Gold’s role in portfolios should not just be reactive

Gold’s role in portfolios should not just be reactive

While many view gold as an opportunistic “trade,” investors concerned about capital preservation and optimized returns should consider gold as a key portfolio element.

Gold has been generating news and commentary throughout 2020—including the fact that the precious metal reached all-time high price levels on Monday, July 27. Gold’s spot price in dollars surpassed its September 2011 all-time highs, reaching $1,943 an ounce according to CNBC.

Institutional and retail investors have been bidding up gold’s price for much of 2020, with the exception of a steep drop in March as most asset classes declined in unison. As of July 28, MarketWatch reports that gold’s continuous futures contract has had a 52-week range of $1,412.10–$1,974.70, reflecting new highs in the overnight market. The recent price was up about 28% for year-to-date 2020.

Source: MarketWatch, data as of July 28, 2020

Analyst outlooks for gold have boosted interest in the metal, along with the volatile equity markets and gloomy economic and employment projections due to the pandemic shutdown.

Gold’s initial ramp-up in this cycle began during the summer of 2019 and then moved significantly higher in earnest in February 2020, as the financial community started to take the global COVID-19 outbreak seriously. At that time, a call by Goldman Sachs received a good amount of publicity.

Reporting by ForexLive highlighted a note from Goldman Sachs related to the virus and the outlook for gold:

“Goldman argues that the outlook for lower US yields and weaker equities ‘creates further upside risks to our gold forecasts.’ …

“If the virus disruption stretches into Q2, they say, ‘we see substantially more upside from here—towards $1,850, depending on the magnitude of global monetary policy response.’ …

“‘We see such a rally being driven by the continued search for yield, increased demand for portfolio diversification and higher political uncertainty’ with gold being ‘a strategic allocation to protect a portfolio from geopolitical risks such as the current outbreak, de-dollarization and negative real yields.’”

In April, Bank of America upped that ante, calling for up to a 50% increase in gold’s price. According to Bloomberg on April 21,

“Bank of America Corp. raised its 18-month gold-price target to $3,000 an ounce—more than 50% above the existing price record—in a report titled ‘The Fed can’t print gold.’

“The bank increased its target from $2,000 previously, as policy makers across the globe unleash vast amounts of fiscal and monetary stimulus to help shore up economies hurt by the coronavirus.

“‘As economic output contracts sharply, fiscal outlays surge, and central bank balance sheets double, fiat currencies could come under pressure,’ analysts including Michael Widmer and Francisco Blanch said in the report. ‘Investors will aim for gold.’”

In early June, Schwab’s “Looking to the Futures” column noted that although gold had been largely range-bound for two months, escalating tensions with China should be bullish for gold, along with continued weak economic data, and the fact that “the COVID-19 pandemic still appears to be generating safe-haven demand despite the optimism around reopening the economy.”

They also noted in that column, that “exchange traded funds have increased their long gold positions for the 27th straight trading session.” (As seems to happen so often in the markets, gold’s price then fell $33.80, or 1.9%, the next day, June 3.)

Goldman Sachs is now out with a fresh gold forecast, according to MarketWatch, calling for prices in the $2,300 area over the next 12 months. MarketWatch says Goldman’s analysts base this on “a potential shift in the U.S. Fed toward an inflationary bias against a backdrop of rising geopolitical tensions, elevated U.S. domestic political and social uncertainty, and a growing second wave of COVID-19 related infections.”

In addition to these and other bullish analysts’ calls for gold, one can also usually gauge how strong gold’s performance has been in the prior few months—or the volatility in equity markets—by a less-than-scientific “indicator.” The frequency of gold infomercials on TV and radio—or those spots touting a “special” minting of gold commemorative coins—have seemed unusually abundant this year. They are generally accompanied by various email offers, which unfortunately include a good number of fraudulent “deals”—especially those targeting retirees.

By way of some history regarding gold, Bespoke Investment Group noted in late 2019,

“Similar to other commodities, gold prices are susceptible to long term trends in price movements. The 1970s inflationary episode saw massive increases in prices, before surging real interest rates in the late 1970s and early 1980s drove down gold prices dramatically.

“After doing almost nothing for the next decade and a half, prices rose almost ten-fold. The post-crisis precious metals collapse cut prices almost in half but have been rising more recently. 2019 saw price sharply increase, especially after taking out the critical multiyear resistance around $1350-$1400. This year, gold has been an almost perfect proxy for short term rates, rising as the Fed got more dovish in the middle of the year before reversing as the Fed’s tone also turned around in Q4.”

Schwab points out in their article, “Going for the Gold,” that gold generally is viewed by some investors as “a defensive play against a declining U.S. Dollar and an uptick in inflation.” Other factors they point to as reasons to own gold include geopolitical concerns, energy shocks, and the desire for further portfolio diversification.

Schwab adds, “Many investors on the lookout for new ways to spread their money across a number of economic sectors have flocked to gold. The draw is due not only to gold’s inherent attractiveness as a commodity component, but because it touches on so many disparate areas of the economy—from interest rates and the equities markets to investor sentiment and foreign exchange.”

But Schwab also concedes that there are many disparate theories as to what drives gold’s price and its cycles.

Mark Hulbert at MarketWatch recently explored some of the inconsistencies in the arguments for gold, driven by unprecedented actions from the Federal Reserve, the impact of those actions on various asset classes and economic data, and the very uncertain outlook for inflation. He comments,

“Perhaps in frustration at the lack of the high inflation that they’re looking to in order to justify a higher gold price, some gold bulls have turned to another argument: Today’s record-low interest rates. One rationale for this argument is that lower rates reduce the value of the U.S. dollar, which in turn leads to a higher dollar-denominated gold price. Another is that low rates make bonds and other fixed-income investments less competitive, which should help gold in relative terms.”

Barron’s “Up & Down Wall Street” column echoed part of this argument on July 20, saying,

“Falling bond yields, both nominal and real, historically have been positive for the yellow metal, but something more may be happening. And whatever it is, it hasn’t gone unnoticed by the investing public. It’s fueling a record buying surge of gold exchange-traded funds. …

“Peter Cecchini, the former chief market strategist at Cantor Fitzgerald and head of AlphaOmega Advisors, contends that it [gold] provides a substitute reserve asset without Treasuries’ risk of price decline from rising interest rates or a further downgrade of the U.S. government’s credit. Essentially, it is an asset without a corresponding liability.”

While all of the analyst commentaries are interesting, they are no more than educated opinions. They also tend to lean toward “trading opportunities” for gold, not viewing gold as an integral part of an investor’s portfolio.

Two phrases in Goldman’s February statement are more important for financial advisors and their clients than a short- or intermediate-term outlook or trying to “chase” gold higher. These are “portfolio diversification” and “strategic allocation.”

What evidence supports a more long-term rationale for investors owning gold?

The World Gold Council’s paper, “The Relevance of Gold as a Strategic Asset 2020,” provides a wealth of data-driven findings.

In a short video highlighting some of the research, John Reade, head of research and chief market strategist says,

- Since 1971, when gold was released from its peg against the U.S. dollar, its average annual return has averaged 7.8%—higher than cash, bonds, and emerging-market equities.

