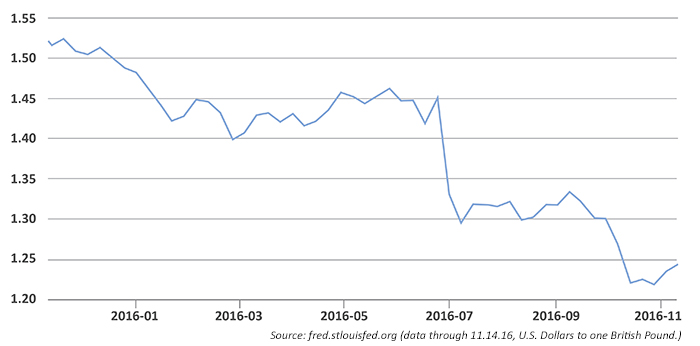

The Brexit effect on the British pound.

Money has been flowing into the U.S. markets for the relatively juicy yields on our bonds. I call it a Brexit “shopping spree” for U.S. bonds. On the flip side, U.S. consumers are having their own shopping spree, as the Brexit effect on the British pound has been pronounced since the U.K. vote this summer. Americans benefit from a strong U.S. dollar as they consider traveling abroad and purchasing goods and services from Britain and Europe.

How long can this last, and when will we see this migration of money stop? The flow of money will end when the cost of hedging the currency risk becomes too expensive. Unless bond yields appreciate (go higher), the cost of hedging that transaction back into the investing currency will eventually negate the interest rate earned. In turn, this will inevitably slow down the flow of funds into U.S. bond markets—although interest rates certainly may continue their recent move higher.

A year ago, I observed that a strong U.S. dollar would have a negative impact on U.S. multinationals. Today, we clearly see that this has occurred. A strong U.S. dollar is deflationary. Commodities priced in dollars are declining, with the possible exception of crude oil, which is a geopolitical story in and of itself. Imports are becoming cheaper for the U.S. consumer, which is putting pressure on multinationals. Large multinationals have had to slowly increase wages, but have been largely unable to pass that cost through to the consumer. Multinational company margins are getting pressured.

The Bank of England devalued its currency by lowering interest rates after the haircut the British pound suffered as the U.K. voted to leave the European Union. This effectively deflates the value of the pound. Here in the U.S., the FOMC seems to be itching to raise interest rates, which would also make the U.S. dollar stronger. Remember, a weak currency can be inflationary, while a strong currency can be viewed as deflationary.

For example, should one want to buy real estate in London with strong dollars, it is much cheaper today than it was a couple of months ago. A London hotel room and many other services in the U.K. should continue to be less expensive for U.S. visitors.

FIGURE 1: U.S./U.K FOREIGN EXHANGE RATE

English companies might now be so cheap as to become the target for takeovers, assuming there are quality U.K. companies left in existence following the number of acquisitions over the past three decades. Imports from England are also becoming cheaper. Is it any wonder that England is now the hot destination for tourism? Brexit put England on sale not only for tourists, but also for bankers. If English companies were fairly valued before Brexit, they are downright cheap now.

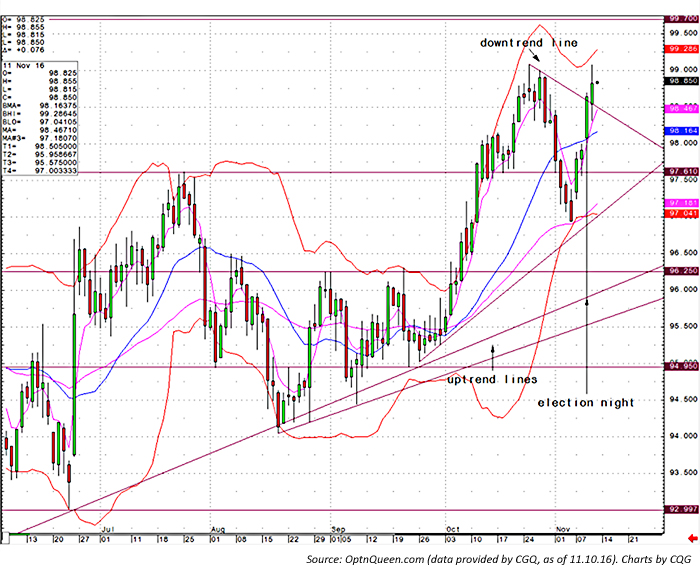

Please see the weekly chart of the U.S. Dollar Index as of Nov. 10, 2016. The dollar is above the uptrend line but needs to break above 98.64 to inspire the shorts to cover their positions. If it goes above 99.0, panic might inspire any shorts left to cover their positions, taking this index to near the par-100 level. (Editor’s note: The dollar did break the 100 level on Nov. 14.)

FIGURE 2: WEEKLY CHART OF THE U.S. DOLLAR INDEX

The surprise election of Donald Trump as U.S. president struck a bolt of fear in the overnight equity futures and currencies session. The S&P 500 plunged as our foreign trade partners became fearful of our new president. The Mexican peso fell, the Canadian dollar was pressured, and the U.S. Dollar Index took a leap to the upside. Interest rates on the 10-year Treasury bond jumped from 1.85% to 2.11%. The British pound has shown something of a rebound following the U.S. election. Some traders believe the currency was oversold following Brexit and that Trump’s election may be leading to a global “reflation trade.”

We do not know what the future will bring as markets continue to digest the election news. The post-election U.S. equity rally surprised many analysts, and it is a very fluid situation. I do suggest that traders and investors keep a very close eye on the currency and bond markets for signals that can often be well ahead of equity market moves.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com