Risk is always with us

Risk is always with us

All investors must remember that risk is real and that, like death and taxes, it is always with us. Dynamic risk management within sophisticated active strategies can help investors deal with the three different types of risk to their investment portfolios: unavoidable risk, probable risk, and improbable risk.

“Nothing is certain except death and taxes.” How often that phrase has been quoted since Ben Franklin penned it in a letter to his friend, the French scientist Jean-Baptiste Leroy, in the midst of the French Revolution.

With apologies to a great American and a personal hero, I would amend Franklin’s axiom to “Nothing is certain except death, taxes, and the fact that risk is always with us.”

It’s true that the risks of our American founders and the French intelligentsia caught in the days of the mob were very different—each from the other and also from those that we face today. Even in the present world, which seems to be growing ever smaller, the risks faced in each corner of it vary widely.

What is constant is that, regardless of circumstance, location, or century, risk remains an integral part of our lives. It is an everyday element … it is always with us.

How often have we been to a funeral and said, or heard others around us say, “I just saw him last week, and now he’s gone.” Often we may not be aware of the risk, but it is still present and can sometimes suddenly become tragically apparent.

We are very aware of some risk, and we probably overemphasize its influence. The media, be it entertainment or network news, does seem programmed to put us in a constant state of distress. News programming has become what Dr. Norm Siegel called “a horror movie from which we don’t get to go home.” But I do not think that we should let this induced “culture of fear” overcome us.

On the contrary, as an entrepreneur, I believe in self-reliance … that opportunities arise from taking risk. In contrast, fear of risk can overwhelm and paralyze. Such an attitude is counter to both our national heritage and the future success of our children and ourselves.

If risk is always with us, but fixating on it can be detrimental to living out our days, how should we think of risk? As with most fears, usually the best thing we can do is to learn more about it and how it affects us so that we can achieve some balance in our lives.

There are many types of risk. In investing, investors must cope with at least three main types, and each must be approached differently.

The first is probably the least likely, but it sometimes seems to be the most feared. It is unavoidable risk. That is a risk that something bad will happen to you, no matter what you do. It seems there are groups of people and investors that believe unavoidable risk is a quite common risk.

Actually, I think this type of risk is fairly rare. I mean, yes, Earth may someday be hit by a comet or an asteroid, and there is nothing we can do about it presently. The sun may explode in a supernova, and, unless we’ve moved to a new home planet, we won’t have any survivable options. But how many risks in our everyday lives ascend to that level of inevitable catastrophe?

I do think it is fair to say that just being born assures all of us that at some time in our lives something bad will happen. But what it is, and when and how bad, is just not ascertainable or entirely preventable, no matter how you live.

Similarly, death is not avoidable. It is inevitable. But that’s in the long run. Every day, we learn of new ways in which we can, in the short run, push off its occurrence to a later date.

Similarly, it may be said that if we step off the corner in front of an oncoming speeding truck, our death is not avoidable. But it was … just a second before we took the step off the curb.

In the same way, with investments, whether in bonds or stocks, we know that a bear market is inevitable. Up until two years ago, bonds had essentially been in a bull market for 30 years. However, before that, bonds were in a ferocious bear market during which some money-market-fund yields topped 20%, bond volatility equaled that in the worst of stock bear markets, and bond values were crushed.

Last year we got just a small taste of what rising yields can do. Most bond investments lost money in 2018.

Stocks, of course, are not spared this type of experience. Stocks, on average, have historically experienced a loss of more than 20% every 5.5 years. We had two declines of 50% or more in the last two decades.

TABLE 1: U.S. BEAR MARKETS—DURATION, % DRAWDOWN, AND YEARS TO RECOVER

Source: FPI Research

Additionally, last year we had two near-20% downturns, one at the beginning of the year and the other at the end. While most of our strategies were able to outperform the stock indexes in the last 2018 down cycle, two corrections made it very clear that risk is always present and that some losses in investing are unavoidable.

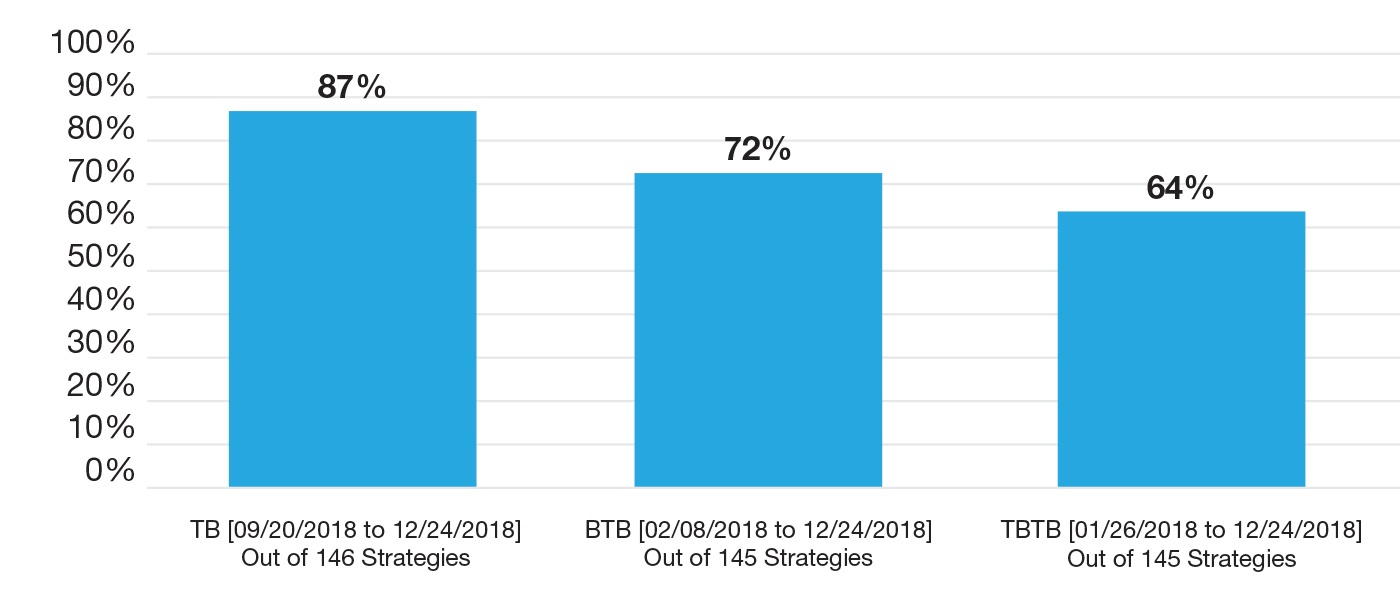

FIGURE 1: % FPI STRATEGIC SOLUTIONS STRATEGIES BEATING S&P 500 TOTAL RETURN

Source: FPI model returns after advisory fee.

Yet even with this seeming inevitability, as Figure 2 demonstrates, we can take actions to seek to mitigate the effects of these declines. Asset and strategy diversification combined with dynamic risk management can help diminish the losses, even if such protective measures cannot always avoid them entirely.

The second class of risk involves those that are improbable. These are risks that happen only a small percentage of the time. These lead us to one of two courses of action: ignoring them because they have a small chance of occurring or slipping into the paralysis of the culture of fear.

It’s like the constant drumbeat of conflicting cancer research. You hear that “X” can cause cancer, but the actual chance of such an occurrence is infinitesimally small.

It has been widely reported that “half of Americans are at risk of carcinogen exposure from soda.” Two facts in the research were certainly correct: (1) about half of Americans drink a can of soda a day, and (2) extremely high exposure to a coloring agent in soda is a known carcinogen.

Yet, delving into the research, one learns that to be exposed to the level of carcinogen that caused tumors in rats in the study would require, according to the U.S. Food and Drug Administration, the consumption of more than a thousand cans of soda a day! I like soda (or “pop” as we call it here in Michigan), but really …

Similarly, everyone has heard a story of someone who lost everything in the Depression or even in the last financial crisis. These types of market crashes are extremely rare and yet they do occur. However, focusing on them can cause paralysis.

Investors suffered mightily when they lost more than half of their portfolios in 2007–2008. Then they were punished again as they sat out the bull market that followed. They overemphasized the risk of the crash of 2007–2008 repeating itself.

There was a solution to this type of risk. They could have worked with a financial advisor that would have helped them create a portfolio of strategies with both a defensive plan to exit the market and an offensive plan to re-engage. This would have been much better than having been paralyzed by fear.

The final type of risk is probable or realistic risk. This is the type of risk that we can anticipate. We’re told that if you smoke, lung and breathing difficulties are likely. If you drive a car, an accident of some sort during your driving career is probable.

Probable risks are indeed everywhere around us. They permeate our lives. Yet, despite their numbers, our minds are trained to weigh them all as they appear, and then immediately take action.

The human mind was designed to deal with these probable risks in this basic way. And it worked well for our early ancestors. They had to decide instantly whether to fight or run, and our ancestors survived a hostile, primitive environment as a result.

But the more complex decisions called for by modern life are not so easily handled by the chemistry of our brains. Studies show that we humans are not very good at weighing probabilities. Even studies of statisticians show that they are easily misled by the circuitry of our brains to reject the more probable of two outcomes.

This is often caused by an overreliance on recent experience. For example, many of us take a down day or week or quarter in our investments and extrapolate that experience into the future, and then we become frightened.

It is also caused by the fact that humans fear loss more than they appreciate gains. In fact, studies show that the fear of losing a dollar has a greater influence on a prospective investor’s decision-making than the opportunity of a gain of more than two dollars.

