An age of fiscal limits

An age of fiscal limits

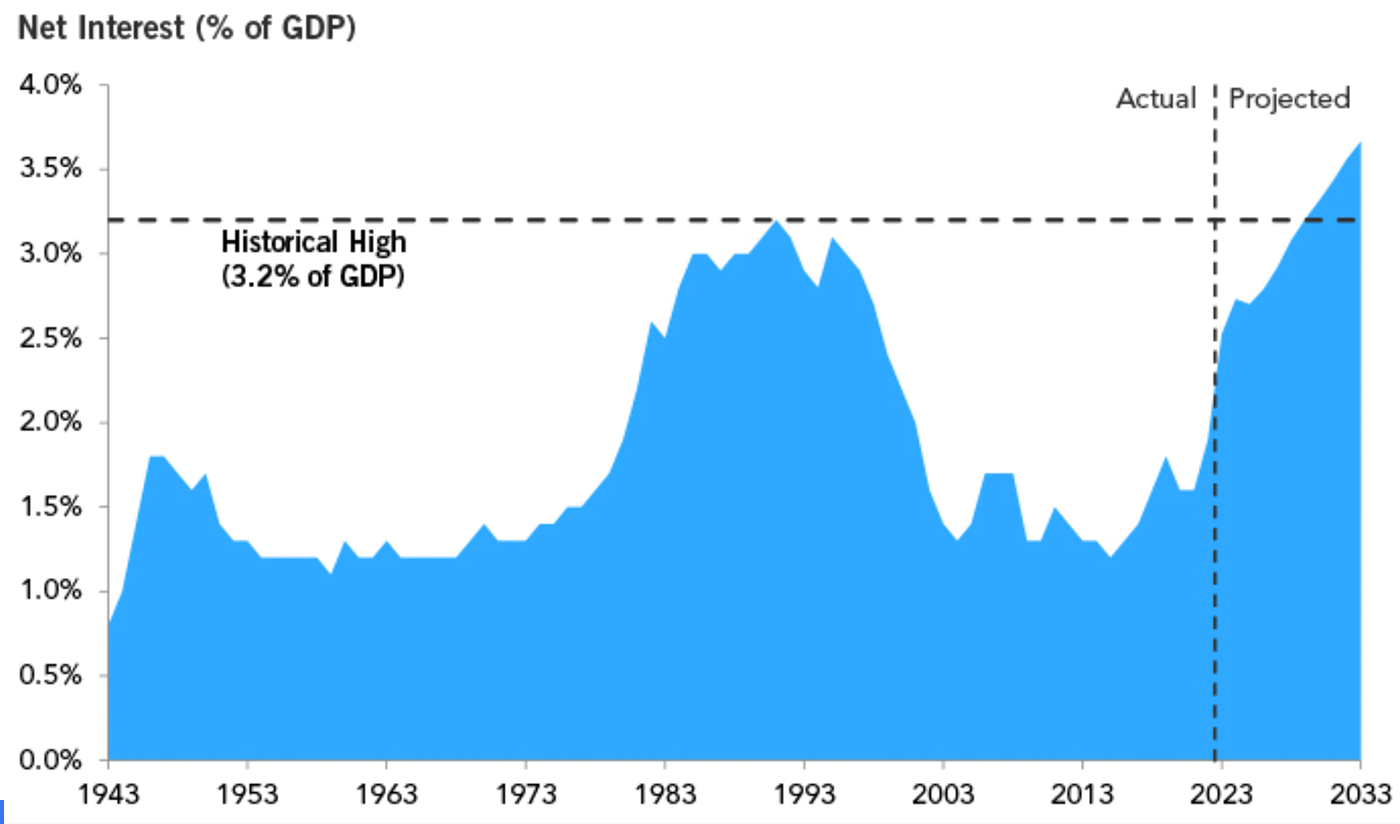

A historical perspective on servicing the national debt

Wars cost money, and throughout history, countries have borrowed to fight them. There are plenty of examples of wars bankrupting countries, but the U.S. was so dominant in the 1940s that at the end of World War II, its debt only cost about 1.8% of GDP to service. By 1959, debt service was back down to 1.1% of GDP.

Policymakers then got complacent about the budget in the 1960s and 1970s. Great Society programs included Medicare and Medicaid. Vietnam spending was huge. The Federal Reserve attempted to monetize all this spending, and inflation sent interest rates higher. The result: Between 1982 and 1998, interest on the national debt averaged about 3.0% of GDP.

But as rates rose, the U.S. worked to get its act together. Former President Ronald Reagan spent to win the Cold War but slowed spending in other areas. The peace dividend that resulted, in addition to budget deals between former President Bill Clinton and former House Speaker Newt Gingrich, led to balanced budgets. In turn, the interest burden started heading back down. Between 2000 and 2020, interest on the national debt averaged 1.5% of GDP.

And even though spending soared during the 2008 financial panic and later during the COVID pandemic, the Fed was holding interest rates artificially low and monetizing some of that spending.

Evaluating the current and future debt-servicing burden

But just like the 1970s, the U.S. is paying the price. Interest costs last year were 1.9% of GDP, the highest since 2001. We’re projecting this year will be 2.5% of GDP, the highest since 1998.

Unlike the 1980s, however, politicians don’t seem interested in changing course. The U.S. isn’t Argentina, but as the interest burden climbs back to 3.0% of GDP, we believe it will capture the attention of more politicians, who won’t like sending so much money to bondholders. In turn, that should generate some bipartisan interest in finding ways to bring the interest share of GDP back down.

But here’s the problem: Back in the 1980s–1990s, as policymakers started focusing on controlling budget deficits (remember the Gramm-Rudman-Hollings acts in 1985 and 1987 and the Bush budget caps in 1990), they had some favorable winds at their backs.

The Reagan-led victory in the Cold War led to a “peace dividend.” National defense spending peaked at 6.0% of GDP in 1986 and then dropped to 2.9% by 1999. Meanwhile, the baby-boom generation wasn’t collecting Social Security or Medicare. In fact, that generation was in its peak earning years and paying into those programs. That demographic wave plus lower spending and the legacy of the Reagan tax cuts meant robust economic growth.

Bottom line: We controlled discretionary spending (like the military budget), didn’t enact new entitlements, and then essentially grew our way out of the problem. But growing our way out of the current budget situation will be much tougher.

Interest rates declined substantially in the early 1980s, as inflation was tamed. They then fell further when the Fed switched to its abundant reserve policy and manipulated them lower. So even when economic growth was strong, the budget was helped by these lower rates. But faster economic growth usually comes with higher long-term interest rates than we have experienced in recent years. It’s a conundrum that AI can’t solve.

Meanwhile, the baby-boom generation is now drawing on Social Security and Medicare and leaving the workforce, putting persistent upward pressure on federal spending. In addition, the peace dividend is gone, and the U.S. must prepare for a potential military confrontation with China in the decade ahead.

The U.S. is on the cusp of some very big budget challenges. If policymakers don’t address entitlement spending, expect worse budget news in the years ahead. Whether voters actually hold politicians’ feet to the fire will determine whether the U.S. becomes another Argentina, or France, or finds its way back to fiscal sanity as it has in the past.

Editor’s note: This figure was developed by the Peter G. Peterson Foundation, based on U.S. government data from the Congressional Budget Office and the Office of Management and Budget.

Sources: Congressional Budget Office, an update to the Budget Outlook: 2023 to 2033, May 2023; and Office of Management and Budget, Historical Tables, Budget of the United States Government, Fiscal Year 2024, March 2023.

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports. Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on Aug. 14, 2023.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS