ESG analysis: Benefiting society through ‘long-termism’

ESG analysis: Benefiting society through ‘long-termism’

One of the core questions surrounding SRI and ESG investing involves the trade-offs of short-term investment performance versus direct or indirect contribution to an adverse long-term societal impact.

Sustainable, responsible, and impact (SRI) investing represents a multi-faceted and somewhat misunderstood (and occasionally maligned) investment approach that has nonetheless surged in popularity over the past few decades.

SRI investing seeks to integrate environmental, social, and governance (ESG) criteria with financial analysis to generate both long-term competitive returns and a positive societal impact.

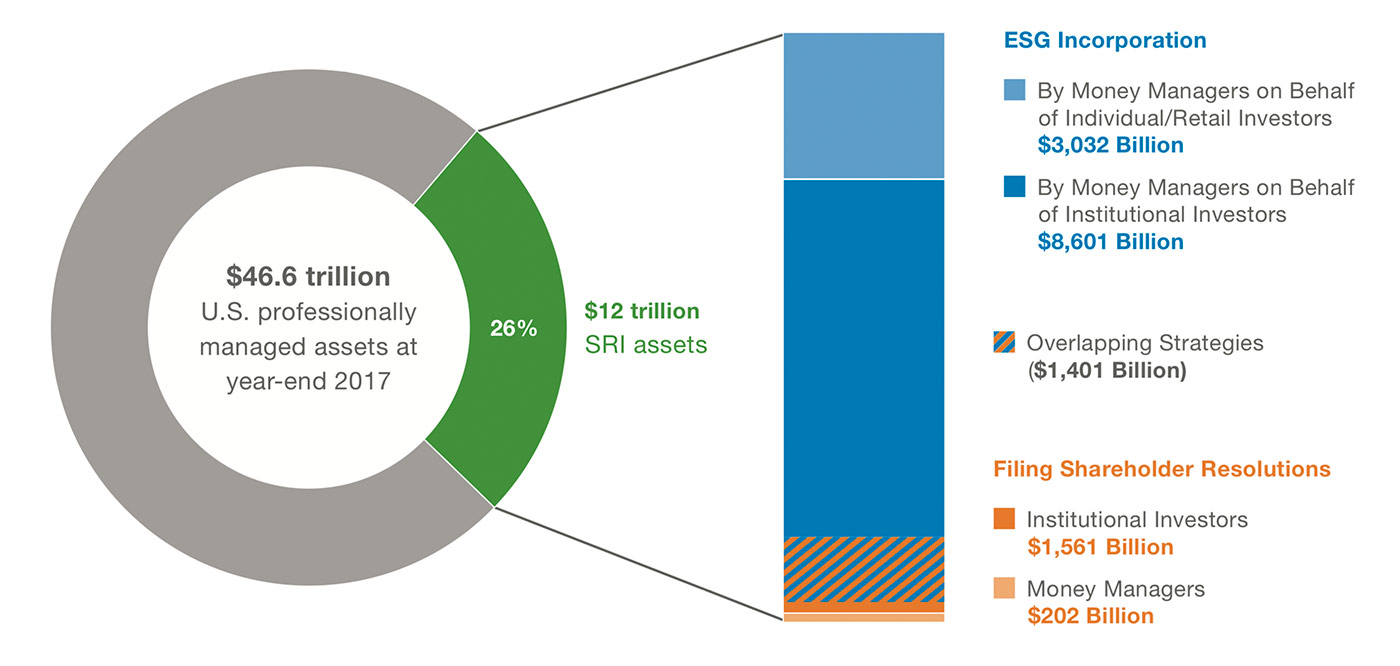

According to US SIF, the Forum for Sustainable and Responsible Investment, approximately $12 trillion in U.S.-domiciled assets in 2018 used ESG analysis as part of the broader investment-analysis process. This represents one in every four dollars under professional management in the United States, and an increase of 38% over 2016.

