Adding active management into the portfolio-construction equation

Adding active management into the portfolio-construction equation

A passive core is not enough: Part II

A multi-strategy core approach to portfolio construction addresses the issues present with other methodologies, which include a lack of consideration of risk, the loss of diversification benefits during crisis periods, and risk concentration in single strategies.

In Part I of this paper, we applied established asset-allocation methodologies (equal weight, Markowitz, and risk parity) to passive asset-class investments (Lipper mutual fund indexes). In our next step, we apply these same routines to dynamically risk-managed mutual funds. This potentially provides two levels of risk management. The first would be within the “actively” managed funds. The second would be by allocating among the funds.

Advantages

Active management within mutual funds seeks to achieve higher returns and/or less risk. Until the 21st century, actively managed funds offered to the public were, in general, strictly limited by their prospectuses to a certain number of asset classes and to a very limited level of activity. Tactically managed funds were rare, as were global macro strategy funds that could seek out investments in multiple asset classes.

Tactical and global macro management strategies have traditionally been offered in the form of hedge funds or separately managed accounts. While many investors believe such strategies are principally for “beating the market” in the short term, studies show their primary purpose is to deliver better risk-adjusted returns over a complete market cycle, which encompasses both a bull and a bear market.

A passive core

is not enough

This two-part guest commentary

by Flexible Plan Investments explores

why investors should reconsider

the construction of their portfolios’ core.

According to “Why Market Timing Works,” published in the Journal of Portfolio Management,

“There are a growing number of timers who consistently outperform the market over a full market cycle—both bull and bear. When risk-adjusted return is used as the standard to measure performance—as dictated by modern portfolio theory—even the average market timer outperforms the market by a notable margin (see Wagner, Shellans, and Paul [1992] and Hulbert [1993]).

“A study of twenty-five market timers by Wagner, Shellans, and Paul [1992] looks at the level of risk and returns achieved by the timers during the period 1985 to 1990, which includes the bear market of 1987 and the market’s three-month decline in 1990. During this period, the level of risk assumed by the average timer was 40% to 60% below the S&P 500, even after subtracting fees. Even adjusted for relative market exposure (57% in stocks, 43% in cash), the average timer’s risk-adjusted return premium remains considerable.”

There are many advantages of dynamic risk management, including the following:

- It can help avoid the mediocre returns inherent in a diversification-only risk-management approach.

- It has the ability to respond to the market environment.

- It addresses the difficulty of persuading investors to add to losing positions and reduce winning positions (as is required by mean-variance optimization).

- It can take advantage of short-term opportunities to achieve higher profit and to avoid risk and volatility.

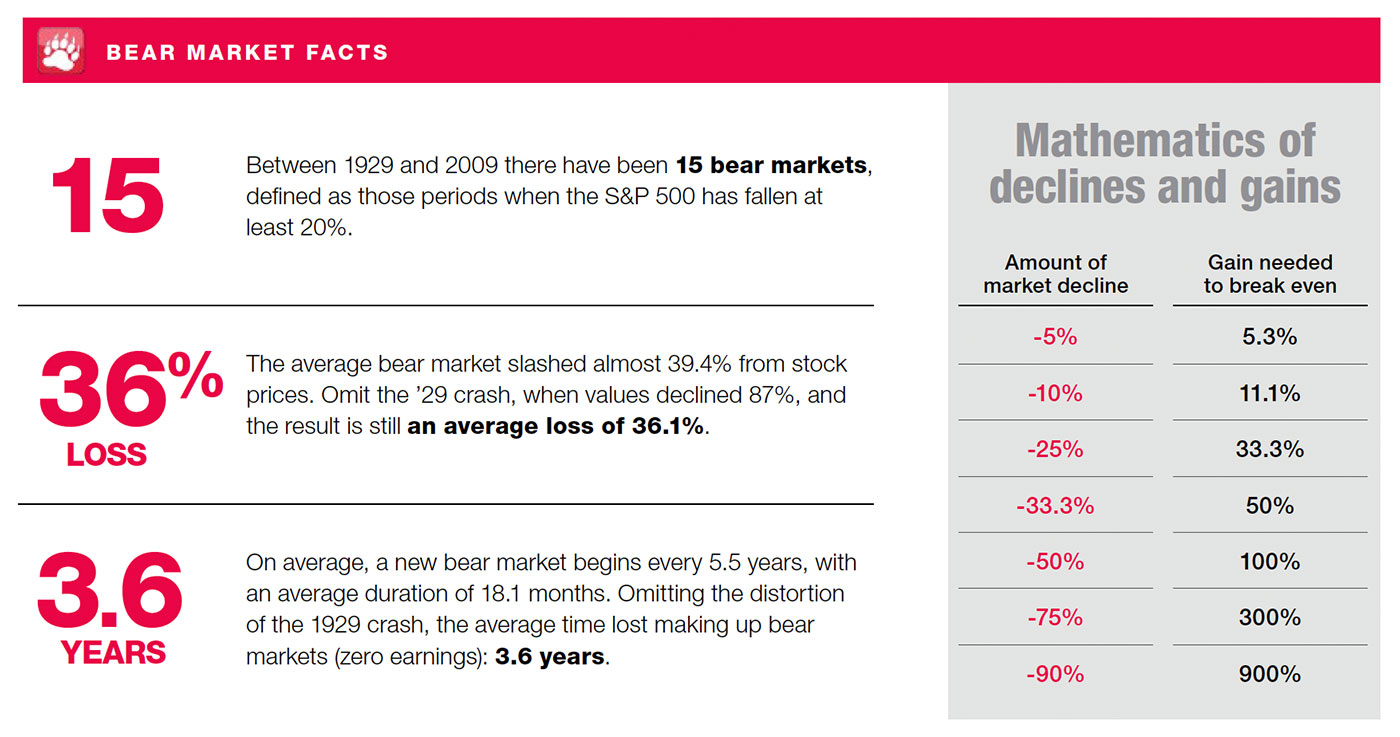

The mathematics of losses (Figure 11) demonstrates how important it is to manage risk during downturns.