As a result, it is easy to see why some investors have let periodic losses in stocks and bonds keep them from sticking to an investment plan or strategy. This fear of loss can even overshadow the joy of the most recent new highs in the stock market. It can then cause an investor in a stock, bond, or strategy to abandon that investment in the face of a recent quarterly loss.

Yet I am relatively certain that when the investor chose that stock, bond, or strategy, he or she was not relying on a single quarter’s return in making that decision. Instead, they were probably persuaded by a history of higher returns earned over years, not just a single quarter.

While our mistaken weighing of probable risk can lead us down the wrong path, there is a very positive side to this class of risk. Probable risks are anticipatable and controllable. You can stop or limit your smoking. You can get insurance for that car accident to come. You can reformulate your portfolio.

Dynamic risk management can help you deal with all three types of risk in your investment portfolio.

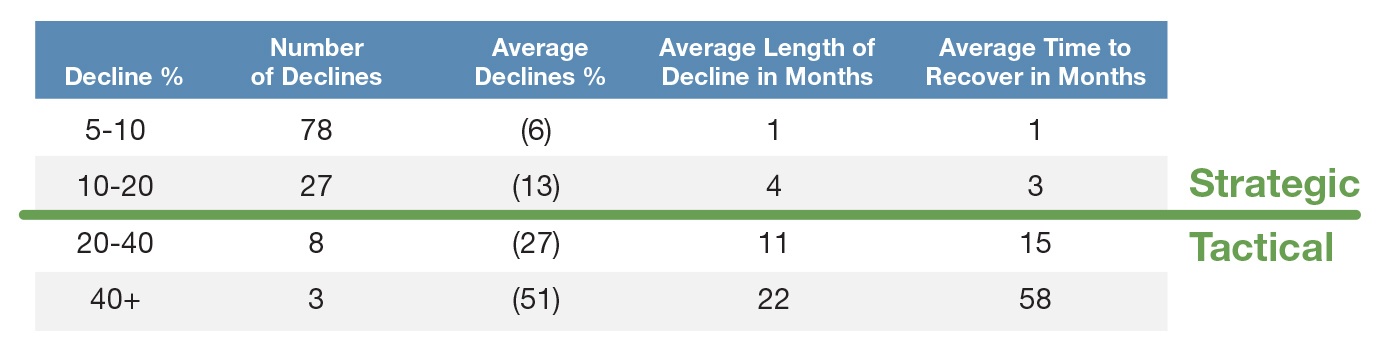

Bear markets come in two varieties: probable, baby bears that are short, frequent, and shallow (20% or less in downside risk) and improbable but unavoidable super bears (when the market falls more than 20%) that are rare, long, and deep.

Table 2 does a fine job of distinguishing between “baby bears” and “super bears” since 1945, separated by the green line.

TABLE 2: THE DEEPER THE STOCK MARKET DECLINE, THE LONGER THE RECOVERY

Source: Reprinted with permission from Guggenheim’s “Putting Pullbacks in Perspective,” Critical Conversations series.

Data as of 9/30/2018. Copyright 2018 Ned Davis Research Inc.

To cope with the baby bears, simplistic passive allocation can be an effective tool. Even better, in my opinion, is a multi-strategy core portfolio.

Multi-strategy core portfolios are suitability based and use multiple strategies that include asset-class diversification, strategy diversification, and dynamic risk-management measures instead of just the simple asset-class diversification employed by passive asset allocation. These can keep investors engaged in the market most of the time and help them avoid whipsaws and quick corrections that are sharp but shallow.

In contrast, tactical strategies and dynamic rotation strategies are best used in the “explore” portion of one’s portfolio, designed with super bear markets in mind. The former can move completely out of stocks when necessary to avoid the 50%-plus losses of the super bear. The latter can become increasingly defensive as the market descends until at some point they move completely to cash or bonds to sit out the really steep part of the decline. Both have time-tested methodologies for returning to stocks when the coast is clear.

By combining multi-strategy core portfolios for baby bears and tactical and rotational explore strategies for super bears, an investor can build a portfolio that addresses all three types of risk. Dynamic risk management makes this possible.

* * *

Why this discussion of risk? I think it is a necessary reminder. Yes, I am concerned about those who have sat out the current market rally, which is now in its 10th year. But, more importantly, understanding the pervasiveness of risk is essential for those investors, like our clients, who have been mostly invested during this bull market.

With stocks hitting new highs, it is easy to forget this lesson. Even after the appalling losses that occurred in 2007–2009—and then the near-20% losses in 2011, 2015, and now 2018—I fear that the memory of these downturns will fade in the flashing neon lights of a quick recovery or the trek to market heights.

And, perhaps, through all of the talk and headlines heralding the new market highs, investors who have been profiting will feel that risk “has left the building.” But they should never forget that every bear market begins with a bull market top—therefore, we must be ever vigilant. Passive is not vigilant—dynamic is.

Each of us must remember that risk is real and that, like death and taxes, risk is always with us. We must remember this not to be paralyzed by risk but rather to anticipate and control it.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com