There was positive market and economic news last week, despite the growing concern over the newly elevated number of COVID cases and uncertainty and inconsistency regarding pandemic health guidelines heading into the fall school season:

-

The Dow Jones Industrial Average and S&P 500 finished the week ending August 6 at fresh all-time highs, with the NASDAQ Composite not far from its own record. The Dow was up 0.8%, the S&P 500 gained 0.9%, and the NASDAQ posted a 1.1% increase for the week.

-

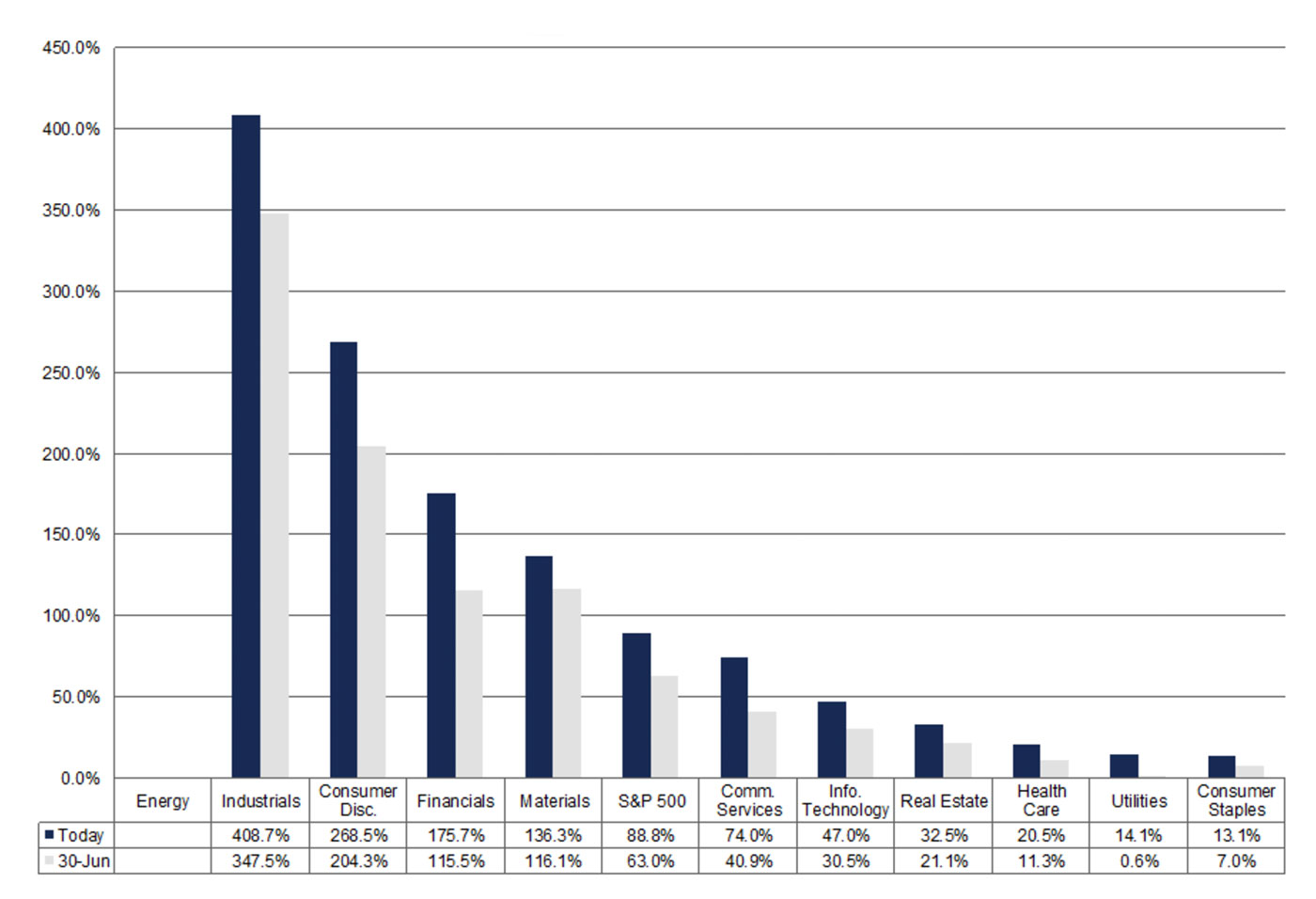

In general, Q2 earnings season continues to impress. According to FactSet, 87% of S&P 500 companies have reported actual earnings per share (EPS) above estimates, which is well above the five-year average of 75%. In addition, overall year-over-year earnings growth for the S&P 500 is now projected at 88.8%, compared to estimates just above 60% at the end of June. Revenue growth is projected at 24.7%, which would represent “the highest year-over-year revenue growth rate reported by the index since FactSet began tracking this metric in 2008.”

Note: The Energy sector is coming off a loss in Q2 2020, preventing a mathematical projection for earnings growth.

