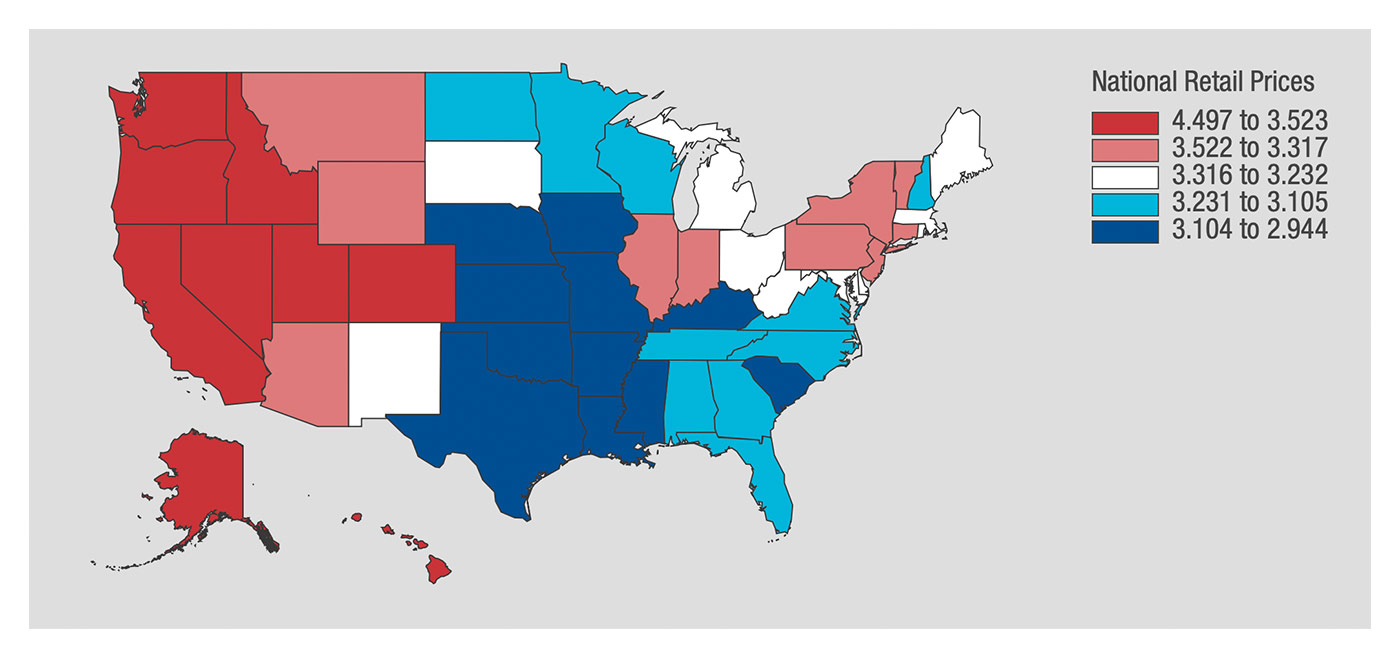

The rise in costs for retail gasoline prices at the pump has been apparent to consumers for months. Premium gas is now averaging close to $4.00 in many areas, with several Western states seeing prices well over that level. California is currently averaging just over $3.90 for regular gas and $4.80 for premium.

The American Automobile Association (AAA) wrote on Monday (Oct. 18),

“The national average for a gallon of [regular] gasoline rose a nickel over the past week to hit $3.32. The primary driver of this surge remains the cost of crude oil, which is now closing daily above $80 a barrel. In August, the price of crude was in the low $60s per barrel.

“Compared to the price of gas a year ago, it now costs consumers about $17 more to fill up their vehicles,” said Andrew Gross, AAA spokesperson. “… And unfortunately, it doesn’t look like drivers will be finding relief at the pump any time soon.” …

“Typically, softening demand should result in some easing of pump prices, but the higher cost for crude is blocking this. With oil prices remaining elevated, pump prices will follow suit because the cost of crude oil accounts for more than half of the price of each gallon of gas.”

Source: AAA

What may not be apparent to many consumers yet is the anticipated increase in the cost of keeping their homes warm this winter.

NPR reported last week,

“U.S. households can expect to spend more money to heat their homes this winter compared with last year, federal officials announced.

“A report released Wednesday by the Energy Information Administration predicts that home heating costs will go up because fuel prices are rising and fuel demand has increased over the previous winter. …

“All residential consumers should expect to pay more for heat, but officials say the type of fuel you use will determine how much extra you’ll have to shell out.

“Nearly half of U.S. households heat their homes with natural gas, and they will pay 30% more on average this winter, while homes warmed with electricity will pay 6% more. …

“Far fewer households keep their homes warm with heating oil or propane, but their costs are expected to jump even higher. Heating oil users will pay 43% more on average than they did last winter, while propane users will pay 54% more.

