On May 3, NBC’s Meet the Press reported on the latest findings from research provider Dynata. Dynata has created a weekly tracker of consumer attitudes around the globe regarding economic, personal finance, and health concerns.

The latest data shows improvement in how U.S. consumers are feeling in several areas, but it still shows that a majority of people believe there is a long road ahead toward recovery and a return to normalcy.

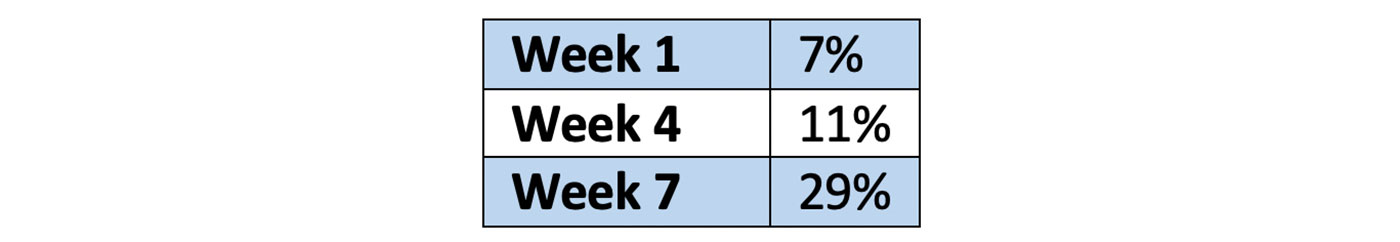

TABLE 1: U.S. CONSUMERS BELIEVING ‘THE WORST IS BEHIND US’

Source: NBC, Dynata Global Consumer Trends Report, survey conducted 4/27–28.

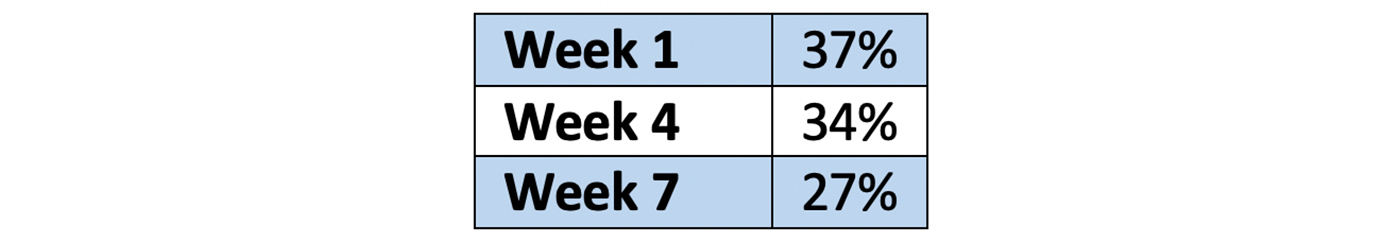

TABLE 2: ‘VERY CONCERNED ABOUT FAMILY’S FINANCIAL SECURITY’

Source: NBC, Dynata Global Consumer Trends Report, survey conducted 4/27–28.

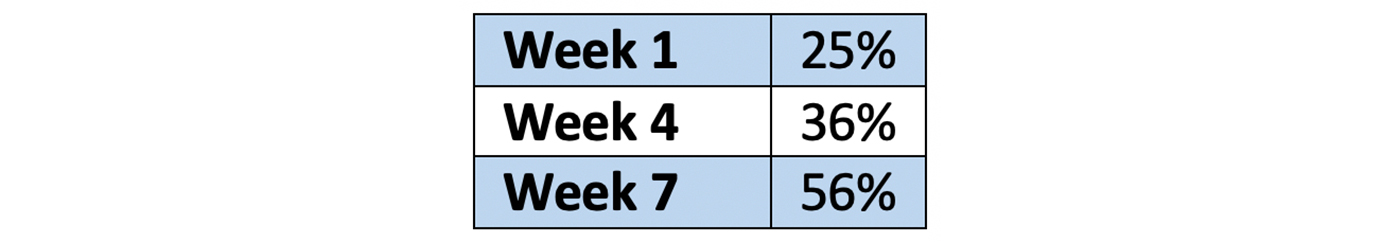

TABLE 3: ‘PANDEMIC WILL LAST 6 MONTHS OR MORE’

Source: NBC, Dynata Global Consumer Trends Report, survey conducted 4/27–28.

In reporting on the findings, NBC noted,

“And even when Americans are given an all-clear on the virus, Dynata’s figures suggest the world isn’t going to suddenly click back to the way things used to be. … In a separate survey, the company asked Americans when they would resume their normal habits after ‘the government establishes that it is safe’ to do so. On a broad range of questions, those surveyed were not in a rush to jump back into life as it was. …

“… The larger trend in these results seems to be that, seven weeks in, the COVID-19 pandemic has moved from being an unknown and scary disease to being a lingering medical condition in the eyes of many Americans. It’s difficult to manage. It’s causing pain. And it’s not going away soon.”

