When analysts look at investment markets, they frequently look for confirmations from other markets and other indicators to gain confidence in their conclusions. One of the indicators I have found to be useful is an indicator kept by Tom McClellan, editor of The McClellan Market Report newsletter and its companion, Daily Edition.

Many of us, Mr. McClellan included, have followed high-yield bonds for years because we understand their performance is closely linked to the performance of the equity market. McClellan has gone one step further. Instead of just looking at the price pattern of high-yield bonds, he has created an advance/decline (A/D) line of high-yield bonds. The advance/decline line indicator was not created by McClellan, but he is the only market analyst I know of that has created such an indicator for high-yield corporate bonds and maintains it in real time.

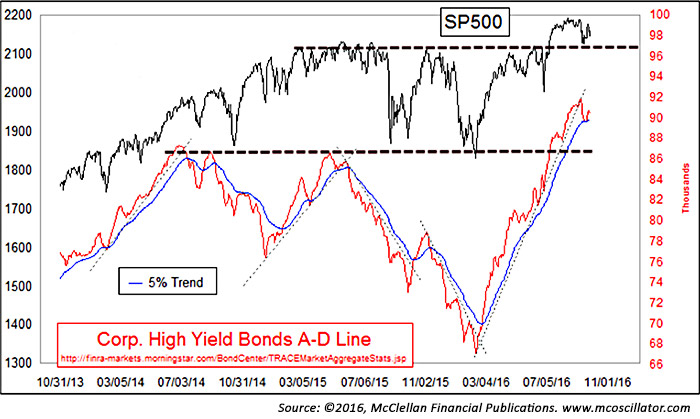

FIGURE 1: HIGH-YIELD BOND A/D TREND VS. S&P 500 (Oct. 2013–Sept. 2016)

Given that background, we can look at Figure 1 and see some interesting periods of time when we had confirmation and others when we did not.

First let’s look at periods when we had confirmation. One was when the S&P 500 rallied in late 2013 into 2014. Another was when the S&P 500 declined in late 2015 into early 2016. And let us not overlook the new highs set in the S&P 500 earlier this year, when the index and the A/D line both moved to new all-time highs.

On the other hand, there are “periods of nonconfirmation.” For example, if we look at the middle of 2015, we can see that the S&P 500 moved to new highs, but the corporate high-yield bond A/D line did not. For technical or quantitative analysts, this nonconfirmation was a warning flag worthy of concern. As the stock market struggled sideways through the summer of 2015, it eventually gave way to a correction that brought the index in alignment with what the high-yield bond A/D line was representing in its fairly steady decline.

Managers who design strategies around concepts like this look for confidence in the rules they design and follow to make buy and sell decisions. Looking at Figure 1, the S&P 500 Index provides the actual price trend that institutions and retail investors “invest in,” but the high-yield bond indicator provides a strong level of confidence—or raises concerns—that the buy or sell decision is the correct action to take.

It should be noted that high-yield bonds pose their own unique risks apart from equities. For example, they generally have credit risk that is higher than many equities. High-yield bonds also are generally less liquid than many equities. This lack of liquidity makes high-yield bonds less susceptible to short-term news events such as the U.K.’s Brexit vote in June 2016. You will note in Figure 1 that while the S&P 500 had a rapid and sharp decline immediately following the Brexit vote, the high-yield bond indicator had little reaction. For this reason and others, the high-yield bond A/D indicator perhaps offers better guidance over intermediate-term and long-term trends.

This is just one of many examples of indicators that are used to gain confidence when making buy and sell decisions for assets committed to domestic or international equities, bonds, or alternative assets. In the end, we all invest in the price, but we look to indicators to help guide us to make sound decisions on when to buy and sell.

Peter Mauthe is vice president of corporate development at Flexible Plan Investments, Ltd., where he develops new business initiatives and implements corporate and business-level strategies. Mr. Mauthe has been an independent market maker on the Chicago Board Options Exchange; served as president of the American Association of Professional Technical Analysts; and was president, chairman, and director of the National Association of Active Investment Managers (NAAIM). flexibleplan.com

Peter Mauthe is vice president of corporate development at Flexible Plan Investments, Ltd., where he develops new business initiatives and implements corporate and business-level strategies. Mr. Mauthe has been an independent market maker on the Chicago Board Options Exchange; served as president of the American Association of Professional Technical Analysts; and was president, chairman, and director of the National Association of Active Investment Managers (NAAIM). flexibleplan.com