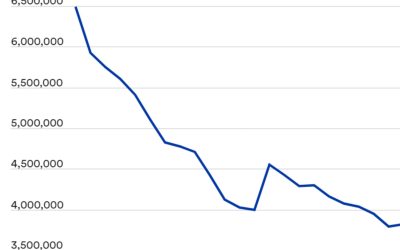

Last week, the U.S. Department of Commerce (Bureau of Economic Analysis) released the first look at Q2 2023 GDP for the U.S., reporting,

“Real gross domestic product (GDP) increased at an annual rate of 2.4 percent in the second quarter of 2023 [Figure 1], according to the ‘advance’ estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.0 percent. …”

In addition to surpassing the first quarter’s GDP growth rate, the preliminary estimate was also above forecasts that ranged from 1.8% to 2.0% estimated growth.

FIGURE 1: REAL GDP—% CHANGE FROM PRECEDING QUARTER

Note: Seasonally adjusted annual rates.

Source: U.S. Department of Commerce (Bureau of Economic Analysis)

In analyzing the report, CNBC wrote,

“Consumer spending powered the solid quarter. …

“Perhaps as important, inflation was held in check through the period. The personal consumption expenditures price index increased 2.6%, down from a 4.1% rise in the first quarter and well below the Dow Jones estimate for a gain of 3.2%.

“Consumer spending, as gauged by the department’s personal consumption expenditures index, increased 1.6% and accounted for 68% of all economic activity during the quarter. That did mark a pullback from the 4.2% increase in the first quarter but still showed resiliency amid higher interest rates and persistent inflation.

“In the face of persistent calls for a recession, the economy showed surprising resilience despite a series of Federal Reserve interest rate increases that most Wall Street economists and even those at the central bank expect to cause a contraction. …

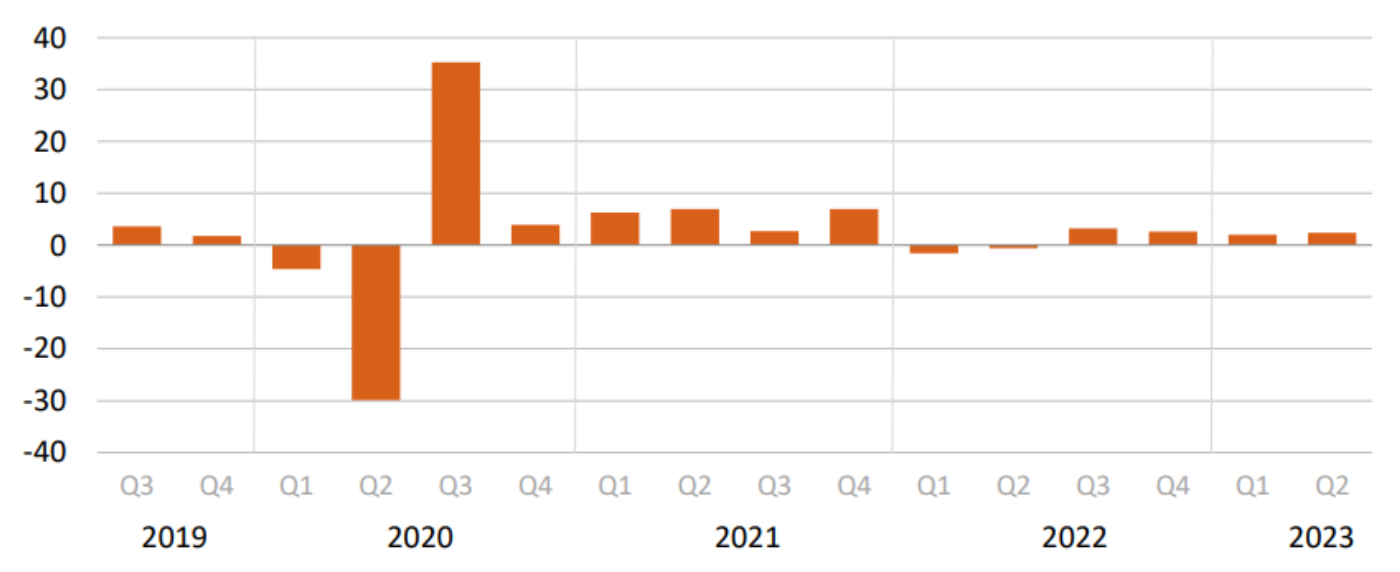

“Powerful employment gains and a resilient consumer are at the heart of the growing economy.