Source: FactSet

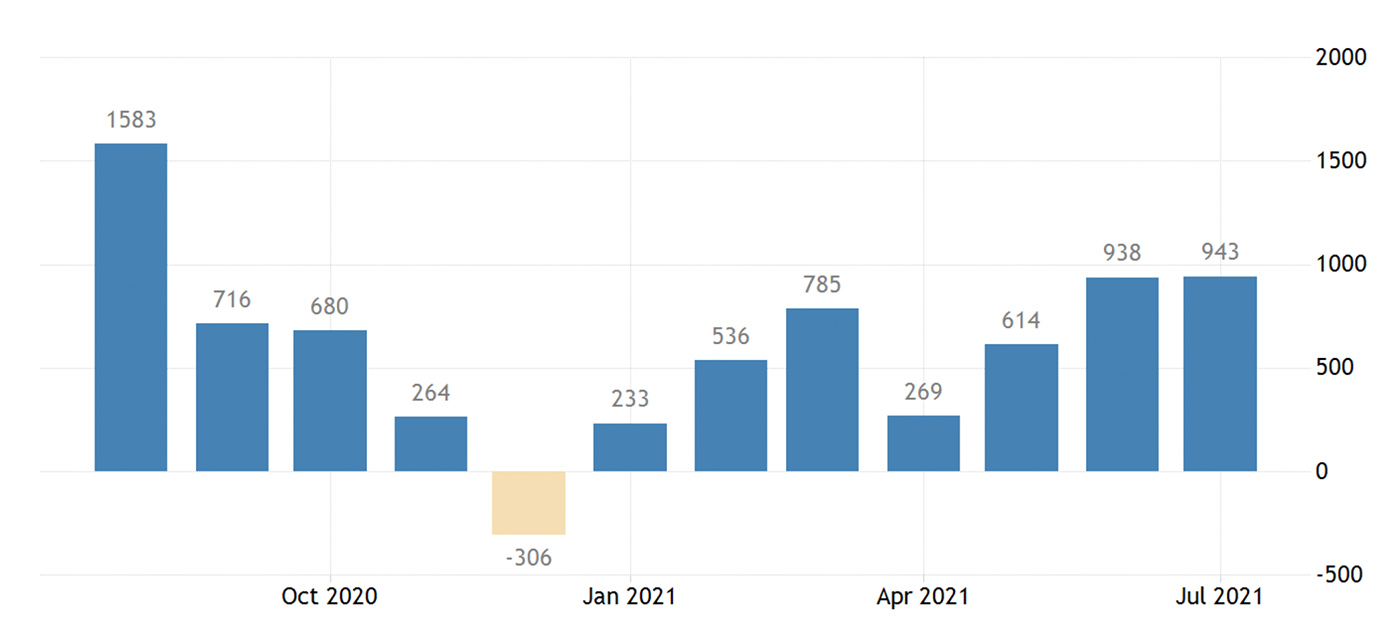

- The Labor Department’s July nonfarm payrolls report for July exceeded going-in estimates, with upward revisions for the prior two months as well.

Barron’s noted that the 943,000 rise in nonfarm payrolls beat the average forecast of 870,000, and 119,000 jobs were added to estimates for May and June.

Barron’s added, “… Unemployment tumbled by a sharp 0.5 of a percentage point, to 5.4%, for the right reasons: More people entered the labor force and found jobs. … There’s no denying the strength of the report. The ‘underemployment rate,’ known as U6 to data fans, fell by 0.4 of a point, to 9.2%. That was its lowest level since 2017, and a result of having fewer discouraged workers and fewer part-timers who’d prefer a full-time gig.”

FIGURE 2: U.S. NONFARM PAYROLLS (ONE-YEAR TREND—JOB GAINS/LOSSES)

Sources: Trading Economics, U.S. Bureau of Labor Statistics

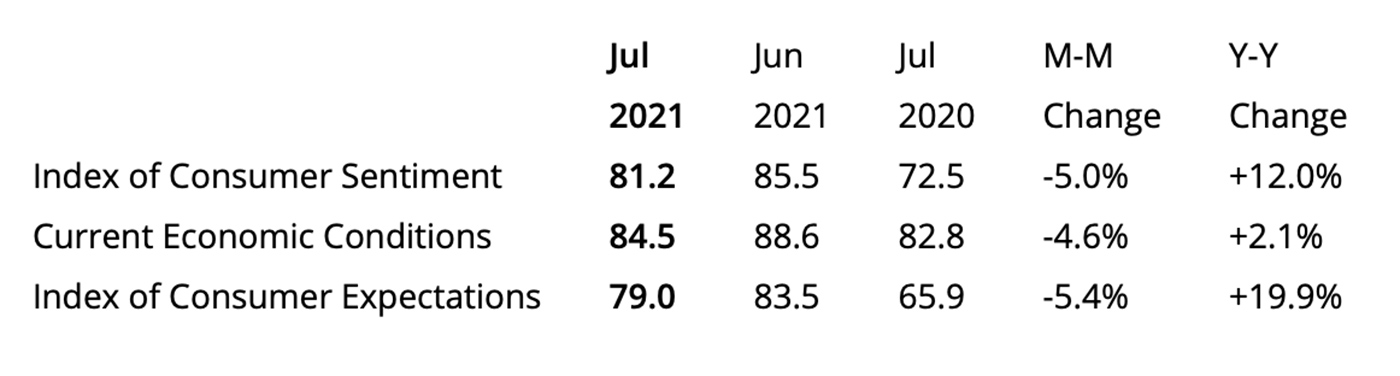

Against this backdrop, according to the University of Michigan, consumer sentiment declined by 5% in July.

