How advisors help navigate the financial challenges of a disability

How advisors help navigate the financial challenges of a disability

People with disabilities and their families often encounter significant challenges in their daily lives, including complex financial issues. Qualified advisors can provide meaningful guidance.

Financial advisors who specialize in helping individuals with disabilities and their families serve a much-needed function in addressing an important societal issue.

According to a 2017 report by the National Disability Institute, which analyzed findings from the FINRA Investor Education Foundation’s National Financial Capability Study, people with disabilities face significant barriers to financial stability.

The report notes that “individuals with disabilities often have a tenuous connection with the labor force because they tend to be employed in low-wage or temporary jobs that are less secure. They are often the ‘first fired and last hired’ in times of economic downturn.”

Additionally, the report states that people with some conditions and a “thinner margin of health” may also have to stop working, either temporarily or permanently, when their health condition deteriorates or is exacerbated. As such, many seek government assistance to make ends meet. The report cites other research, which found that 65% of adults with disabilities participate in at least one disability or safety-net program, compared with 17% of those without disabilities.

However, individuals with disabilities are often hampered by limited access to information on how to maintain eligibility for income-support programs, like Supplemental Security Income (SSI), according to the report.

The report explains that “restrictions in the SSI program for beneficiaries to work and to save may affect how, when, where and what types of financial education and capability services they need. Financial planners often do not understand the intricacies of the benefit system and the work incentives (or disincentives) these programs contain, making it very difficult for program beneficiaries to receive full and accurate information.”

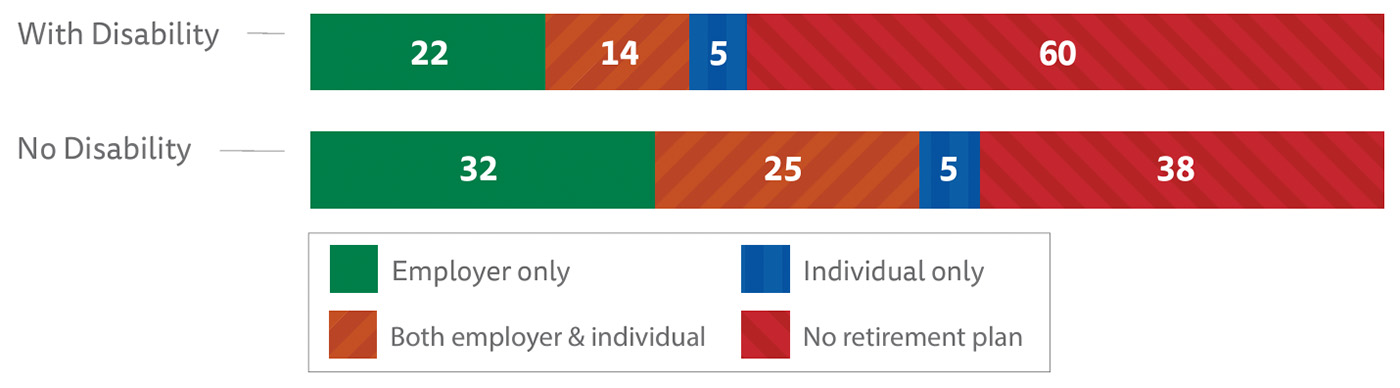

The report further states that individuals with disabilities are far less likely than the general population to “make ends meet, plan ahead, manage financial products and services and improve financial decision making.” This dichotomy can be seen in the critical area of retirement planning.

TYPE OF RETIREMENT ACCOUNTS, PERCENTAGES BY DISABILITY STATUS

Source: FINRA Investor Education Foundation’s National Financial Capability Study, National Disability Institute; data from 2015

That’s why it’s important for such individuals and their families to work with a financial advisor who is well-versed in supporting them. We sat down with a senior financial planning consultant and two financial advisors who specialize in helping individuals with disabilities—and their families—asking them to share their best practices.

Joe Burhmann, CFP, CLU, ChFC

Joe Burhmann, CFP, CLU, ChFC

Senior financial planning consultant at Fidelity’s eMoney Advisor

“Planning for a family member with special needs—whether it’s physical, intellectual, or emotional needs—takes planning. Several critical issues must be addressed, including protecting eligibility for government benefits, including SSI and Medicaid health care; choosing a trustee, guardian, or conservator; and funding a trust (such as a special needs trust) to provide for lifetime care.

