A deep dive into the latest BLS payroll revision

A deep dive into the latest BLS payroll revision

On Aug. 21, the Bureau of Labor Statistics (BLS) released the preliminary benchmark revision of payrolls for the year ending in March 2024. In this week’s “Three on Thursday,” we explore what happened and its implications for jobs.

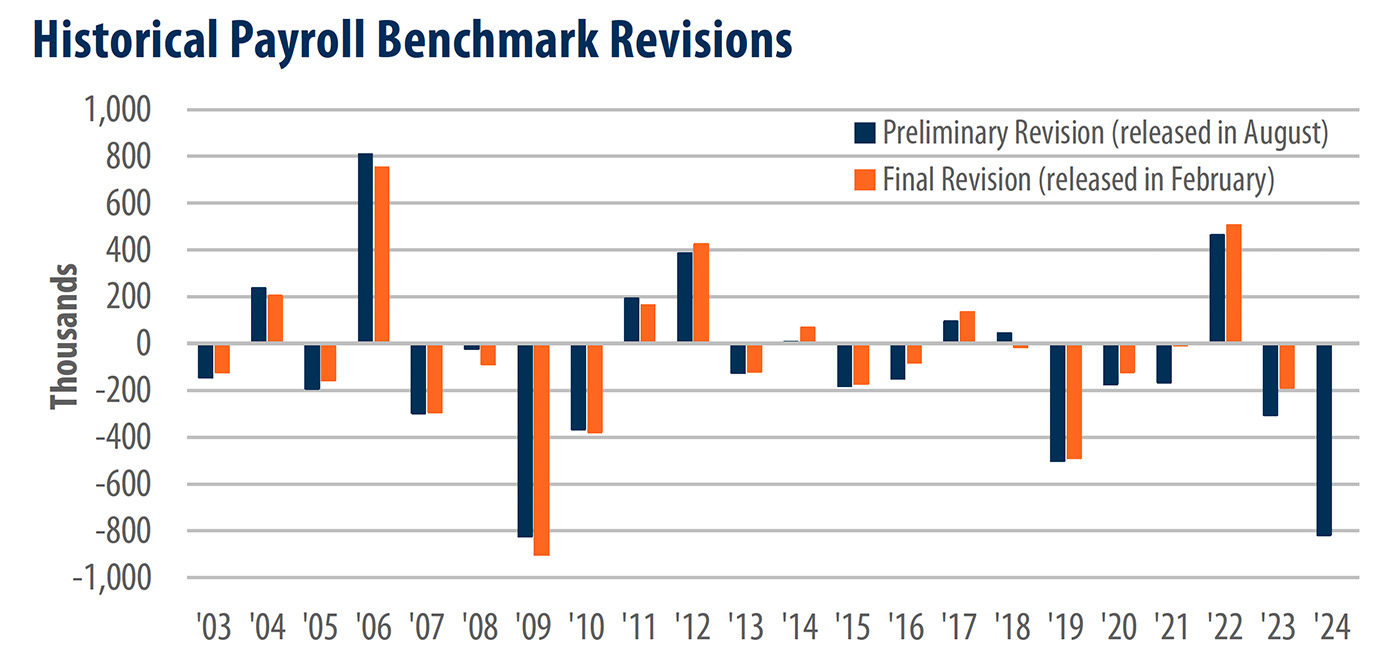

Every August, the BLS publishes a preliminary set of revisions to payroll growth, with the final revision released in February. These revisions provide a more accurate picture of job growth, as they’re based on state unemployment insurance tax records from the Quarterly Census of Employment and Wages (QCEW).

While the QCEW takes time to put together, it’s more comprehensive than the monthly payroll data, which only covers 119,000 establishments. It’s also important to realize the existing payroll series is not officially updated with the release of the preliminary revisions in August. The BLS will do the official update when the final revision is issued in February.

Curious about the results? Check out the three charts below.

Sources: Bureau of Labor Statistics, First Trust Advisors. Annual revisions for the 12 months ending in March of the listed year.

The preliminary revision shows a substantial downward adjustment of 818,000 to payroll growth for the 12-month period from April 2023 to March 2024. Initially, it was estimated that 2.9 million jobs (approximately 242,000 per month) were added during this timeframe. However, more accurate data now indicate that the actual increase was closer to 2.1 million jobs (around 174,000 per month). The Establishment survey data will be updated with the final figures next February.