“Nonfarm payrolls have grown by nearly 1.7 million so far in 2023 and the 3.6% unemployment rate for June is the same as it was a year ago.”

FIGURE 2: UNITED STATES NONFARM PAYROLLS GROWTH

Sources: Trading Economics, U.S. Bureau of Labor Statistics

Will economic growth continue throughout 2023?

Despite the positives in the GDP report, Barron’s recently pointed to some discouraging signs:

“But economic activity wasn’t quite as robust as the headline number suggests, given decelerating growth in consumer spending.

“That leaves the economy more dependent on the more volatile components of gross domestic product, namely business investment and government spending. ‘GDP growth in the second quarter was stronger than expected, but the result is hiding a strong slowdown in consumer demand, which accounts for two thirds of GDP,’ says Eugenio Aleman, chief economist at Raymond James.

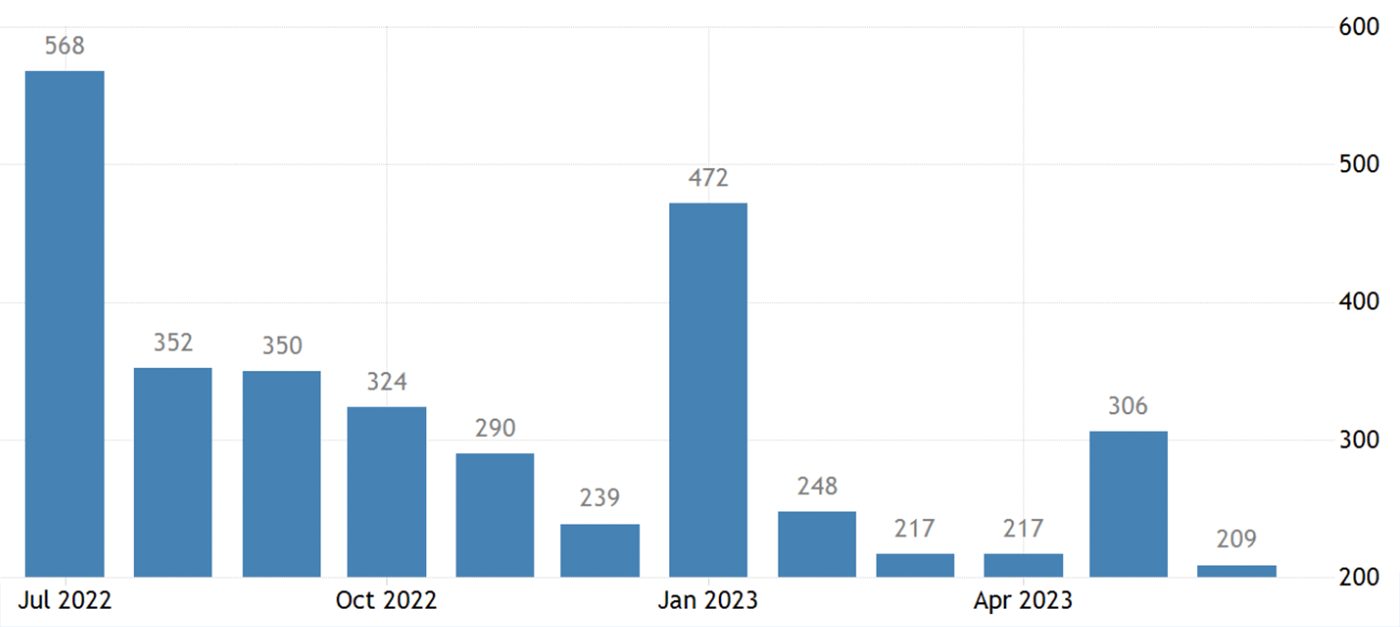

“Personal consumption expenditures grew by 1.6% in the quarter, down from the first quarter’s 4.2%. In general, Americans spent more on services than goods in the period.