“Planning is important for several reasons. It ensures a high quality of life for the family member with the disability, and it allows families to maximize their own personal resources while protecting the individual’s eligibility for receiving government benefits. It also prepares successor caregivers for the task at hand—providing peace of mind for the entire family.

“One of the biggest worries for parents is the question, ‘What will happen when I am gone?’ While it may seem to be an easy solution to just leave funds to other family members to take care of an individual with a disability, it may not be the best solution.

“There is no legal obligation for the family member to use the funds for the disabled individual. The funds can also be reached by creditors or family members who may have only ‘the best of intentions’ but end up acting otherwise. Funds could become marital property lost in a divorce. Lastly, if the family member passes away, the funds could go to someone who has no interest in supporting the disabled individual.

“As a result, many families who have a child with a disability turn to establishing a special needs trust. When families consider the planning impacts of caring for a disabled child, it is important in most cases to have arrangements in place for the death of the parents. A surviving parent may be able to assist in caring for the disabled individual, but it’s typically at the time of the second parent’s death that the established plans need to be activated.

“Often, this trust is funded with life insurance on the parents or other assets at their death. These funds could then provide supplemental benefits to the disabled individual, such as entertainment and companion expenses, health-care costs not covered by government benefits, legal services, companion pets, rehabilitation therapies and equipment, training programs and education, and transportation and travel expenses.

“A family with a disabled member can often be the trigger for families to begin their estate-planning process. Similar to the flight attendant’s preflight presentation about parents placing an oxygen mask on themselves before assisting others, it’s important for parents to have their overall plan in place before beginning to plan for the disabled family member.

“Up-to-date beneficiaries on insurance and retirement accounts, a will, and supporting power-of-attorney documents for legal and health-care decisions should be reviewed and/or established along with any supporting trusts for the family member.

“Families will want to put together a team of professionals to assist in their planning efforts, including an attorney skilled in the planning needs of disabled individuals, as well as a financial professional with access to a planning platform that can model a plan for these individuals and their families to ensure they’re prepared for any eventuality that comes their way.”

“I specialize in disability finance—the type of personal finance that people with disabilities may need to make sure their cash flow, estate plans, and all the resources and tools that they need are in place. When someone is considering applying for disability benefits, they are required to follow the rules of federal and state asset and income regulations. Disability finance considers those government benefits as a key part of the financial-planning equation when families choose to pursue those benefits.

“Someone who is under asset-capped programs, like SSI or Medicaid, needs to be careful of accumulating any savings in their checking accounts. If someone has a job, even when earning below the substantial gainful activity threshold of $1,550 per month for 2024, they may still start to see small savings build up in their checking account when working. The people who are most likely to save are people who are living in supported rent-controlled housing through their local HUD programming or the people living with their parents.

“I’m constantly reviewing Medicaid law because it changes. Every state is different. We have to be up to date on what a particular state’s Medicaid programming is. States have the option to ‘waive’ federal guidelines to establish their own Medicaid programming.

“Some states give more access to working adults with disabilities, keeping their eligibility for support services even if their income or assets would normally be too high to participate in standard Medicaid. Some waivers are available to people with specific diagnoses, like autism or traumatic brain injury, and some may be age dependent, such as for childhood supports or adult-only supports.

“We need to keep up to date with how each state defines their own disability support programs through Medicaid. What are the changes when someone is no longer a child and now an adult, and how do we make sure that our clients are accessing everything available to them?

“As a financial advisor, we won’t physically help someone with federal and state government benefits paperwork. We do educate our clients on what type of benefits they could be eligible for, and we make sure that they know who to talk to, to help them complete the application. We are educators, planners, and connectors.

“At the beginning of the relationship with a client, one of the things that I first address is building trust. Many of these families have been told various different things by people. What they haven’t received often is information specific to their own families’ needs and resources.

“Most of my clients when I first meet them are living in fear that they are doing things wrong. I encourage them to look at the realities of their financial picture, look at what’s available, and what they need to do to protect themselves and their loved ones who rely on government benefits.

“Because all of my clients and their families have different needs and resources, every planning engagement requires defining their goals and their ideal life. Once we define what that life is, my goal is to connect them to the communities that give them access to that ideal life.

“For example, there are families who are adamant about making sure that their adult child can maintain their family home when the parents are no longer living. That may be a primary goal at the beginning of our time together. As their planner and financial advisor, I attempt to connect them with housing support if there is a need for that.

