How AI is reshaping the landscape of financial planning

How AI is reshaping the landscape of financial planning

Artificial intelligence has the capability to transform many facets of today’s best practices in financial planning and wealth management. Industry experts share their perspectives on the current AI landscape.

Artificial intelligence (AI) became quite the buzzword across many industries in 2023, and the financial-planning sector was no exception.

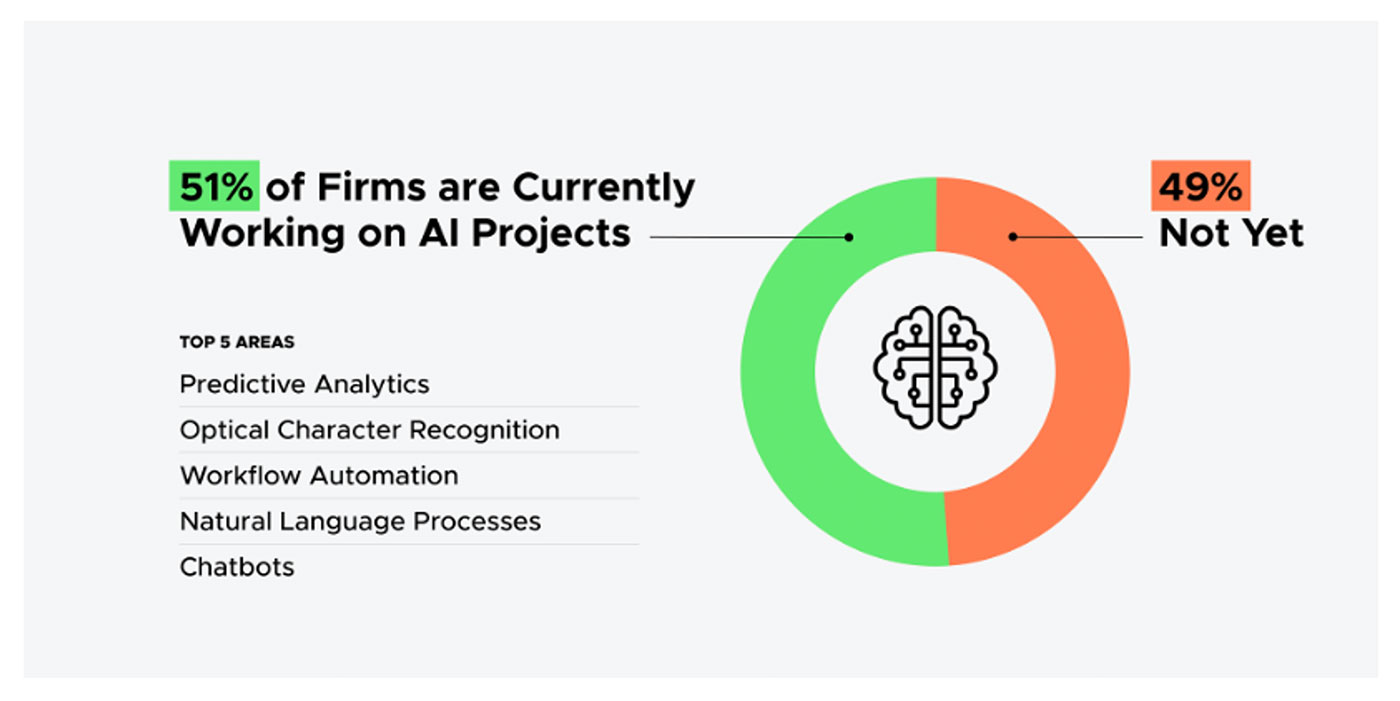

Indeed, more than half (51%) of wealth-management firms have AI projects in the works today, according to a recent survey by F2 Strategy. One in four are using optical character recognition (the AI-enabled extraction of text and data from images and documents), predictive analytics (AI-powered data mining and trend analysis), or both.

Source: F2 Strategy

Firms are keen to explore how AI can be applied to enhance various aspects of their business, including improvements to the client experience, efficiency, and growth, F2 Strategy’s survey found. Some firms report they have found significant time savings with AI tools—for example, the prospect of spending 90% less time on transcription.

