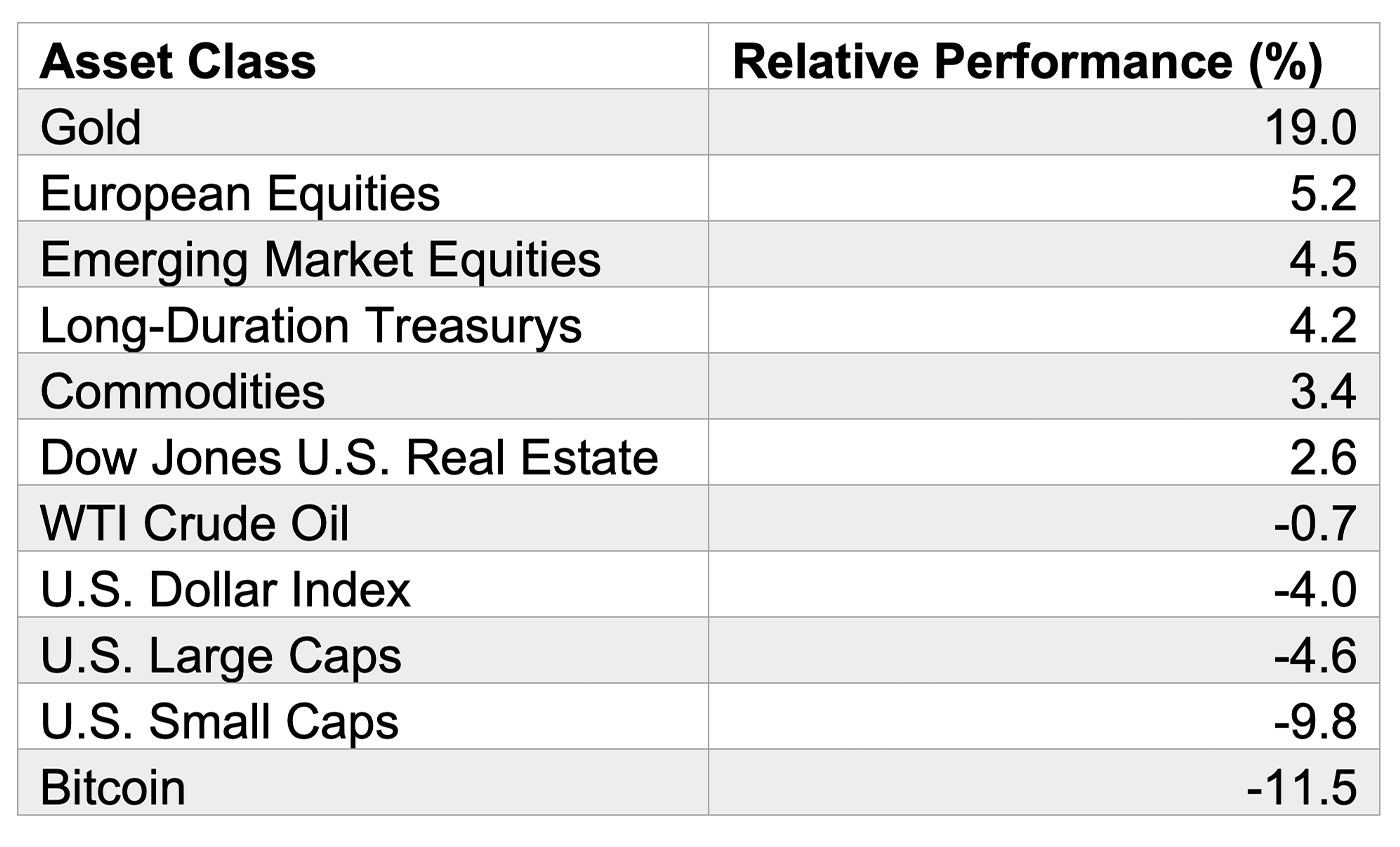

Gold significantly outperformed U.S. equity indexes and other major asset classes in Q1 2025—including ETFs that track the broad commodity market.

TABLE 1: RELATIVE PERFORMANCE OF MAJOR ASSET CLASSES IN Q1 2025

Source: Visual Capitalist

State Street Global Advisors says that the precious metal continues to “find strong momentum led by global investors piling into gold on the back of surging market volatility and economic uncertainty. Rising inflation expectations, slower global potential growth, and heightened geopolitical tensions have supported the ongoing strength in the gold market.”