It’s worth noting that the current -818,000 revision may be revised upward (becoming less negative) in February. The QCEW data, which forms the basis for these revisions, will undergo further updates. Over the past four years, QCEW employment figures have been consistently revised upward each quarter. If this trend continues, the final payroll benchmark revision could be less severe than the BLS’s preliminary estimate.

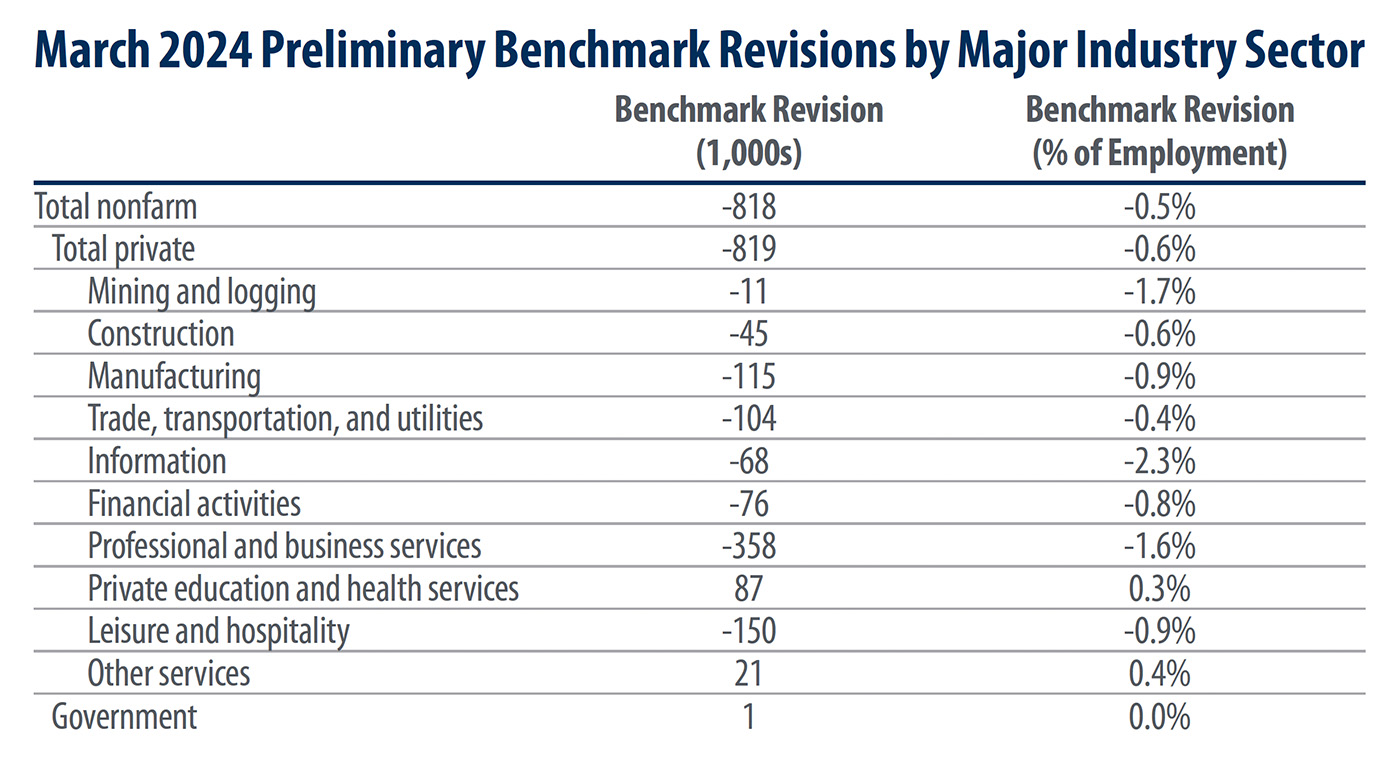

Sources: Bureau of Labor Statistics, First Trust Advisors. Revisions for the 12 months ending in March 2024.

