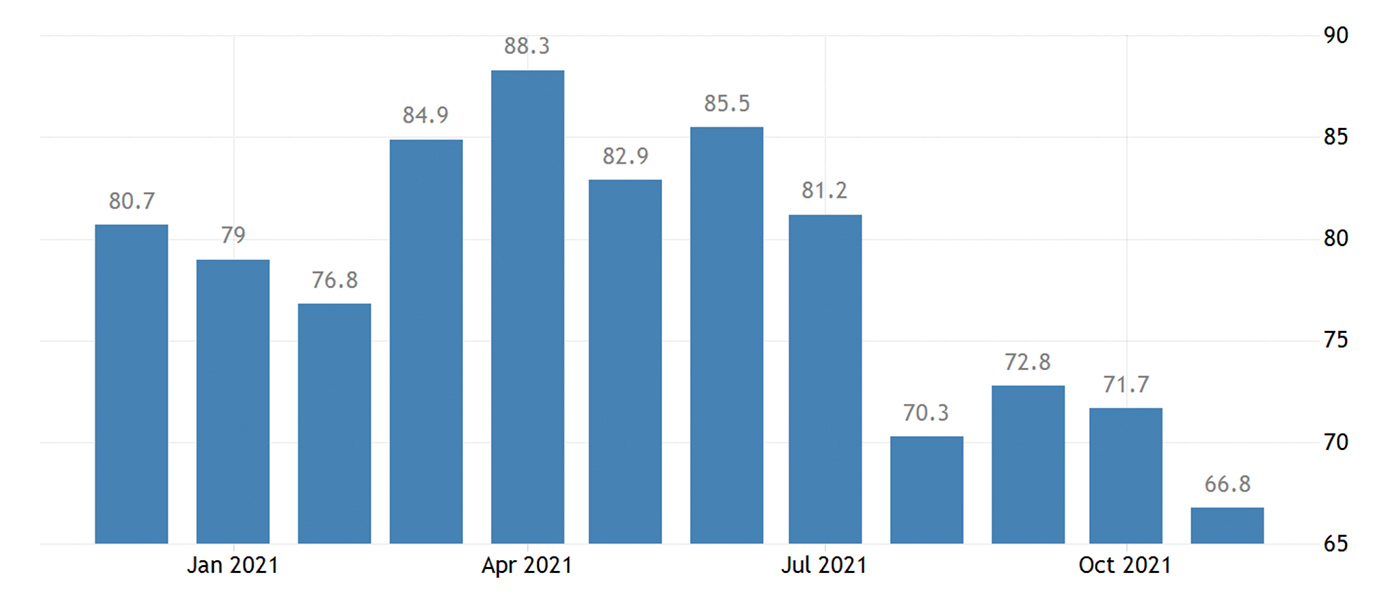

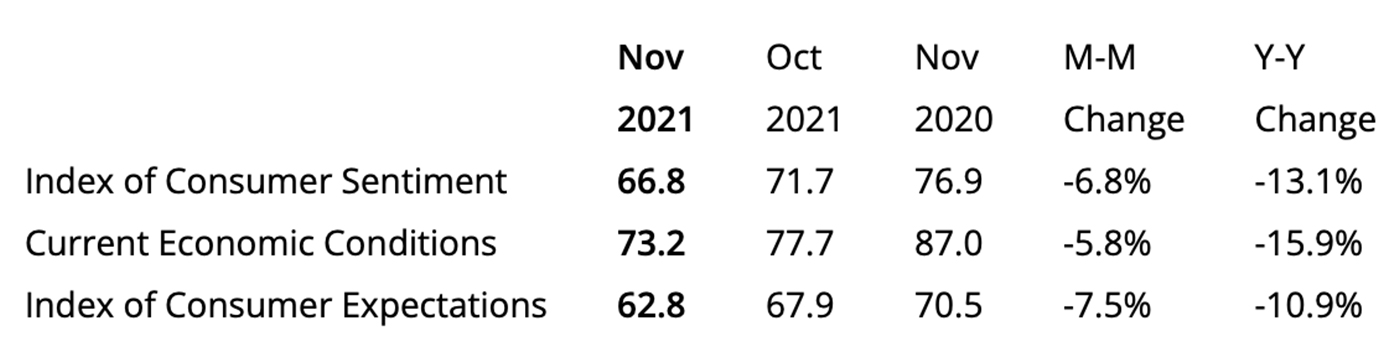

The University of Michigan’s Index of Consumer Sentiment fell to 66.8 for November, according to preliminary data released Friday, Nov. 12.

According to CNBC, “That was the lowest since November 2011 and well below the Dow Jones estimate of 72.5. October’s reading was 71.7, meaning that the November level represented a 6.8% drop.”

Sources: Trading Economics, University of Michigan

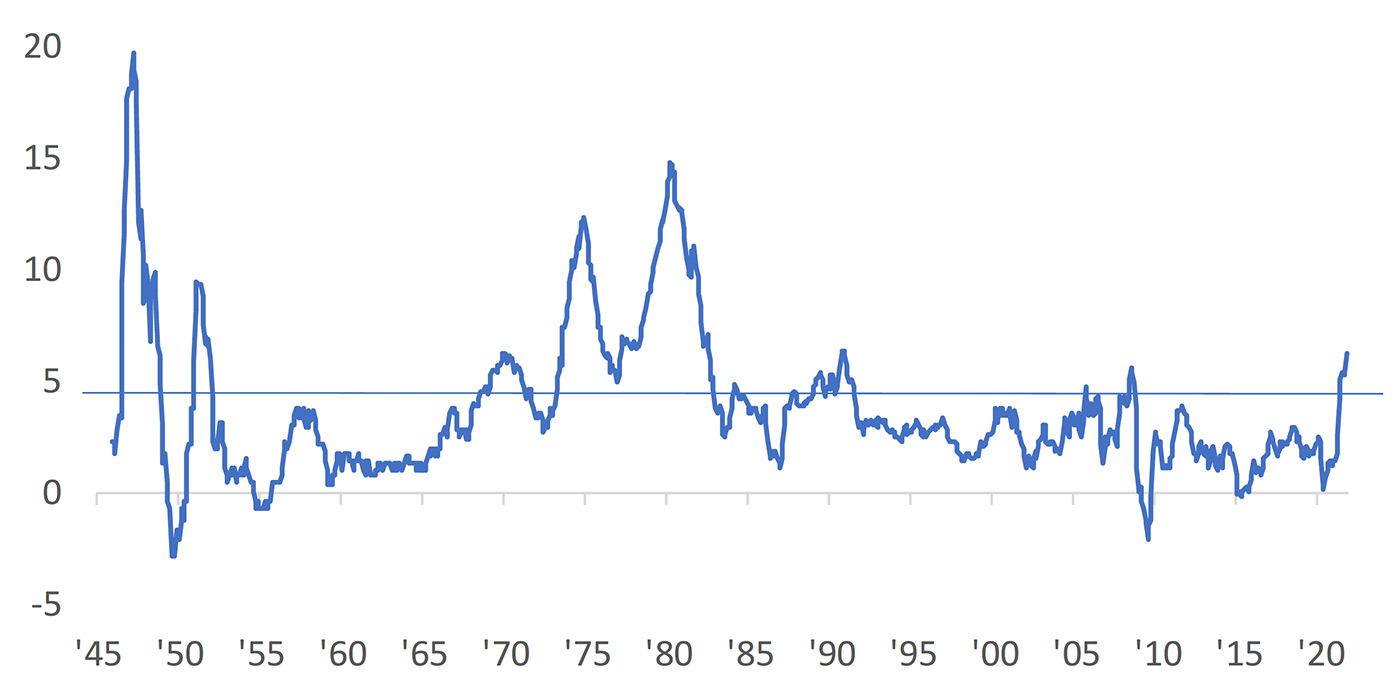

Forbes noted, “The preliminary index comes as consumer prices rose 6.2% in October compared to the same month last year, marking the fastest annual pace in 30 years, according to the Bureau of Labor Statistics.”

Sources: Bespoke Investment Group, Bureau of Labor Statistics

The University of Michigan Surveys of Consumers chief economist Richard Curtin said the following about the survey results:

“Consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation. One-in-four consumers cited inflationary reductions in their living standards in November, with lower income and older consumers voicing the greatest impact. Nominal income gains were widely reported but when asked about inflation-adjusted gains, half of all families anticipated reduced real incomes next year.

“Rising prices for homes, vehicles, and durables were reported more frequently than any other time in more than half a century. The reactions of consumers to surging inflation should be no surprise, as it has been reported during the past several months. The description that inflation would be ‘transient’ has the undertone that consumers could ‘grin and bear it’ as economic policies counted on a quick and automatic self-correction to supply and labor shortages. Instead, the pandemic caused economic dislocation unlike any prior recession, and has been intertwined with partisan interpretations of economic developments.”

Source: University of Michigan

Reuters reported the following on another related economic report released on Friday, which showed that more than 4.4 million workers left their jobs in September:

“The number of Americans voluntarily quitting their jobs rose to a record high in September while job openings stayed stubbornly above pre-pandemic levels, a sign that businesses may have to continue to raise wages in order to attract workers.