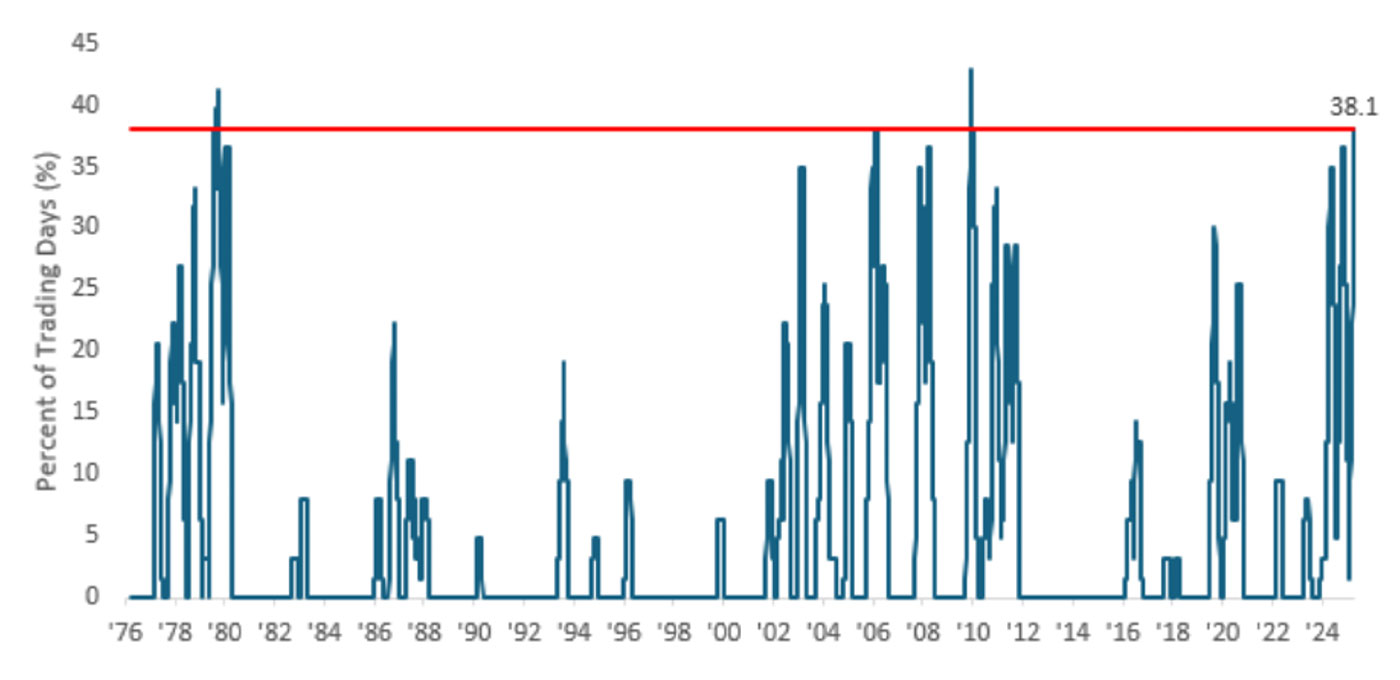

Bespoke Investment Group echoed that sentiment in an update on April 16:

FIGURE 1: GOLD 52-WEEK HIGHS (ROLLING THREE-MONTH TOTAL)—1976–2025

Source: Bespoke Investment Group, data through 4/15/2025

On Monday, April 21, gold was up over $100 in morning trading, breaking through the $3,400-per-ounce level for the first time.