“I also ask them about transportation and access to employment, the local community, and grocery shopping. This also encourages them to think if there are alternatives to the family home that may have more access to the adult child’s daily needs.

“I have a very positive community of clients. They often will refer me to some of their friends and colleagues when they know that there’s something going on in those families that requires a specialist.

“When I chose this work, I knew that part of the commitment would be working with people who have intense things going on in their personal lives. There’s a lot of emotional things that I need to process through and find a release for. There are other advisors across the country who work within disability finance. We reach out to each other when we have questions. The support helps with not feeling alone in the emotional work of caring for our clients.

“I love meeting with members of the disability community within nonprofits and community resource boards. I will often offer webinars and meetings to talk with them about financial planning, specifically the complexities of Social Security, Medicare, and Medicaid. The blending of all the benefits informs their personal financial plans.

“I also write blog posts on my website, delving into topics that don’t always get discussed in depth or at all. I regularly share on LinkedIn as well, because I want to encourage more people to consider doing financial planning for families with disabilities. There are just not enough specialists who confidently talk about these planning topics, and there are many more families who need our work.”

Nicky Amore, CFP, CFP Board Ambassador

Nicky Amore, CFP, CFP Board Ambassador

Managing director at Falcon Wealth Planning in Oakbrook, IL

Amore teaches finance at Harper College and the CFP certification courses at NYU School of Professional Studies, John Carroll University, and UCLA Extension.

“Clients who are impacted by disability really need someone who’s always acting in their best interest as a fiduciary, such as the CFP professional. They need an advisor who can remain curious and recognize that the client is the expert in their own life.

“You need to understand that the client and their family know exactly what’s going on in their circumstances as far as whatever their disability or special need may be. Then we can add our expertise to let them know just what they don’t know.

“The many stages of grief that we can all go through—anger, resentment, disappointment—are very, very common among these families as well. As advisors, we need to acknowledge those emotions and focus on what we can control.

“For example, when planning for an adult child who needs care for their entire life, their family might be investing for 100 years—much like an endowment does—to make sure that adult child always has what they need, whereas a typical investor might only be investing for 30 to 60 years. As an advisor, I’m acknowledging the perpetuity of this income stream as it’s needed, as well as addressing the fears of the family that there might not be enough money for their child who needs care for the rest of their life.

“If there’s additional support needed, we recommend that the clients and their families seek that out too. The groups I refer to address specific needs—a network of resources for autism and other networks for individuals with Down syndrome, cystic fibrosis, cancer, all different types of disabilities and special needs. Usually, we first check with their health insurance provider to make sure that whatever services they are utilizing are covered, especially the services of a therapist or social worker.

“The CFP designation really gives us a well-rounded scope of education, including income planning as well as government benefits planning. We learn about ABLE accounts, special needs trusts, government benefits, and entitlement programs. All of those areas are covered in detail in CFP certification. For individuals who are seeking an additional designation, there’s also the Chartered Special Needs Consultant, which I’m in the process of acquiring as well. That’s specifically for advisors or financial planners who work with families impacted by disabilities.

“I usually get about four to six referrals per month from my existing clients, especially because many of these communities network internally. They are looking for good advice, but what often happens is they’re being sold a product. That is just one of the reasons why it’s so important to be an impartial CFP professional—who are always fiduciaries—in this setting. As far as marketing, I attend networking events, especially for communities impacted by special needs. I volunteer to fundraise for Special Olympics Chicago, as well as for St. Jude Children’s Hospitals, so I meet a lot of my clients through those different avenues.

“One of the CFP certification classes that I teach is the psychology of financial planning, which all CFP professionals learn and are tested on. I give my students emotional intelligence strategies so they can practice self-awareness, self-management, relationship awareness, and relationship management as well.

“I tell all of my students that you can’t pour from an empty cup, and compassion fatigue is real. So we want to make sure we’re filling up our own cup by taking good care of ourselves, getting enough rest, eating well, exercising, and doing things that rejuvenate us.

“As we go forward serving our clients and our families who are impacted by disabilities and special needs, it’s important to just maintain that devout curiosity. I feel most CFP professionals have that curiosity, which they have demonstrated by earning their CFP designation.

“All of the advisors in this area need to know that the individual is the expert in their own life and to be respectful and curious about what they already know—so that you can add value with your expert opinion and just educate them on what they don’t yet know.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

CFP is a registered trademark of The Certified Financial Planner Board of Standards Inc. (CFP Board). CLU and ChFC are registered trademarks of The American College.

RECENT POSTS