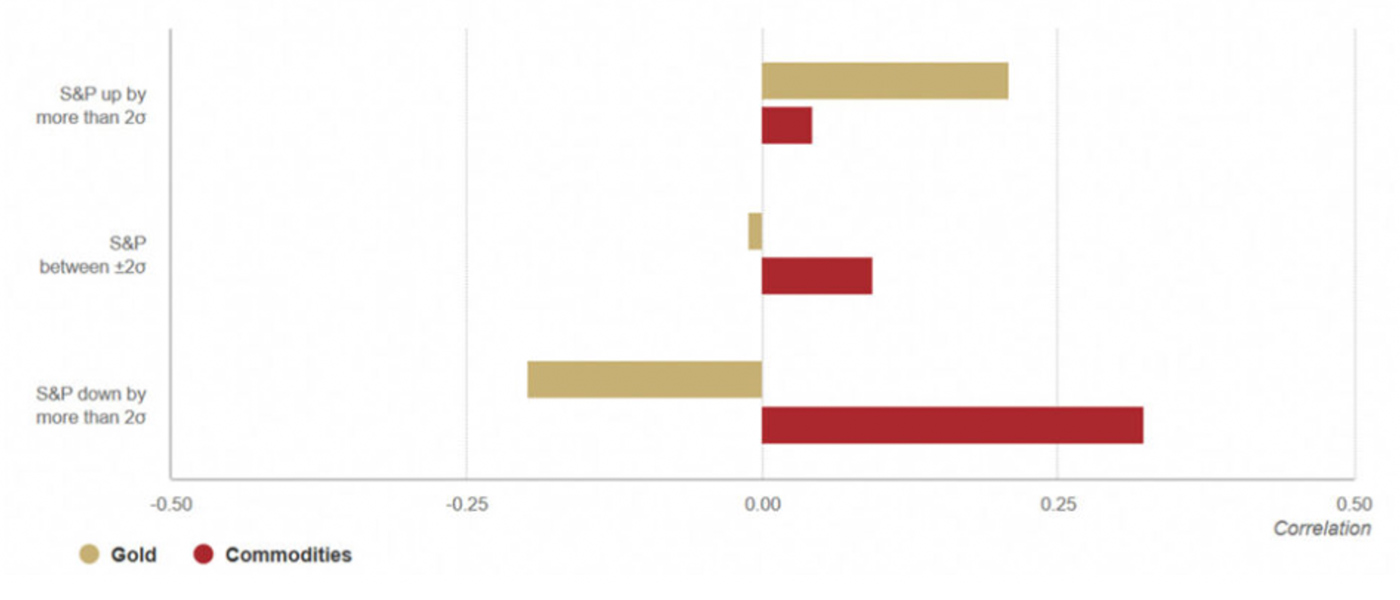

- Gold has demonstrated unique characteristics of correlation to U.S. equities since 1987:

- When the S&P 500 is relatively flat over a weekly period, gold has a very slightly negative correlation—essentially no correlation either way.

- When the S&P 500 has been especially strong over a weekly period, gold has had a moderately positive correlation—far more than traditional commodities.

- When the S&P 500 sharply declines over a weekly period, gold shifts over to a moderately negative correlation, unlike traditional commodities. (This is a historical average. As we have seen during volatile market “events,” the negative correlation of gold to equities can be far stronger.)

Note: As of Dec. 31, 2019. The middle bar corresponds to the unconditional correlation over the full period. The bottom bar corresponds to the correlation conditional on S&P 500 weekly return falling by more than two standard deviations, while the top bar corresponds to the S&P 500 weekly return increasing by more than two standard deviations. The standard deviation is based on the same weekly returns over the full period.