Source: Flexible Plan Investments Research

Next, we examine the results of combining the traditional allocation approach with dynamically risk-managed funds (instead of passive asset classes).

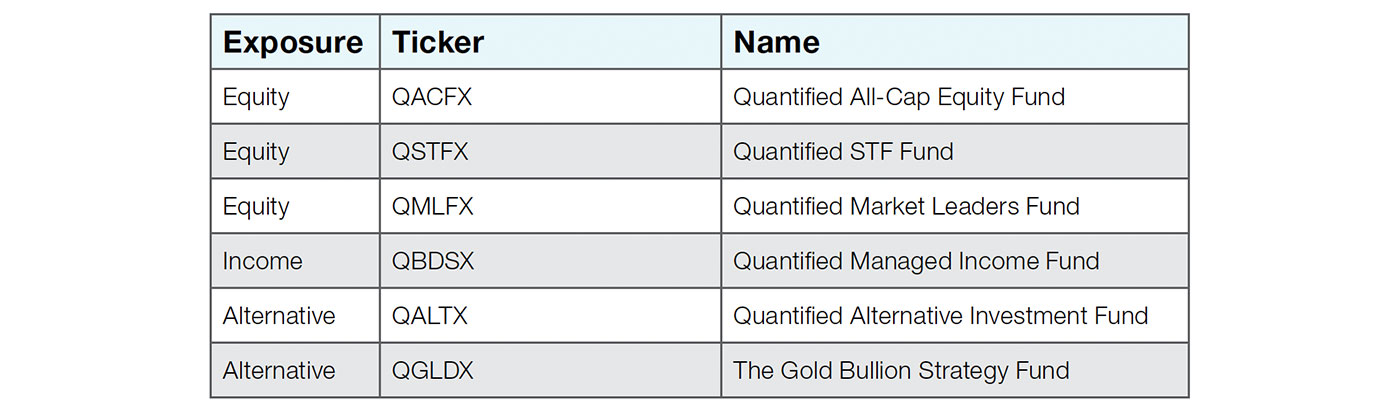

As the funds themselves have not been available for the period of our previous studies, we allocate among six hypothetical, backtested funds that seek to replicate strategies currently used in the affiliated funds listed in Table 4, which are subadvised by Flexible Plan Investments. Employing a cloning technique, we hypothetically extend the subadvised strategies employed by the funds over a period exceeding the actual lifetime of the funds (see Disclosures in complete white paper). Therefore, these results are not represented to be those of the actual funds listed in Table 4.

We will apply mean-variance optimization as the allocation approach using the results of the cloned, hypothetical fund strategy. Flexible Plan Investments offers a managed account strategy that actually does this called Dynamic Fund Profiles, which supports five suitability-based portfolios.

Source: Flexible Plan Investments Research

Note: The funds are each risk managed by a multitude of dynamic strategies, while the gold fund (which is subadvised by Flexible Plan Investments, Ltd., but is not a part of the Quantified Fund family) simply tries to produce daily returns consistent with those generated by gold bullion.

Analysis

An allocation methodology applied to actively managed funds should reduce risk and drawdown significantly without sacrificing returns, which we saw when mean-variance optimization was applied to passive asset classes.

