Editor’s note: Thanks to Lowry Research Corporation for permission to publish this recent special report. Two of Lowry Research’s proprietary momentum indicators identified a reversal from an oversold condition in the broad U.S. equity market on April 16, 2020, that indicated a potentially strong buying opportunity. This article provides a historical perspective on how markets have performed 12 and 24 months after similar signals over the past 30 years.

Among the most challenging tasks for investors is discerning an oversold market—that may fall further, becoming more oversold—from a market that presents a long-term buying opportunity.

The most recent market sell-off serves as a perfect example of how stocks can cascade lower without respect for traditional staging levels or popular indicators watched by eager buyers. The problem is that there are plenty of metrics that identify washed-out market conditions that can mislead investors, but there are few that reliably capture the strong wave of buying that defines new, sustainable market uptrends.

While our core, proprietary measures of investor supply and demand—Selling Pressure and Buying Power—along with Lowry’s Short Term Index, which is a shorter-term gauge of demand, are most sensitive to changes in market trends, other confirmatory indicators are helpful in gaining conviction. This is particularly important in the aftermath of dramatic market corrections like that of recent months, when confidence can be in short supply and false rallies are common.

As complements to our primary indicators, the Lowry analysis employs a host of additional measures to assess the health of market trends under the surface of prices and occasionally to assist in identifying market reversals.