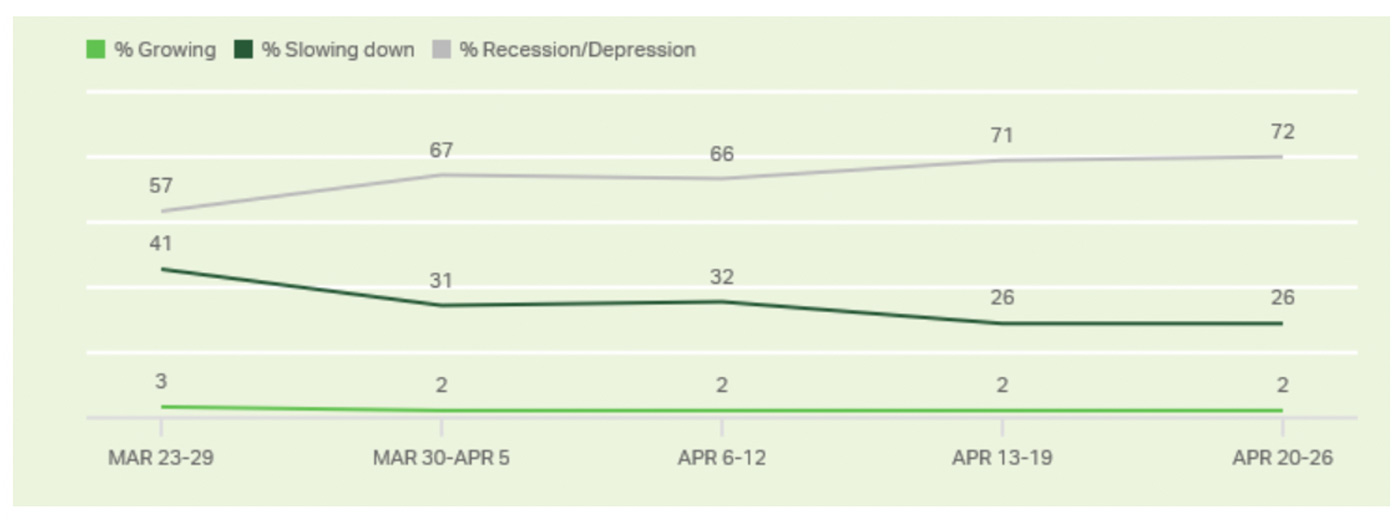

A recent Gallup poll sees a similar directional slant, finding that Americans are expressing a “mix of concern and hope on the economy.”

The Gallup poll’s key findings include the following:

- 70% of Americans say the “U.S. economy is in recession or worse.”

- Roughly the same percentage “believe economic conditions are getting worse.”

- However, “six-month outlooks for economic growth, stock market [are] relatively upbeat.”

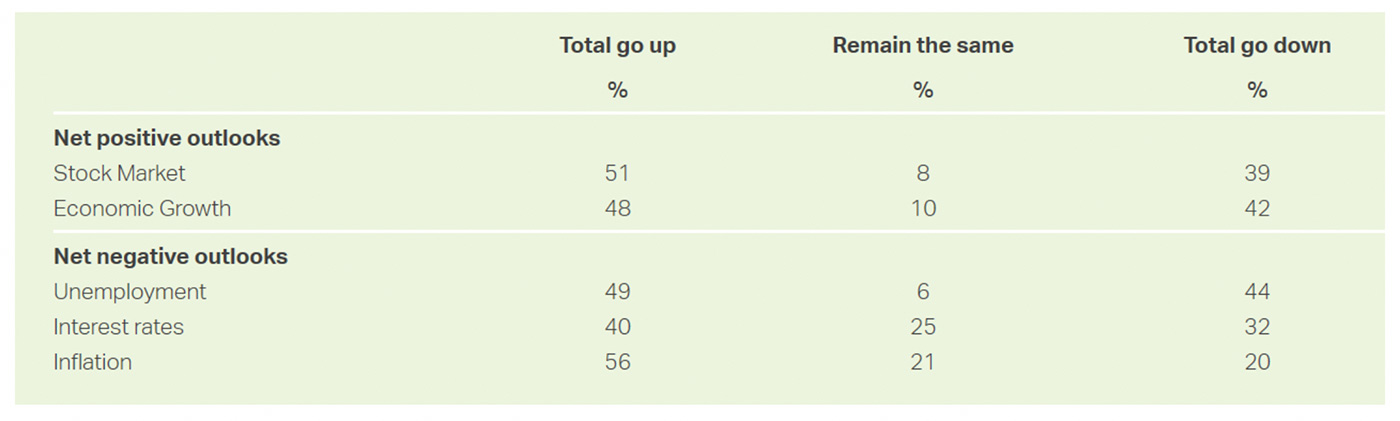

“Over the next six months, do you think that each of the following will go up a lot, go up a little, remain the same, go down a little, [or] go down a lot?”

Source: Gallup, survey conducted April 14–28, 2020

Source: Gallup panel, April 20–26, 2020

Bloomberg tracks consumer sentiment in its weekly Bloomberg Consumer Comfort Index. In the most recent survey, they reported a slowing of the decline in consumers’ attitudes. However, the Index has declined in 12 of the last 13 weeks, and the move from 67.3 in January 2020 to the current April level of 39.5 is “the steepest drop in more than three decades’ worth of data.”