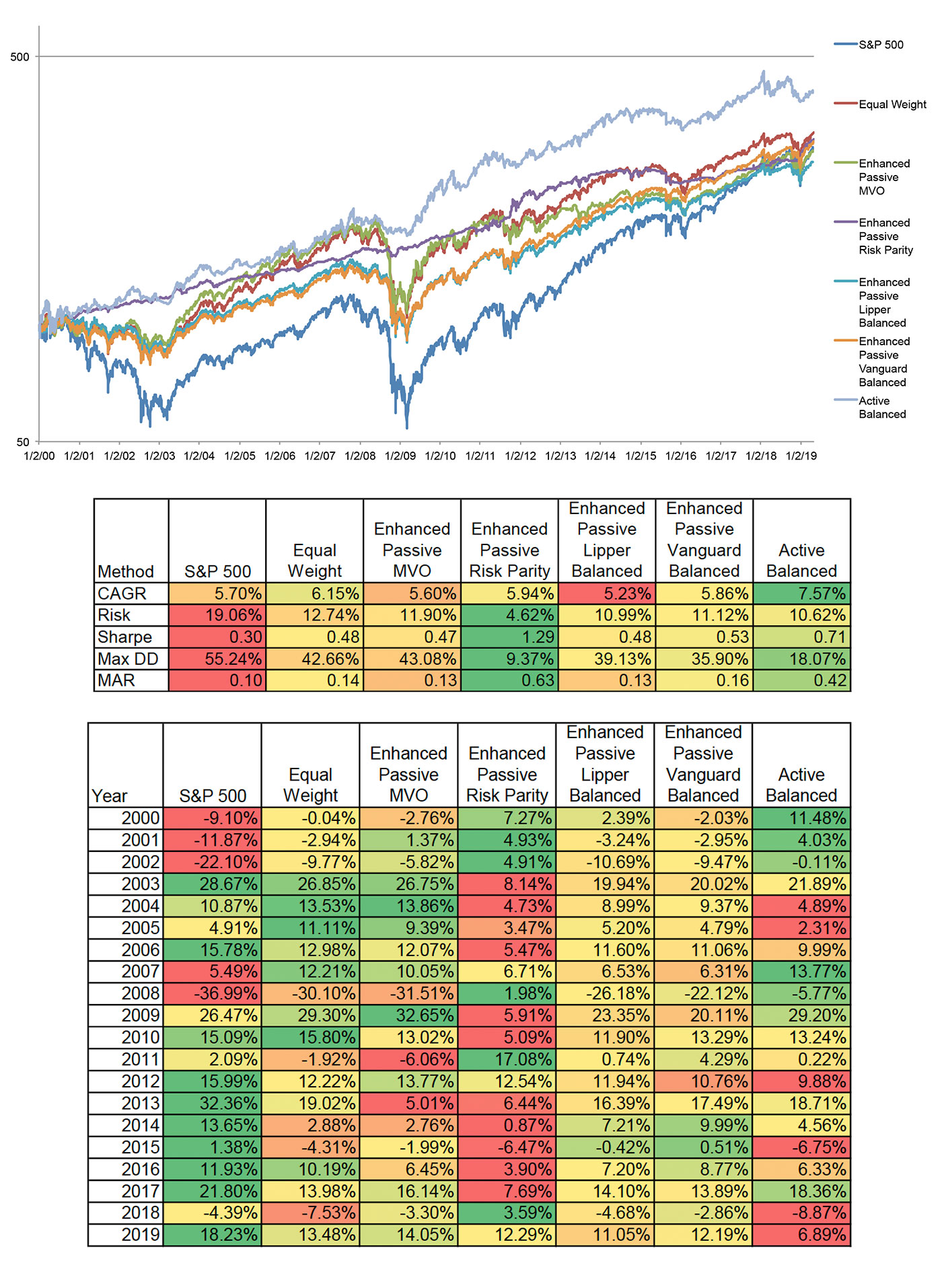

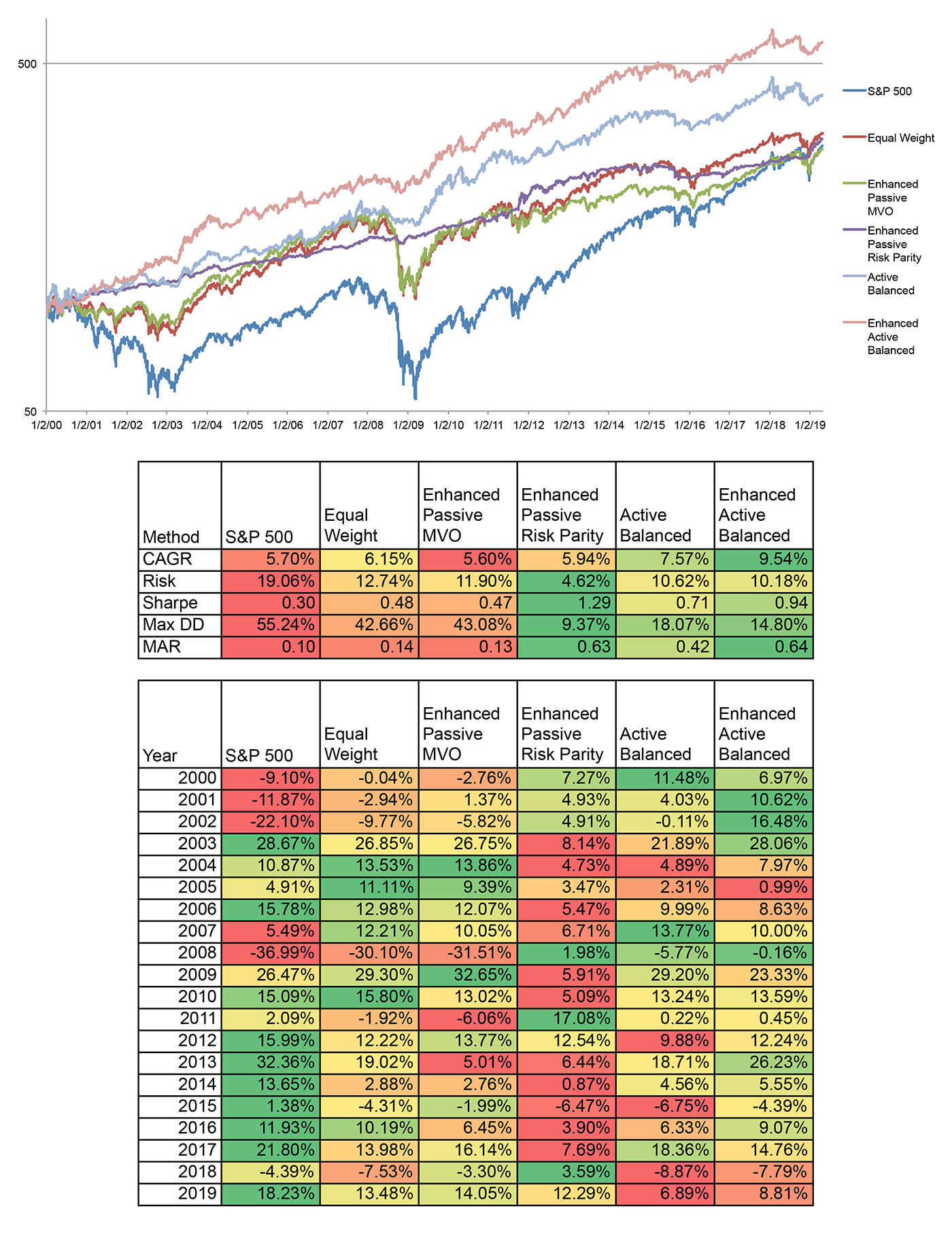

This is exactly what the research shows. Figure 12 demonstrates the benefits of applying active risk management at the investment level: returns increase, risk decreases, and the risk-adjusted measures substantially improve. The risk reduction is especially evident in 2008: Losses using actively managed investments were reduced to below 5.77%. Compare that to the 42.66% loss experienced using equal weight in Figure 12. And the enhanced mean-variance optimization approach does even worse by this measure.