Source: US SIF Foundation’s 2018 Report on US Sustainable, Responsible and Impact Investing Trends

Naturally, this growth has caught the attention of financial institutions around the world, and with that attention comes notable criticism. Some of the most common arguments against the use of SRI strategies are that funds have a propensity to underperform major stock indexes such as the S&P 500. Also, it is argued that the potential avoidance of stock categories that generally pay high dividends is doing a major disservice to retirees.

Portfolio returns that ought to be focused on stable, long-term growth are often subject to criticism when their short-term growth rates do not outpace those of major indexes on an absolute basis. However, the comparison of SRI mutual funds and ETFs to major indexes is really apples and oranges— and the philosophy that drives SRI investing is meant to be long term.

To effectively invest in an SRI strategy, one needs to shift thinking away from the long-held belief that alpha must be maximized for shareholders today, even if these alpha-generating investments were to become obsolete years or decades from now—and possibly wind up costing society billions. When the focus is on long-term returns and sustainability of corporations rather than solely on short-term gains, the attractiveness of SRI mutual funds and ETFs becomes clear.

Within the past decade, there has been a shift from the use of the term “socially responsible investing,” to “sustainable and responsible investing,” which is generally recognized as all-encompassing rather than limiting. Socially responsible investing can be attributed to the framework of an earlier investment strategy—one that has been largely employed by many legacy SRI funds. The first SRI mutual funds were primarily exclusionary in nature—in other words, they sought to screen out investments that did not meet specific criteria. More often than not, investments were excluded for religious purposes and were dubbed “sin stocks” since the companies benefited from the exploitation of personal vices rather than providing a benefit or advancement to society.

Tobacco companies are considered the most common sin stock, and they are known for paying relatively high dividends. As such, it was concluded that funds excluding tobacco company stocks might not always be in the best interest of investors due to the sacrifice of short-term performance. This sentiment has stuck with many senior financial advisors today. And it is true that the impact of tobacco exclusion has impacted the performance of SRI funds, including some used by the California Public Employees’ Retirement System, or CalPERS.

As of August 2018, the total market value of CalPERS investment fund was approximately $374 billion. Wilshire Associates, the pension’s investment consultant, reported that over 17 years the exclusion of tobacco products from the state pension plan cost the fund $3.5 billion—or approximately 1% of the fund’s total value. Many were quick to point out that the underperformance of CalPERS funds were at least partly due to the exclusion of dividend-paying tobacco stocks.

The counterargument is that CalPERS had a very good reason for excluding these stocks. According to the Centers for Disease Control and Prevention, the State of California spends more than $9.0 billion on an annual basis for tobacco-related medical costs and loses another $8.5 billion per year to reduced work productivity from employee “smoke breaks,” illness, and death.

The trade-off is $3.5 billion in lost returns from excluding tobacco stocks over 17 years for CalPERS investors versus an estimated $297.5 billion in tobacco-related costs for California society over the same period. One can easily argue that CalPERS is not responsible for California’s society as a whole. However, with an estimated 1.9 million members in its retirement system, CalPERS represents a major component of the state’s workforce and retirees. It is also a significant factor in the state’s economy.

Sustainable development architect William McDonough famously said, “Sustainability takes forever. And that’s the point.”

Speculative, short-term trades are generally not part of the vocabulary of SRI-focused advisors and investors since the whole purpose of sustainable investing is finding investments that will weather hardships and stand the test of time. ESG integration, the use of environmental, social, and governance research and evaluation as part of investment research, is the much more dominant strategy used for SRI investment products today. Doing so adds a layer of risk analysis that is traditionally overlooked and can mean the difference between owning a viable long-term investment or a risk-prone violator whose company may have difficulties in the future related to ESG factors. One has only to look back a couple of years to find examples of such research working for the shareholder’s benefit.