“‘Consumers are still willing to spend, but they have become increasingly cautious and selective amidst still-high prices and tighter credit conditions,’ says Gregory Daco, chief economist at Ernst & Young’s global strategy consulting arm. ‘This has translated into much slower consumer-spending momentum after a strong start to the year.’

“Thursday’s GDP number likely confirms the idea that the U.S. economy will have a soft landing, wherein inflation moderates without a significant economic downturn, Daco says. But it is unlikely to alter the Federal Reserve’s tough stance on taming inflation.”

FIGURE 3: DISPOSABLE PERSONAL INCOME, OUTLAYS, AND SAVING

Source: U.S. Bureau of Economic Analysis, seasonally adjusted

On July 12, before the Q2 GDP report, The Conference Board published a fairly pessimistic outlook for the remainder of 2023, and even more negative for 2024, saying,

“The Conference Board forecasts that weaknesses emerging in some parts of the economy will intensify and grow more diffuse over the coming months, leading to a recession. This outlook is associated with numerous factors, including, persistent inflation, Federal Reserve hawkishness, dampened bank lending amid the banking crisis, reduced government spending due to the debt ceiling deal, and the resumption of mandatory student loan repayments. We forecast that real GDP growth will slow to 1.3 percent in 2023, and then fall to 0.1 percent in 2024.

“Consumer spending has either been flat or fallen in four of the last six months. However, a large spending spike in January and a smaller spike in April have more than offset this anemia. While demand for services has continued to expand, demand for goods has begun to decline. As real income growth cools and savings dwindle, we expect consumers to pull back on spending. We forecast that overall consumer spending will grow in Q2 2023 but anticipate a contraction in H2 2023.”

On a more positive note, The Conference Board’s chief economist Dana Peterson reported,

“Consumer confidence rose in July 2023 to its highest level since July 2021, reflecting pops in both current conditions and expectations. … Headline confidence appears to have broken out of the sideways trend that prevailed for much of the last year. Greater confidence was evident across all age groups, and among both consumers earning incomes less than $50,000 and those making more than $100,000.”