Most notable is the improvement in the MAR ratio (return/max drawdown), going from 0.14 for passive mean-variance optimization to 0.42 for the active balanced approach. The max drawdown is reduced from 42.66% (passive mean-variance optimization) down to 18.07% (active), while return after max fees outperforms passive mean-variance optimization by 1.42% on an annualized basis.

Source: Calculations are by Flexible Plan Investments Research. Returns are hypothetical and backtested. The chart in this figure uses a logarithmic scale. See white paper for further notes on methodology.

Issues

As good as these results are, both absolutely and when compared with the results of restricting one’s investments to passive asset classes or index funds, it is important to note that Dynamic Fund Profiles is just one strategy. By investing in a single dynamic strategy, you are still putting all of your eggs in one strategy’s basket.

Studies show that different strategies are better suited for different market environments. For example, hedge fund manager Ray Dalio of Bridgewater Associates states that “any single approach to investing—e.g., investing in any asset class, investing via any investment style (such as value, growth, distressed), investing in anything—will experience a time when it performs so terribly that it can ruin you.”

Investing in a single strategy exposes you to strategy-specific risk that can be largely diversified away by using a multi-strategy approach, as presented in the next section.

Dynamic risk management of dynamic strategies adds a third layer of risk management to the two benefits that can be achieved through asset allocation of dynamically managed funds. It also solves the problem of putting all of your eggs in one strategy’s basket.

This method uses different core allocation strategies that can be created to use the actively managed funds. It then dynamically invests among multiple core strategies that use these funds. Since the method allocates among multiple core strategies, it provides strategy and asset-class diversification and eliminates the concentrated risk that arises when investing in a single strategy. Since these core strategies support five suitability profiles (conservative, moderate, balanced, growth, and aggressive), the resulting “strategy of strategies” can offer five suitability strategies as well.

Advantages

This enhanced active methodology provides diversification of strategies using dynamic allocation. Its portfolio creation process is designed to add multiple layers of turnkey risk management for the benefit of the investor, as detailed in the following section.

Multi-Strategy Core

To further test the efficacy of this new approach, we will examine the hypothetical results of Flexible Plan Investments’ Multi-Strategy Core applied over the study period. Multi-Strategy Core blends Flexible Plan Investments’ suitability-based Quantified Fee Credit (QFC) core strategies to produce portfolios designed to be robust in changing market conditions. Based on over 20 years of experience in creating portfolios employing multiple strategies, the process of combining actively managed strategies is designed to provide additional layers of portfolio defense and return potential.

The goal of the Multi-Strategy Core process is to deliver three levels of risk management:

- The dynamic risk management employed within the funds used in each strategy.

- The active management among the funds required by the strategies themselves.

- The dynamic allocation employed among the strategies by Multi-Strategy Core itself.

To further manage risk, Multi-Strategy Core provides five risk-based profiles (conservative, moderate, balanced, growth, and aggressive) based on investor answers to a suitability questionnaire.

As explained previously, the strategies used by Multi-Strategy Core are predicated on hypothetical results of strategies employing affiliated funds that pay Flexible Plan Investments as subadvisor. Flexible Plan Investments returns all of those fees to investors as a dollar-for-dollar fee credit.

How Multi-Strategy Core works

- Multi-Strategy Core draws from a universe of core strategies that are designed to contend with volatility and deliver superior risk-adjusted returns.

- Multi-Strategy Core monitors and reallocates among these core strategies automatically for the investor.

- Each strategy uses funds that are designed to deliver dynamic, risk-managed performance and fee credits to offset advisory fees.

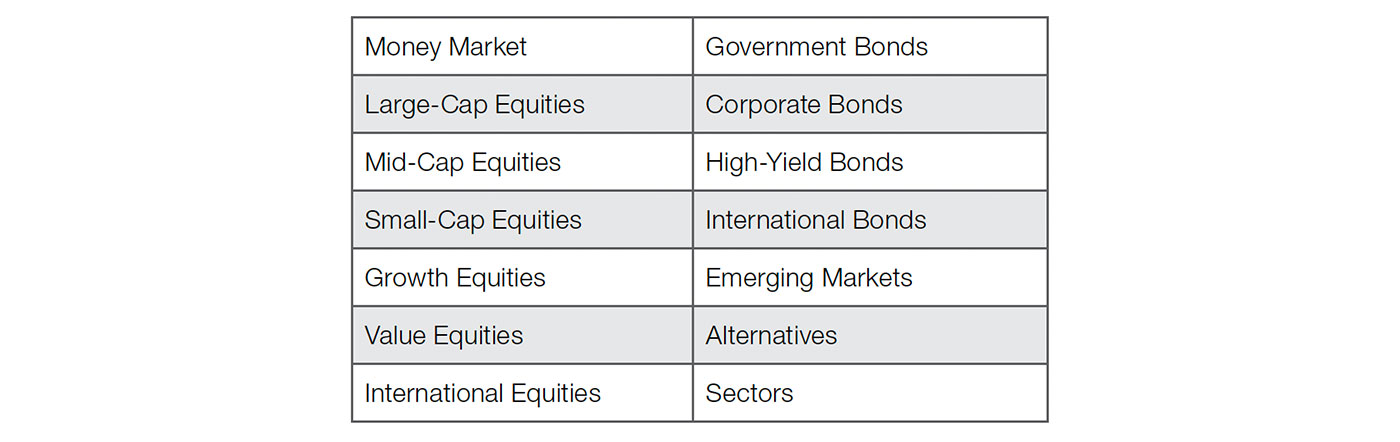

Asset classes currently represented in these QFC strategies are presented in Table 5. Inverse and leveraged positions in such asset classes may also be employed.