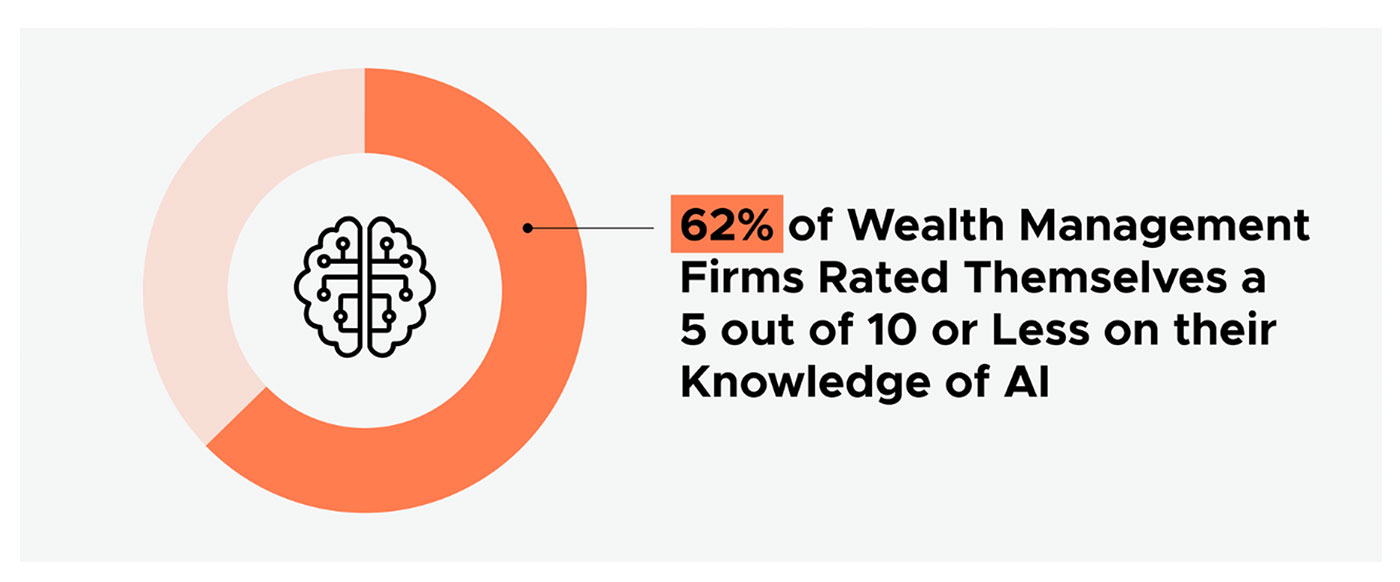

A majority (74%) expect to move forward by collaborating with vendors, while 18% will rely solely on vendors, according to the survey. Just 8% will develop their own internal firm AI capabilities. F2 Strategy’s research notes that AI education is critical for wealth-management firms:

“Many respondents recognized there is much to learn about AI, as well as many unknowns in this rapidly developing field and expressed a strong desire to learn more about AI’s real-world applications.”

“Specifically, wealth management firms want to see case studies showcasing successful AI implementations and want to understand the possibilities and risks of AI technology.

“Many also want to understand the role regulatory agencies will play in its use.”

Source: F2 Strategy

With all of the publicity and interest around AI, industry pros say financial advisors need not worry that AI will eventually make them obsolete—like dial-up internet or VCRs.

“AI technologies like ML [machine learning] will never replace advisors or do planning for them,” writes Nick DiLisi, head of technology at eMoney. “Still, they will make financial planning software an even more intelligent partner for advisors of any level of expertise by enhancing planning efficiency and expanding planning knowledge.” DiLisi also notes, “In financial planning technology, ML is everywhere, and you’re probably using it regularly without even realizing it.”

How are financial advisors experimenting with AI today, and what capabilities are on the horizon? We asked four industry experts to weigh in.

Priyanka Mohan

Priyanka Mohan

Senior manager at Deloitte Consulting LLP, based in New York City, NY

“Over 60% of organizations who participated in Deloitte’s most recent global planning and budgeting survey intend to make changes to the way they carry out financial planning and analysis. AI is one of the most promising tools to help address those changes. Successful AI applications are predominantly focusing on improving internal operations, augmenting employees, and driving increased productivity and efficiency.

“Some specific examples include translating, summarizing, and augmenting research reports; creating marketing materials, including fact sheets and fund profiles; providing personalized investment advice for clients; curating highly contextualized responses within the contact center to support agent responses; conducting complex financial analysis and forecasting across multiple variables; and leveraging AI to support refactoring of code from legacy systems or accelerate the creation of new applications.