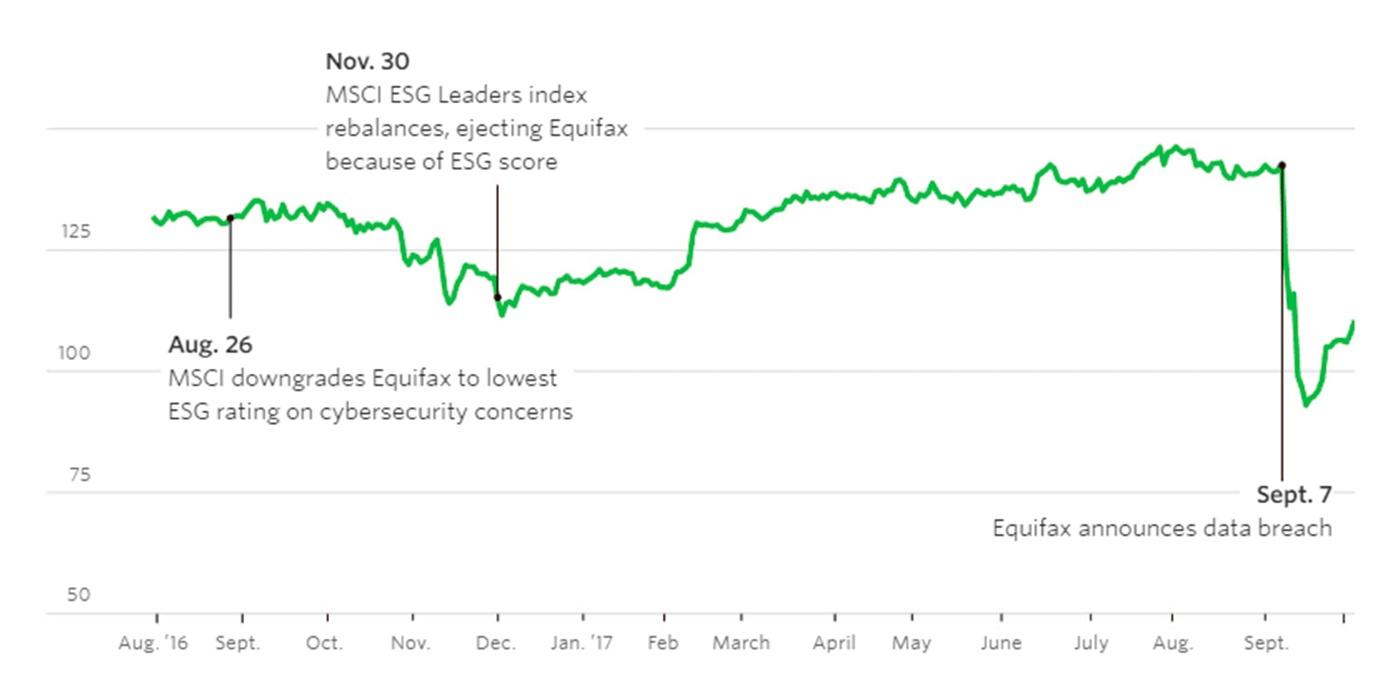

The most significant example that comes to mind is when Equifax announced in August 2017 that the company experienced a data breach compromising the private data of approximately 145.5 million consumers. While this came as shock to much of the market, it was less of a surprise to ESG analysts and investors.

The Wall Street Journal reported that as early as Aug. 26, 2016, the index, data, and research provider, MSCI, cautioned that Equifax was “ill-prepared to face the increasing frequency and sophistication of data breaches.” MSCI uncovered that Equifax had no documentation of regular cybersecurity audits, offered no training to employees on how to recognize the signs and risks of a data breach, and had no emergency plan in place should an intrusion occur. Given their findings, MSCI removed Equifax from one of MSCI’s major ESG indexes on Nov. 30, 2016. Less than a year later, Equifax publically announced the data breach. The following chart shows the price movements of Equifax (EFX) from the time it was downgraded by MSCI to the time the data breach was made public.