Source: Flexible Plan Investments Research

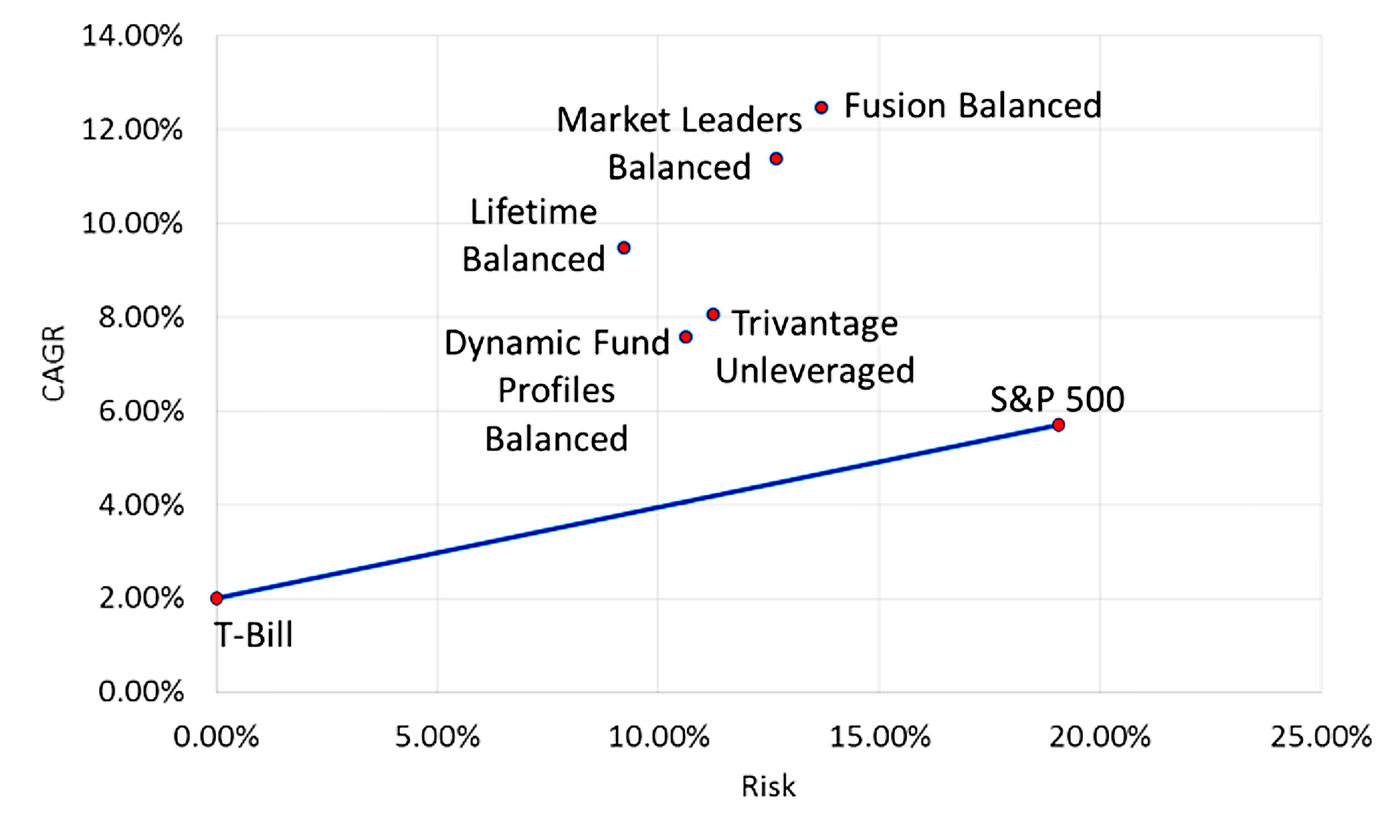

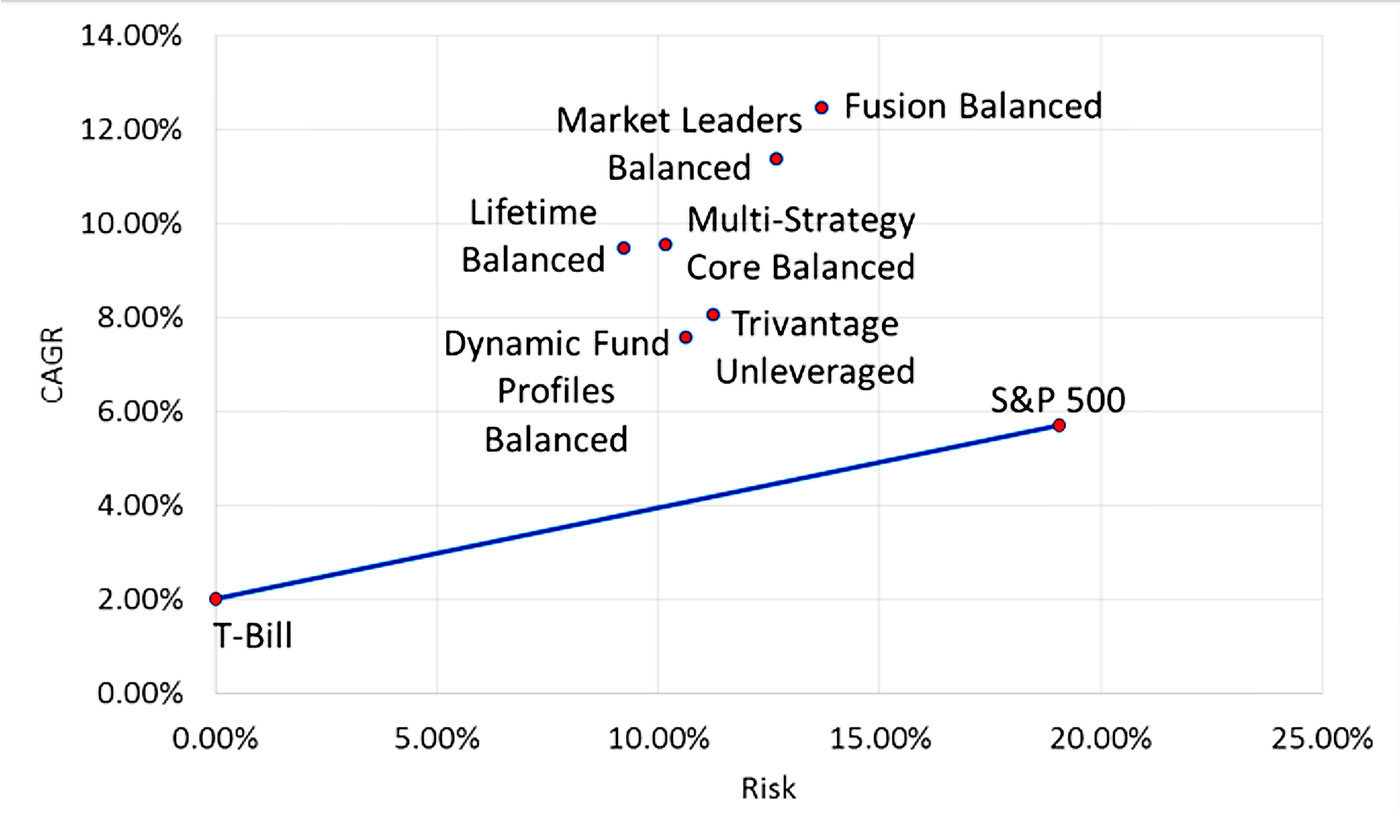

A capital market line chart of the core balanced strategies drawn upon by Multi-Strategy Core is shown in Figure 13. The chart makes clear that while each dot represents a core strategy, even within the Balanced category, results can be very different when measured on both a return and risk continuum.