“We will continue to see AI mature in terms of capabilities provided, which will in turn help transform end-to-end functions at organizations, including finance. Specifically, within financial planning, some key areas for use of AI will be within predictive planning; budget, forecast, and ROI analysis; generating performance insights and decision analysis; performing risk assessment; and scenario planning and data engineering.

“Organizations will continue to make significant investments in AI due to the growing maturity of this technology, extensive applicability, and labor shortage. For example, according to IDC’s latest Worldwide Artificial Intelligence Spending Guide, these investments are expected to surpass $300 billion by 2026.

“Anticipating the need for AI in finance, Deloitte has been investing heavily in AI, including financial planning with tools such as Precision View. Additionally, according to the findings from Deloitte’s most recent State of AI in the Enterprise survey, in which approximately 2,600 business leaders participated, operations and finance continue to be top users of AI.

“While it is anticipated that AI will bring significant benefits to financial planning, it is not without risks to the organization. Some risks are new, such as lack of explainability, given the opaqueness of generative AI. Some risks exist but are amplified through new AI technologies, such as unintended bias.

“There is an evolving regulatory environment that organizations need to respond to as it relates to managing these risks. Organizations are focused on establishing or enhancing their comprehensive risk-management programs so that the risks of AI are mitigated, allowing for scaled AI usage.”

Spencer Betts, CFP, CFP Board Ambassador

Spencer Betts, CFP, CFP Board Ambassador

Financial consultant with Bickling Financial Services in Lexington, MA

“I am seeing the use of AI just now starting in our industry. AI use is an evolutionary change rather than a revolutionary change. We are already using technology to review client portfolios, cash flow, and other data-driven review needs.

“At my company, the area where we see AI having the biggest impact is how we conduct business by using it in daily office workflows. Advisors use AI to summarize meeting notes with clients, review emails for workflow needs, and help with writing marketing documents. This should make our office team more efficient and effective in giving our clients excellent services on a timely basis.

“The most significant issue facing advisors as they consider AI is regulation. Make sure you understand how you can use AI in your day-to-day work environment. Advisors should talk with their broker-dealer, RIA, and other oversight departments to confirm what tasks are appropriate to undertake with AI.

“I think we will be using AI to gather client data to make the financial-planning process more efficient. AI tools can review clients’ social media for announcements like retirement, birth of a child, and other life events. AI can also review a client’s bank statements, create a cash-flow sheet, and quickly review their current portfolio for rebalancing opportunities.

“Same for investment research—finding an investment that fits a specific set of objectives will become much easier with AI. But AI will not replace financial planners. It’s evident that clients value the human element, seeking advisors they can confide in and discuss challenges with, and who can pose insightful questions.

“Don’t think of AI as a competitor—instead, think of it as an asset within your practice. AI doesn’t have the emotional intelligence and know-how to offer personalized financial advice. You can, however, use the AI tools to help create workflow efficiencies, allowing you to focus more on client needs.”

Greg O’Gara

Greg O’Gara

Lead analyst, wealth management, for Javelin Strategy and Research, based in Riverdale Park, MD

“Client onboarding is a critical area of client interaction as it sets the initial tone for the advisory engagement. AI is being deployed during the onboarding process in two ways: First, it’s increasing the efficiency of client data collection, which can come from a number of different places, including the original documents submitted through the account opening process. Second, it’s creating greater intelligence for advisors about what clients may be doing with their investments held in other accounts and retirement plans.

“Further along in the relationship, this enhanced client intelligence can be used for portfolio construction and in ways to engage through increasingly advanced algorithms that deliver client content, marketing, and next-best actions for the advisor throughout the client life cycle. These client insights can be utilized across the tech stack for portfolio construction and then later for the financial-planning discussion.

“For portfolio construction, AI is still in its nascent stages. In time, I would expect AI to be able to analyze certain client metrics and preferences, which might include ESG or tax management to turbocharge the construction of highly personalized portfolios. Direct indexing platforms will play a role here. For financial planning, there are still some hurdles to integrating client data across the tech stack. And broadly speaking, integrations are done manually on a component-by-component basis.

“Another advantage of AI is that it’s going to accelerate both advisor efficiency and investor personalization. On the efficiency side, AI is being explored as an agent that can optimize advisor workflow and data collection to provide advisors with better insights about their clients and also manage the flow of next-best actions. That’s being done to a certain extent today, but mostly through alerts. An AI client workflow dashboard, with greater automation, will be the next iteration of the technology. CRM providers are moving in that direction.