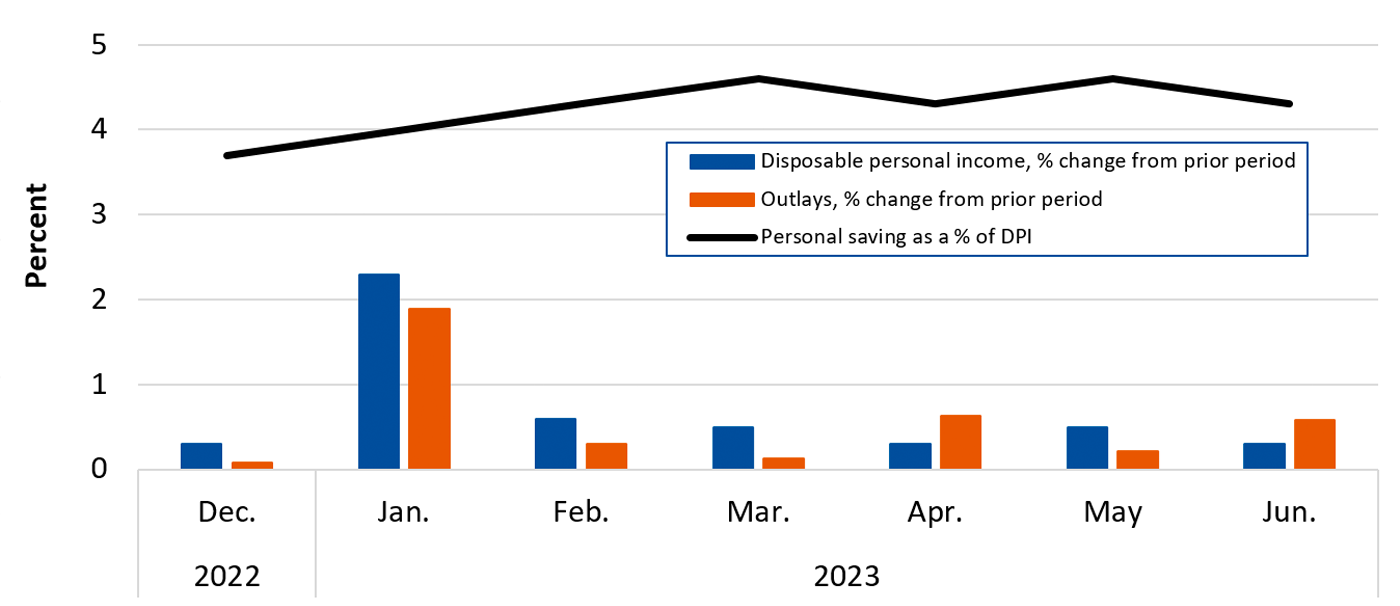

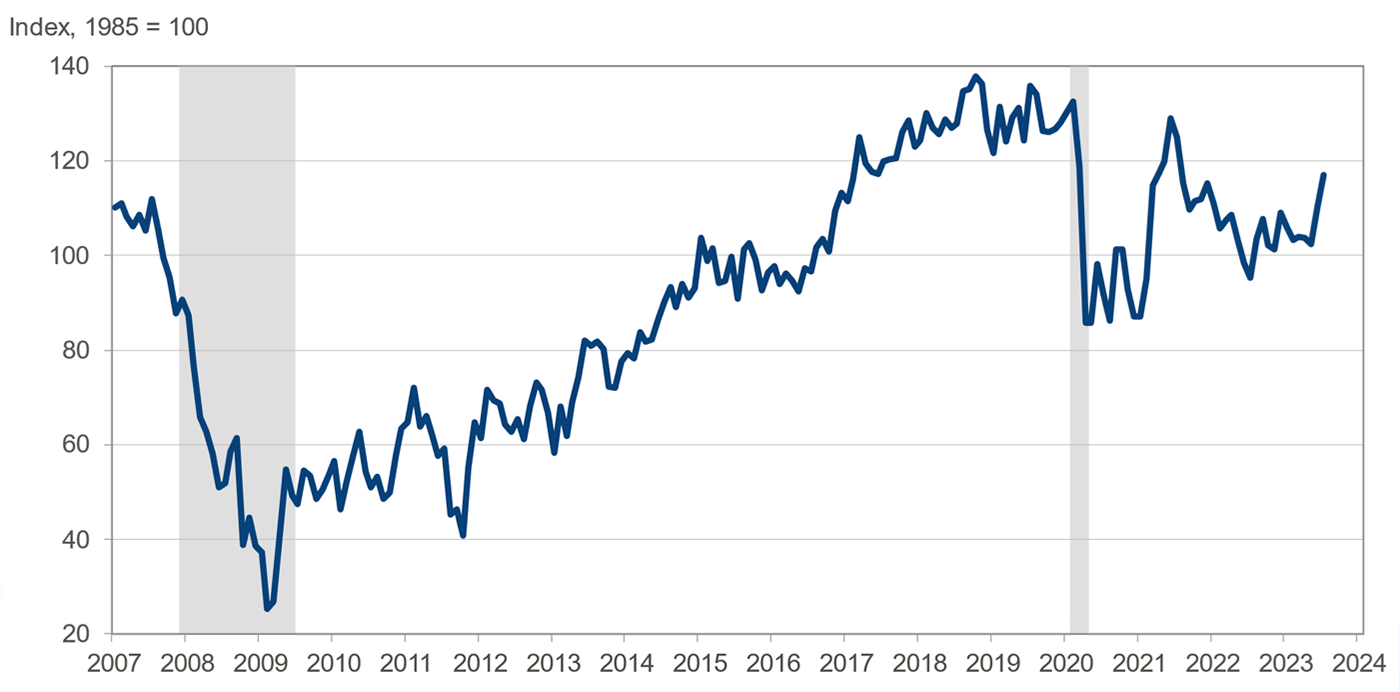

FIGURE 4: CONFERENCE BOARD CONSUMER CONFIDENCE INDEX

Note: Shaded areas represent periods of recession.

