Active, risk-managed strategies always have a game plan for bear markets long before they occur. They have a strong rules-based exit strategy in place when they make their first investment purchases at the start of any new bull market. Active managers are realistic; they know that all bull markets end with a bear market.

Many managers profess to being active and having a risk-management strategy, but investors won’t know who does until a real bear market occurs. As Warren Buffett stated, “Only when the tide goes out do you discover who’s been swimming naked.”

First, check to make sure your strategy really has a defense. If your investment approach has not applied the brakes yet, it probably does not have an adequate risk-management strategy.

Second, if risk management is important to you, move now to a strategy that has demonstrated both a strong offense and strong defense. The Denver Broncos’ Super Bowl win is a great demonstration of having both a great defense and talented offense. (Yes, our firm is located in Colorado!)

Third, and most important, think of this bear market as a window of opportunity to get positioned for the next cyclical bull market. That means doing the research today for winning equity strategies that can do well in both up and down markets.

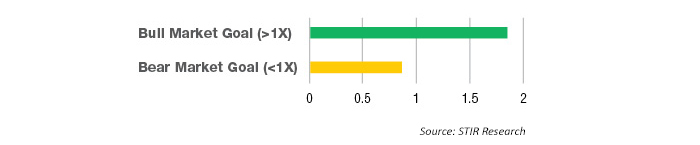

In our book, “Dow 85000! Aim Higher!,” we presented two rules-based risk-managed sector strategies (Sector Growth and Ultra Sector) that strived to do 150% better than the broad indexes in bull markets and perform no worse than major indexes (such as the S&P 500) in bear markets (see Exhibit 1). If that could be accomplished, over a series of cyclical bull markets followed by cyclical bear markets in the 20-year long-term secular bull that we are forecasting, a final return of over 2100% could be achieved versus 700% for the market. Sounds outrageous, but that math works because of compounding gains and controlling losses.

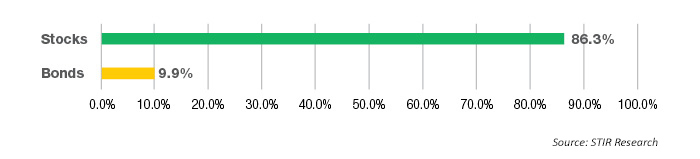

Stocks versus bonds (9/2011-5/2015)

Lastly, think about your bond allocations at this time with the attitude of “buy low, sell high.” Bonds have been rallying, while stocks have been falling. Get prepared and think ahead. We believe the next major move will be another bull market in equities. During the last bull market, bonds lagged (up 9.9%) and stocks ruled (gaining over 86%) (see Exhibit 2). This should be a cautionary note for what might occur again.

Use the window of opportunity during this bear market to get positioned in true risk-managed active strategies that will add value during the next equity bull market and protect against future bear markets.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com