“AI is also going to be able to interpret data across a variety of sources, including raw document information held in the CRM, and communication channels like voice and messaging. This is going to inform the advisor about client needs and preferences. These tools will come to market through fintechs that are providing solutions for various aspects of advisor workflow. To that end, advisors should consider how much they trust the technology vendor and consider how that vendor is implementing controls around the AI application.

“For example, the SEC is looking at two aspects of AI. One has more to do with back-office efficiencies and the other has to do with client engagement. Examination of client engagement will encompass advisors who deploy AI in any way that touches the client, which could be through generative AI, chatbot, marketing materials, prospecting, or even emails or article content. All of that needs to be vetted closely by the advisor. As of now, it is not clear how much of that responsibility will rest with the advisor versus the vendor.

“We are not yet at the point of ‘set it and forget it’ with AI today. And caution is always warranted. In many cases, it’s unpredictable, and the type of content that it generates may not be up to the standards that an advisor expects for their practice. Advisors should always test any system before going on autopilot and work closely with their vendors.

“That said, I expect a lot of good things to come that will enhance workflow efficiency and deliver magnitudes of investor personalization. This speaks loudly to increased client retention with systemic mechanisms for targeted, deep communication, both face-to-face and through digital delivery.”

Doug Fritz

Doug Fritz

CEO and co-founder of F2 Strategy, based in Chicago, IL

“The Merrill Lynches and Goldman Sachses of the world have professional technology teams and hundreds of millions, if not billions, of dollars per year to spend on technology. But the other corner of the wealth is managed by smaller firms. Their clients also expect Apple and Amazon kinds of experiences because that’s what you get from the big firms. How do smaller firms compete?

“The cost of having an AI program precludes many of those small firms from being able to do it on their own, mainly because of the cost of having in-house talent. So they are going to have to ramp up their existing third-party relationships or establish new ones to get these kinds of insights.

“The best AI solutions we’ve seen are ones that are very focused and do one thing well, like going through your CRM and pulling out actionable prospects or opportunities for you to contact your clients. Examples of these include Catchlight from Fidelity Labs, which helps determine the best prospects and what they may need, and Bento Engine, which pulls out data and suggests timely, personal, and impactful advice content to clients.

“There are AI tools that can pull out the content within client data to alert advisors to various situations, such as that they are getting very close to retirement, that the client’s kids are about to go to college, that a client has a disproportionate amount of cash in a bank account that we’re linked to, or that a client said they were going to sell their business in three years two years ago—so we should go talk to them about selling their business now.

“These solutions provide actionable human-level interactions that are not like ChatGPT writing stories to your clients. When it comes to external-facing, natural-language-generation stuff, I’m still waiting for the regulators to come in and put significant constraints on that. So any money you’re spending on generative AI capability, just expect that you’re going to have to come back and run some serious compliance work on it in the future.

“We’re really kind of in the middle of the AI hype cycle right now, so we will see a lot more news and attention being spent on AI, at least for the next 12 to 16 months. But then that will fade away. There will be disillusionment about many solutions. What will be left are technologies that help bring answers to us faster and tell us things that our human minds and our biases might have prevented us from seeing.

“Over time, we’ll see things like undiscovered risks in portfolios, correlations between asset classes or investment types, opportunities to engage with our clients better—ways for us to change the tone and content of our emails, reports, and digital finance experiences to match how clients have been engaging with us.

“Right now in the industry, AI is the thing that advisors are talking about, but many are not thinking about what they actually need for AI to solve for them. We’ve got people looking for an AI solution without understanding that they have a problem. And that’s a bit of a dangerous thing.

“So the first step for people is to identify the problems their current technology cannot solve—and that an AI system might be able to help them with.

“For example, they may want to deliver better client experience, or they may want to increase their organic growth through their center of influence network. Everybody says that, but are they prepared for that? They may get the data they need from AI to take action on that, but now their people need to be ready to take on that kind of change.

“Those are really good questions to ask up front, and they often lead to some pretty boring project work, like determining the most efficient workflow to figure out what your client experience should be. All these tend to be more critical questions before you sign a contract with the vendor. Be a little bit cautious that you’re being sold on a concept that your firm might not be necessarily ready to take on—or else it’s just a bunch of money wasted.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

CFP and Certified Financial Planner are registered trademarks of the Certified Financial Planner Board of Standards Inc. (CFP Board).

RECENT POSTS