“The Labor Department’s monthly Job Openings and Labor Turnover Survey, or JOLTS report, released on Friday, reflects an uneven economy with strong demand grinding against labor and goods shortages, driving overall inflation to its biggest annual gain in 31 years. …

“Quits rose by about 164,000 in September, lifting the total to a record high of 4.4 million. The quits rate is seen as a good measure of labor market confidence as workers leave when they are more secure in their ability to find a new job. … Job openings, a measure of labor demand, edged down by 191,000 to 10.4 million on the last day of September. …

“‘The continued surge in quits points to wage growth of between 4.5%-5.0%, well above rates that would be consistent with inflation falling sustainably back towards the Fed’s 2% target,’ said Michael Pearce, senior U.S. economist at Capital Economics in New York, following the report.”

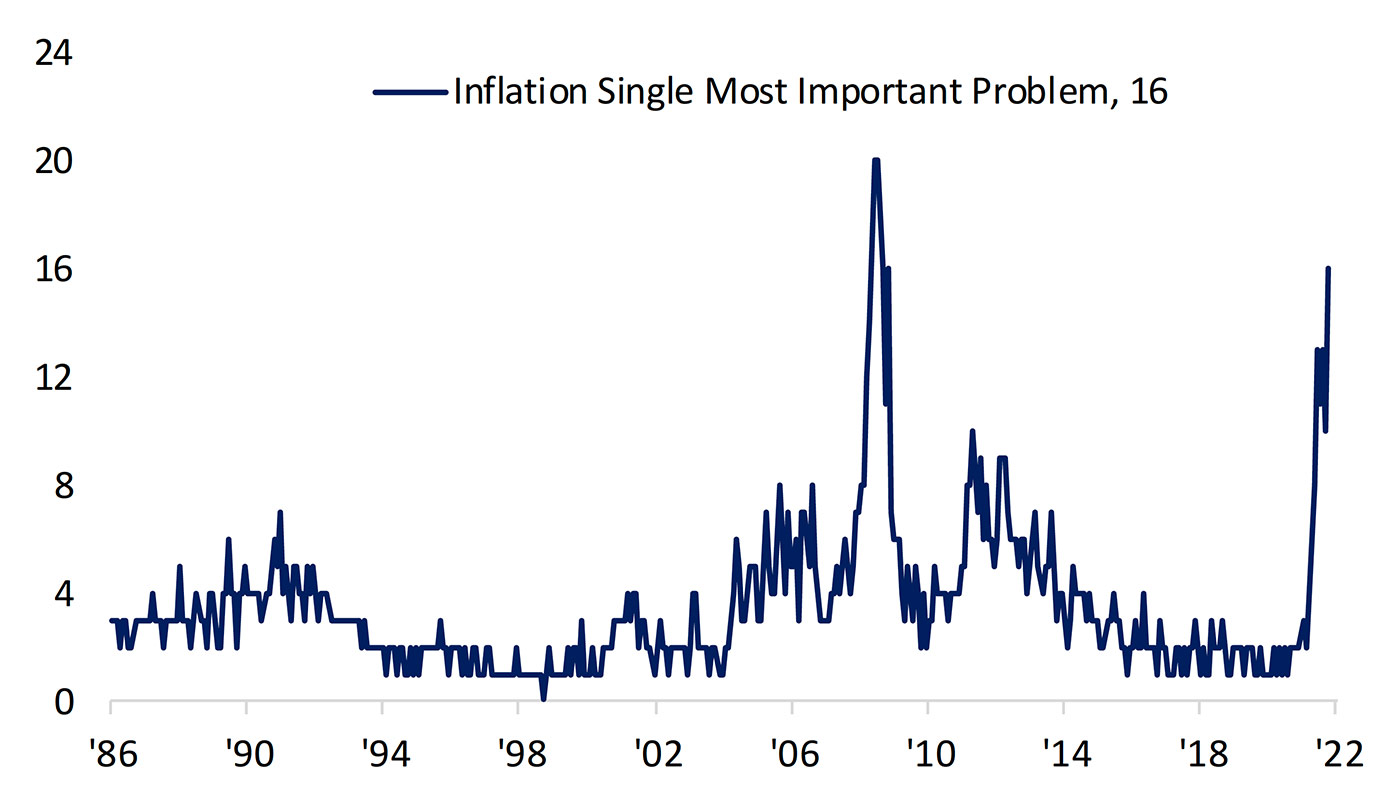

Related to the issues of inflation and wage growth, Bespoke Investment Group points out, “Each month, small businesses are asked what their number one problem is, and recently it’s been all about inflation, the cost of labor, and the quality of labor. … The inflation data in the monthly NFIB Small Business Sentiment release is also quite telling.”

Sources: Bespoke Investment Group, National Federation of Independent Business (NFIB)