Sources: Bloomberg, ICE Benchmark Administration, World Gold Council

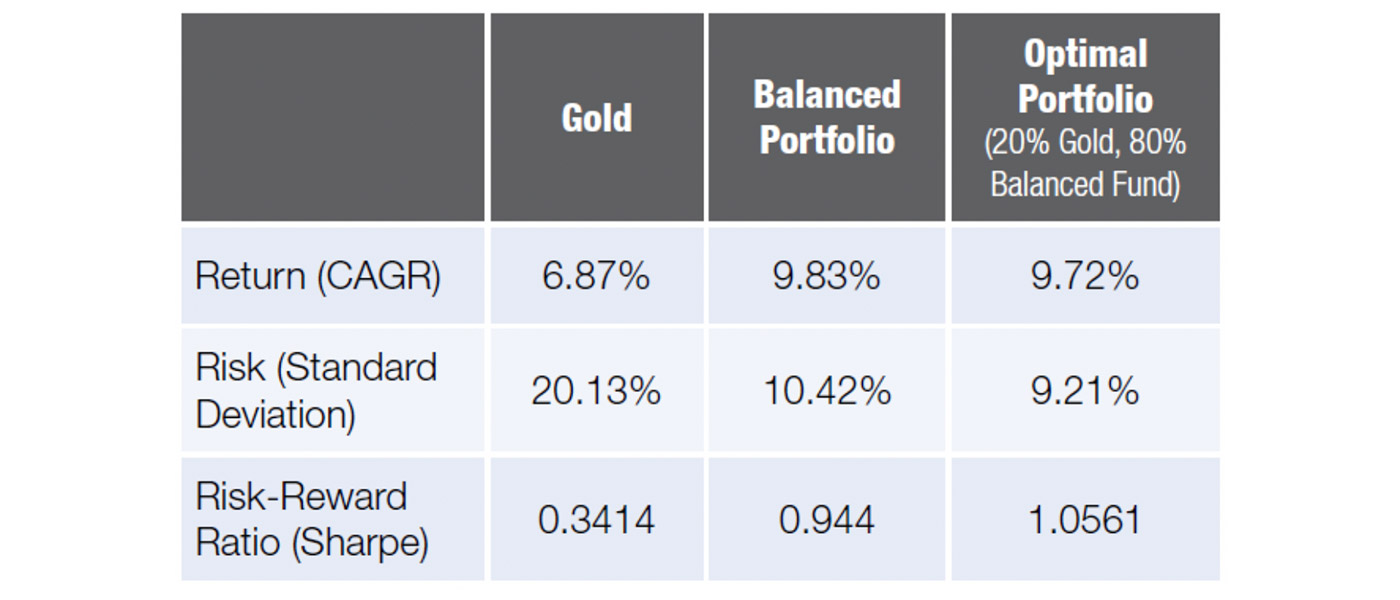

Jerry Wagner, founder and president of Flexible Plan Investments (FPI), a turnkey asset management program (TAMP), has remarked, “For investors looking for further portfolio diversification, gold is a unique diversifier—especially in trying times. Our comprehensive white paper shows that over the past 40-plus years gold has proven to be the best or second-best asset class to hold during seven different investing scenarios that concern investors. And holding gold in even a balanced portfolio has increased risk-adjusted returns over that period.”

TABLE 1: GOLD VS. A BALANCED PORTFOLIO VS. AN “OPTIMAL PORTFOLIO”

Source: FPI Research, “The Role of Gold in Investment Portfolios”

The FPI white paper referred to is a comprehensive analysis of gold’s performance, looking at data over a lengthy period (1973–2019).

“The Role of Gold in Investment Portfolios” presents the history and ongoing discussion about the investment merits of gold, offering many compelling reasons why investors should consider adding the precious metal to their portfolios.

The paper does the following:

- Examines the performance of gold relative to other asset classes under seven different market environments that typically concern investors.

- Looks closely at how gold performs under four different classic economic regimes.

- Analyzes gold’s diversification characteristics versus other asset classes.

- Reviews the risk-reward characteristics of portfolios with different allocations to gold.

The study concludes, in part,

“Our study demonstrates that adding gold to a typical balanced portfolio has been beneficial across a wide range of allocations in terms of boosting risk-adjusted returns. Over the time period studied [1973–2019], the optimal allocation in a balanced portfolio has actually been 20% to gold and 80% to a balanced portfolio, representing a result of roughly 50% stocks, 30% bonds, and 20% gold. In fact, investors could have allocated as much as 35% to gold based on historical analysis and still placed higher on the frontier of efficient portfolios than a purely balanced fund. …

“Based on our study, it appears most investors are likely underinvested in a full range of investment alternatives, and specifically in gold as a long-term asset class. …

“Investors concerned about capital preservation in times of macroeconomic risk and optimized returns in favorable times should strongly consider gold as a key portfolio element. Over the long term, gold offers the broad benefits of (a) ongoing marketplace demand in the face of limited supply; (b) historic protection from extreme market events, high periods of inflation, and devalued currencies; (c) a time-tested component of portfolio diversification; and (d) liquidity and versatility in terms of the many forms of ownership possible for an investor.”

***

While news, macroeconomic data, monetary policy, and sentiment all influence short-term gold-price swings, historical data regarding gold’s potential role in a well-diversified portfolio should be the focus. No matter how an investor chooses to take advantage of the investment benefits of gold, the key point is that an investment in gold should be proactive, not reactive. Editor’s note: You can download the referenced white paper here. David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.