As is often the case, individual industry series experienced more significant percentage revisions compared to the total nonfarm series, mainly due to greater statistical sampling error at more detailed levels. The professional and business services sector was hit hardest, with a downward revision of 358,000 jobs, followed by a reduction of 150,000 jobs in the leisure and hospitality sector. Conversely, the government sector and the private education and health services sector saw upward revisions. Including these adjustments, 87% of all net new jobs in the year ending in March 2024 were concentrated in government, health care, and education. This revision further strengthens their share in the job market—not a good sign in our view.

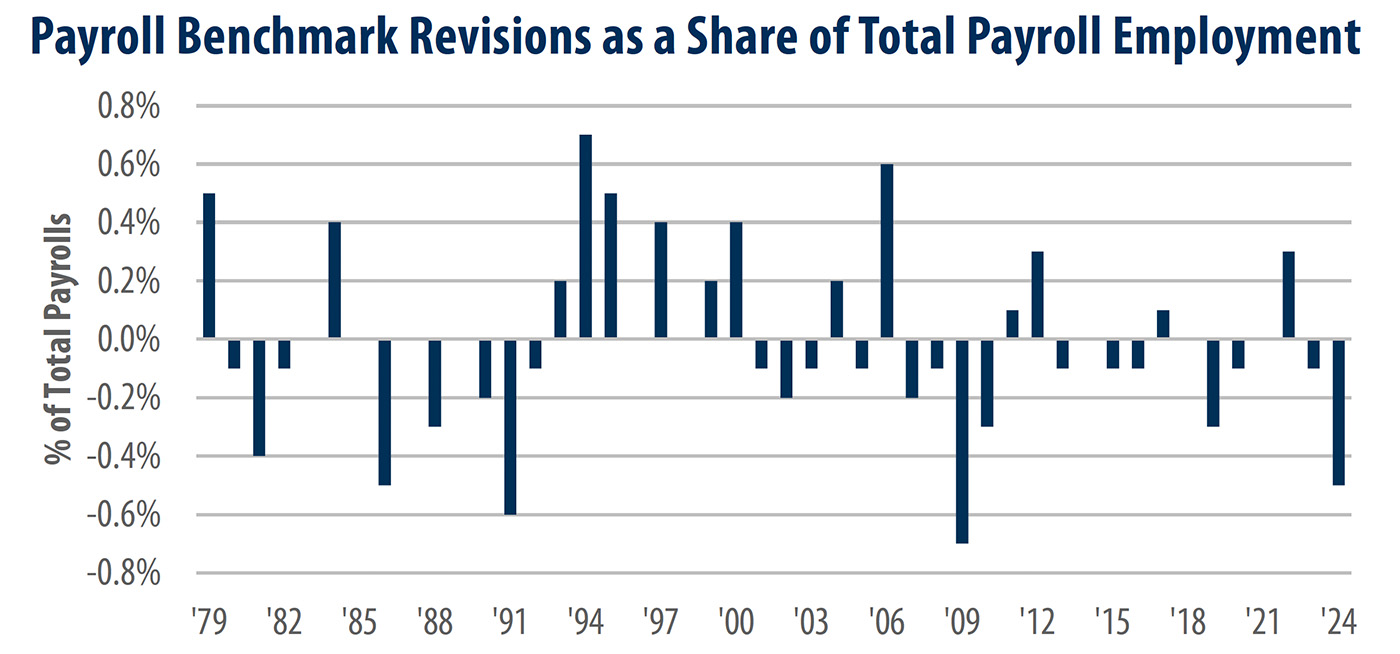

Sources: Bureau of Labor Statistics, First Trust Advisors. Final benchmark revision used for 1979-2023, preliminary revision used for 2024.

![]() Related Article: The Fed ‘faithful’: Will they address a weaker economy?

Related Article: The Fed ‘faithful’: Will they address a weaker economy?

Since 1979, annual benchmark revisions have typically fluctuated between +/-0.2% of total nonfarm payroll employment, with the most extreme changes reaching +/-0.7%. Last week’s preliminary revision of -818,000 jobs, representing a -0.5% adjustment, is poised to be the largest downward revision since 2009 and the third-largest negative revision in the past 46 years if it holds in the final estimate. This significant adjustment suggests that the BLS models may be struggling to accurately account for the 2023 surge in immigration and net business creation.

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports and the recurring feature “Three on Thursday.” Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on Aug. 29, 2024.

This report was prepared by First Trust Advisors LP and reflects the current opinion of the authors. It is based on sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS