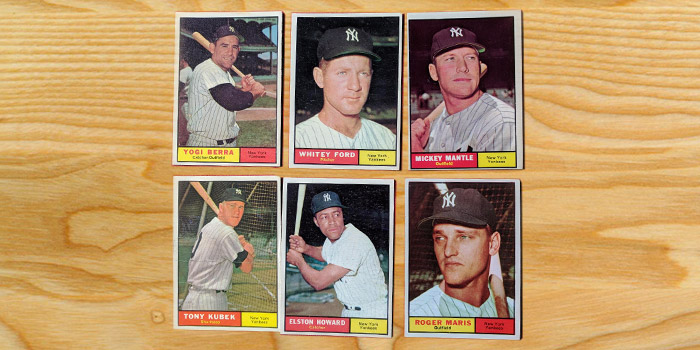

My “fandom” goes back to about age 6, when I started to collect baseball cards. Despite growing up in the Philadelphia suburbs and rooting for the Phillies, many of the cards I coveted most were those of the stars of the then-dominant New York Yankees. I still have a few of those.

Fast forward to the present-day Yankees team.

Last year, they surprised everyone by coming within a game of the World Series, losing the ALCS to Houston in seven games. Four new stars emerged: outfielder Aaron Judge, who had 52 home runs; slugging catcher Gary Sanchez; shortstop Didi Gregorius; and starting pitcher Luis Severino.

This year they added outfielder Giancarlo Stanton (who beat out Judge with 59 home runs last season for Miami) and two sensational rookie infielders, Miguel Andujar and Gleyber Torres. The team started out 9-9. Since then, they have been on a tear and now own one of the best winning percentages in baseball.

To paraphrase longtime Yankees radio announcer John Sterling, “That is what great teams do. They always have someone stepping up and picking up the rest of the team.” If five players are playing just OK, another four will start performing superbly. It is an extremely well-balanced team in that way, where periods of individual inconsistency do not end up hurting the overall winning record of the team.

In this respect, the Yankees’ 2018 “story” is strikingly similar to some principles of sound portfolio construction and strategic diversification.

Financial advisors we have interviewed for Proactive Advisor Magazine frequently talk about using a combination of strategies that are meant to work together (with different performance characteristics) as a cohesive portfolio over full market cycles. These might be exclusively actively managed strategies or a combination of active and passive strategies.

Financial advisor Thomas Campbell, of Plano, Texas, puts it this way:

Flexible Plan Investments’ president, Jerry Wagner, who has written several articles for this publication, has also commented about this aspect of diversification. He has said, “If every strategy in a portfolio is going up or down at the same time, there is a high probability that the portfolio is not properly diversified.”

While it is hard for baseball fans, and investors, to not get caught up in the emotion of day-to-day action, it is a “long season” for both. All that really counts is achieving their respective end objectives.

“The solution to this that I will generally propose is using some combination of actively managed strategies in an overlay with more traditional passive strategies. We want to keep risk in check to the degree possible, and tactical strategies can help in that regard. For these, I turn to a select group of third-party managers who have a variety of quantitatively based strategies. Some of these specifically seek to mitigate the risk of extreme market downturns.

“Returns might not be as high for these strategies during bull markets, but that is more than offset by the potential benefits of missing the worst effects of bear markets. As I tell clients, we would like to see your investments progress toward your return goals with the least amount of risk possible.”

“While there are no guarantees with any investment approach, I am a proponent of risk-managed, growth-oriented active strategies that seek to capture reasonable upside in the market while attempting to avoid the worst of market drops. My overall recommended approach in this scenario could include multi-asset-class and multi-strategy portfolio construction, where risk is also managed through strategic diversification.”

“As an advisor, I also must be cognizant of not letting short-term decisions affect recommendations for clients. If strategy X is underperforming and strategy Y is performing exceptionally well, the natural inclination might be to abandon X in favor of a higher weighting to Y—the flavor of the month. But strategy X might be playing a critical role in a portfolio and may perform that role well when market conditions change. That is the type of consideration I explain to clients as part of the risk-management discussion.”

“My focus is on the planning process and relationship management, so I use third-party money management for most of my clients. They are the experts in this area and have staff specifically devoted to managing client investments. These managers almost universally emphasize actively managed investment strategies that focus first and foremost on risk. Their strategies may not see all of the upside in the market, but they are constructed to avoid catastrophic downside. They use quantitative, rules-based strategies. Their returns, by and large, can be very competitive throughout market cycles, while providing that key element of downside protection. As I explain this to clients, they come to see the merits of such an approach.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.