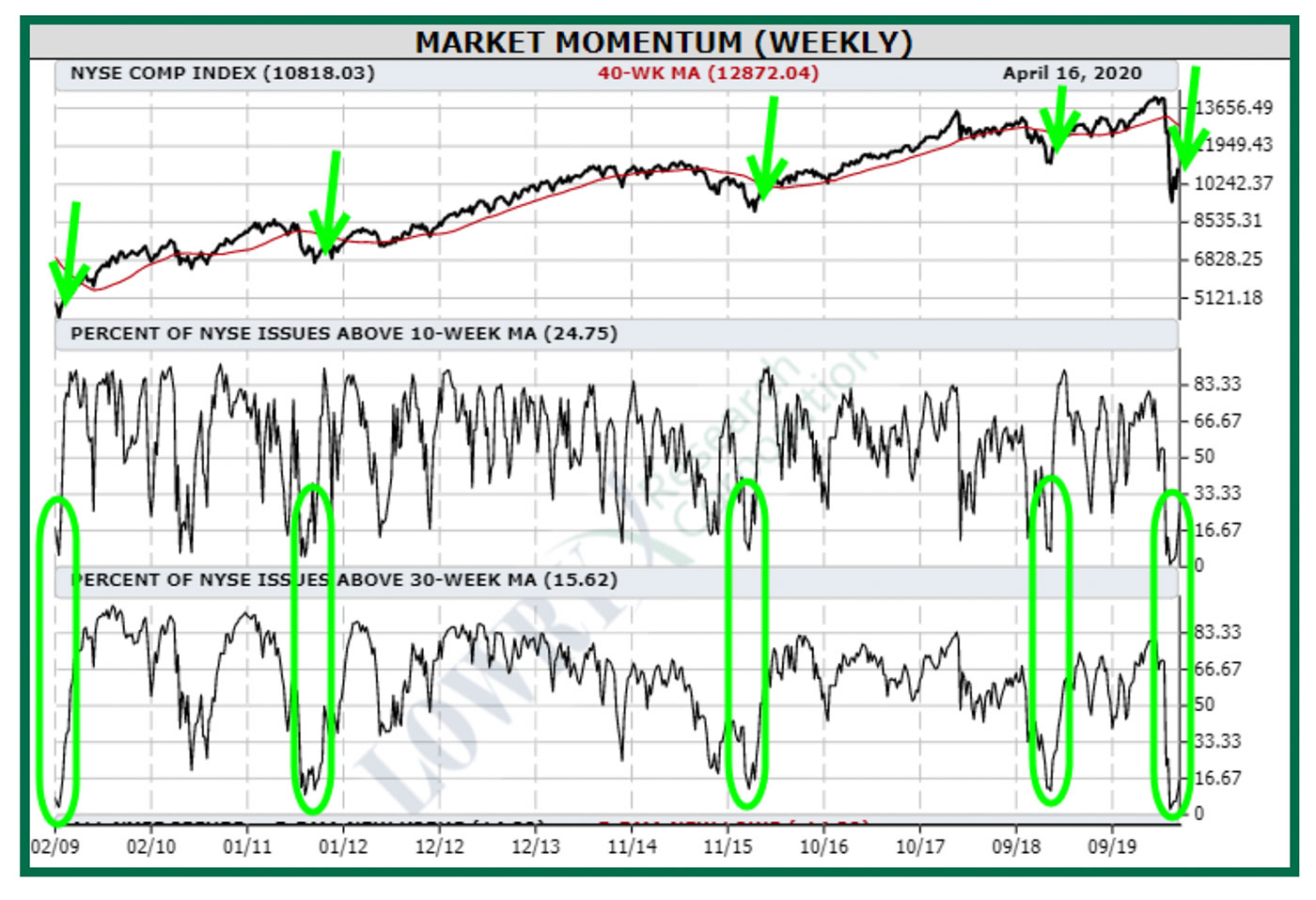

Among these supporting indicators are Lowry’s weekly momentum indicators. This group of indicators is composed of Lowry’s percent of New York Stock Exchange (NYSE) issues above 10-week moving averages (WMA), Lowry’s percent of NYSE issues above 30-WMAs, and the all NYSE issues 5-day moving average (DMA) of new 52-week highs and 52-week lows. As price derivatives, these momentum indicators tell us how many stocks are in both intermediate- and long-term uptrends.

Applying an extension of the concept of Lowry’s 90% downside day/90% upside day combinations (that helps to identify market reversals using this evidence of exhaustion from sellers and the return of enthusiastic buying), we tested Lowry’s percent of NYSE issues above 10- and 30-WMAs. Specifically, we looked back over the last 30 years (from 1989) to see if there were commonalities between major market bottoms with reference to these indicators.