FIGURE 2: GOLD CONTINUOUS CONTRACT—PAST THREE YEARS

Source: MarketWatch, data through 4/21/2025

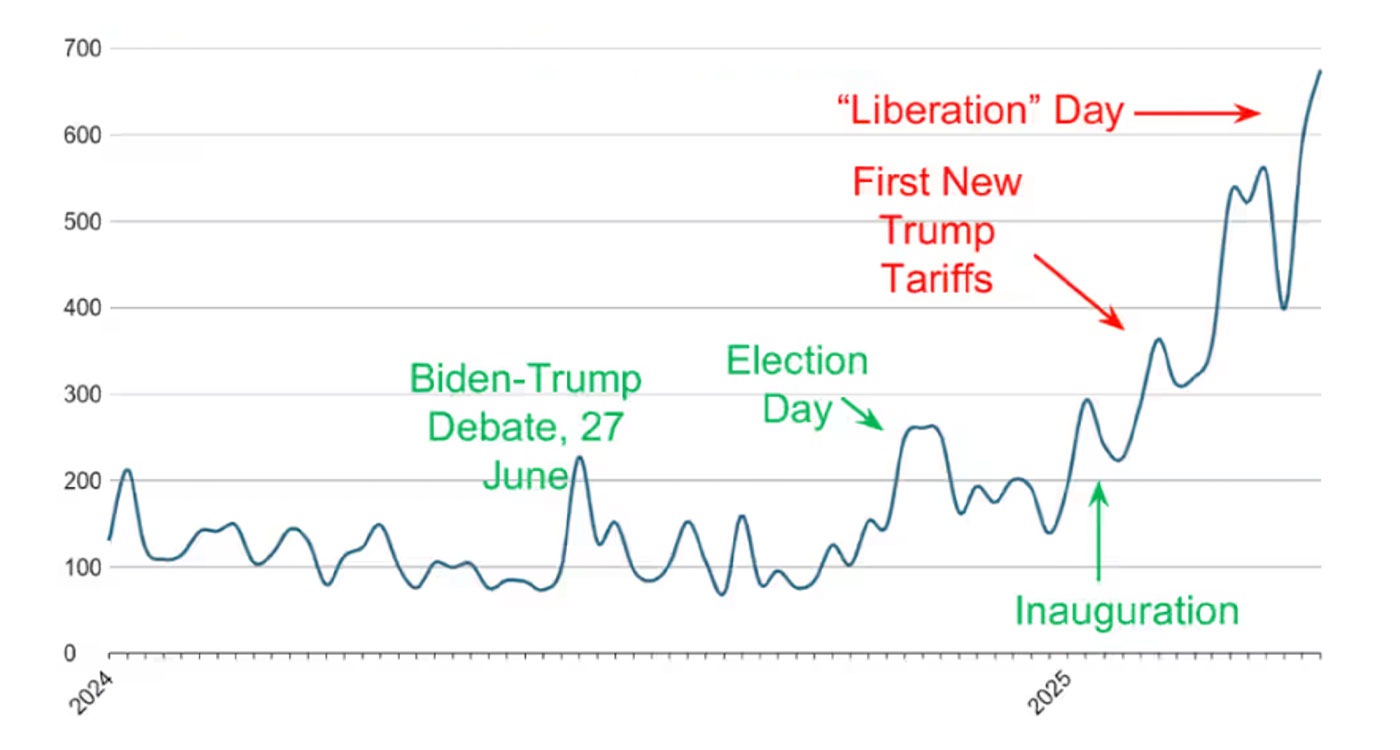

Supporting State Street’s point about market uncertainty, MarketWatch reported the following last week:

FIGURE 3: U.S. ECONOMIC POLICY UNCERTAINTY INDEX—WEEKLY

Through April 6–12, 2025

Source: MarketWatch, based on data from policyuncertainty.com

Analysts raising price targets for gold

Several major Wall Street firms have recently raised their price targets for gold in the short term and beyond.

Reuters reported on April 17 that Citi raised its gold price target:

“Citi Research raised its gold price target for the next three months to $3,500 per ounce from $3,200, led by fresh buying from Chinese insurers and safe-haven flows amid tariff risks and market weakness, it said in a note on Thursday.

“China’s recent move to let 10 insurers allocate up to 1% of their total assets to gold could generate annual demand of around 255 tonnes, equal to roughly a quarter of total global central bank buying, Citi said.”

Reuters also noted a new year-end 2025 target from Goldman Sachs:

“Goldman Sachs raised its end-2025 gold price forecast to $3,700 per ounce from $3,300, with a projected range of $3,650-$3,950, citing stronger-than-expected demand from central banks and higher exchange-traded fund inflows due to recession risks.

“‘If a recession occurs, ETF inflows could accelerate further and lift gold prices to $3,880 per troy ounce (toz) by year-end,’ the bank said in a note dated Friday.

“‘That said, if growth surprised to the upside on reduced policy uncertainty, ETF flows would likely revert to our rates-based predictions, with year-end prices closer to $3,550/toz.’”