Bloomberg adds, “Confidence among American consumers fell for a sixth straight week, though the latest decline was the smallest since the coronavirus-induced plunge started and a hopeful sign as states seek to reopen their shuttered economies.”

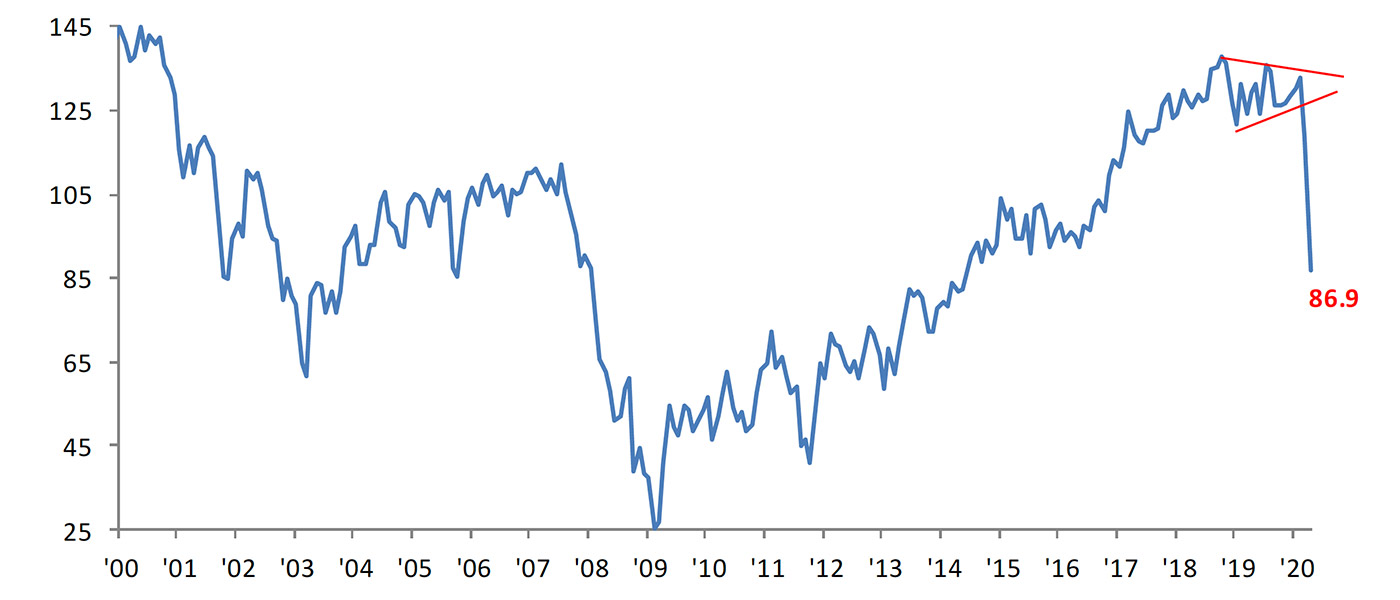

The Conference Board’s Consumer Confidence Index “deteriorated further in April, following a sharp decline in March,” according to their April 28 press release. It is interesting that Index levels are still significantly higher than those seen across the period of the 2008–2009 downturn and several years into the recovery from the credit crisis.

Bespoke Investment Group noted the extreme moves to the downside in consumer confidence, while finding some rays of hope in future expectations of those surveyed:

- “While it wasn’t the largest monthly decline on record, the 31.9 point drop was the largest since December 1973 (when the report was released every other month).

- Declines of this magnitude are incredibly uncommon. While there has only been one other report that showed a larger drop than April, there are also only five other periods where the sequential decline in the headline reading was even down twenty points let alone thirty points!”

Source: Bespoke Investment Group, Conference Board

- “While consumer sentiment towards ‘Present Conditions’ showed the largest sequential decline on record (by a factor of more than 2), sentiment towards expectations six months from now actually improved!

- This is an interesting trend to watch because these two indices suggest that consumers appear to be expecting the impact of the COVID to be relatively short-lived.”

All of these consumer studies occurred against a backdrop of stock market moves that flew in the face of consumers’ current attitudes, likely reflecting the widespread hope of institutions and retail investors that both health issues and economic factors will improve substantially over the next 6–12 months.

Said Barron’s “The Trader” column this past weekend,

“The narratives that have been driving the market since the coronavirus crisis began have been straightforward. At first, the S&P 500 index tumbled 34% to its March low because the U.S. economy was going to come to a full stop, causing a massive recession.

“Then the index rebounded off those lows—and experienced its best month since 1987 in April—because a combination of monetary policy, fiscal stimulus, advances in potential treatments, and the possibility of an economic reopening showed that the situation might not be the national nightmare it was supposed to be.”

However, the column pointedly called out a quote from Peter Andersen of Andersen Capital Management, who says, “The market is delicately balanced. … If you put an additional feather on one end, you see it tip to that side.”