“The Energy Information Administration said those estimates were based on weather predictions from the National Oceanic and Atmospheric Administration, which is forecasting a colder winter.”

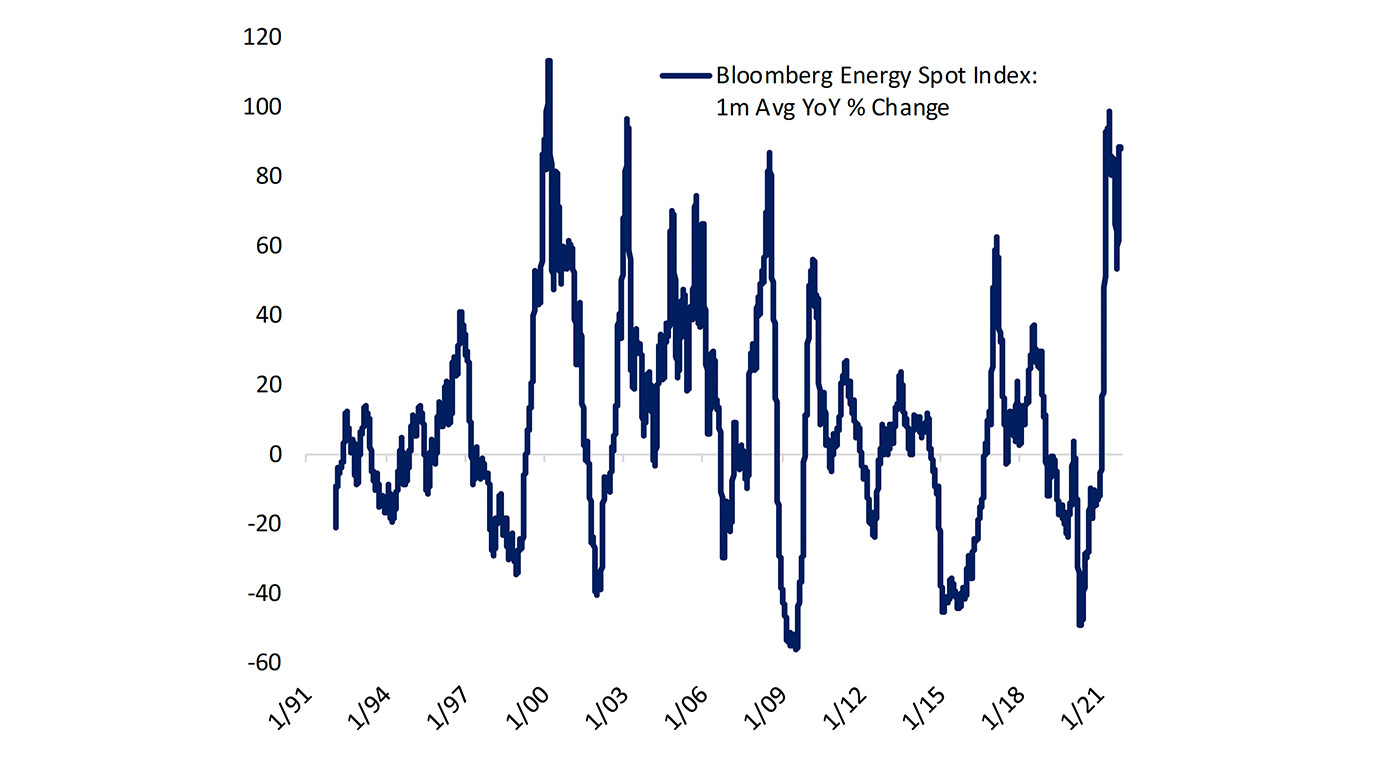

Bespoke Investment Group notes, “Oil is at the highest levels since 2014, and natural gas futures have risen 52% in the second half of the year, but US energy markets are not the driver of these moves, which are ricocheting around the world.”

This has led to a 2021 spike in Bloomberg’s subindex of energy-related futures.

Sources: Bespoke Investment Group, Bloomberg

As a result of rising energy prices and a positive earnings outlook, Barron’s forecast a continued positive view of the energy sector. An interview published this weekend with Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, found she was bullish on the financial and energy sectors moving forward:

“As things get better, management outlooks for year-end and early 2022 on third-quarter conference calls might be surprisingly upbeat. Calvasina suggests investors lean into the reflation trade, as rising prices benefit old-economy sectors that lagged behind big technology names in 2020.

“She picks the energy and financial sectors as outperformers, pointing out that both are insulated from supply-chain problems and earnings estimates for companies in both sectors are still rising.”

Barron’s also notes that although energy stocks, based on a percentage gain from the low, are up significantly, “if you look at a chart going back 10 years, energy exchange-traded funds still have much further to go.”