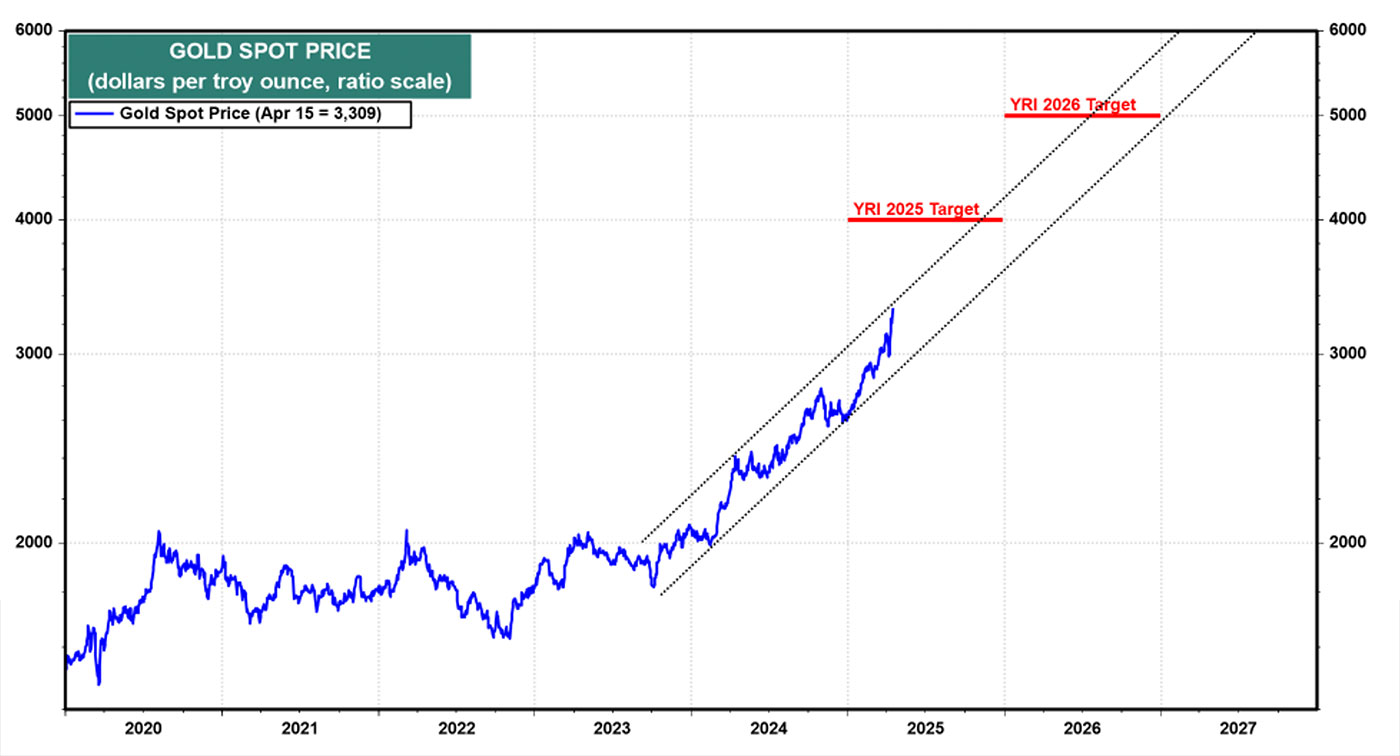

Yardeni Research remains positive about gold prices as well, writing on April 17,

“We’ve been bullish on gold since it broke out above $2,000 per ounce at the end of February 2024. It has been trading in an upward channel since then (chart). It soared to $2,600 by the end of last year. In recent days, it has jumped to a record $3,300, which is the upper end of the channel. Our $4,000 target by the end of this year looks increasingly realistic. If that happens, then $5,000 would be our target for the end of 2026. …

“Central banks around the world have been increasing the percentage of their international reserves held in gold since early 2022. That’s after Russia invaded Ukraine in February 2022. The US and its allies responded by freezing Russia’s foreign exchange reserves, which amounted to $280 billion. The central banks of countries that are hostile to American interests have moved more of their reserves into gold as a result.”

FIGURE 4: GOLD’S PRICE CHANNEL AND TARGETS FOR 2025 AND 2026

Sources: Yardeni Research, LSEG Datastream, ICE Benchmark Administration Ltd.

RECENT POSTS