MarketWatch reported,

“The second and final reading of the University of Michigan’s consumer sentiment index fell to 81.2 in July from a reading of 85.5 in June. …

“Consumers remained guarded about the general health of the economy, with near-term inflation remaining at top of mind. Expectations for inflation over the next year rose to 4.7% from 4.2% in June and remain higher than they’ve been for more than a decade.”

Source: University of Michigan

Richard Curtin, the chief economist of the Surveys of Consumers, wrote, in part,

“Consumer sentiment edged upward at the end of July, although it still posted a monthly decline of 5.0%. The largest monthly declines remained concentrated in the outlook for the national economy and complaints about high prices for homes, vehicles, and household durables. While most consumers still expect inflation to be transitory, there is growing evidence that an inflation storm is likely to develop on the not too distant horizon.”

Mr. Curtin also notes that “the improved finances of consumers have greatly reduced consumers’ resistance to price increases …” and that these unusual times—and fiscal and monetary government policies—have created a reaction to rising prices that is “quite different from the inflationary psychology of the 1970s.”

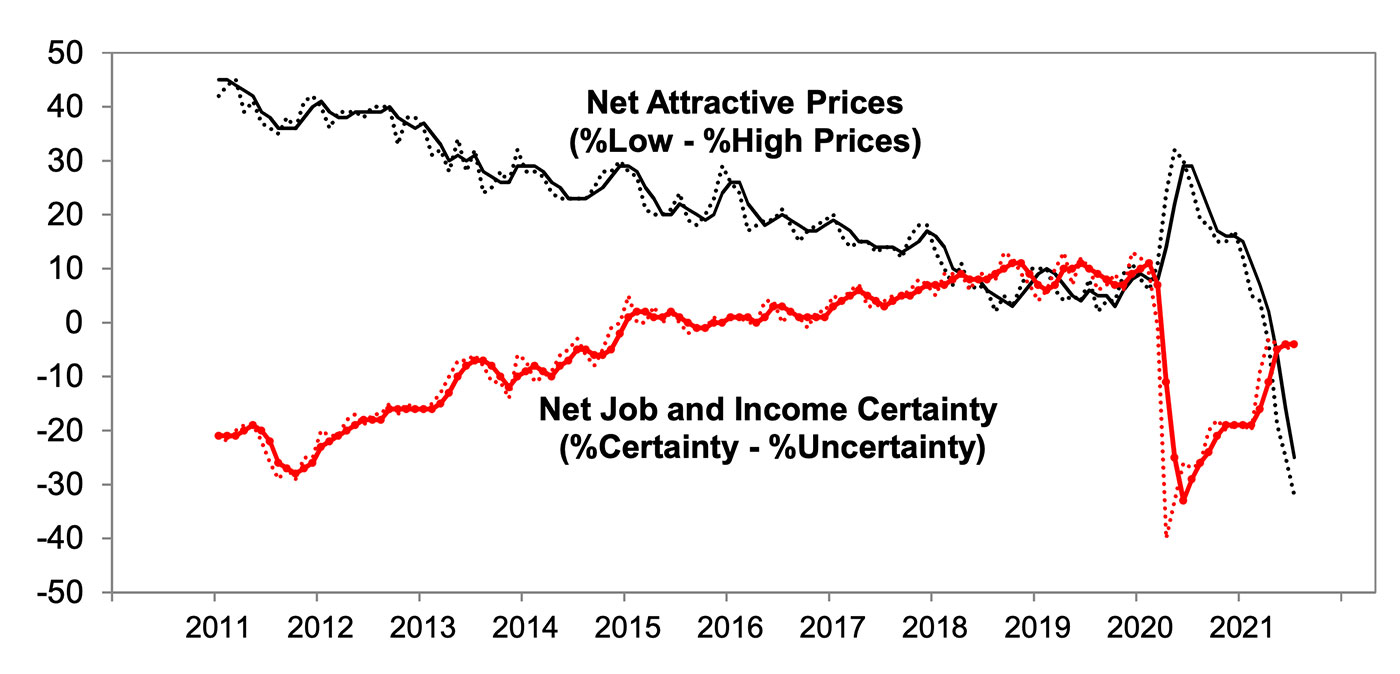

In part, some of the adverse consumer reaction to rising prices has been tempered by a more positive outlook on job and income prospects, as seen in Figure 4.

FIGURE 3: JOB AND INCOME PROSPECTS HELP OFFSET COMPLAINTS ABOUT PRICES

(AVERAGE FOR HOME, VEHICLE, AND HOUSEHOLD DURABLES)

Source: University of Michigan