FIGURE 2: EQUIFAX SHARE PRICE BEFORE AND AFTER THE DATA BREACH

Source: Wall Street Journal, using data from MSCI and FactSet

EFX shares have since recovered much of their losses since that time. Their initial reaction and outreach to consumers following the breach was less than ideal, but the markets, at least, have judged that they have made significant improvements in their security protocol. In general, the recovery from corporate controversies of all kinds has more to do with the way in which management responds to the controversy rather than the controversy itself.

Importantly, the ESG research conducted by MSCI pointed out the cracks in Equifax’s system as an early warning sign. This highlights the importance of ESG research and ratings in encouraging corporations to set higher standards in a variety of ESG-related areas.

Addressing sustainability is a sore spot for many C-level executives and board members since the pressure to deliver short-term performance usually outweighs their capacity or willingness to focus on long-term sustainability, though they recognize its importance. In 2013, Accenture conducted a survey of 1,000 CEOs and found that 80% of these leaders believe sustainability is the way to achieve an edge over competitors in the years to come. However, the same survey noted that only 33% of those same CEOs think that their businesses are making sufficient efforts to address sustainability challenges.

A survey conducted on behalf of McKinsey & Co. and the Canadian Pension Plan Investment Board (CPPIB), and referenced in a Harvard Business Review article, concluded the following:

- 79% of C-level executives feel pressure to deliver stronger financial results in under two years.

- 73% said they should use a time horizon of more than three years.

- 86% declared that using a longer time horizon to make business decisions would positively affect corporate performance in a number of ways, including strengthening financial returns and increasing innovation.

It is evident, though, that since this survey was conducted in 2013, a notable shift has occurred in the way corporate management engages with shareholders regarding sustainability. Companies that put in the effort to disclose and discuss sustainability matters are now commonplace, with more than 86% of companies in the S&P 500 Index voluntarily disclosing data in sustainability reports in 2018, according to the Governance & Accountability Institute. This is up from just 20% of companies in 2011, and 72% in 2013.

Coupled with sustainability reports, more corporate leaders are taking steps to keep the focus on long-term time horizons rather than pressure their employees to consistently deliver better financial results quarter over quarter and year over year. An example of this focus is when Unilever’s former CEO Paul Polman announced that the company would no longer be providing quarterly earnings reports or earnings guidance, so that the company could focus on long-term results. There is a desire to focus on, and address, long-term sustainability among companies and doing so will help to mediate risk factors that historically were overlooked.

Investment performance is of prime concern for financial advisors and their clients, many of whom are nearing or already in retirement.

Taking on the universe of the many studies centered on the performance of ESG funds is beyond the scope of this article. But it is important to address to some degree the long-held belief by many advisors that SRI or ESG investing necessarily has to extract a performance penalty (and that is not even considering the context of long-term corporate sustainability addressed previously).

Research shows that organizations that adopt solid ESG (environmental, social, governance) practices reap better operational performance. Another study shows that the incorporation of corporate social responsibility proposals can lead to increased shareholder value. In fact, according to research conducted by the Global Impact Investing Network, 89% of “principled investors” said their financial performance was in line with or outperformed their expectations.

Further, select third-party investment managers offer principled, actively managed SRI investment strategies that use cutting-edge technology to seek superior returns, manage for risk, and adjust to the market—allowing investors to participate during strong market growth and provide protection during downturns.

A second issue pertains to a somewhat valid criticism of the burgeoning SRI investment industry. There is hardly an industry standard for ESG evaluation, and many companies have legitimate complaints about being “branded” on certain criteria by one or more companies or services providing ESG research. A recent Wealth Management article put it this way,

“But right now we have a world where seemingly dozens of different ESG ratings schemes compete in the marketplace, and that just invites confusion. Often, the standards contradict one another. Is Tesla good for the environment, or bad? Does Facebook’s privacy issues mean more to sustainability investors than its commitment to 100 percent renewable energy by 2020? Depends on which data provider you ask. This may be one reason why mentions of ‘sustainable investing’ often solicit eye-rolls from financial advisors.”