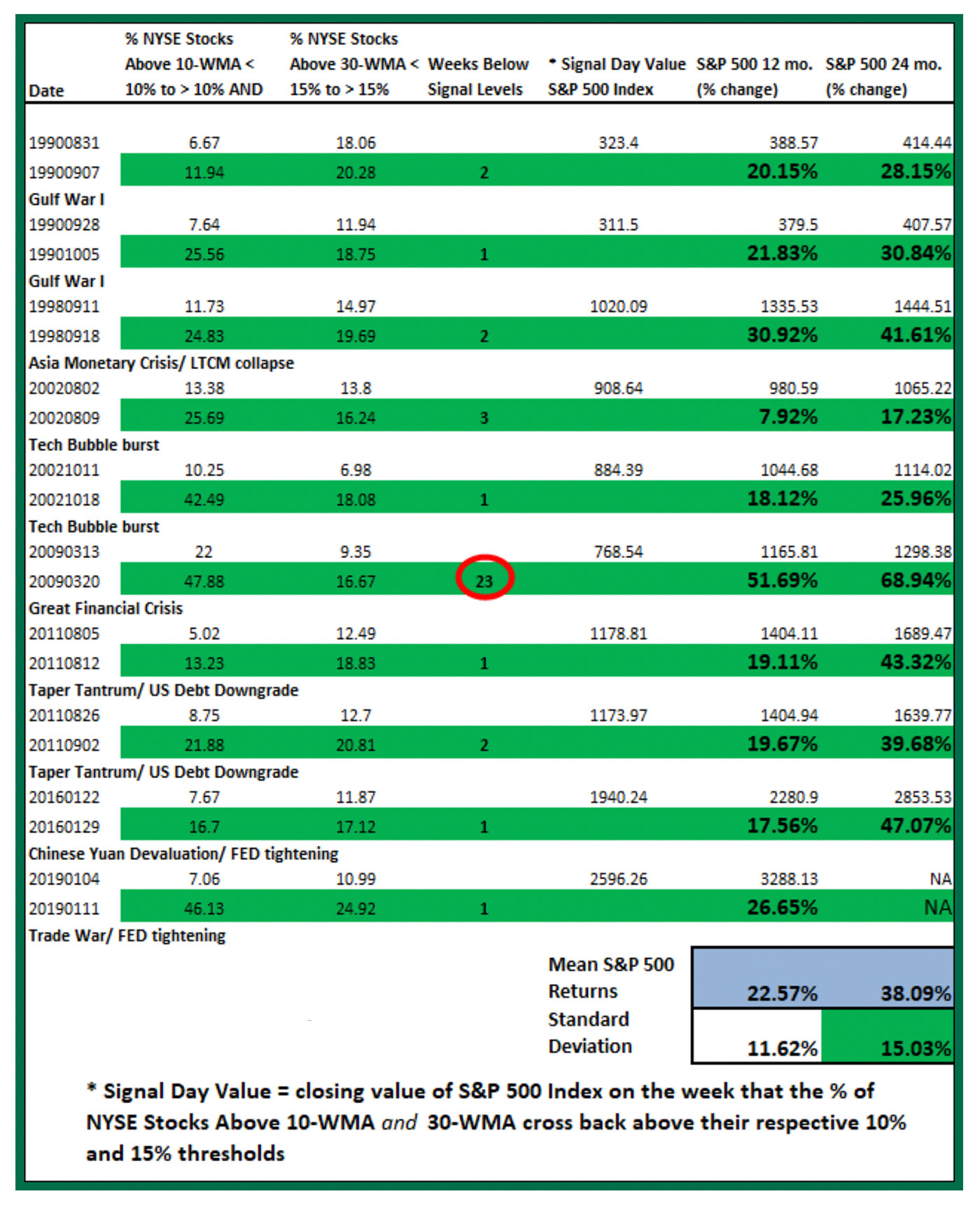

As shown in Table 1, we found that reversals from deeply oversold levels—10% for the percent of NYSE issues above 10-WMAs and 15% for the percent of NYSE issues above 30-WMAs—marked the early stages of new long-term market uptrends.

On average, the 10 signals since 1989 produced forward 12- and 24-month returns in the S&P 500 Index of 22.57% and 38.09%, respectively. What is perhaps even more compelling is that there were no instances of negative returns on either time horizon. Further, the standard deviations of the returns were low (well below the mean returns), indicating a high level of consistency of returns. In fact, we see that the standard deviation of 24-month S&P 500 returns was comparatively lower than for that of 12-month returns, which demonstrates that this signal is longer term.

TABLE 1: WEEKLY REVERSALS IN LOWRY’S PERCENT OF NYSE ISSUES SINCE 1989

Note: Weekly momentum reversals in Lowry’s percent of NYSE issues above 10- and 30-WMAs from fully oversold levels since 1989.

Source: Lowry Research Corporation

Two other points add to the prospective long-term significance of these signals. First, all observations roughly coincided with major market lows and/or world events. Second, even the “whipsaw” signals—those that were triggered, reversed, and re-triggered weeks or even months later—ultimately were highly profitable on a 12- and 24-month basis. Examples of these whipsaw signals were 1990, 2002, and 2011. The implication is that these reversals from deeply oversold conditions should be regarded as strong evidence that an important new market uptrend is likely developing.

To underscore the importance of waiting for the reversal from below to back above deeply oversold thresholds, we highlight the 2009 observation, when deeply oversold conditions prevailed for 23 consecutive weeks. In this case, investing simply based on the presence of abundantly oversold conditions, without respect for the sustained demand necessary to propel a new market uptrend, proved costly, with the major price indexes continuing to show precipitous declines.

The latest observation, with five consecutive weeks below the respective fully oversold thresholds for Lowry’s percent of NYSE issues above 10- and 30-WMAs prior to the April 16 signal, is yet another reminder of the importance of waiting for demand to confirm that a new market uptrend has begun.

After having reached just 0.99% in the percent of NYSE issues above 10-WMAs and 2.41% in the percent of NYSE issues above 30-WMAs on March 12, these figures have rebounded strongly to 24.75% and 15.62%, respectively, as of April 16.

Based on history, these reversals suggest that a new long-term market uptrend could be underway.

Source: Lowry Research Corporation

Vincent Randazzo, CMT, is a senior market analyst at Lowry Research with more than 15 years of experience in professional equity market research, technical analysis, and market intelligence. Before joining Lowry, Mr. Randazzo was chief market analyst at NASDAQ. He was also director of research at ICAP and a research salesperson at Morgan Stanley and UBS. He has been a Chartered Market Technician (CMT) since 2008. For more information on Lowry Research, please visit lowryresearch.com.

Vincent Randazzo, CMT, is a senior market analyst at Lowry Research with more than 15 years of experience in professional equity market research, technical analysis, and market intelligence. Before joining Lowry, Mr. Randazzo was chief market analyst at NASDAQ. He was also director of research at ICAP and a research salesperson at Morgan Stanley and UBS. He has been a Chartered Market Technician (CMT) since 2008. For more information on Lowry Research, please visit lowryresearch.com.