Source: Flexible Plan Investments Research

Analysis

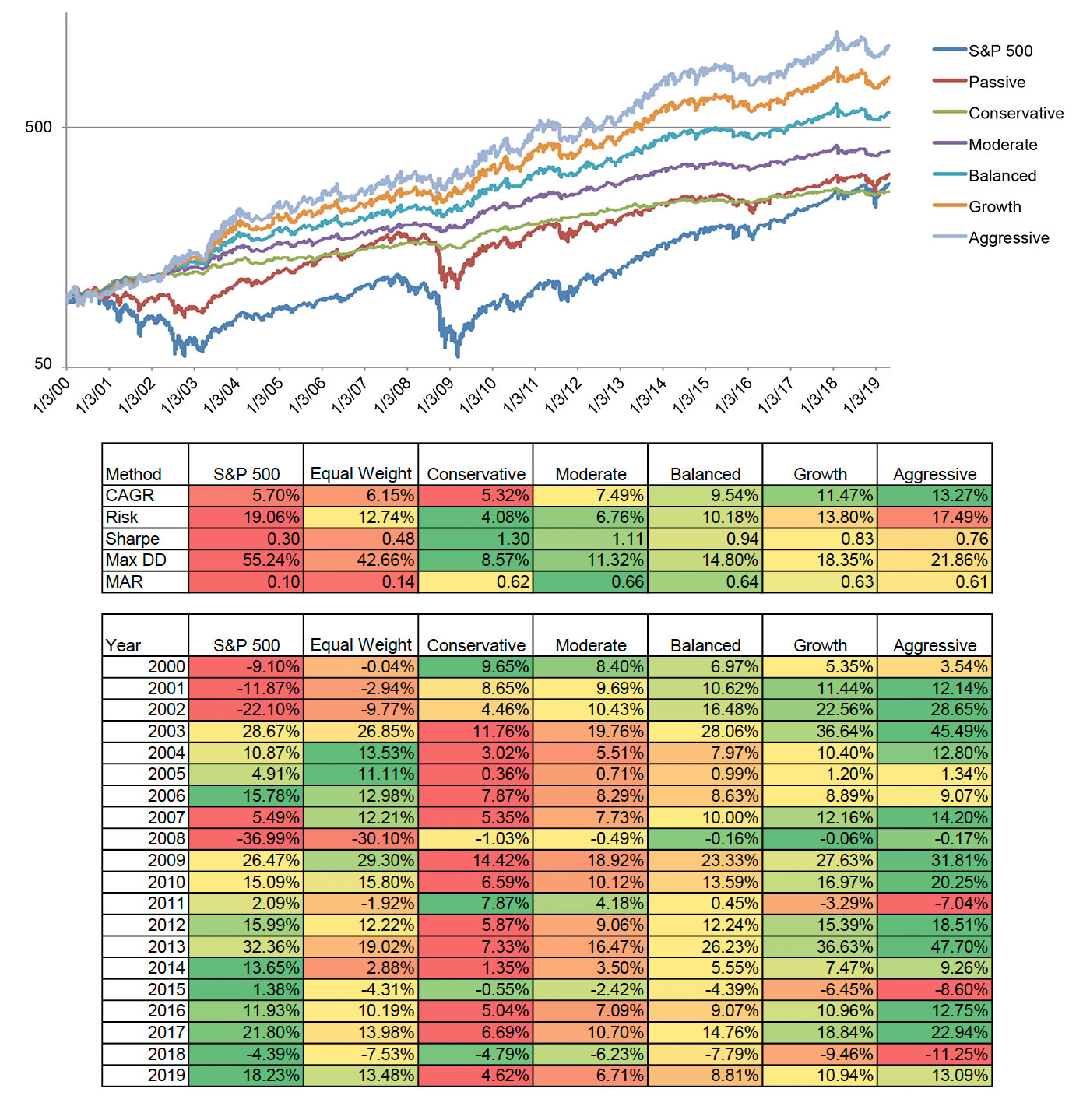

Figure 14 shows the benefits of using this multi-strategy approach. Risk and drawdown are reduced even further versus the single-strategy active method. The Sharpe ratio improves from 0.71 to 0.94, and the MAR increases from 0.42 to 0.64.