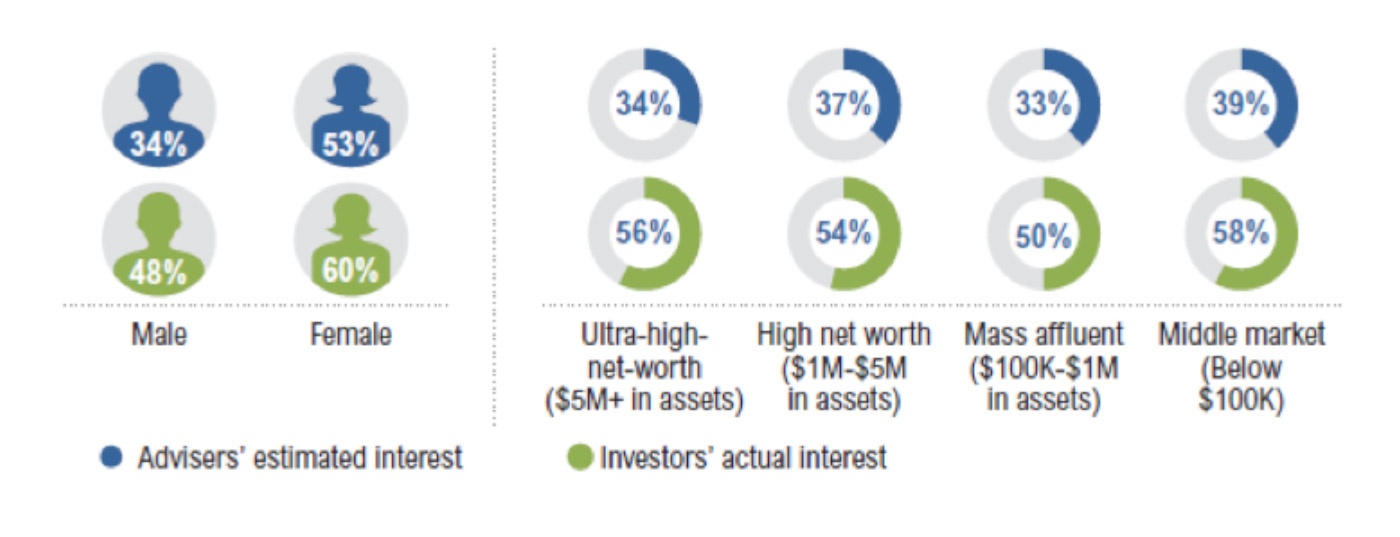

That said, it seems undeniable that a growing number of advisors’ clients are strongly interested in SRI and ESG investing, and, in general, many financial advisors are underestimating that demand.

FIGURE 3: ADVISORS’ ESTIMATED INVESTOR INTEREST IN ESG VS.

INVESTORS’ ACTUAL INTEREST

Source: InvestmentNews Research, 2019

In my experience, those who question the viability of SRI or ESG investing are generally not well-informed or lack the vision to adapt their practice to accommodate the changing attitudes of their current and future client base. The whole purpose of ESG analysis is to add to investor value, not take away from it. I believe advisors would be acting in their clients’ best interests by exploring investment options that focus on companies and technologies that will benefit society for decades to come.

Jennifer N. Coombs, CRPC, is an associate professor at the College for Financial Planning, and is the creator, author, and lead instructor of the Chartered SRI Counselor (CSRIC) financial designation education program. Before joining the college, Ms. Coombs spent a decade working in trading and financial services in New York City, with a focus on equity research and economic analysis. She holds a bachelor’s degree in finance and political science from Clarkson University.

Jennifer N. Coombs, CRPC, is an associate professor at the College for Financial Planning, and is the creator, author, and lead instructor of the Chartered SRI Counselor (CSRIC) financial designation education program. Before joining the college, Ms. Coombs spent a decade working in trading and financial services in New York City, with a focus on equity research and economic analysis. She holds a bachelor’s degree in finance and political science from Clarkson University.