Sources: The Conference Board, NBER

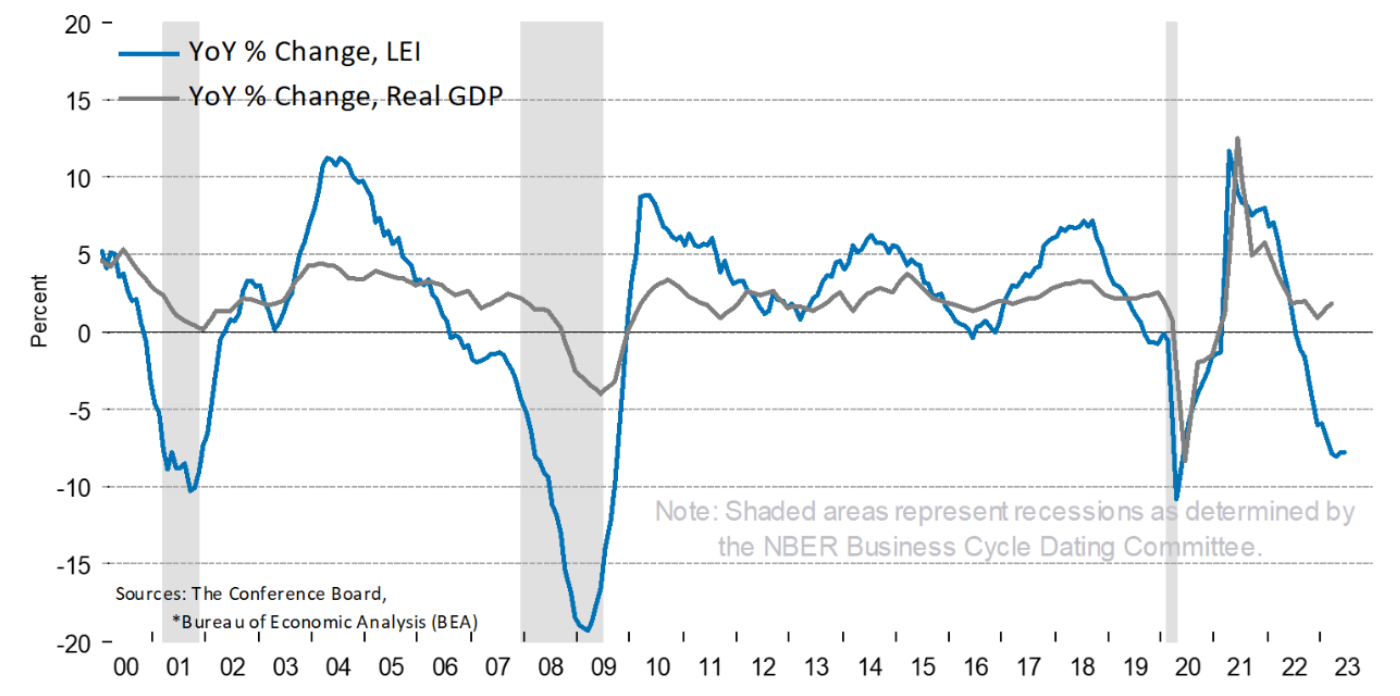

That said, The Conference Board’s widely followed Leading Economic Index remains in a significant downtrend, according to the latest release of data on July 20:

“The Conference Board Leading Economic Index (LEI) for the U.S. declined by 0.7 percent in June 2023 to 106.1 (2016=100), following a decline of 0.6 percent in May. The LEI is down 4.2 percent over the six-month period between December 2022 and June 2023—a steeper rate of decline than its 3.8 percent contraction over the previous six months (June to December 2022). …

“The Leading Index has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession. Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead. We forecast that the US economy is likely to be in recession from Q3 2023 to Q1 2024. Elevated prices, tighter monetary policy, harder-to-get credit, and reduced government spending are poised to dampen economic growth further.”

FIGURE 5: NEGATIVE GROWTH RATE OF THE LEI SIGNALS CONTINUED SLOWING IN ECONOMIC ACTIVITY

Sources: The Conference Board, Bureau of Economic Analysis (BEA)

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

RECENT POSTS