Source: Calculations are by Flexible Plan Investments Research. Returns are hypothetical and backtested. The chart in this figure uses a logarithmic scale. See white paper for further notes on methodology.

Investing using this enhanced active approach helps diversify away the concentration risk that can be experienced when investing in one single strategy. This is the case whether that strategy is a passive strategy, such as mean-variance optimization, or an active strategy, such as Dynamic Fund Profiles.

In Figure 15, Multi-Strategy Core (Balanced) is able to achieve a Sharpe ratio of almost 1 by allocating among the core strategies available at Flexible Plan Investments. Since no single strategy has a tendency to outperform in perpetuity, Multi-Strategy Core has an advantage over single-strategy allocation by dynamically allocating to strategies believed to be in favor during rebalance periods. Historically, asset classes and strategies fall in and out of favor with changing market conditions. Overall selection risk can be reduced by using a systematic multi-strategy allocation approach such as Multi-Strategy Core.

Source: Flexible Plan Investments Research

Source: Calculations are by Flexible Plan Investments Research. Returns are hypothetical and backtested. The chart in this figure uses a logarithmic scale. See white paper for further notes on methodology.

Source: Flexible Plan Investments Research

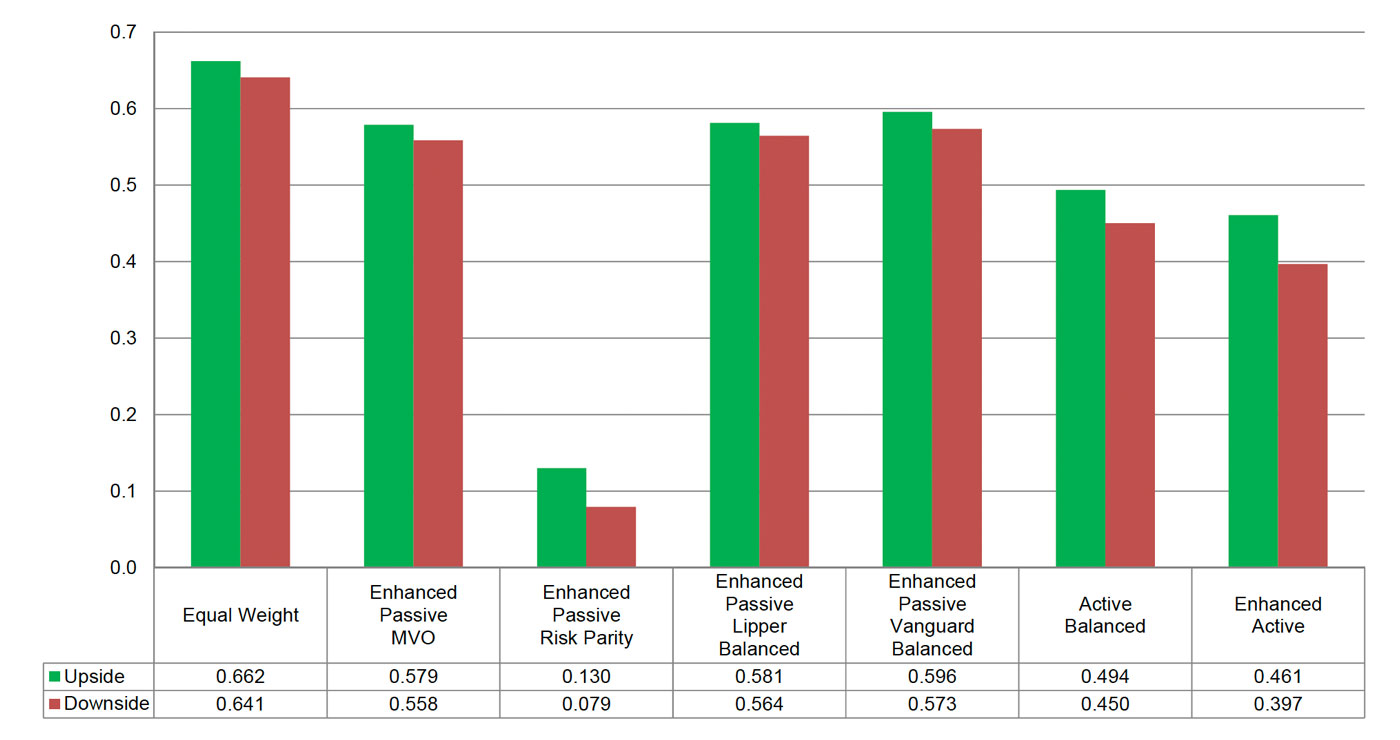

Asset diversification using a passive (equal-weight) asset-allocation approach captures roughly 65% of the S&P 500 on both the upside and downside. An active balanced strategy is able to achieve better risk-adjusted performance versus passive with an upside capture of 0.49 and a downside capture of 0.45. Using a Multi-Strategy Core to build an enhanced active portfolio improves the risk-adjusted performance even further with a slightly lower upside capture ratio of 0.46 (versus 0.49 for the active balanced approach) but a greatly reduced downside capture ratio of 0.40 (versus 0.45 for the active balanced approach).

This means that on positive days in the S&P 500, Multi-Strategy Core is able to capture almost 50% of the S&P 500’s return. On down days, it is only subject to around 40% of the loss experienced by the S&P 500. While this can cause the balanced strategy to lag the S&P 500 Index in sustained up periods (in fact, all allocations lag the S&P 500 in such periods), the mathematics of losses discussed earlier (Figure 11) suggests that the strategy with the greatest risk reduction—be it in the passive world (risk parity) or the active world (Multi-Strategy Core)—generates the best returns over the last 20 years. The results of the research in this white paper confirm this.

