Gold prices are important not just to traders of gold coins. They are also a great leading indicator of many things that will happen in the future. A recent chart shows one of the messages we can take from gold prices, which concerns long-term interest rates.

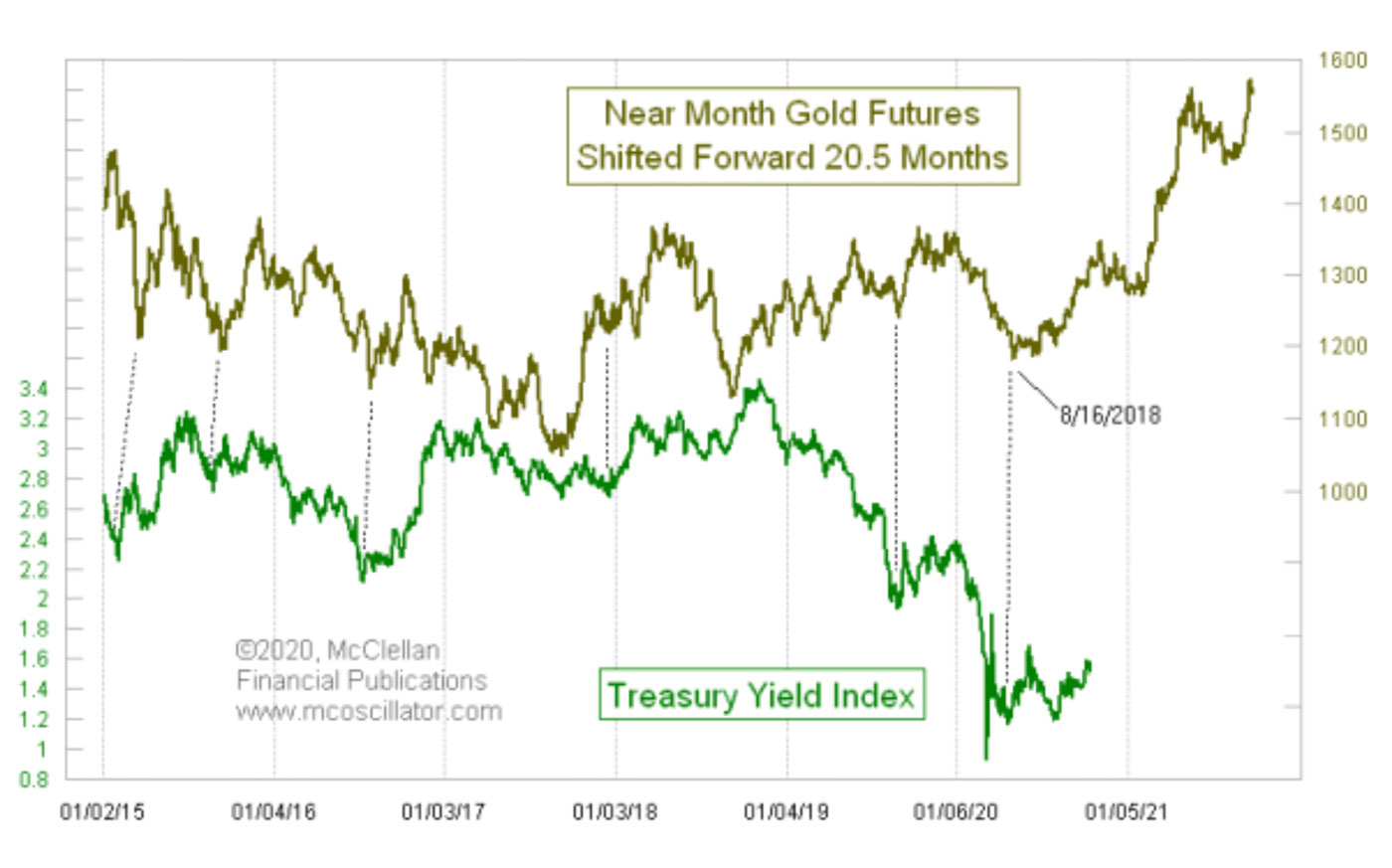

In Figure 1, the plot of gold prices has been shifted forward by 20 1/2 months to help reveal how the dance steps that gold prices make tend to get repeated by long-term interest rates. The Treasury Yield Index (TYX) is the current yield-to-maturity (YTM) on the most recently issued 30-year Treasury bond. For reasons that are not immediately clear, gold’s movements tend to show up again 20 1/2 months later in long-term bond yields.

FIGURE 1: THE RELATIONSHIP BETWEEN GOLD FUTURES AND THE TREASURY YIELD INDEX

Source: McClellan Financial Publications

Why the lag is 20 1/2 months, I do not know. Our job is not to dictate to the markets what rules they ought to follow but instead to use the data we have available to figure out what the market’s rules are. We don’t get to tell an electron what its mass should be. Nor should we presume to tell interest rates that they should lag gold by a different amount of time.

The correlation between the two plots is far from perfect. And we should not expect perfection of prediction from a messenger sending its signal almost two years before. That there could be any correlation at all over such a time frame is amazing.

Figure 2 provides a closer look at the immediate relationship between the two.

FIGURE 2: A CLOSER LOOK AT THE RELATIONSHIP BETWEEN GOLD FUTURES AND THE TREASURY YIELD INDEX

Source: McClellan Financial Publications

The COVID crash was not on the original schedule, or any other schedule, and so we should not fault this model too much for missing that event in its predictions. Now that we are into the “clear air” and out of the turbulence of that event, the TYX is starting to correlate more closely again with what gold has said should be happening.

These charts do not show the full history of what gold has done most recently. That is intentional. It allows us to focus on the immediate future for interest rates without getting distracted by gold’s swoop up to above $2,000. That swoop will matter several months from now, but it is not a concern for the immediate future of interest rates.

What gold shows is an uptrend ahead for interest rates, and especially once we get into 2021. Rising interest rates mean falling bond prices, and so bond investors will want to pay attention to that message. The Fed’s efforts to stimulate economic growth have increased the supply of dollars, but they have done nothing to the supply of gold. Every price is a ratio of dollars per stuff. If the stuff quantity stays the same (such as the amount of gold on the planet), and the supply of dollars goes up, it is natural to expect the dollars/stuff ratio to change.

The magic of the bond market is that such changes flow through eventually into interest rates, with a lag of about 20 1/2 months. We are in for some interesting months ahead in the bond market.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on Oct. 15, 2020.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com