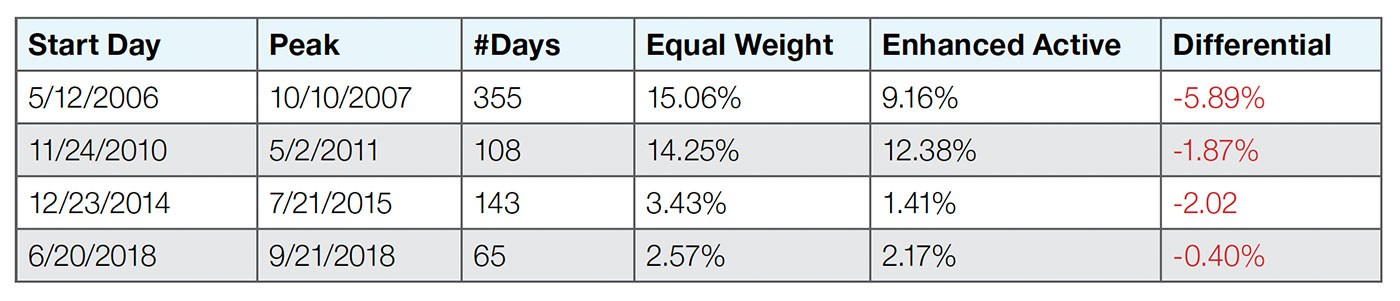

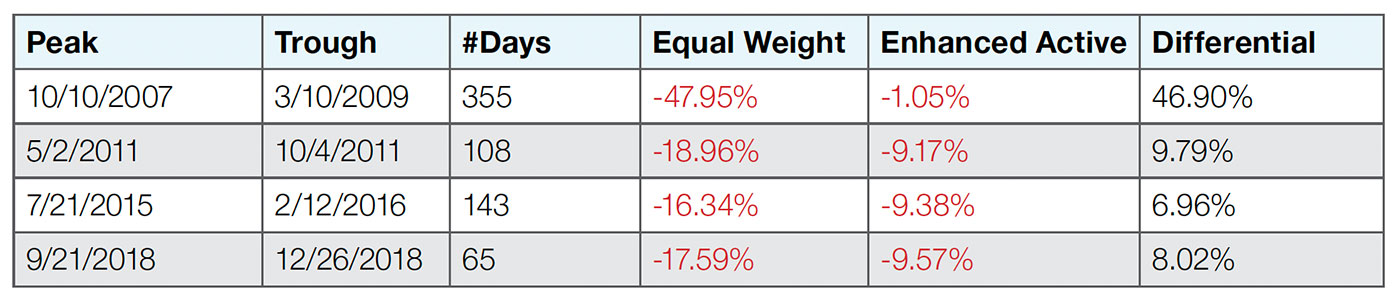

To address the crisis correlation analysis discussed earlier, we examined the return performance of the enhanced active (Multi-Strategy Core) and passive (equal-weight) methodologies. Using the same good/bad market environment periods as in the correlation study, we have provided the return performance of the passive (equal-weight) and enhanced active methods during good and bad market environments (Tables 6 and 7).

Source: Flexible Plan Investments Research

Source: Flexible Plan Investments Research

Leading up to peaks, the equal-weight methodology slightly outperforms enhanced active. This is expected since equal weight has more exposure to the equity markets and takes on more risk than enhanced active. Conversely, during bad times, enhanced active significantly outperforms the equal-weight methodology.

During severe bear markets like the one experienced in 2008, the differential in the loss sustained is substantial, with an almost 50% reduction in loss by being actively allocated rather than invested on an equal-weight basis.

According to Two Centuries Investments, “If you buy and hold S&P 500 for the long-run, you are mostly exposed to the underlying asset risk. The strategy in this case is very simple, and the only way it breaks is if you don’t stick with it. On the other hand, the asset risk is huge. Will S&P repeat its stellar 20th century performance during the 21st century? Will it also repeat its maximum drawdown of -84%? Is there a small chance that it will go to zero before recovering again? That’s the asset risk.”

This paper was a quest to find the best portfolio methodology for creating the essential core of investors’ portfolios. We examined the practical options and problems associated with portfolio construction across the spectrum of portfolio management—from a passive portfolio of equally weighted asset classes to a portfolio that holds and actively weights multiple dynamically risk-managed strategies.

We presented the advantages and issues of each methodology, including performance analysis and comparison between the different methods of allocating assets.

In doing so, we introduced the Multi-Strategy Core approach, a turnkey, “strategy of strategies” approach that attempts to address issues present in other portfolio construction methodologies, which include a lack of consideration of risk, the loss of diversification benefits during crisis periods, and risk concentration in single strategies. Multi-Strategy Core (the enhanced active methodology) was able to effectively outperform a passive methodology by a large margin. It also did so during “bad” or downtrending market environments while retaining strong relative performance leading up to multiple peak periods during the study time range.

This type of portfolio creation process is designed to add multiple layers of risk management, providing diversification and eliminating the concentrated risk associated with investing in one single strategy. The research supports the effectiveness of Multi-Strategy Core, which blends Flexible Plan Investments’ suitability-based core strategies to produce portfolios designed to be robust to changing market conditions.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article presents an excerpt from the white paper “A Passive Core Is Not Enough.” The complete paper—including a list of source data and disclosures—can be found here.

This white paper is provided for information purposes only and should not be used or construed as an indicator of future performance, an offer to sell, a solicitation to buy, or a recommendation for any security. Flexible Plan Investments, Ltd., cannot guarantee the suitability or potential value of any particular investment. Please see the complete white paper for further disclosure information, appendix data, and notes on methodology.

Since 1981, Flexible Plan Investments (FPI) has been dedicated to preserving and growing wealth through dynamic risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine FPI’s many risk-managed strategies within a single account. FPI’s fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. FPI also offers advisors the OnTarget Investing tool to help set realistic, custom benchmarks for clients and regularly measure progress. flexibleplan.com